In this article we have made an attempt to answer few very basic questions relating to DSCs

Page Contents

- 1. What is DSC (Digital Signature Certificate)?

- 2. How can I apply for DSC?

- 3. Who issues DSC?

- 4. What are the Benefits of a digital signature certificate ?

- 5. Classes of DSC that are valid on MCA:

- 6. Documents/Information required for issuing DSC:

- 7. Cost/Price of obtaining a DSC:

- 8. How much time do CAs take to issue a DSC?

- 9. In Addition to MCA, where can I use my DSC?

- 10. Points to be Remember:

1. What is DSC (Digital Signature Certificate)?

Digital Signature Certificates (DSC) is the digital equivalent (that is electronic format) of physical or paper certificates. Few Examples of physical certificates are drivers’ licenses, passports or membership cards. The Certificates serve as proof of identity of an individual for a certain purpose; for example, a driver’s license identifies someone who can legally drive in a particular country. Likewise, a digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally.

Physical documents are signed manually, similarly, electronic documents, for example e-forms are required to be signed digitally using a Digital Signature Certificate.

A digital signature certificate (DSC) contains information about the user’s name, pin code, country, email address, time of signing and date of issuance of certificate and name of the certifying authority.

2. How can I apply for DSC?

- Application of DSC is required to be made in physical form along with self attested copy of PAN card (Mandatory for IT and MCA Filing of local resident) and 1 Address Proof (Preferably AADHAR Card).

- The application form vary depending on the vendor but it contains more or less same information.

- Once Application is submitted, the Certifying Authority (CA) will process the application and will send one confirmation message on applicants mobile number for verification along with Video Verification.

- On completion of mobile & Video verification, the DSC will be issued in the name of applicant.

3. Who issues DSC?

A licensed Certifying Authority (CA) issues the digital signature. Certifying Authority (CA) means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT-Act 2000.The list of licensed CAs along with their contact information is available on the MCA portal.

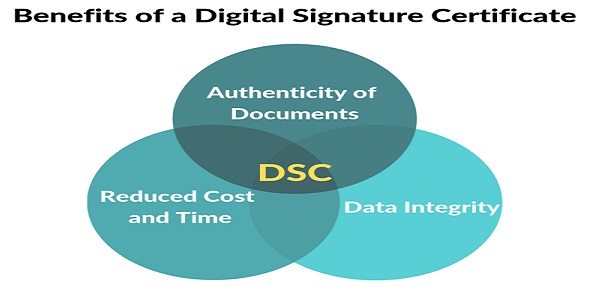

4. What are the Benefits of a digital signature certificate ?

- Authenticity of documents: Digitally signed documents give confidence to the receiver to be assured of the signer’s authenticity. They can take action on the basis of such documents without getting worried about the documents being forged.

- Data integrity: Documents that are signed digitally cannot be altered or edited after signing, which makes the data safe and secure.

- Reduced cost and time: Instead of signing the hard copy documents physically and scanning them to send them via e-mail, you can digitally sign the PDF files and send them much more quickly. This saves time as well as the cost of printing and scanning the documents.

5. Classes of DSC that are valid on MCA:

There are three classes of DSC, and each is differentiated as per the level of security:

- Class II DSCs – These DSCs are used to sign documents where the risk is moderate. The signature is installed on a hardware cryptographic device. Here, the identity of a person is verified against a trusted, pre-verified database

- Class III DSCs –This is the highest level where the person needs to present himself or herself in front of a Registration Authority (RA) and prove his/ her identity, used where the risk of data compromise is at the extreme level. In this case, also, the signature is installed in a hardware cryptographic device.

6. Documents/Information required for issuing DSC:

- Identity Proof – Self-attested PAN card

- Address Proof – Self-attested Aadhar Card or such other address proof as may be accepted by CA from time to time.

- Other – 1 photograph, unique email id and unique contact no. along with DSC application form.

7. Cost/Price of obtaining a DSC:

The cost of obtaining a digital signature certificate may vary as there are many entities issuing DSCs and their charges may differ.

8. How much time do CAs take to issue a DSC?

Generally all DSCs can be issued within 1 or 2 working days. However, issuance of DSC is generally dependent on the confirmation by the applicant.

9. In Addition to MCA, where can I use my DSC?

Digital Signatures are legally admissible in a Court of Law, as provided under the provisions of Information Technologies Act, 2000. The acceptance of DSC is still not universal, however, various government authorities like Income Tax, GST etc have made it mandatory to use DSC for various applicants and it is voluntary for few exempted class. However, in near future it is expected to grow its presence and requirement with many other services.

10. Points to be Remember:

- Digitally signed documents are acceptable in legal courts as an evidence or proof as well as it is mandatory for various filing like Income Tax, Ministry of Corporate Affairs (MCA), GST etc

- A person can have different DSCs – however, generally all government websites have a specified a requirement of registering a DSC with the respective government server. Once registered, no other DSC can be used, unless new DSC is registered with the server again.

- DSCs are issued for 1 or 2 years. After their validity has expired, they need to be issued again.

- Digital Signatures are legally admissible in a Court of Law, as provided under the provisions of Information Technologies Act, 2000.

Source: www.mca.gov.in

About Author: CS Jigar Shah is the Founder and Partner at JMJA & Associates LLP. With over 10 years of work experience in various listed companies and conglomerates, CS Jigar Shah has a rich and varied experience in his portfolio.

We were planned to affix the digital signature through our ERP system. ERP System have generates the PDF invoices from various locations for supply.

In this, Location wise and format wise various tokens should be activate and affix the digital signature on that respective PDF Invoices.

Please check and share the possible solutions for the same.

Regarding Class 3 DSC. If the existing director replaces, Let me know company has to get New class 3 DSC

Is an email sent without digital signature valid ? Please see the comments from Supreme Court of India 👇

Your Grievance/Communication registered against Diary No. 24701/2020, has been lodged/filed on 12-09-2020 since email is not digitally signed.

I had sent email without digital signature.

Please answer

9072850065 whatsapp number

A person is using dsc in capacity of Director. However, if he uses DSC for banks and MFs forms and letters in the capacity of auth sign, is it ok as per law. What is the legal angle.

can one person have two DSC,? and if yes, than unique email id and mobile number is required.?