Companies (Indian Accounting Standards) Amendment Rules 2023 have revamped the accounting for leases, aligning with IndAS 116 and IFRS 16. The amendments introduce changes to lease recognition, measurement, and presentation. The rules cover the objective, scope, and identification of leases, impacting lessees and lessors. Notable inclusions address temporary exceptions related to interest rate benchmark reform and Covid-19 rent concessions. These amendments, requiring retrospective application, may significantly impact entities’ financial statements. Understanding these changes is crucial for accurate financial reporting and compliance.

Companies (Indian Accounting Standards) Amendment Rules 2023 have introduced changes regarding accounting for leases. The relevant standards include IndAS 116 (Leases) and IFRS 16 (Leases), which replace IAS 17. The rules specify the objective, scope, and recognition criteria for leases. They also provide guidance on identifying leases and outline the treatment of leases for lessees and lessors. The amendments further address temporary exceptions arising from interest rate benchmark reform and Covid-19-related rent concessions. These changes require retrospective application and may impact the financial statements of entities.

Accounting for leases by incorporating Companies (Indian Accounting Standards) Amendment Rules 2023

Following are the relevant standards relating with Accounting for leases

1. IndAS 116-Leases-Inserted by the Companies (Accounting Standards) Amendment Rules 2019 w.e.f 1/4/2019.

2. IFRS 16, Leases-Corresponding International Financial Reporting Standard issued by IASB.

3. IFRS 16 replaces IAS 17 effective 1 January 2019, with earlier application permitted.

4. AS 19 Leases.

Lease.

It is an arrangement between lessor and lessee through which the lessor gives the right to use an asset for given period of time to lessee on lease rent.

Ind AS 116-Leases-Inserted by the Companies (Accounting Standards) Amendment Rules 2019 w.e.f 1/4/2019.

I. Objective .

To set out the principles for the—

a. recognition

b. measurement

c. presentation

d. disclosure of leases

II. Scope.

An entity shall apply this standard to all leases, including leases of right -of-use assets in a sublease, except for:

(a) Lease to explore or use minerals, oil, natural gas and similar non-generative resources.

(b) Leases of biological assets (Ind AS 41) held by the lessee

(c) Service concession arrangement within the scope of Appendix D, Service Concession Arrangements, of Ind AS 115

(d) Licences of intellectual property granted by the lessor within the scope of Ind AS 115.

(e) Rights held by a lessee under licensing agreements within the scope of Ind AS 38, Intangible assets.

III. Identifying a lease

At the starting of a contract, an entity shall assess whether the contract is or contains, a lease .

Paragraphs B9-B31 of INDAS 116(Appendix B) gives guidance on the assessment of whether a contract is, or contains, a lease.

IV. Lessee.

A lessee shall treat almost all leases, except lease for short-term and leases of low value assets, as finance leases. The following points with respect to lessee are not applicable to lease for short-term and leases of low value assets

No classification such as Finance lease, Operating lease at the point of view of lessee.

V. Recognition.

At the commencement date, a lessee shall recognize a right -of-use asset and a lease liability.

A. A lessee shall measure the right -of -use asset at cost.

The right -of -use asset at cost shall include the following:-

a. The amount of the initial measurement of the lessee liability.

(The amount of the initial measurement of the lessee liability=present value of the lease payments discounted @interest rate implicit in the lease. If interest rate implicit in the lease cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate)

b. any lease payments made at or before the commencement date, less

any lease incentives received;

c. any initial direct costs incurred by the lessee

d. An estimate of costs to be incurred by the lessee in dismantling and removing the underlying asset and restoring the asset.

B. Initial measurement of the lessee liability.

The amount of the initial measurement of the lessee liability.

The amount of the initial measurement of the lessee liability=present value of the lease payments discounted @interest rate implicit in the lease. If interest rate implicit in the lease cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate.

VI. Subsequent measurement of lease Asset (At the balance sheet date)

Subsequent measurement for the right -of-use asset.

The lessee shall measure the right-of -use asset applying a cost model or revaluation model

Cost model

The lessee shall measure right -of-use asset at cost less depreciation less impairment losses.

Revaluation Model.

At fair value.

VII. Subsequent measurement of lease liability (At the balance sheet date).

Lessee shall measure the lease liability as follows

Carrying Amount

Add: Interest on the lease liability

Less: Amount of lease payments

Then adjust lease modifications

VIII. Journal Entries

At Inception

ROU Assets A/c ……………Dr

To Lease liability A/C

At the end of First Year

Interest Expenses A/C ……Dr

To lease liability A/C

Lease Liability A/C ………Dr

To Bank A/C

Depreciation A/C ………Dr

To ROU Asset A/C

Second Year

Interest Expenses A/C ……Dr

To lease liability A/C

Lease Liability A/C ………Dr

To Bank A/C

Depreciation A/C ………Dr

To ROU Asset A/C

Third Year

Interest Expenses A/C ……Dr

To lease liability A/C

Lease Liability A/C ………Dr

To Bank A/C

Depreciation A/C ………Dr

To ROU Asset A/C

Fourth Year

Interest Expenses A/C ……Dr

To lease liability A/C

Lease Liability A/C ………Dr

To Bank A/C

Depreciation A/C ………Dr

To ROU Asset A/C

Lease Liability A/C ………Dr

To Bank A/C

IX. Presentation in the financial statements

Presented in Financial Statements

Balance sheet

| Particulars | At the end of First Year | At the end of Second Year | At the end of Third Year | At the end of Fourth Year |

| ROU Asset | ||||

| Lease Liability |

Statement of Profit and Loss.

| Particulars | At the end of First Year | At the end of Second Year | At the end of Third Year | At the end of Fourth Year |

| Interest | ||||

| Depreciation |

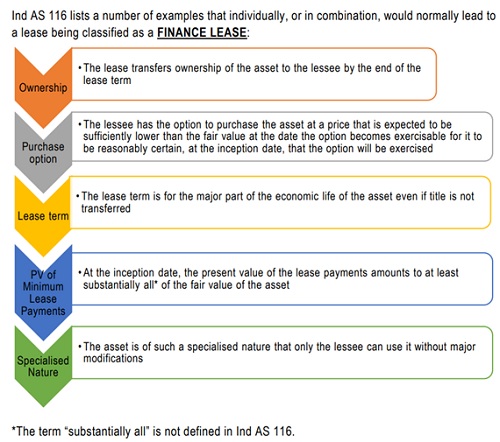

X. Lessor.

A lessor shall classify each of its leases as either

a. an operating lease or

b. a finance lease.

A. Finance Leases.

Recognition and measurement

A lessor shall recognize assets held under a finance lease in its balance sheet and present them

as a receivable at an amount equal to the net investment in the lease.

Subsequent measurement (At the balance sheet date).

Should recognize finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the lease.

Journal

At the inception of the year

Net Investment in Lease A/C………………Dr

To PPE A/C

At the end of the First Year

Bank A/C ……………….Dr.

To Interest Income A/C

To Net Investment in Lease A/C

At the end of the Second Year

Bank A/C ……………….Dr.

To Interest Income A/C

To Net Investment in Lease A/C

At the end of the Third Year

Bank A/C ……………….Dr.

To Interest Income A/C

To Net Investment in Lease A/C

At the end of the Fourth Year

Bank A/C ……………….Dr

To Interest Income A/C

To Net Investment in Lease A/C

Bank A/C

……………….Dr

PPE A/C

…………………Dr

To Net Investment in Lease A/C

Presented in Financial Statements

Balance sheet

| Particulars | At Inception | At the end of First Year | At the end of Second Year | At the end of Third Year | At the end of Fourth Year |

| Net Investment in Lease | |||||

| PPE | |||||

| Cash |

Statement of Profit and Loss.

| Particulars | At the end of First Year | At the end of Second Year | At the end of Third Year | At the end of Fourth Year |

| Interest | ||||

(Source: https://resource.cdn.icai.org/67209bos54111-cp7u3.pdf)

B.. Operating Leases

Recognition and measurement

A lessor shall recognize lease payments from operating leases as income on either a straight-line basis or another systematic basis.

X. Companies (Indian Accounting Standards) Amendment Rules 2021

Following Amendments have been made.

Indian Accounting Standard (Ind AS) 116, –

(i) In paragraph 46B, for item (b), the following shall be substituted, namely:- ―

(b) any reduction in lease payments affects only payments originally due on or before the 30th June, 2022 (for example, a rent concession would meet this condition if it results in reduced lease payments on or before the 30th June, 2022 and increased lease payments that extend beyond the 30th June, 2022); and;

(ii) After paragraph 103, the following shall be inserted, namely:- ―

Temporary exception arising from interest rate benchmark reform

104 A lessee shall apply paragraphs 105–106 to all lease modifications that change the basis for determining future lease payments as a result of interest rate benchmark reform (see paragraphs 5.4.6 and 5.4.8 of Ind AS 109). These paragraphs apply only to such lease

Modifications. For this purpose, the term ‗interest rate benchmark reform‘ refers to the market-wide reform of an interest rate benchmark as described in paragraph 6.8.2 of Ind AS 109.

105 As a practical expedient, a lessee shall apply paragraph 42 to account for a lease modification required by interest rate benchmark reform. This practical expedient applies only to such modifications. For this purpose, a lease modification is required by interest rate benchmark reform if, and only if, both of these conditions are met: (a) the modification is necessary as a direct consequence of interest rate benchmark reform; and

(b) The new basis for determining the lease payments is economically equivalent to the previous basis (ie the basis immediately preceding the modification)

106 However, if lease modifications are made in addition to those lease modifications required by interest rate benchmark reform, a lessee shall apply the applicable requirements in this Standard to account for all lease modifications made at the same time, including those required by interest rate benchmark reform.;

(iii) In Appendix C,

(a)After paragraph C1A, the following shall be inserted, namely:-

―C1B Interest Rate Benchmark Reform—Phase 2, which amended Ind AS 109, Ind AS 107, Ind AS 104 and Ind AS 116, added paragraphs 104–106 and C20C–C20D. An entity shall apply these amendments for annual reporting periods beginning on or after the 1st April 2021.

C1C Covid-19-Related Rent Concessions beyond 30 June 2021, amended paragraph 46B and added paragraphs C20BA–C20BC. A lessee shall apply that amendment for annual reporting periods beginning on or after the 1st April 2021. In case a lessee has not yet approved the financial statements for issue before the issuance of this amendment, then the same may be applied for annual reporting periods beginning on or after April 1, 2020.;

(a) after paragraph C20B, the following shall be inserted, namely:- ―C20BA A lessee shall apply Covid-19-Related Rent Concessions beyond 30 June 2021 (see paragraph C1C)

retrospectively, recognizing the cumulative effect of initially applying that amendment as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at the beginning of the annual reporting period in which the lessee first applies the amendment.

C20BB In the reporting period in which a lessee first applies Covid-19-Related Rent Concessions beyond 30 June 2021, a lessee is not required to disclose the information required by paragraph 28(f) of Ind AS 8.

C20BC Applying paragraph 2 of this Standard, a lessee shall apply the practical expedient in paragraph 46A consistently to eligible contracts with similar characteristics and in similar circumstances, irrespective of whether the contract became eligible for the practical expedient as a result of the lessee applying Covid-19-Related Rent Concessions (see paragraph C1A) or Covid-19-Related Rent Concessions beyond 30 June 2021 (see paragraph C1C).

Interest Rate Benchmark Reform—Phase 2.

C20C An entity shall apply these amendments retrospectively in accordance with Ind AS 8, except as specified in paragraph C20D.

C20D An entity is not required to restate prior periods to reflect the application of these amendments. The entity may restate prior periods if, and only if, it is possible without the use of hindsight. If an entity does not restate prior periods, the entity shall recognize any difference between the previous carrying amount and the carrying amount at the beginning of the annual reporting period that includes the date of initial application of these amendments in the opening retained earnings (or other component of equity, as appropriate) of the annual reporting period that includes the date of initial application of these amendments.;

(Republished with amendments)

Thanks for the insightful article Mr. Sivakumar. The concepts are explained well and are very easy to understand. Looking forward to reading more and learning more.