Govt of India decided for further upward revision of the ceiling limits for the Medium Enterprises in the MSME Definition. This will help in attracting Investments & creating more jobs in the MSME sectors & encourage Medium Enterprises to invest even more.

Read Notification – Govt notifies revised criteria for classification of MSME

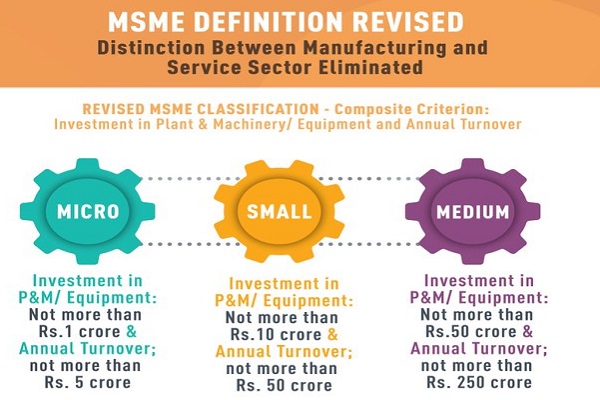

Ms. Meghna Suryakumar, Founder & CEO, Crediwatch has said that “In our view, some of the measures which should be welcomed by small businesses in India are – New definition for MSMEs – As per the new regulation, the new categorization of investment of Rs 1 cr and turnover of Rs 5 cr being classified as micro-units. Units with an investment of Rs 10 cr and turnover of Rs 50 cr will be classified as small units while those with an investment of Rs 50 cr and turnover of Rs 250 cr will be classified as medium units.the new definition will promote them into growing further in size and scale. The infusion of Rs 50,000 crore equity scheme for MSMEs with an excellent export track record will help them in getting listed, this move to further push – India’s step onto becoming self-reliant.

Collateral-free automatic loans – While this extends the previous loan moratorium benefits, the new terms should benefit as many as 45 lac businesses and help with working capital requirements in coming days. We believe, setting the threshold for eligibility (Rs 25 cr outstanding and Rs 100 cr turnover) is helpful. This would help the small businesses meet some immediate working capital needs like salaries, rents etc and would help kickstart the business after the lockdown. The distressed asset fund of Rs 4,000 crore, will aid 200,000 distressed MSMEs with loans of up to Rs 75 lakhs”.

Text of the Press release issued by Cabinet Committee on Economic Affairs (CCEA) is as follows:-

*Cabinet Committee on Economic Affairs (CCEA)

Cabinet approves Upward revision of MSME definition and modalities/ road map for implementing remaining two Packages for MSMEs (a) Rs 20000 crore package for Distressed MSMEs and (b) Rs 50,000 crore equity infusion through Fund of Funds

Fully paved way for Energising the MSME Sector through entire gamut of ‘Atmanirbhar Bharat Package’

Posted On: 01 JUN 2020

In line with Government of India’s top focus on energising MSMEs in the country, a special meeting of Cabinet Committee on Economic Affairs (CCEA) was convened under the Chairmanship of Prime Minister Shri Narendra Modi, here today, which approved the upward revision of MSME definition and modalities/ road map for laying down effective implementation mechanism for the remaining two announcements under the Atmanirbhar Bharat Package. These include:

- In the package announcement, the definition of micro manufacturing and services unit was increased to Rs. 1 crore of investment and Rs. 5 crore of turnover. The limit of small unit was increased to Rs. 10 crore of investment and Rs 50 crore of turnover. Similarly, the limit of a medium unit was increased to Rs 20 crore of investment and Rs. 100 crore of turnover. It may be noted that this revision was done after 14 years since the MSME Development Act came into existence in 2006. After the package announcement on 13th May, 2020, there were several representations that the announced revision is still not in tune with market and pricing conditions and it should be further revised upwards. Keeping in mind these representations, it was decided to further increase the limit for medium manufacturing and service units. Now it will be Rs. 50 crore of investment and Rs. 250 crore of turnover. It has also been decided that the turnover with respect to exports will not be counted in the limits of turnover for any category of MSME units whether micro, small or medium. This is yet another step towards ease of doing business. This will help in attracting investments and creating more jobs in the MSME sector. The following table provides the details of revised limits:

| Category | Old Capital | Old Turnover | New Capital | New Turnover |

| Micro | 25 Lakh | 10 Lakh | 1 Crore | 5 Crore |

| Small | 5 Crore | 2 Crore | 10 Crore | 50 Crore |

| Medium | 10 crore | 5 Crore | 50 Crore | 250 Crore |

- Approval for provisioning of Rs 20,000 crore as subordinate debt to provide equity support to the stressed MSMEs. This will benefit 2 lakh stressed MSMEs.

- Approval for equity infusion of Rs. 50,000 crore for MSMEs through Fund of Funds (FoF). This will establish a framework to help MSMEs in capacity augmentation. This will also provide an opportunity to get listed in stock exchanges.

With today’s approval, implementation Modalities and Road Map for entire components of the Atmnirbhar Bharat Abhiyan package are in place. This will help in attracting investments and creating more jobs in the MSME sector.

In the aftermath of COVID-19 pandemic, Prime Minister Shri Modi was quick to recognise the role of MSMEs in building the Nation. As such, MSMEs formed a very prominent part of the announcements made under the Atmanirbhar Bharat Abhiyaan. Under this package, the MSME sector has not only been given substantial allocation but has also been accorded priority in implementation of the measures to revive the economy. To provide immediate relief to MSME sector, various announcements have been made under the Package. The most important ones also included:

- Rupees Three lakh crore collateral-free automatic loans for MSMEs to meet operational liabilities, buy raw material and restart businesses.

- Revision of MSME definition to render maximum benefits to the sector;

- Disallowing global tenders in procurements uptoRs. 200 crores- to create more opportunities for domestic players,

- And clearing of MSME dues by the Government and Public Sector Units within 45 days.

Government of India has been taking all necessary steps to ensure that the benefit of these landmark decisions reaches to the MSMEs at the earliest. In this regard, following necessary policy decisions have been already taken and the implementation strategy has been put in place.

- The scheme for Rs. Three lakh crore col lateral-free automatic loans was earlier approved by CCEA and has been formally launched.

- Modalities have been worked out for Upward revision of MSME Definition making it more inclusive broad-based providing greater avenues to MSMEs to harness their potentials.

- Similarly, amendments in General Financial Rules mandating no global tenders for procurement upto 200 crore have been carried out. The new rules have already been issued and effected. This will open up new business avenues for Indian MSMEs.

- To ensure that MSME payments are released within the timeframe of 45 days, directions have been issued at the level of Cabinet Secretary, Expenditure Secretary and Secretary, MSME.

- To further ease the burden on MSMEs, RBI has extended moratorium on repayment of loans for another three months.

To manage all this, a robust ICT based system called CHAMPIONS has also been launched by the Ministry of MSME. The portal is not only helping and handholding MSMEs in the present situation, but is also providing guidance to grab the new business opportunities and in the long run, become national and international Champions.

MSME Ministry is committed to support the MSMEs, and the people who depend on them. All efforts are being made to encourage MSMEs to take benefit of the initiatives under the Atmanirbhar Bharat package and our other schemes.

Background:

Micro, small and Medium Enterprises (MSMEs) popularly called as MSMEs are the backbone of Indian economy. Silently operating in different areas across the country, more than 6 crore MSMEs have a crucial role to play in building a stronger and self-reliant India. These small economic engines have a huge impact on the country’s GDP-making a contribution of 29 percent. They contribute to almost half of exports from the country. Additionally, more than 11 crore people are employed in the MSME sector.

Release ID: 1628344

* Images above are not part of Press Release.

Dear Sir,

Thank you so much for this information, but i want to know that “export sales will not be considered in 250 crores” is not mentioned in govt. nitification.

Any modification has been published by govt.

Since we hear lots of support on MSME from govt, whats in offer for traders who are having turnover less than 5 crores and stucked with payments to be made to wages, electricity, rent, vendors etc. what kind of other loans are available since our pvt bank(Axis Bank) is not giving any enhancements on existing OD loans even if we have great clean record!