Responsibilities of CFO/CEO Under Companies Act, 2013 & SEBI (LODR) Regulations, 2015

The definition of the term Key Managerial Personnel is contained in Section 2(51) of the Companies Act, 2013. The said Section states as under:

“key managerial personnel”, in relation to a company, means—

(i) the Chief Executive Officer or the managing director or the manager;

(ii) the company secretary;

(iii) the whole-time director;

(iv) the Chief Financial Officer;

(v) such other officer, not more than one level below the directors who is in whole-time employment, designated as key managerial personnel by the Board; and

(vi) such other officer as may be prescribed;

NOTE: One more category of KMP introduces by The Companies (Amendment) Act, 2017 which shall be person not below the rank of directors. He/she can be appointed by a director and must be in Whole tine employment of the company.

The above definition is an exhaustive definition but point number (vi) gives the power to the legislature to include some other personnel also within the definition of Key Managerial Personnel as may be deemed fit by them from time to time.

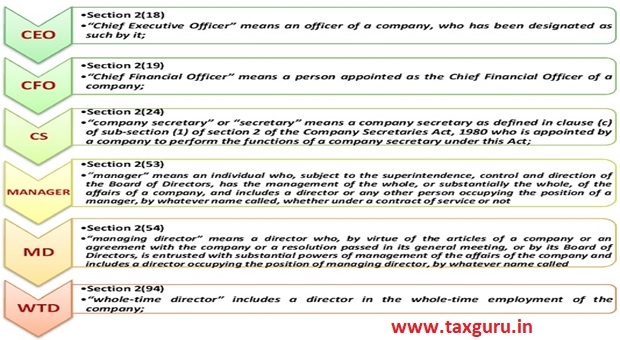

LET’S CONSIDER DEFINITION OF KMP

LET’S DISCUSS ROLE OF CEO/CFO

A. Role of CEO/CFO in Compliance Under Companies Act, 2013

| Section | Particulars | Compliance |

| 102(4) | Benefit accruing from any item of business to be approved by the members to be disclosed in a statement to be annexed to the notice of AGM/EOGM (Explanatory Statement) | If proper disclosure is not made then the CFO/CEO shall hold such benefit in trust for the company , and shall, without prejudice to any other action being taken against him under this Act or under any other law for the time being in force , be liable to compensate the company to the extent the benefit received by him. |

| 102(5) | Default in compliance with provisions regarding Statement to be annexed with Notice of AGM/EOGM. | CFO/CEO inn default shall be punishable with fine which may be extend to Rs. 50000/- or five times the amount of benefits accruing to the promoter, director, manager or other KMP or any of its relatives, whichever is more. |

| 134(1) | The Financial Statements, including Consolidated Financial Statement. | Shall be approved by the Board of Director before they are signed on behalf of the Board at least the Chairperson of the Company where he is authorised by the Board or by two directors out of which one shall be MD and the CEO, if he is a Director of the Company( recently amended if CEO is not a Director of the Company, then also he has to sign the Financial Statement), the CFO and the CS of the Company, wherever they are appointed. |

| 137(3) | Failure to file copy of Financial Statements before prescribed period. | The Company shall be punishable with of fine Rs.1000/- for every day during which the failure continues but which shall not be more than Rs. 10.00 Lakhs, and the MD and CFO of the Company , if any and , in the absence of MD and CFO , any other director who is authorised by Board with responsibility of complying with the provisions of filing of Financial Statements and ,in absence all directors of the Company , shall be punishable with imprisonment for a term which may extend to 6(six) months or with fine which shall not be less than Rs. 1.00 Lakh but which may extend to Rs. 5.00 Lakhs or with both. |

| 177(7) | Right to be heard in the meeting of the Audit Committee, when it considers the Audit Report | In this case CEO/CFO do not have right to vote in meeting. |

| 189(2) | Disclosure of concern or interest in other associations, which are required to be included in the Register or such other information relating to himself as may be prescribed. | To be complied within a period of 30(thirty) days of Appointment or Relinquishment of Office. |

| 194 | Prohibition on forward dealing in securities of the company by Director or KMP | No CEO/CFO shall buy in the Company, or in its Holding, Subsidiary/ Associates Company;

i) A right to call for delivery or a right to make delivery at a specified price and within a specified time, of a specified number of relevant shares or a specified number of relevant debentures; or ii) A right, as he may elect, to call for delivery or to make delivery at a specified price and within a specified time, of a specified number of relevant shares or a specified number of relevant debentures. Non compliance shall result in punishment with imprisonment for a term which may extend to two years or fine which shall not be less than Rs.1.00 Lakh but which may extend to Rs. 5.00 Lakhs or with both. In case CEO/CFO acquires any securities in contravention of the provisions of this section , he shall be liable to surrender the same to the company and the company shall not register the securities so acquired in his/her name in the Register of Members/Debenture holders and if it is in dematerialised form then inform the Depository not to record such acquisition. |

| 195 | Prohibition on Insider Trading of Securities | Non-Compliance would result in punishment with imprisonment for a term which may extent 5(five) years or with fine which shall be not less than Rs. 5.00 Lakhs, but which may extend Rs.25.00 Crores or three times the amounts of profits made out of Insider Trading, whoever is higher or with both. |

| 197(13) | Insurance taken on behalf of CEO/CFO for indemnifying any of them against any liability in respect of any negligence, default, misfeasance, breach of duty of trust for which they may be guilty in relation to the Company. | However, the Premium payable on such insurance policy shall not be treated his/her remuneration.

If CEO/CFO proves guilty then in such instants, the Premium paid shall be treated a part of his/her remuneration. |

| 199 | Recovery of remuneration if Company is required to re-state its Financial Statements due to fraud or noncompliance of provisions of applicable laws on the Company. | The Company shall recover from any past or present MD/WTD/CEO/CFO (by whatever name called) who, during which Financial Statements are required to re-stated, received the remuneration (including stock option if any) in excess of what would have been payable to him as per restatement of Financial Statements. |

| 203(3) | Prohibition to hold office in more than one Company except its Subsidiary Company at a time. | Any contravention of above provisions liable to fine of Rs. 50000/- with punishment and where the contravention is continuing one, with a further fine, which may extend to Rs.1000/- per day after the first during which the contravention continues. |

| 224(5) | Fraud by CEO/CFO whether in the form of any asset, property or cash or in any other manner | CEO/CFO shall be liable personally without any limit. |

B. Role of CEO/CFO in Compliance under SEBI (LODR) Regulations, 2015

Regulation |

Particulars | Compliance |

| 17(8) | Board of Directors | The CEO& CFO shall provide Compliance Certificate to the Board of Directors as specified in Part B of Schedule II. |

| 33(2) | Financial Results | Before placing Financial Statements for consideration, the CEO& CFO of the Company will certify that Financial Statements do not contain any false or misleading statements or figures and do not omit any material fact, which may make the statements or figures contained therein misleading. |

| 33(1)(e) read with Schedule IV Para E | Disclosure in Financial Statements | If listed Company/entity had not commenced commercial production or commercial operations during the reportable period, the listed entity shall, instead of submitting Financial results, disclose the following details;

i) Details of amount raised i.e. proceeds of any issue of shares or debentures made by the listed entity; ii) The portions thereof, which is utilised and remaining portion unutilised; iii) The details of investment made pending utilisation; iv) Brief description of the project which is pending completion; v) Status of projects and; vi) Expected date of commencement of commercial production or commercial operations. The above shall be approved by Board of Directors, on certification of CEO & CFO of the Company. |