In the earlier article we had seen basics of Indian Accounting standards (IND AS), Now in this article you will be able to read about IND AS 1- Presentation of Financial Statements

1. What is the objective of IND AS 1?

- This standard prescribes the basis of Presentation of General Purpose Financial statements.

- This will ensure comparability both with-

- Entity’s Financial statements of previous periods

- Financial statements of other entities

- It sets out-

- Overall requirement of presentation of financial statements

- Guidelines for their structure and

- Minimum requirement for their content

2. What is the purpose of financial statements?

- Financial statements represent two important aspects about an entity-

3. As per IND AS, Financial statement comprises of what?

3. As per IND AS, Financial statement comprises of what?

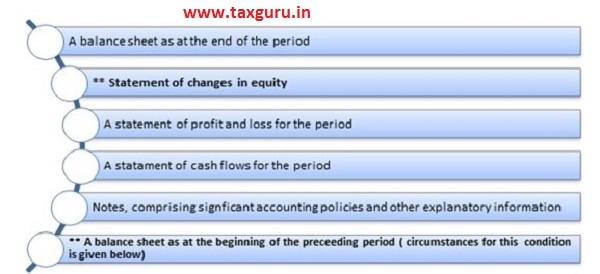

- A complete set of financial statements comprises of –

** These are the new requirement in IND AS which were not present in accounting standards (AS).

4. What is Statement for changes in Equity?

- This requirement of IND AS 1 was not present in Accounting standards.

- In statement of changes in equity, the standard requires an entity to present ALL OWNER CHANGES in equity.

- All Non-owner changes in equity (i.e. Comprehensive Income) are required to be presented in single statement of profit and loss and other comprehensive income presented in two sections.

5. Under IND AS 1, there are few circumstances where three Balances sheets are required to be given. What are those circumstances?

- IND AS 1 specifies few circumstances where an entity is required to prepare opening balance of previous year. There was no such requirement present in accounting standards.

- The circumstances are as follows-

- When an entity applies an accounting policies retrospectively; or

- Makes a retrospective restatement of items in its financial statements;

- When it reclassifies items in its financial statements.

- That is in IND AS 1 there is THREE BALANCE SHEET

- Three Balance sheet concept can be explained with the following example-

- Suppose an entity is required to prepare balance sheet for F.Y 2018-19 and it restates an item in its balance sheet as on 31.03.2012.

- Then the entity is required to make changes in its financial statements from 31.03.2012 till 31.03.2017. Prepare a separate balance sheet as on 01.04.2017 after incorporating all the changes.

- The financial statements for F.Y 2018-19 will include-

- Balance Sheet as on 31.03.2019

- Balance Sheet as on 31.03.2018

- Balance Sheet as on 01.04.2017

6. What is Other Comprehensive Income?

- The Standards requires an entity to present a single statement of Profit and Loss.

- Statement of Profit and Loss will comprise of 2 sections-

1. Profit and loss items

2. Other comprehensive income

- Other comprehensive income comprises of income and expenses (including reclassification adjustments) that are not recognized in profit and loss as required or permitted by other Ind As.

- Reclassification adjustments are the amounts reclassified to profit and loss in the current period that were previously recognized in other comprehensive income.

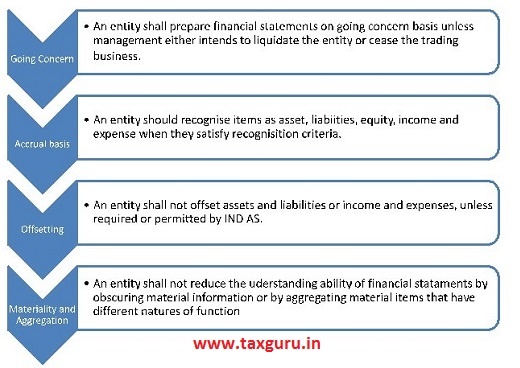

7. What are the fundamental assumptions?

Hope you enjoy reading this article!