The purpose of CSR is to ensure that corporates give back to the community as they are using the social resources. CSR is extremely important for sustainable development of all stakeholders. India is the only country which has regulated and mandated CSR for some select categories of companies registered under the companies act. The CSR concept in India is governed by Section 135 of the Companies Act, 2013 and rules made thereunder.

Section 135 of the Companies Act, 2013

It mandate that any company with

– a net worth of over Rs 500 crore or more; or

– annual turnover of Rs 1,000 crore or more; or

– net profit of Rs 5 crore or more during the immediately preceding financial year has to spend 2% of the average profit of the previous three years on CSR activities.

Following are the important amendments in section 135 pursuant to Companies (Amendment) Act, 2019 and 2020.

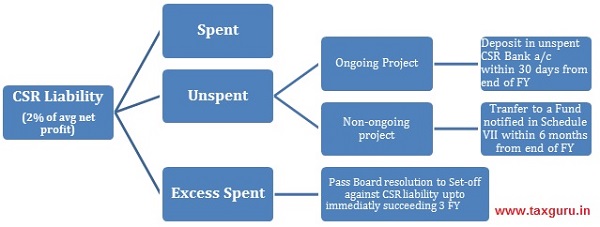

Set-off of CSR expenditure:

Companies are allowed to set off any amount spent in excess of their CSR spending obligation in a particular financial year towards such obligation in subsequent three financial years.

Introduction of Penal provisions for non-compliances:

If a company is in default in complying with the provisions of sub-section (5) i.e. spending of 2% of the average profits or sub-section (6) i.e. transferring the unspent amount to a special account, the company shall be liable to a penalty of twice the amount required to be transferred by the company to the Fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account, as the case may be, or Rs.1 crore rupees, whichever is less, and Every officer of the company who is in default shall be liable to a penalty of one-tenth of the amount required to be transferred by the company to such Fund specified in Schedule VII, or the Unspent Corporate Social Responsibility Account, as the case may be, or two lakh rupees, whichever is less and Provision for imprisonment is removed.

CSR liability Sec.135 (5) and (6):

Relaxation to constitute CSR Committee for some companies:

A new sub-section 9 has been inserted wherein the amount to be spent by a company under sub-section (5) does not exceed Rs.50 lakh , the requirement of constitution of the CSR Committee shall not be applicable. Functions of such Committee shall be discharged by the Board of Directors of such company.

All said amendments in Sec.135 are effective from 22nd January, 2021.

Companies (Corporate Social Responsibilities Policies) Rules:

On 22nd January, 2021 The Companies (Corporate Social Responsibilities Policies) Amendment Rules, 2020 (CSR Amendment Rules, 2020) were notified altering the provisions made under the Companies (Corporate Social Responsibilities Policies) Rules, 2014 (CSR Rules, 2014)

Rule 2 – Definitions:

| Erstwhile definition | New definition |

| – | “Administrative overheads” means the expenses incurred by the company for ‘general management and administration’ of Corporate Social Responsibility functions in the company but shall not include the expenses directly incurred for the designing, implementation, monitoring, and evaluation of a particular Corporate Social Responsibility project or programme; |

| – | “On-going Project” means a multi-year project undertaken by a Company in fulfilment of its CSR obligation having timelines not exceeding three years excluding the financial year in which it was commenced, and shall include such project that was initially not approved as a multi-year project but whose duration has been extended beyond one year by the board based on reasonable justification; |

| – | “Public Authority” means ‘Public Authority’ as defined in clause (h) of section 2 of the Right to Information Act, 2005 |

| – | “International Organisation” means an organisation notified by the Central Government as an international organisation under section 3 of the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), to which the provisions of the Schedule to the said Act apply; |

| Corporate Social Responsibility

CSR means and includes but is not limited to :- (4) Projects or programs relating to activities [areas or subjects] specified in Schedule VII to the Act; or (ii) Projects or programs relating to activities undertaken by the board of directors of a company (Board) in pursuance of recommendations of the CSR Committee of the Board as per declared CSR Policy of the company subject to the condition that such policy will include activities, areas or subjects specified in Schedule VII of the Act. |

Corporate Social Responsibility

CSR means the activities undertaken by a Company in pursuance of its statutory obligation laid down in section 135 of the Act but does not include following (i) Activities undertaken in pursuance of normal course of business of the company; (except R & D activity pertain to COVID-19 vaccine); (ii) any activity undertaken by the company outside India; (iii) direct or indirect contribution to any political party under section 182; (iv) activities benefitting employees of the company; (v) activities supported by the companies on sponsorship basis for deriving marketing benefits for its products or services; (vi) activities carried out for fulfilment of any other statutory obligations |

| CSR Policy relates to the activities to be undertaken by thecompany in areas or subjects specified in Schedule VII to the Act and the expenditure thereon, excluding activities undertaken in pursuance of normal course of business of a company; | CSR Policy means a statement containing the approach and direction given by the board of a company, taking into account the recommendations of its CSR Committee, and includes guiding principles for selection, implementation and monitoring of activities as well as formulation of the annual action plan; |

–

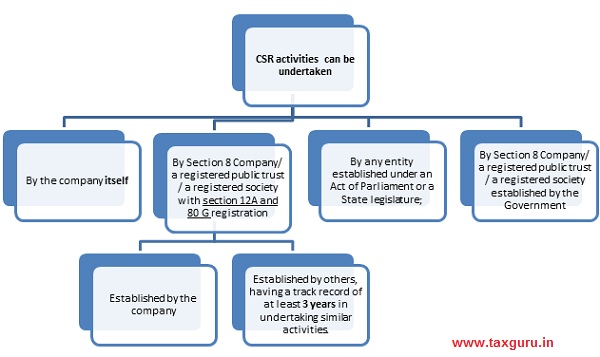

| Rules 4 | CSR Implementation |

| 4 (1) | The Board shall ensure that the CSR activities are undertaken by the company itself or through Section 8 Company, or a registered public trust or a registered society, registered under section 12A and 80 G of the Income Tax Act, 1961

– Established by the company, either singly or along with any other company; – Established by others, having a track record of at least three years in undertaking similar activities.

|

| 4 (2) | CSR Registration Number – Form CSR-1 |

| Other than the Company itself all other entities intends to undertake any CSR activity shall filing the Form CSR-1 w.e.f. 1st April, 2021 and get the unique CSR Registration Number | |

| 4 (3) | International Organisation (IO) |

| IO can assist Company in for capacity building designing, monitoring and evaluation of CSR projects/programmes | |

| 4 (4) | CSR can be undertaken with collaboration of other companies |

| 4 (5) | The Board of a Company shall ensure utilisation of CSR fund for the purpose and in the manner approved by it and CFO or other person responsible for financial management shall certify the same. |

| 4 (6) | Board to monitor on-going CSR projects with reverence to timeline and year wise fund allocation. |

CSR Implementation:

| Rule 5 | CSR Committees |

| 5 (1) | Constitution of CSR Committee |

| 5 (2) | CSR Committee shall formulate and recommend to the Board, an annual action plan in pursuance of its CSR policy, which shall include the following:

– list of CSR projects or programmes – the manner of execution of such projects or programmes – the modalities of utilisation of funds and implementation schedules – monitoring and reporting mechanism – details of need and impact assessment, if any With reasonable justification the Board may alter action plan. |

–

| Rule 6 | CSR Policy |

| Omitted

What is to be captured in CSR policy is already sheltered under Sec.135 (3)(a) and revised CSR policy definition. CSR policy shall: – indicate the activities to be undertaken by the company in areas or subject, specified in Schedule VII; – comprise approach and direction with respect to Company’s CSR; – includes guiding principles for selection, implementation and monitoring of activities as well as formulation of the annual action plan |

–

| Rule 7 | CSR Expenditure |

| 7 (1) | The Board shall ensure that the administrative overheads shall not exceed 5% total CSR expenditure of the company for one financial year. |

| 7 (2) | Surplus from CSR

Any surplus arising out of the CSR activities shall be ploughed back into the same project or shall be transferred to the Unspent CSR Account and spent in pursuance of CSR policy and annual action plan of the company or transfer such surplus amount to a Fund specified in Schedule VII, within a period of 6 months of the expiry of the financial year. |

| 7 (3) | Excess CSR spends

Set-off of CSR expenditure: Excess amount may be set off up to immediate succeeding three financial years CSR obligation. Such excess amount shall not include the surplus arising out of the CSR activities and the Board of the company shall pass a resolution to that effect. Set-off of excess spends is available however same is not available for Surplus arising from CSR activities. |

| 7 (4) | Capital Assets

CSR amount may be spent by a company for creation or acquisition of a capital asset. Which shall be held by – (a) a company established under section 8 of the Act, or a Registered Public Trust or Registered Society, having charitable objects and CSR Registration Number under sub-rule (2) of rule 4; or (b) beneficiaries of the said CSR project, in the form of self-help groups, collectives, entities; or (c) a public authority: Capital Assets created prior to CSR Rules, 2021 to be transferred as per these Rules in 180 days ( 90 days with approval of Board with justification. As per this rule company shall not keep ownership of Capital assets and may act as a custodian only. MCA shall clarify issues which may arise in transfer of capital assets. E.g Stamp duty and registration cost, accounting etc. |

–

| Rule 8 | CSR Reporting |

| 8 (1) | Board’s Report to include an annual report on CSR containing particulars specified in Annexure I or Annexure II, as applicable. |

| 8 (2) | Foreign Company to include annual report on CSR containing particulars specified in Annexure I or Annexure II, as applicable with their balance sheet filed under Sec.381(1)(b) |

| 8 (3) | Impact assessment of CSR projects having outlays of 1 crore rupees or more, through an independent agency is mandatory for companies having average CSR obligation of 10 crore rupees or more.

The impact assessment reports shall be placed before the Board and shall be annexed to the annual report on CSR. Company can book impact assessment expenditure towards CSR for that financial year not exceeding 5% of the total CSR expenditure for that financial year or Rs.50 lakhs whichever is less. |

–

| Rule 9 | Display of CSR activities on website |

| The Board of Directors shall disclose following on Company’s website:

– Composition of the CSR Committee; – CSR Policy; – Projects approved by the Board |

Role and Responsibility of CSR Committee

- To formulate & recommend to the Board CSR policy;

- The CSR Committee shall formulate and recommend to the Board, an annual action plan in pursuance of its CSR policy;

- To recommend the amount of expenditure to be incurred on CSR activities

- To monitor CSR policy of the Company from time to time.

Role and Responsibility of Board of Directors

- Formulate CSR Policy and ensure that activities as are included in the Policy are undertaken by the company.

- shall satisfy itself that the funds so disbursed have been utilised for the purposes and in the manner as approved by it and the Chief Financial Officer (CFO) or the person responsible for financial management shall certify to the effect.

- shall monitor the implementation of the project with reference to the approved timelines and year-wise allocation and shall be competent to make modifications, if any, for smooth implementation of the project within the overall permissible time period.

- board shall ensure that the administrative overheads shall not exceed 5 % of total CSR expenditure of the company for the financial year

- shall mandatorily disclose the composition of the CSR Committee, and CSR Policy and Projects approved by the Board on their website, if any, for public access.

The new rules shall bring following benefits to the companies:

– Companies can now spend excess amount towards its CSR obligations in one financial year, if required in the project, knowing that such excess amount would be set off in the subsequent financial years;

– Companies whose CSR obligations are less than INR 50 lakhs need not constitute a CSR committee.

– Impact assessment will help the company to use the CSR fund towards its optimum utilization. It will also help to bring meaningful and positive impact in society at large.

Disclaimer: This article shall not be construed as legal opinion. It is for general information only and not intended for solicitation.