CS Anjali Yadav & CS Mehak Gupta

Relevant Chapter:

Relevant Chapter:

Chapter XVIII of the Companies Act, 2013 (hereinafter referred to as “the Act”)

Relevant Section(s) : {Notified w.e.f. 26th December 2016}

Section 248 to 252 of the Act [Erstwhile Section 560 of the Companies Act, 1956]

Relevant Rules {Notified w.e.f. 26th December 2016}

Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016.

A. CATEGORIES OF COMPANIES NOT ELIGIBLE TO BE REMOVED FROM THE REGISTER OF COMPANIES UNDER THESE RULES:

1. Listed companies

2. Companies that have been delisted due to non-compliance of listing regulations/listing agreement or any other statutory laws.

3. Vanishing Companies

4. Companies where inspection or investigation is ordered and being carried out or actions on such order are yet to be taken up or were completed but prosecutions arising out of such inspection or investigation are pending in the court

5. Companies, where notices under Section 234 of the Companies Act, 1956 (1 of 1956) or Section 206 or Section 207 of the Act have been issued by the Registrar or inspector and reply thereto, is pending or report under Section 208 has not yet been submitted or follow-up of instructions on report under Section 208 is pending or where any prosecution arising out of such inquiry or scrutiny, if any, is pending with the Court.

6. Companies against which any prosecution for an offence is pending in any court.

7. Companies whose application for compounding is pending before the competent authority for compounding the offences committed by the Company or any of its officers in default.

8. Companies which have accepted public deposits which are either outstanding or the Company is in default in repayment of the same.

9. Companies having charges which are pending for satisfaction.

10. Companies registered under Section 25 of the Companies Act, 1956 or Section 8 of the Act.

Author’s remark:

Companies other than the categories as mentioned above at Serial No. 1 to 10 are eligible to apply to Registrar of Companies for removal of their name from the Register of companies.

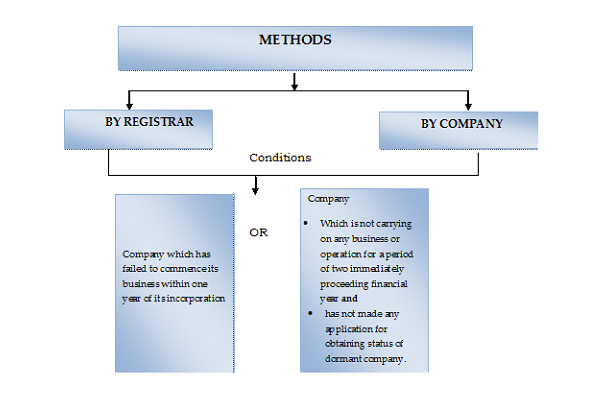

B. METHODS OF REMOVAL OF NAME OF COMPANIES FROM THE REGISTER OF COMPANIES:

C. PROCEDURE TO BE FOLLOWED BY REGISTRAR SOU-MOTO:

1. If a Company satisfies any of the conditions as stated in Point No. B, it can make an application to the Registrar of Companies for removal of its name from the Register of Companies.

Provided further that before making an application, it shall extinguish all its liabilities and shall also obtain the authorization from Board to make an application in prescribed form.

Provided further that before filing the application, the Company shall also obtain the consent by way of Special resolution from its members or obtain the consent of 75% of the members of the Company in terms of the paid up share capital as on the date of application for removal of its name from the Register of Companies.

2. The notice in Form STK1 shall specify the reason of proposed removal.

3. The Registrar shall also provide an opportunity of representation to the company and its directors. However, the representation along with the relevant documents has to be submitted within a period of 30 days from the date of notice1.

Author’s remark:

1It may be noted here that the representation has to be submitted within a period of 30 days from the date of notice and not from the date of receipt of notice.

D. PROCEDURE TO BE FOLLOWED BY THE COMPANY FOR MAKING APPLICATION TO THE REGISTRAR:

1. If a Company satisfies any of the conditions as stated in Point No. B, it can make an application to the Registrar of Companies for removal of its name from the Register of Companies.

Provided further that before making an application, it shall extinguish all its liabilities and shall also obtain the authorization from Board to make an application in prescribed form.

Provided further that before filing the application, the Company shall also obtain the consent by way of Special resolution from its members or obtain the consent of 75% of the members of the Company in terms of the paid up share capital as on the date of application for removal of its name from the Register of Companies.

2. The application shall be made in Form STK 2 along with the documents as stated below2 and with a fee of Rs. 5,000 (Rupees Five Thousand Only) to the Registrar of Companies of the State in which the registered office of the Company is situated.

3. The application shall be digitally signed by the director duly authorised by the Board. In case the director does not have a registered digital signature, a physical copy of the Form STK 2 shall be signed manually by the director duly authorised and the same shall be attached with the Form STK 2.

4. The Form STK 2 shall be certified by a Company Secretary in whole time practice, or a Chartered Accountant in whole time practice, or by a Cost Accountant in whole time practice.

2Documents to be submitted with Form STK2:

- Duly notarized Indemnity Bond in Form STK 3 (to be submitted by every director)

- Duly certified Statement of the account by a Chartered Accountant containing the details of assets and liabilities made up to a day not more than 30 days before the date of application.

- Duly notarized affidavit in Form STK 4 (to be submitted by every director)

- A copy of the Special Resolution duly certified by each of the directors or consent of 75% of the members of the Company in terms of the paid up share capital as on the date of application.

- A statement of pending litigation(s) if any, involving the Company.

Note: If the director is a foreign national or non-resident Indian, the indemnity bond and affidavit shall be notarized or apostilled or consularised.

E. ADDITIONAL REQUIREMENTS:

In respect of the following companies in addition to the documents mentioned above, a no objection certificate from appropriate regulatory authority is required to be attached with the application in Form STK 2.

List of type of companies required to take no objection from the appropriate regulatory authorities:

- Companies which have conducted or conducting non-banking financial & investment activities

- Housing finance companies

- Insurance companies

- Companies in the business of capital market intermediaries

- Companies engaged in collective investment schemes

- Asset management companies

- Any other company which is regulated under any other law for the time being in force.

F. NOTICE OF STRIKING OFF AND DISSOLUTION OF THE COMPANY

The Registrar shall cause a notice under sub-section (5) of Section 248 of striking off the name of the Company from the register of companies and its dissolution to be published in the Official Gazette in Form STK 7 and the same shall also be placed on the official website of the Ministry of Corporate Affairs.

Disclaimer:

The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of preparation. We assume no responsibility for the consequence of such information. It is hereby advised that the reader refers to the relevant provisions of applicable laws for the time being in force.

It must also be noted that this information is not a professional advice and is subject to change without notice.

The author(s) can be reached at anjaliyadav.associates@gmail.com

what happens if the directors are not available and only one director is available. what happens if the notice for removal of the name from the Register of Companies is not replied to because the company ceased operations more than 10 years ago.

very informative with complete detail.

TRIPTI

Good article with right qty of details. Quite insightful. My regards for Taxguru and the author of the article

Thanks