F.No. 296/29/2016-CX.9

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise & Customs

****

New Delhi, the Dated: 22nd March, 2016

All Chief Commissioners of Central Excise & Service Tax,

All Chief Commissioners of Central Excise & Customs,

All Chief Commissioners of Customs,

All Chief Commissioners of LTU.

Sub: Analysis of reports uploaded on All India MPR–reg.

Sir,

I am directed to say that while reviewing the performance of CBEC in the month of January, 2016, the Revenue Secretary has highlighted the following and advised regular monitoring by Supervisory Officers:-

(i) 19496 cases pending adjudication beyond one year, as on 1st January, 2016, in Customs, Central Excise & Service Tax, whereas adjudication should not be perang for more than 1 year.

(ii) 58991 cases are pending in Call Book, in Customs, Central Excise & Service Tax.

(iii) 11357 refund claims of Customs, Central Excise & Service Tax are pending for more than 3 months.

(iv) 1192 LARs and 90 SOFs, in Customs, Central Excise & Service Tax, have not been replied so far for more than 1 year.

(v) 2913 investigations in Central Excise & Service Tax are pending for more than 1 year.

(vi) Meetings of Regional Advisory Committee in various Chief Commissioner charges have not been

2. It is also noted that regular inspections are not being carried out by the field formations and timely data is not uploaded online through MIS. It was, further, pointed out that the initiative of resolving the issues, which are likely to result in litigation and or impediments to ease of doing business is a positive step ‘towards facilitating tax payer services and hence there is a need to monitor such issues by Supervisory Officers on regular basis.

3. The data on.MPR of January, 2016 was analyzed and it was found that pendency in these matters is as under:-

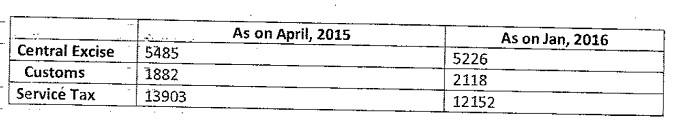

(i) Cases pending adjudication beyond one year:-

(ii) Call Book Pendency:-

| As on April, 2015 | As on Jan, 2016 | |||

| Cases pending | Amount (in crore) | Cases pending | Amount (in crore) | |

| Central Excise | 36850 | 62471.86 | 37538 | 68101.03 |

| Custorns | 4998 | 61646.74 | 5519 | 61646.75 |

| Service Tax | 15073 | 32739:37 | 15934 | 33316.14 |

(iii) LARs/SOFs not replied to for more than one year:-

| As on April, 2015 | As on Jan, 2016 | |||

| LAR | SOF | LAR | SOF | |

| Central Excise | 623 | 16 | 238 | 23 |

| Customs | 941 | 99 | 770 | 65 |

| Service Tax | 292 | 6 | 184 | 12 |

4. From the above data, it is seen that there is marginal increase in the number of cases of SOF from 16 to 23. Call Book cases in Central Excise have shown substantial increase during the 10 month period as compared to previous year. Adjudications pending in customs has shown an increasing trend.

5. The Board is monitoring the monthly performance report of all field formations and the same is being submitted to the Revenue Secretary for review. It is desired that all Supervisory Officers may take immediate steps to eliminate the pendency in key areas of work it may also be ensured that the data is uploaded on Monthly Information System in a timely manner.

Yours faithfully,

(Surendra Singh)

Under Secretary to the Govt. of India

Tel: 2309 2413