INTRODUCTION

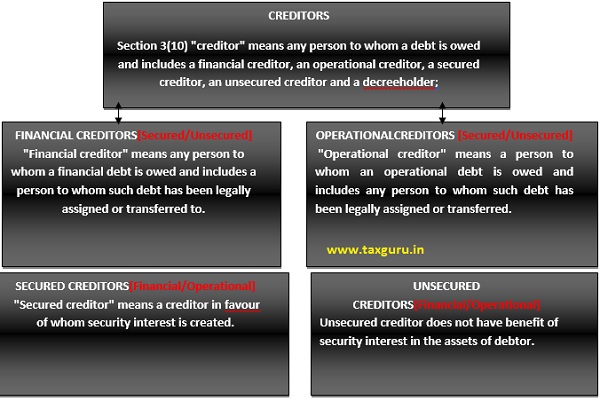

An ostentatious feature of the Insolvency and Bankruptcy Code, 2016 (‘Code’), is the classification of creditors on the basis of debt. It is highly applaudable as the classification is not restricted to security [i.e. secured/unsecured creditors] but also covers Financial/ Operational creditors within its ambit.

As per the apposite provisions under IBC, operational creditors are mostly unsecured and according to the liquidation waterfall under section 53 of the code, they rank much below other class of creditors. Moreover, creditors are given a differential treatment and certain provisions of this Code may be unfair and disadvantageous to a respective class.In the Landmark judgment of Essar Steel Insolvency case, the Hon’ble NCLAT observed that “secured financial creditors have primacy over operational creditors.”

INTERPRETATION OF ‘CREDITOR’ UNDER THE CODE

PRIORITY TO FINANCIAL CREDITORS

- Financial Creditors are at priority as they constitute Committee of Creditors and are eligible to participate in the voting process. However, Operational Creditors are excluded from such group of creditors.

- The matter in issue is that certain classes of operational creditors are being discriminated against as the relevant provisions of the statute favours and protect the rights of Financial Creditors.

This statement can be corroborated with the help of an example, wherein despite the fact that application is filed by the Operational Creditors, the respective class does not have a locus standi in framing any opinion in Meetings conducted by Committee of Creditors [CoC] and consequently cannot deliver any opinion in formation of a Resolution Plan.

Suppose, Operational Creditor [‘A’] has instituted a petition under Section 9 of the Code. Once the CIRP is initiated, Financial Creditors ‘B’, ‘C’ and ‘D’ joins the petition. In the Committee of Creditors meeting[CoC], ‘B’, ‘C’ and ‘D’ have a locus standi to attend and vote in any matter raised in CoC meetings. However, ‘A’ being the Operational Creditor does not have a right to vote in such meetings, despite the fact that petition is filed by ‘A’ in the capacity of an Operational Creditor as the right is barred by the Code.

Let us consider a hypothetical situation;

- ‘A’ is the Corporate Debtor who owes debt to various creditors including operational and financial creditors.

- ‘X’ is the Operational Creditor who has made an application under Section 9 of the Code.

- ‘Y’ is a leading bank who is an Unsecured Financial Creditor joins a petition filed by Mr. ‘X’.

- ‘Z’ is a leading bank and a secured Financial Creditor joins a petition filed by Mr. ‘X’.

- ‘F’ is a Financial Institution and has also joined a petition filed by Mr. ‘X’

- ‘W’ is a Financial Institution and has also joined a petition filed by Mr. ‘X’.

As per the minutes drafted after CoC meeting was conducted, following were present to attend and vote in the meeting conducted by CoC;

| Creditors | Authorized Representative of concerned creditor | Voting share |

| Y Bank Ltd. | Mr. ABC [Senior Manager Legal – Y Bank] | 5 percent |

| Z Bank Ltd. | Mr. DEF [Vice President Legal – Z Bank Ltd.] | 70 percent |

| F Ltd. | Mr. GHI [Manager Legal – F Ltd.] | 15 percent |

| W Ltd. | Mr. JKL [Legal Associate – W Ltd.] | 10 percent |

However, Mr. ‘X’ who is the Operational Creditor was not permitted to attend and vote in the meeting conducted by committee of creditors.

The aforementioned example makes it clear that, even if Operational creditors have a locus standi to move an application before the Hon’ble Tribunal, it does not have a right to attend and vote in CoC meeting and is hence disadvantageous in nature.

Shanaya Fashions vs. One World Creations, C.P. (IB)-2044/MB/2018 is a remarkable example corroborating the aforementioned statement, wherein despite the fact that Shanaya fashions has moved a Section 9 petition before the Hon’ble Tribunal, it was not a part of CoC and hence was not authorized to question the validity of a resolution plan or decide any matter pertaining to liquidation.

According to the BLRC Committee Report, Operational Creditors are neither able to decide on matters relating to insolvency of the entity nor willing to take risk of postponing payments for better future payments for the entity. Operational Creditors are not eligible to be an active member in CoC and consequently cannot deliver any opinion relating to Resolution Plan.

However, operational creditors having amount of aggregate dues not less than 10 percent of debts are allowed to attend the meetings of CoC as per Section 24 but are not allowed to vote.It was also observed in the BLRC Report that, Financial Creditors can modify the terms of existing liabilities unlike Operational Creditors who cannot take such a huge risk. It is assumed that, Financial Creditor can take a haircut as per their discretion unlike Operational Creditors. [Binani Industries Case]. The committee also reasoned that members of CoC should have the capability to assess viability as well as willing to modify terms of existing liabilities in negotiations.

NIL VALUE – TO OPERATIONAL CREDITORS

It might happen that value available with Operational Creditors is “Nil’ during distribution of payments during liquidation.- In the matter of IDBI Bank Ltd vs. EPC Constructions India Ltd, a Misc. Application was made by Indian Oil Corporation in the capacity of Operational Creditor challenging the validity of Resolution Plan. According to the RP, security deposit of INR 48 crores was not given by Resolution Applicant [‘RA’], and Applicant has no locus standi to question the understanding between CoC and RA. Liquidation Value as per valuation report submitted by one of the auditors was INR 891.96 crores and admitted claims of Financial Creditors are in excess of Liquidation Value. Therefore, if amount is distributed as per liquidation waterfall under section 53, value available to operational creditors will be NIL.

RELATED PARTY OF FINANCIAL CREDITORS

Related party of a Financial Creditor is not permitted to attend or vote in CoC meetings. It may be possible that related parties have a claim, however, they are not permitted to be a part of such meetings. The rationale behind such a provision is that, related party may influence the decision of non-related parties which may be adversely affect the CIRP process.

PRIORITY OF PAYMENTS TO RELATED PARTIES – Section 53 does not discriminate between related and unrelated creditors.

Let us consider a hypothetical situation:

PQR Ltd. is the Corporate Debtor and owes INR 20 Lakhs to Mr. ‘N’ – {In this case, Mr. ‘N’ is a related unsecured Creditor}. Mr. ‘N’ controls more than 20% voting rights in the corporate debtor on account of voting arrangement. Inspite of several reminders given by Mr. N, PQR Ltd. did not repay the outstanding amount and consequently, a Section 7 petition was instituted by Mr. ‘N’. Once the CIRP was initiated, ‘X Ltd’, ‘Y Ltd’, ‘and Z Ltd’ [unrelated secured Financial Creditors] constituted a committee of creditors. Mr. ‘N’ was not permitted to attend and vote in CoC meetings. Even after conducting 25 CoC meetings, the Resolution Professional was not in a position to rehabilitate the Corporate Debtor and consequently a liquidation order was passed. However, at the time of distribution of payments, Mr. N was paid in priority to X, Y and Z Ltd. [secured Financial Creditors].

Note:

Unrelated Creditors are treated at par with Related Creditors under Section 53 of the Code.

EXTENT OF DISCRETION OF CoC AND CONCEPT OF JUDICIAL REVIEW

The Supreme Court in Essar Steel Judgment reiterated that CoC is authorized to suggest a modification w.r.t. distribution of proceeds to all classes of creditors. However, CoC decision is subjected to limited Judicial Review if the same is not conformity with the provisions of the Code or related Regulations. Moreover, absolute discretion of what to pay and how much to pay each class of creditors is with the CoC, the Hon’ble NCLT has to see that the CoC decision reflects that the following provisions of the Code have been taken into account:

- the corporate debtor needs to keep going as a going concern during the insolvency resolution process;

- it needs to maximize the value of the assets of the corporate debtor; and

- interests of all stakeholders, including operational creditors have been taken care of.

CRITICAL ANALYSIS OF SECTION 53 – WATERFALL MECHANISM

Proceeds of sale of liquidation assets of the Corporate Debtor are distributed in an order of priority. Distribution is as follows

- Insolvency Resolution process or liquidation costs;

- Workmen dues for 24 months preceding liquidation commencement date and secured dues if security is relinquished;

- Employees’ dues for 12 months preceding liquidation commencement;

- Unsecured Financial Creditors;

- dues and debts owed to secured creditor for any amount unpaid following the enforcement of security interest;

- Remaining debts and dues- [includes unsecured Operational Creditors];

- Preference shareholders;

- Equity shareholders.

The aforementioned gives a clarification to the order of priority during liquidation of assets and makes it clear that as far as proceeds of sale in relation to class of creditors are concerned , unsecured financial creditor tops the list followed by secured creditors [either financial/operational]. Once the sale proceeds are distributed to class of creditors as mentioned above, the remaining proceeds are distributed amongst unsecured operational creditors.

Therefore, after analyzing the aforesaid provision, it can be inferred that, Financial Creditors are ranked above Operational creditors during liquidation waterfall.

DICHOTOMY BETWEEN SECTION 53 AND SECTION 30 IBC READ WITH REGULATION 38 OF CIRP REGULATIONS

Although Section 53 gives priority to Financial Creditors including other secured creditors, Section 30 read with Regulation 38 of CIRP Regulations, strengthens the position of Operational Creditors. As per the said regulation, outstanding amount due to the Operational Creditor shall be given priority in payment over Financial Creditors. It is to be noted that both these sections are consist with each other, hence not repugnant.

REGULATION 38(1) of CIRP Regulations, states that “The amount payable under a resolution plan – (a) to the operational creditors shall be paid in priority over financial creditors; and (b) to the financial creditors, who have a right to vote under sub-section (2) of section 21 and did not vote in favor of the resolution plan, shall be paid in priority over financial creditors who voted in favor of the plan.”

Regulation 38 protects the interests of Operational Creditors and dissenting Financial Creditors.

MAHARASTHRA SEAMLESS LIMITEDVERSUS PADMANABHAN VENKATESH & ORS. [CIVIL APPEAL NO. 4242 OF 2019]- (Also referred case of Essar Steel (supra)) – “The amended Regulation 38 does not lead to the conclusion that financial and operational creditors, or secured and unsecured creditors, must be paid the same amounts, percentage wise, under the resolution plan before it can pass muster. Fair and equitable dealing of operational creditors’ rights under the said Regulation involves the resolution plan stating as to how it has dealt with the interests of operational creditors, which is not the same thing as saying that they must be paid the same amount of their debt proportionately. Also, the fact that the operational creditors are given priority in payment over all financial creditors does not lead to the conclusion that such payment must necessarily be the same recovery percentage as financial creditors. So long as the provisions of the Code and the Regulations have been met, it is the commercial wisdom of the requisite majority of the Committee of Creditors which is to negotiate and accept a resolution plan, which may involve differential payment to different classes of creditors, together with negotiating with a prospective resolution applicant for better or different terms which may also involve differences in distribution of amounts between different classes of creditors.”

The Hon’ble Apex Court in Essar Steel Judgment upheld the order approving resolution plan of Arcelor Mittal India Pvt. Ltd. It was observed that Section 30(2) is interrelated to Section 53 however the relation is not based on the context of ‘priority of payments’ but to provide minimum payments to Operational Creditors. It was also observed that, CoC has discretionary powers to classify creditor as Financial/Operational.

ARTICLE 14 AND THEORY OF INTELLIGIBLE DIFFERENTIA

- Intelligible differentia distinguishes persons or things grouped together from others that are left out in the group.

- The differentia or classification must have a rational nexus with the object sought to be achieved [ State of W.B. vs. Anwar Ali Sarkar, AIR 1952 SC 75]

The matter of concern is whether intelligible differentia exists between different classes of creditor i.e. is there an intelligible differentia between Financial [secured/unsecured creditors] with Operational [secured/unsecured] creditors. This statement can be corroborated with the fact that Financial Creditors are actively involved in Reorganization of business of the Corporate Debtor as the main object of Financial Creditors are to assess viability and feasibility of corporate debtor unlike Operational Creditors are only seeking to recover their dues. In SWISS ROBBINS PVT. LTD. & ANR. Vs. U.O.I [WRIT PETITION (CIVIL) NO. 99 OF 2018], Hon’ble Apex Court concluded that, distinction between Financial and Operational Creditor is neither discriminatory nor arbitrary nor violative of Article 14 of the Constitution of India. It was observed that, as Financial Creditors have a better understanding of business, assess the viability of Corporate Debtor, engage in restructuring of loan and reorganize business of Corporate Debtor whereas nature of Operational Creditors business is to supply goods and services. Financial Creditors have specified schedule of repayment unlike Operational Creditors. It was also observed that while looking into the viability and feasibility of resolution plans approved by the committee of creditors, has always gone into the question of whether operational creditors are given roughly the same treatment as financial creditors, and if not, such plans have been rejected or modified so that the rights of operational creditors are safeguarded.

APPOSITE PROVISIONS FAVORING OPERATIONAL CREDITORS

- Although, Operational Creditors are not authorized to be a part of CoC, they have a locus standi to move a Section 9 petition before the Hon’ble NCLT.

- Section 24 states that if the aggregate dues of Operational Creditors are more than 10%, they are authorized to attend the CoC meetings;

- Section 25(h) states that, Operational creditors are eligible to submit a Resolution Plan if they fulfill the criteria as stated in Section 29A of the Code.

- Section 42 of the Code is also favorable to the Operational Creditors as they have a right to appeal to the Adjudicating Authority against the liquidator if not satisfied with valuation of claims.

- Pursuant to Section 47 of the Code, Operational Creditor has a locus standi to make an application before the Hon’ble NCLT in case of any undervalued transaction not observed by Resolution Professional/Liquidator. Let us consider a hypothetical situation:

{“ABC Ltd. (the Operational Creditor) initiates a Section 9 petition. Once CIRP begins, three Financial Creditors join the petition and forms committee of Creditors. It is a known fact that Operational Creditor, ABC Ltd. was not authorized to attend the meeting and as the aggregate dues were less than 10%, he was unable to attend the meeting. After several rounds of CoC meetings, it was observed by the members that, business of the Corporate Debtor cannot be rehabilitated and the process for liquidation shall be initiated at the earliest. Once process of liquidation started, it was observed by ABC Ltd. that, before the initiation of CIRP, Corporate Debtor (XYZ Ltd) entered into a transaction with another business entity (GEH Ltd) and sold assets valuing INR 30 Lakhs for merely INR 5 Lakhs. As this was an undervalued transaction, ABC Ltd. immediately reported this to the Liquidator who was unaware of this transaction. Consequently, a Stakeholders meeting was conducted by the Liquidator to discuss the aforementioned issue. Pertinent to note that, even though, Mr. X was not authorized to attend or vote in such meetings, the contention raised by him was discussed in the stakeholders meeting and consequently a Miscellaneous Application was filed against XYZ Ltd. for initiating undervalued transaction.”}

- Pursuant to Section 61(3) of the Code, if the Operational Creditors are not satisfied with a Resolution Plan as submitted by the Financial Creditors, they have a right to prefer an appeal before the Adjudicating Authority within the prescribed period.

REMARKS

- To initiate a Corporate Insolvency Resolution Process [‘CIRP’ for brevity], it is a sine qua non to prove that creditor falls within the ambit of either a Financial or an Operational debt.

- Operational Creditors are generally uninterested in revival of Company and focus only on liquidation. On the other hand, the intention of Financial Creditor is rehabilitation of Corporate Debtor.

- Hon’ble Apex Court in Rajputana Industries vs. Ultratech Cement & Ors. [Civil Appeal Nos. 5789-5790 of 2018], held that similar treatment should be given to Operational Creditors if not same.

- Unrelated creditors are treated at par with related creditors under the liquidation waterfall.

- If a person acts in the capacity of a Financial as well as an Operational Creditor, he shall be eligible to vote only in the capacity of Financial Creditor.

END NOTES

1. https://www.ibbi.gov.in/webadmin/pdf/whatsnew/2019/Jan/Swiss%20Ribbons_2019-01-27%2019:08:24.pdf;

2. https://nclt.gov.in/sites/default/files/final-orders-pdf/EPC%20Constructions%20India%20Limited%20%20MA%202738-2019%20%26%20MA%20354-2019%20IN%20CP%201832-2017%20NCLT%20ON%2020.09.2019%20FINAL.pdf

3. https://www.ibbi.gov.in/uploads/whatsnew/2019-10-11-191223-exc18-2456194a119394217a926e595b537437.pdf

4. https://main.sci.gov.in/supremecourt/2019/14331/14331_2019_4_1501_19773_Judgement_22-Jan-2020.pdf

5. https://www.businesstoday.in/current/corporate/essar-steel-operational-creditors-arcelormittal-nclat-committee-of-creditors-coc/story/339887.html

6. https://taxguru.in/corporate-law/dissenting-financial-creditors-resolution-process-ibc.html

7. https://www.financialexpress.com/industry/dissenting-financial-creditor-should-not-be-discriminated-nclat/1709121/

8. https://www.vantageasia.com/ibc-ensuring-dissenting-creditors-get-fair-deal/

9. https://www.livelaw.in/top-stories/sc-sets-aside-nclat-order-which-held-that-dissenting-financial-creditor-should-not-be-discriminated-149629

10. https://www.thehindubusinessline.com/economy/why-the-centre-has-kept-away-from-classifying-home-buyers-as-secured-and-unsecured-creditors-under-ibc/article24138323.ece