The responsibility of efficient running of the company, maintenance of adequate books of accounts and effective internal control is the responsibility of the management.

Inspections under Companies Act provide assurance to the regulators that the management has satisfactorily achieved these ends.

Page Contents

- Inspection under Section 209A

- Investigation under Section 235:-

- Investigation is the act of determining whether criminal matters such as employee theft, securities fraud (including falsification of financial statements), identity theft, and insurance fraud have occurred.

- Strategy of Inspection

- Techniques

- Case Study: Even Amounts

- Practical applications

- Restructuring

- Creative acquisition accounting

- Companies involved in Creative accounting

Inspection under Section 209A

Inspection can be carried out by

- The Registrar

- Officer of the Government as may be authorised by the Central Government in its behalf.

- Officers of SEBI

The information brought out in the inspection reports, is used for considering action under the provisions of the Companies Act. Prosecutions are launched on the basis of findings in the inspection reports. Besides, cases involving non-compliance of the Companies Act, 1956 including inadequate maintenance of statutory records noticed during such inspection are taken up with the companies for necessary remedial action. In addition, information of interest to other Government Departments and agencies as brought out in the inspection reports are communicated to them for suitable action.

Investigation under Section 235:-

Investigation is the act of determining whether criminal matters such as employee theft, securities fraud (including falsification of financial statements), identity theft, and insurance fraud have occurred.

(1) The Central Govt. may, where a report has been made by the registrar under sub-section (6) of section 234 or under sub-section (7) of that section , read with sub-section (6) thereof, appoint one or more competent persons to investigate the affairs of the company and to report thereon in such a manner as the Central Government may direct.

(2) Where —–

(a) In the case of a company having a share capital an application has been received from not less than two hundred members or from members holding not less than one-tenth of the total voting power therein, and

(b) in the case of the company having no share capital , an application received from not less than one-fifth of the person’s on the company’s register of members,

Criteria for Selection of companies :

a) Complaints received against companies relating to non-refund of deposits/debentures, non-transfer of shares and mis-management etc.

b) Adverse qualification of Statutory Auditors in the Balance Sheet and Profit and Loss Account.

c) References received from other Government Departments namely, Income Tax, RBI, SEBI etc.

d) The companies who have come out with the Public issue of Shares and Debentures.

e) Companies incurring losses continuously for more than three years.

f) Routine Inspection.

Strategy of Inspection

Each assignment is unique, but the following approach can be used:

- Understanding the issues and the problems

- Determining the objectives and time scales

- Finding out what other information is there to help with the investigation

Techniques

I. Analysis of the financial statements

a) Trend Analysis

b) Proportional Analysis

c) Even Amounts

d) Data-mining techniques such as Benford’s Law, a procedure used to determine the likelihood that data have been altered.

e) Ratio analysis

II. Inspection of documents and records

III. Conduct of interviews with persons who would have knowledge about any fraud that’s occurred.

I. Data Analysis Techniques

a) Trend Analysis: Operating data for prior years is compared to evaluate current income or expense. Analysis of trends across years, or across departments, divisions, etc. can be very useful in detecting possible frauds. Another useful calculation is the ratio of the current year to the previous year. A high ratio indicates a significant change in the totals.

Sales and freight costs were charted for 5 years. Sales had increased 130 percent but outbound freight increased 300 percent. On checking it was found that freight bills did not add up to the total. Investigation revealed that excess amount was recorded and stolen.

b) Proportional Analysis:It is a method that appraises certain income and expense by relating them to other income or expense. Some ratios may be based on industry average.

Comparison of payroll ratios of similar organisation showed excessive payroll costs. Investigation revealed that the cashier had been stealing each week and concealing the theft by overstating payroll totals.

c) Even Amounts:Another digital analysis technique is to identify even amounts, numbers that have been rounded up, such as Rs.200.00 or Rs.7, 000.00. The existence of even amounts may be a symptom of possible fraud and should be examined.

The MOD () function can be used to identify these types of even numbers. For example: MOD(Amount,100) = 0 will identify transactions that are a multiple of 100, such as Rs.300.00 and Rs.800.00, and also Rs.1,200 and Rs.15,000, but would not identify transactions with Amounts of Rs.200.23, or Rs.2,250.00. MOD(Amount,1000)=0 will identify transactions with Amounts that are multiples of 1,000, such as Rs.26,000,

Case Study: Even Amounts

Employees had a maximum per diem rate when traveling, but had to submit actual receipts for claiming the expenses. Maximums were also established for meals: Breakfast Rs.60.00, Lunch Rs.240.00 and for Hotel Rs.3,000. MOD() function was used to identify transactions that were multiples of Rs 60.00 or multiples of Rs.1.000.00. Comparison to manual receipts determined that some people were charging the maximum rates for meals and hotels even though the receipts did not justify the amounts.

d) Benford’s Law:-

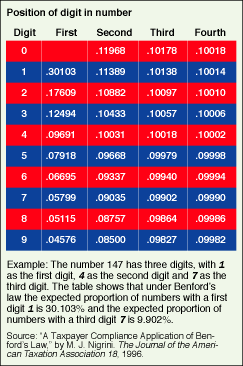

A physicist at GE research laboratories in the 1920s, Frank Benford found that numbers with low first digits occurred more frequently in the world and calculated the expected frequencies of the digits in tabulated data.

A physicist at GE research laboratories in the 1920s, Frank Benford found that numbers with low first digits occurred more frequently in the world and calculated the expected frequencies of the digits in tabulated data.

Benford then tested this idea by looking at the first digits of 20 lists of numbers with a total of 20,229 observations. He found that about 31% of the numbers had 1 as the first digit, 19% had 2, and only 5% had 9 as a first digit.

The expected frequencies of the digits in the first four positions can be seen in exhibit 1, which shows a large bias in favor of low digits in the first position. The probability that the first digit is either a 1, 2 or 3 is 60.2%.

Not all data sets follow Benford’s law. Assigned numbers, such as pin codes or bank account numbers will not conform to Benford’s law. Also as human choices are not random, invented numbers are unlikely to follow Benford’s law.

Benford’s law has been found to apply to many sets of financial data, including income tax or stock exchange data, corporate disbursements and sales figures, demographics and scientific data.

APPLICATION

- Ducking authorisation levels. Sometimes managers concentrate their purchases just below their authorization levels so their choices won’t be scrutinized. Managers with $3,000 purchasing levels might have a lot of invoices for $2,800 to $2,999, which would show up in data analysis by spikes at 28 and 29.

| Benford’s Law Formula |

| P(D1=d1) = log10(1 + 1/d1) for d1{1, 2,…,9} |

- During one bank audit, the auditors analyzed the first two digits of credit card balances written off as uncollectible. The graph showed a large spike at 49. An analysis of the related dollar amounts (that is, from $480 to $499 and from $4,800 to $4,999) showed that the spike was caused mainly by amounts between $4,800 and $4,999, and that one officer was responsible for the bulk of these write-offs. The write-off limit for internal personnel was $5,000. It turned out that the officer was operating with a circle of friends who would apply for credit cards. After they ran up balances of just under $5,000, he would write the debts off.

It’s also possible to test for excessive round numbers when an accountant wants to check for excessive estimating (perhaps royalty receivable schedules) and to test the last two digits to find number invention (perhaps in inventory counts).

Practical applications

Possible practical applications for Benford’s law :

- Accounts payable data.

- Estimations in the general ledger.

- The relative size of inventory unit prices among locations.

- Duplicate payments.

- Computer system conversion (for example, old to new system; accounts receivable files).

- New combination of selling prices.

- Customer refunds

Benford’s law can be used to spot irregularities indicating possible error, fraud, manipulative bias or processing inefficiency. Benford’s law is used to determine the normal level of number duplication in data sets, which in turn makes it possible to identify abnormal digit and number occurrence. Accountants and auditors have begun to apply Benford’s law to corporate data to discover number-pattern anomalies.

e) Ratio Analysis:

Ratio Analysis is of immense value to understand the reasons behind poor financial position. Some of the financial ratios which can be used are:

1. Return on total capital employed.

How to calculate

Profit before interest and tax

------------------------------ x 100

Share capital + reserves + debentures

Using/interpreting this ratio

- This targets the return on capital. The figure will be set by investor expectations. Consistent failure to hit the target would indicate that it would be better selling the company and redeploying its resources elsewhere.

- Comparisons with real interest rates in the market should account for inflation if resources could be redeployed in different economies.

- If assets have been re-evaluated this may increase capital employed and so reduce the return ratio.

- This ratio needs to be considered in relation to the goodwill and development expenditure of accounting policies.

2. Net profit percentage

Identifies the affect of fixed and variable overheads on sales.

How to calculate

Net profit before interest and tax

----------------------------------- x 100

Sales

Using/interpreting this ratio

It requires attention to

- changes in the value of sales.

- changes in the structure of overhead costs. A company that has incurred a move to newer, more costly premises will feel an adverse affect on net profit % .

3. Turnover Ratios

These ratios measure whether a uses the resources effectively. A company which manages its funds/stock properly, realizes its debts in time enjoys good capital turnover ratio. This ratio indicates the efficiency or inefficiency of employment of capital.

II.Inspection of documents and records

1. Study of ROC/RD records

Scrutiny of

a) Memorandum and Articles of Association

b) Prospectus

c) Balance Sheet and P/L account

d) Annual returns

e) Returns of charges, modification of charges

f) Returns under section 303

g) Special resolution

h) Returns under section 58-A

If any of these are not filed the same should be seen in the office to check whether they were not deliberately filed in an attempt at withholding information.

2. Record maintained by the company:

Detailed scrutiny of

a) Board minutes

b) General meeting minutes

c) Trial Balance and related ledger accounts.

d) Transaction in Properties.

e) Investments.

f) Current Assets, Loans and Advances

g) Stock-in trade

h) Sundry Debtors

i) Capitalisation of Profits

j) Miscellaneous Expenditure

k) Transactions in which directors are interested

l) High value transactions and whether directors are interested

m) Verification of managerial remuneration, if any paid, with particulars referred to in Schedule XIII

n) Disclosures as required by Schedule VI ,CARO rules, accounting standards to ascertain true and fair view of the affairs of the company

o) Various secured and unsecured loans granted and availed by the company

p) Fixed Deposits analysis regarding compliance of section 58A and rules framed there under

q) Expenditure in foreign currency

r) Depreciation

III. Conduct of interviews

Interviewing is a significant part of the investigative process. A major factor in the success or failure of an investigation lies in properly conducting interviews. An especially good source of information is the disgruntled employee (who may be disgruntled because of the suspected fraud) or other employee More than one-quarter of all frauds are uncovered because of employee tips.

Investigators may use deception to bluff a suspect into revealing information that may be helpful. To avoid lawsuits or tainting evidence, deception should never be used to threaten, force or coerce a person.

To avoid legal repercussions:

- never make unfounded accusations or statements;

- provide an employee with a written notice of charges

- never ask about activities unrelated to work;

- never disclose private information about an employee to others not involved in the investigation; and

- never detain an employee for an interview in a way that could be construed as threatening or forceful.

The Inspecting officer has to acquaint himself with the working of the company and the pattern of management.

Full appreciation of the level at which decisions are taken will enable the officer to fix responsibility about violations and regulations. Also, the officer should acquaint himself with the basic information about the general economy of the particular industry to which the company belongs, its special process. This will lead to better understanding of the working of the company.

Common techniques of creative accounting –

On Balance Sheet

Most popular creative accounting techniques – “big bath” restructuring charges, creative acquisition accounting, “cookie jar reserves,” “immaterial” misapplications of accounting principles, and the premature recognition of revenue.

“Big bath” charges

Companies sometimes set up large charges associated with companies restructuring. These charges help companies “clean up” their balance sheet — giving them a so-called big bath.”

When earnings take a major hit, – analysts will look beyond a one-time loss and focus only on future earnings. Consequently, these charges are “conservatively estimated” with extra cushioning. The so-called conservative estimates then miraculously end up as income when future earnings fall short.

Restructuring

When a company decides to restructure, management and employees, investors and creditors, customers and suppliers all want to understand the expected effects. It is important to ensure that financial reporting provides this information. But this should not lead to flushing all the associated costs — and maybe a little extra — through the financial statements.

Creative acquisition accounting

In recent years, whole industries have been rationalised through consolidations, acquisitions and spin-offs. Some acquirers, particularly those using stock as an acquisition currency, have used this environment as an opportunity to engage in “Creative Acquisition Accounting.”

In the purchase price allocation procedures, they classify a large portion of the acquisition price as “in-process” Research and Development, which can be written off in a “one-time” charge — removing any future earnings drag. Sometimes, large liabilities for future operating expenses are created to protect future earnings.

A third trick played by some companies is using unrealistic assumptions to estimate liabilities for such items as sales returns, loan losses or warranty costs. In doing so, they stash accruals in “cookie jars” during the good times and reach into them when needed in the bad times.

Materiality

Some companies misuse the concept of materiality. They “intentionally” record errors within a defined percentage ceiling. This is justified on the basis that the effect on the profit is too small to matter. A Fortune 500 company which had recorded a significant accounting error, and the auditors told them so. But they still used a materiality ceiling of six percent earnings to justify the error. Materiality is not a bright line cut-off of three or five percent. It requires consideration of all relevant factors that could impact an investor’s decision.

Revenue recognition

Finally, some companies try to boost earnings by manipulating the recognition of revenue. E.g. recognising it before a sale is complete, before the product is delivered to a customer, or at a time when the customer still has options to terminate, void or delay the sale.

Non recurring charges

Non recurring items are supposed to be income or expenses that are “not expected to recur on a regular basis,” and the “term is often used interchangeably with special items.”

According to experts, companies that supposedly practice clean accounting, have a low incidence of nonrecurring charges. E.g. Dell Computer 1%, Intel 1%, and Microsoft 0%. Experts feel that any company with a ratio of three percent or higher as a suspected nonrecurring expense abuser. Here are the ratios for some firms that persistently record nonrecurring charges: Cisco Systems 7%, Computer Associates 9% and Yahoo 13%.

A company may have a legitimate reason for its persistent nonrecurring expenses. Consider the nonrecurring expense ratios as another tool for evaluation during inspection

Why companies manipulate profits?

1. A company that faces a high (and difficult to meet) security analysts’ (consensus) profit forecast.

Security analysts carry out their own independent research into companies they can come to different conclusions about a company’s future prospects.

An important ingredient in forming a recommendation is to forecast a company’s future profits. The company’s directors might try to manipulate their reported profits to match or slightly exceed the analysts’ forecasts. Falling significantly below the analysts forecasted profit might lead to panic selling of the company’s shares, while reporting a profit greatly in excess of the forecast will only lead to unrealistic expectations next year.

2 A listed company’s interim financial statements.

Public listed companies are required, under Stock Exchange Listing Rules to report half yearly financial statements, as well as annual financial statements (which is of course a Companies Act requirement), there is more scope for companies to report good results in the interim financial statements knowing the statements are not subject to the same detailed scrutiny as the yearly financial statements.

3 A recently taken-over company.

When a company is taken over it is common practise for the existing directors to be sacked and new directors appointed. This situation presents the new directors with a ‘one-off’ accounting opportunity. That is, they may well be able to get away with reporting a loss in the financial accounting period covering the change of management. The loss is often bigger than expected as the results have been manipulated downwards, with the managers ‘saving’ profits for future years. How can they get away with reporting such bad news? Simple, blame the poor results on the previous managers. This well known phenomenon is called ‘big bath accounting’.

The next year the ‘saved profits’ come in very useful, as they can be used to inflate the year’s profits as proof that they are doing a fine job turning a poorly performing company into a ‘super-efficient’ company.

4 A company’s directors are considering changing the status of a private company to a public listed company.

That is, making an Initial Public Offering (IPO) of the company’s shares. In order for the shares to be attractive to potential investors, it is useful to have a good track record of steadily increasing profits, in order to give the impression that this trend will continue into the future. One way is to manipulate the results. That is, if the company experiences a poor year its results are manipulated upwards, while in a good year the results are manipulated downwards (saving profits for future poor years).

5 A large regulated utility company.

Many large companies, particularly regulated utility companies, have a high political profile. Their actions such as raising prices to customers and reporting high increased profits are seen, particularly by the media (press and TV), as an exploitation of their powerful, often monopoly position. Also, politicians are on the look out for ‘public interest’ cases to champion, to show they are representing the electorate. Such companies have an incentive to report lower rather than higher profits to keep out of the political spot-light.

6 The economy is moving into recession.

When the economy is moving into recession, it is likely that most companies are reporting reductions in profit. Therefore, any manipulation may well be in the upward direction in order for the results to be more favourably compared with those of the previous year. It is also common practice for Chairman and Managing Directors to blame their company’s poor performance on the state of the economy.

7 A company whose trade unions are about to submit a large wage demand.

The employees representatives are likely to have done their homework prior to submitting a wage demand. They will do a thorough analysis of the company’s financial statements and in particular the state of the company’s profits. Therefore, company directors have an incentive to report lower rather than higher profits.

8 There is a strong rumour that a public company might be subject to a hostile take-over bid.

Directors’ of public companies live in fear of a hostile or unfriendly take-over bid. If the bid is succesful then the existing directors are likely to soon be out of a job. One of the many defences available to the directors to prevent the bid arising is to impress their shareholders with ‘healthy looking’ financial statements. This may mean reporting a higher than deserved profit figure.

9 A company performing below its industry average.

If a company is under-performing compared with other companies in its industry, there will be incentives for its directors to use aggressive (i.e., profit increasing) accounting policies.

10 A company’s directors are on a profit related bonus scheme.

At first sight the incentives appear obvious; that is, the higher the profit the greater the directors’ bonus.

However, bonus schemes in the real world, are rarely as straightforward as just described. Bonus schemes often have a lower qualifying level and an upper ceiling. Any profits reported below the qualifying level (say £1 million) earns the directors no bonus at all, as this is seen as a poor performance which is not worthy of reward. Reported profits in excess of the ceiling (say £10 million) attract no further bonus as this is seen as excessive reward which may well result from creative accounting.

Now the incentives become more interesting:

(i) if the company has a poor year with, say, profits (after upward manipulation) of only £0.5 million, the incentive may well be for the directors to report a lower profit than £0.5 million and save some profit for future years when it can be used to earn bonuses. However, it is usually advisable to avoid ‘going into the red’ as the psychological impact of reporting losses can be very damaging;

(ii) if the company has an average to good year and its reported profits fall between the two levels, the incentive is to report a higher profit to earn a higher bonus;

(iii) if the company has experienced an exceptionally good year with profits well in excess of the ceiling (say £15 million) the incentive becomes one of reducing profits to the bonus ceiling level, to earn the maximum bonus. The additional profits can be saved for future, less exceptional years.

11 A company that is in fairly permanent decline.

Directors of companies that are in permanent decline, can get quite desperate and be tempted to manipulate profits to a greater and greater extent each year. However, there is only so much manipulation that can be carried out within the law and eventually the only way of covering up poor results is to resort to fraud. You are no doubt familiar with some recent financial scandals where apparently healthy companies suddenly collapsed.

12 A company has borrowed heavily and is highly geared.

When a company borrows money from financial institutions they are frequently forced to agree to a number of restrictive measures contained in a legally enforceable contract called a ‘debt covenant’. One such measure is an upper level for the company’s gearing ratio as measured by dividing debt by shareholders’ funds. If a company is close to this upper level then its directors have an incentive to use accounting manipulation to either reduce its debt or increase its reported shareholders’ funds.

13 A company operates in an industry known for highly volatile profits.

Such companies are likely to use profit manipulation to ‘smooth-out’ their profit trends, on the basis that the greater the variation in reported profits, the greater will be their perceived risk and the lower their share price. So, if the company’s underlying performance is poor it is likely to use profit increasing manipulations, while if underlying performance is good the company is likely to use profit reducing manipulations.

14 A company is faced with severe foreign competition.

Such a company may well look to its government to help it out, by imposing restrictions upon the number and/or quality of foreign imports. The government will need to be satisfied that the company is indeed struggling to survive, therefore, the reporting of lower rather than higher profits will strengthen the company’s case for Government assistance.

15 The directors of one of a group’s non core divisions is planning a ‘buy-out’.

While the group will want to sell the non core division so that it can concentrate upon its core activities, it will want to obtain the highest possible price for the division.

However, the directors of the division will want to pay the lowest possible price. As it is these divisional directors who are responsible for preparing the division’s financial statements, they clearly have an incentive to manipulate the reported divisional profit down-wards in the years proceeding the buy-out, as it is these profit figures that will be used to determine the buy-out price.

16 A company is looking to reduce its tax bill.

As the amount of taxation a company pays is to some extent based upon the reported profit figure, the incentive is to manipulate profit downwards

Companies involved in Creative accounting

- Xerox, restated earnings by $1.2 billion after a whistleblower revealed accounting irregularities

- Qwest Communications, restated $900 million in revenue. The U.S. Justice Department announced a 12-count fraud indictment against four former Qwest executives. The indictment accuses the defendants of seeking to create more than $33 million by wrongly reporting an order with the Arizona School Facilities Board. The action violated Securities and Exchange Commission rules.

The SEC filed related civil fraud charges against those four former executives and four other former Qwest employees, alleging that they inflated the company’s revenues by $144 million in 2000 and 2001 to meet Wall Street’s expectations.

- Two former Kmart Corp. vice presidents were indicted for allegedly inflating the company’s earnings. The federal charges include securities fraud, making false statements to the SEC and conspiracy to commit those offenses. According to the indictment, the pair’s false statements to Kmart’s accounting and auditing divisions resulted in the company filing with the SEC a quarterly report that overstated operating results by $42.3 million in the second quarter of 2001 and helped Kmart meet Wall Street’s earnings expectations.

Click here to Read/Download Other Articles/Books written by CA Rajkumar S. Adukia