Sponsored

1. What are IND AS?

- IND AS stands for Indian Accounting standards and are converged standards for International Financial Reporting standards (IFRS). In simple terms, Indian accounting standards came into existence to meet the requirements of IFRS.

- The Government of India in consultation with ICAI decided to converge and not to adopt IFRS issued by the International Accounting standards Board (IASB).

2. Who has issued IND AS?

- Indian Accounting Standards (IND AS) were issued by Central Government of India under the supervision and control of Accounting Standards Board (ASB) of ICAI and in consultation with National Advisory Committee on Accounting Standards (NACAS).

- National Advisory Committee on Accounting Standards (NACAS) recommends these standards to the Ministry of Corporate Affairs (MCA). Then MCA has to spell out the accounting standards applicable for companies in India.

3. Where in companies Act has these rules being notified?

- The Ministry of Corporate Affairs (MCA) in 2015, had notified the Companies (Indian Accounting Standards (IND AS) Rules 2015 for adoption and implementation of IND AS in a phased manner beginning from Accounting year 2016-17.

- Later MCA has issued three Amendment Rules, one in each year 2016, 2017 and 2018 to amend the 2015 rules.

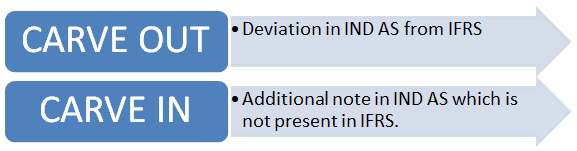

4. What is meant by Carve outs/ins in IND AS?

- As IND AS are converged standards for IFRS i.e. IFRS are not adopted as it is. Certain changes have been made in IFRS considering the economic environment of the country. These differences are due to differences in application of accounting principles and practices and economic conditions prevailing in India. These differences which are in deviation to the accounting principles stated in IFRS are commonly known as ‘Carve- Outs’.

- A carve out essentially means that certain requirements of an accounting standard under IFRS are not be adopted

- There is certain additional note or guidance given in IND AS which is over and above to what is given in IFRS. This is termed as ‘Carve-in’.

Thus to summarize-

5. From when will these IND AS be applicable in India?

- MCA has the power to spell out the accounting standards applicable to companies in India.

- Thus, MCA has notified a phase-wise implementation of IND AS.

IND AS shall be adopted by specific classes of companies based on their Net worth and listing status.

- These Phases will be applicable to all companies except Banks, NBFC’s and Insurance Companies (Separately shown).

- The Phases are as follows-

Note–

- It is applicable to Company that are either listed or unlisted or in process of listing on Stock exchanges in India or Outside India.

- Once IND AS are applicable, an entity shall be required to follow the standards for all subsequent financial statements.

- Net worth shall be checked for the previous three financial years.

Note–

- Listed Companies will not include companies listed on SME exchanges.

- Companies listed on SME exchange will not be required to apply IND AS.

- Once IND AS are applicable, an entity shall be required to follow the standard for all subsequent financial statements.

- Companies not covered in Phase I and Phase II shall continue to apply existing Accounting standards notified in Companies (Accounting Standards) Rules, 2006.

Phases for NBFC’s, Banks and Insurance Company

1. NBFC

- Phase II

Note–

- It is applicable to NBFC which are either listed or in process on being listed on any stock exchange whether in India or outside India.

- It is applicable for both Consolidated and Individual Financial Statements.

- NBFC’s having net worth below 250 crores shall not apply IND AS.

- Voluntary adoption of IND AS is not allowed.

2. Scheduled Commercial banks (excluding RRB’s) and Insurance Companies

- Applicable from 1st April, 2018.

- It will be applicable to Holding, subsidiary, JV and Associate companies of scheduled commercial banks.

- Urban Co-operative Banks (UCBs) and Regional Co-operative Banks (RRBs) are not required to apply IND AS.

- IND AS were applicable on banking companies from 1st April, 2018. Reserve Bank of India (RBI) has deferred applicability of IND AS on commercial bank by one year i.e. 1st April, 2019.

- IND AS were applicable on insurance companies from 1st April, 2018. Insurance Regulatory and Development Authority of India (IRDA) has deferred applicability of IND AS in insurance sector by two years i.e. 1st April, 2020.

6. How to calculate Net worth of the company?

- Net worth can be calculated by using the following formula

- Net worth will be calculated as per standalone balance sheet as at 31.03.2014 or the first audited balance sheet for accounting period which ends after date.

Hope this article helps you. Happy reading!

This article is for guidance only, not to be substituted for detailed research or the exercise of professional judgement.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Can we just take net-worth as total assets minus total liabilities?