Understand Ind AS 103 for Business Combinations, Mergers, and Acquisitions. Learn about the objective, acquisition method, goodwill, reverse acquisition, and more. Stay updated with the Companies (Indian Accounting Standards) Amendment Rules 2023.

Indian Accounting Standard for Accounting the Corporate Restructuring Accounting for Mergers, Acquisition and Re-construction (internal and external) by incorporating Changes as per Companies (Indian Accounting Standards) Amendment Rules 2023 (Ind AS:103).

Business Combination is one of the important accounting Standard which is related with the Corporate Restructuring Accounting for Mergers, Acquisition and Re-construction. Following is the Indian Accounting Standard related with Business Combination.

Ind AS -103

I. Objective:

The objective of the standard is to improve the transparency of financial reporting by an entity about the business combination and its effects

II. Business Combination

A transaction or other event in which the acquirer obtains control of one or more business

III. Acquiree.

The business or business in which control goes to the acquirer

IV. Acquirer.

The business which gets control of the acquiree.

V. Acquisition Method can be applied in the business Combination. It involves the following steps

a. Identifying the acquirer

b. Identifying the acquisition date

c. Recognizing and measuring

i. Assets

ii. Liabilities

iii. Non-Controlling interests

iv. Goodwill or gain from bargain purchase

VI. Identification and Measurement of Assets Acquired and Liabilities assumed at their acquisition date fair values.

Exceptions to the above rule are the following items. Following items are measured as per the specific accounting standards.

a. Contingent Assets and Liabilities.

b. Income Tax

c. Employee Benefits

d. Leases.

e. Share based payment transactions

f. Assets held for sale

VII. Recognizing and measuring goodwill or a gain from a bargain purchase (As per Ind AS 103)

The acquirer shall recognize goodwill as of the acquisition date measured as the excess of

(a) over (b) below:

(a) the aggregate of:

(i) the consideration transferred measured in accordance with this INDAS, which generally requires acquisition‑date fair value;

(ii) the amount of any non‑controlling interest in the acquiree measured in accordance with this INDAS; and

(iii) in a business combination achieved in stages, the acquisition‑date fair value of the acquirer’s previously held equity interest in the acquiree.

(b) the net of the acquisition‑date amounts of the identifiable assets acquired and the liabilities assumed measured in accordance with this INDAS

Gain from Bargain Purchase. (As per INDAS 103)

In extremely rare circumstances an acquirer will make a gain from bargain purchase in a business combination. This happens when the net assets acquired is greater than the total consideration.

VIII. Reverse Acquisition.

A reverse acquisition occurs when the entity that issues securities (the legal acquirer) is identified as the acquiree for accounting purposes. The entity whose equity interests are acquired (the legal acquire) must be the acquirer for accounting purposes for the transaction to be considered a reverse acquisition.

IX. Different Types of Business Combination and Business Combination under Common Control (as per Appendix C of Ind AS 103)

(Source: https://icmai.in/upload/Students/Syllabus2022/Final_Stdy_Mtrl/P18.pdf)

Absorption

It is a business combination under Ind AS 103.Net Assets and consideration are recognized at fair value, and their difference is recognized as Goodwill/Gain on Bargain Purchase.

Amalgamation.

(Source: https://icmai.in/upload/Students/Syllabus2022/Final_Stdy_Mtrl/P18.pdf)

External Re-Construction:

(Source: https://icmai.in/upload/Students/Syllabus2022/Final_Stdy_Mtrl/P18.pdf)

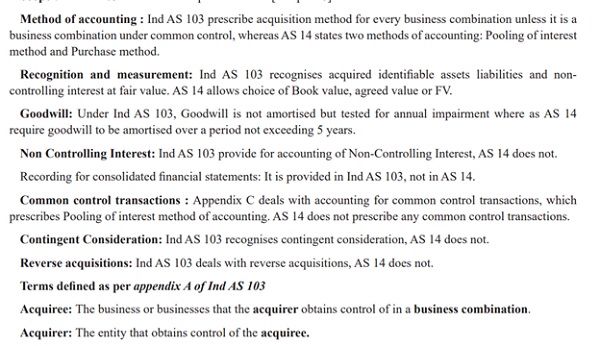

X. Difference between Ind AS 103 and AS 14

(Source:https://icmai.in/upload/Students/Syllabus2022/Final_Stdy_Mtrl/P18.pdf)

Business Combination under Common Control (as per Appendix C of Ind AS 103)

This appendix deals with the Business Combinations of entities or businesses under Common Control.

Common Control business combination means a business combination involving entities or businesses in which all the combining entities or businesses are ultimately controlled by the same party or parties both before and after the business combination, and that control is not transitory.

Pooling of interest method is the accounting method.

Following are features of the above method

a. Assets and liabilities of the combining entities are reflected at their carrying values

b. No adjustments are made to reflect fair values, or recognize any new assets or liabilities.

c. The financial information in the financial statements in respect of prior periods should be restated as if the business combination had occurred from the beginning of the preceding period in the financial statements, irrespective of the actual date of the combination.

XI. Companies (Indian Accounting Standards) Amendment Rules, 2023.

Amendment in the standard is as follows:

In Indian Accounting Standard (Ind AS) 103,in Appendix C, in paragraph 13, for item (b),the following item shall be substituted, namely:-

“(b) the date on which the transferee obtains control of the transferor,”.

XII. Model Balance sheet after the Acquisition.

| Particulars | Note No | Amount |

| Assets | ||

| Non-Current Assets | ||

| Property, Plant and Equipment | ||

| Goodwill | ||

| Other Intangible Assets | ||

| Financial Assets | ||

| Investments | ||

| Loans | ||

| Deferred Tax Assets (Net) | ||

| Other Non-Current Assets | ||

| Total Non-Current Assets | ||

| Current Assets | ||

| Inventories | ||

| Financial Assets | ||

| Investments | ||

| Trade Receivables | ||

| Cash and Cash Equivalents | ||

| Total Current Assets | ||

| Total Assets | ||

| Equity and Liabilities | ||

| Equity | ||

| Equity Share Capital | ||

| Other Equity | ||

| Non-Controlling Interest | ||

| Liabilities | ||

| Non-Current Liabilities | ||

| Financial Liabilities | ||

| Borrowings | ||

| Other Financial Liabilities | ||

| Deferred Payment Liabilities | ||

| Provisions | ||

| Deferred Tax Liabilities (Net) | ||

| Provisions | ||

| Deferred Tax Liabilities (Net) | ||

| Other Non-Current Liabilities | ||

| Total Non-Current Liabilities | ||

| Current Liabilities

Financial Liabilities |

||

| Trade Payables | ||

| Other Financial Liabilities | ||

| Other Current Liabilities | ||

| Provisions | ||

| Total Current Liabilities | ||

| Total Liabilities

|

||

| Total Equity and Liabilities |

(Republished with amendments)