Introduction: Embarking on the journey of corporate tax registration in Dubai UAE involves several essential steps and considerations. From gathering the necessary documents to navigating the EmaraTax Portal, businesses must ensure a smooth registration process. However, challenges such as technical issues or discrepancies in information may arise, requiring swift and effective resolution. This introduction sets the stage for exploring the intricacies of corporate tax registration in Dubai and the proactive steps to address potential hurdles along the way.

To initiate corporate tax registration in Dubai UAE, you must furnish specific details and documents. The requisite information encompasses:

User Credentials:

- Existing VAT Registration: Utilize Current Email ID and Password for EmaraTax Portal Access.

- New VAT Registration: Provide Fresh Email ID for EmaraTax Portal Registration specifically for Corporate Tax.

Company Details:

- Name of the Company

- Mobile Contact Number

- Office Landline Number

Please choose the relevant category from the table below and submit the corresponding documents:

|

Category |

Required Documents |

|

Natural person |

Trade License(s), Partnership Agreement (if applicable), Contact Information Passport and Emirates ID |

| Incorporated Bodies (e.g., a Company, a UAE company established by Decree or Limited Liability Partnership) | Trade License(s) , Certificate of Incorporation (if applicable), Articles of Association/ Partnership Agreement (if applicable), Power of Attorney in favor of Authorized Signatory, Authorized Signatory documents, Passport and Emirates ID of manager, owner and senior management |

| Other non-Corporate bodies (e.g., a partnership, trust, club, charity, etc.) |

Trade License(s) , Certificate of Incorporation (if applicable), Club or Association Registration , Power of Attorney in favor of Authorized Signatory , Authorized Signatory documents, Passport and Emirates ID of manager, owner and senior management |

| Government entity | Law or decree of establishment, Authorized Signatory documents , Customs details (if applicable), Bank Account details, Contact Information |

Ensure all documents are submitted in PDF format and adhere to the individual file size limit of 2 MB.

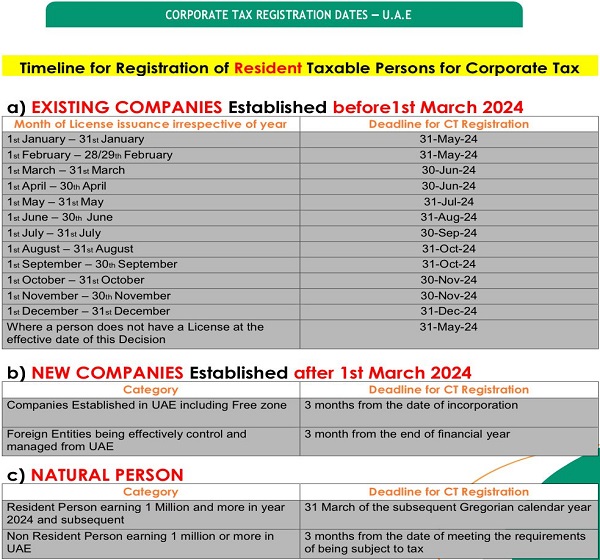

There is a specific timeline for completing the Corporate Tax Registration process in Dubai UAE. New entities incorporated after 1st March 2024 must complete the registration within a maximum of 3 months from the date of issue of their license. For existing companies incorporated before 1st March 2024, the registration process must be completed with the deadline set for 31st December 2024.

There is a Penalty of AED 10,000 if you fail to register before Due Date given above. There are no fees or costs associated with the Corporate Tax Registration process in Dubai UAE. The UAE Government does not impose any charges for Corporate Tax Registration.

Conclusion: If companies or entities face any difficulties or obstacles during the Corporate Tax Registration process on the EmaraTax Portal, such as technical glitches or discrepancies in the provided information, seeking guidance from a professional consultant is recommended. They can offer prompt assistance and advice to resolve any encountered issues effectively.