Managerial Remuneration (MR) encompasses the compensation provided to key management personnel for their efforts in enhancing a company’s performance. This comprehensive guide aims to simplify the provisions of managerial remuneration as outlined in the Companies Act, 2013. It covers essential points such as calculation methods, restrictions, and requirements regarding remuneration for directors, managing directors, and whole-time directors.

“Diving into Managerial Remuneration: Simplifying the Provisions of Managerial Remuneration.”

MANAGERIAL REMUNERATION:

Salary and other benefits provided to managers in exchange for their daily efforts to improve the company’s performance are known as managerial remuneration (MR). To calculate Managerial Remuneration, we consider any salary and other perks drawn by Directors, Managing Director and Whole-Time Director, Managing Director and Managers (Directors). As the company’s uppermost management, directors are responsible for a wide range of critical responsibilities, including developing the company’s strategy, allocating and safeguarding resources, managing finances, making financial choices, and much more. In light of this, it is imperative that their contributions be acknowledged and that they receive adequate compensation.

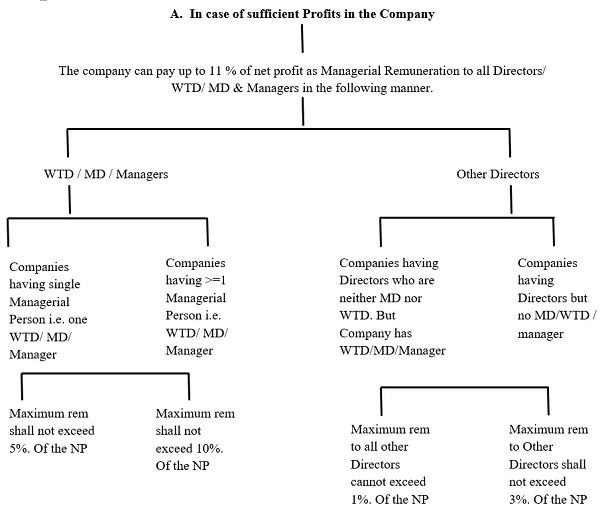

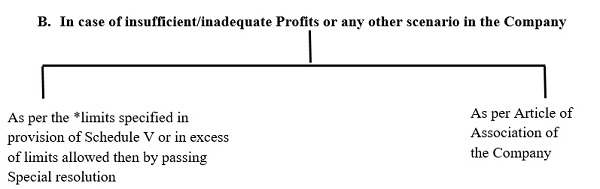

However, the Companies Act, 2013 (Act), restricts the rights of the Directors of the Public Company to withdraw remuneration subjecting it to a maximum limit in terms of the Company’s profitability. Provisions relating to Managerial Remuneration are provided in Section 197, 198, and Schedule V of the Companies Act, 2013.

Let’s note some of the important points:

- Net Profit shall be calculated as per Section 198 of the act.

- Remuneration can be either a monthly payment or a specific percentage of profit.

- If the Company has a Nomination and Remuneration Committee (NRC), remuneration shall be recommended by NRC to the Board

- Fees paid for providing professional services are not considered Managerial Remuneration

- Maximum Sitting fees of INR 1,00,000 /- can be paid to each Director for attending Board and Committee meetings.

- A stock option is a part of Managerial remuneration.

- Independent Directors can be paid sitting fees for the meeting attended and commission paid as a % of the profit of the Company.

- Independent Directors can be paid sitting fees but cannot be paid monthly remuneration and stock options.

- Effective Capital shall be determined as per the last date of the financial year preceding the financial year in which the managerial person is appointed.

- Where the appointment of the managerial person is made in the year in which the company has been incorporated, the effective capital shall be calculated as on the date of such appointment

Note: rem stands for Remuneration; NP stands for Net profit, MD Stands for Managing Director; WTD stands for whole time Director

| # Where the effective capital (in rupees) is | * Limit of yearly remuneration payable shall not exceed (in Rupees) in case of a managerial person | Limit of yearly remuneration payable shall not exceed (in rupees) in case of other director |

| Negative or less than 5 Crores | 60 Lakhs | 12 Lakhs |

| 5 crores and above but less than 100 Crores | 84 Lakhs | 17 Lakhs |

| 100 Crores and above but less than 250 Crores | 120 Lakhs | 24 Lakhs |

| 250 Crores and above | 120 Lakhs Plus 0.01 % of the effective capital in excess of 250 Crores | 24 Lakhs plus 0.01% of the effective Capital in excess of Rs. 250 Crores. |

* “Effective Capital” means the aggregate of the paid-up share capital (excluding share application money or advances against shares); amount, if any, for the time being standing to the credit of share premium account; reserves and surplus (excluding revaluation reserve); long term loans and deposits repayable after one year (excluding working capital loans, overdrafts, interest due on loans unless funded, bank guarantee, etc., and other short-term arrangements) as reduced by the aggregate of any investments (except in case of investment by an investment company whose principal business is the acquisition of shares, stock, debentures or other securities), accumulated losses and preliminary expenses not written off.

Managerial Remuneration under SEBI (Listing of Obligation and Disclosure Regulation) 2015

The board of Directors of a listed entity may on the recommendation of NRC recommend remuneration, fees, and compensation to all Executive Directors and Non-Executive Directors subject to the Approval of Shareholders.

The requirement of obtaining approval of shareholders in general meetings shall not apply to payment of sitting fees to non-executive directors if made within the limits prescribed under the Companies Act, 2013 for payment of sitting fees without the approval of the Central Government.

The approval of shareholders shall specify the limits for the maximum number of stock options that may be granted to non-executive directors, in any financial year and in aggregate.

The approval of shareholders by special resolution shall be obtained every year, in which the annual remuneration payable to a single non-executive director exceeds fifty percent of the total annual remuneration payable to all non-executive directors, giving details of the remuneration thereof.

Independent directors shall not be entitled to any stock option.

The fees or compensation payable to executive directors who are promoters or members of the promoter group shall be subject to the approval of the shareholders by special resolution in a general meeting, if-

i. the annual remuneration payable to such executive director exceeds rupees 5 crores or 2.5 percent of the net profits of the listed entity, whichever is higher; or

ii. where there is more than one such director, the aggregate annual remuneration to such directors exceeds 5 percent of the net profits of the listed entity

Provided that the approval of the shareholders under this provision shall be valid only till the expiry of the term of such director.

[Note: For the purposes of this clause, net profits shall be calculated as per section 198 of the Companies Act, 2013.]

The minimum information to be placed before the board of directors is specified in Part A of Schedule II.

The chief executive officer and the chief financial officer shall provide the compliance certificate to the board of directors as specified in Part B of Schedule II.

Conclusion: Navigating the complexities of managerial remuneration is crucial for ensuring regulatory compliance and fair compensation practices within companies. By understanding the provisions outlined in the Companies Act, 2013, and SEBI regulations, companies can effectively structure remuneration packages for their key management personnel while adhering to legal requirements and corporate governance standards.

*****

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement