Case Law Details

SREI Equipment Finance Limited Vs Roadwings International Private Limited (NCLT Kolkata)

NCLT Kolkata held that a secured creditor having possession over the assets of the corporate debtor does not lose its rights to file an application under Section 7 of the Insolvency and Bankruptcy Code.

Facts- The instant company petition is filed under Section 7 of the Insolvency and Bankruptcy Code, for brevity I&B Code, read with Rule 4 of the Insolvency and Bankruptcy (Application to the Adjudicating Authority) Rules, 2016, by “SREI Equipment Finance Limited”, (Financial Creditor) against “Roadwings International Private Limited” (Corporate Debtor) seeking direction to initiate Corporate Insolvency Resolution Process in respect of the Corporate Debtor. The total amount claimed to be in default is of Rs. 12,35,20,095/- and the Date of Default is claimed as on 05.09.2023.

Conclusion- Held that mere possession of the security assets of the corporate debtor, right of a secured creditor to move an application under Section 7 of the I&B Code does not efface, as a Section 7 proceeding is an independent process.

Held that the financial creditor has preferred the present company petition on 04.11.2023 through one Sohan Kumar Jha whose authorization is invalid and ended on the date of approval of the resolution plan by this Adjudicating Authority, i.e., on 11.08.2023. Thus, the company petition is not maintainable due to lack of valid authorization.

FULL TEXT OF THE NCLT JUDGMENT/ORDER

1. The Court congregated through hybrid mode.

2. Heard the Learned Senior Counsels and Learned Counsels for both the parties.

Company Petition (IB) No. 224/KB/2023

3. The instant company petition is filed under Section 7 of the Insolvency and Bankruptcy Code, for brevity I&B Code, read with Rule 4 of the Insolvency and Bankruptcy (Application to the Adjudicating Authority) Rules, 2016, by “SREI Equipment Finance Limited”, hereinafter referred to as “Financial Creditor”/ “Applicant” against “Roadwings International Private Limited”, hereinafter referred to as “Corporate Debtor”/ “Respondent” seeking direction to initiate Corporate Insolvency Resolution Process (for brevity “CIRP”) in respect of the Corporate Debtor.

4. The total amount claimed to be in default is of Rs. 12,35,20,095/- and the Date of Default is claimed as on 05.09.2023.

Factual matrix:

5. The Financial Creditor is a Non-Banking Financial Company (‘NBFC’ in short) and on 11.08.2023, this Adjudicating Authority in C.P. (IB) No. 294/KB/2021 approved the Resolution Plan of the Financial Creditor herein. It is claimed that in terms of the Resolution Plan approved on 11.08.2023, the Financial Creditor herein is entitled to the debts inter alia towards the Corporate Debtor.

6. That, the claim of the Financial Creditor against the Corporate Debtor arises from the agreements which were executed between the parties pursuant to the financial assistance for purchasing various assets, on being approached by the Corporate Debtor to the Financial Creditor, which are as under:

i. Agreement No. 138478 dated 16.07.2017.

ii. Agreement No. 130853 dated 15.04.2017.

iii. Agreement No. 138524 dated 15.07.2017.

iv. Agreement No. 179066 dated 15.07.2019.

7. It is averred that as on 31.07.2023, the Corporate Debtor is indebted for an amount of Rs. 12,35,20,095/-. It is claimed that in order to secure the said agreements, the Corporate Debtor had executed various further documents being deeds of hypothecation, deeds of personal guarantees etc. which are annexed at pages 196- 251 to the application. Further certain charges were created and recorded with the Registrar of Companies, which are annexed at pages 252-266 to the application.

8. Submissions of the Ld. Sr. Counsel Mr. Jishnu Saha on behalf of the applicant:

8.1. Mr. Jishnu Saha, the Learned Senior Counsel appearing on behalf of the Applicant would submit that vide an order dated August 11, 2023, in C.P. (IB) No. 294/KB/2021, the Adjudicating Authority approved the resolution plan. In terms of the Resolution Plan, the Financial Creditor is entitled to recover the debts owed by the Corporate Debtor.

8.2. The Corporate Debtor was responsible for providing margin money for asset purchases, with the Financial Creditor paying the vendor directly. At the Corporate Debtor’s request, a total of Rs. 97,79,200/- was remitted to the vendor, including Rs. 9,66,400/- as margin money from the Corporate Debtor and Rs. 88,12,800/- as a loan under Agreement No. 138478.

8.3. It is submitted that the Corporate Debtor was sanctioned an additional loan of Rs. 1,89,88,100/- under Contract No. 130853, out of which, Rs. 1,32,62,149/- was used to close or adjust previous contracts, and the remaining Rs. 57,25,951/- was disbursed into the Corporate Debtor’s account under Agreement No. 130853.

8.4. The Corporate Debtor was sanctioned a loan of Rs. 60,00,000/- under Agreement No. 138524, with Rs. 46,48,308/-used to close or adjust previous contracts, and Rs. 13,51,692/-disbursed into the Corporate Debtor’s account under the same contract. Further, a sum of Rs. 75,00,000/- under the contract no. 179066 was disbursed into the account of the corporate debtor.

8.5. Further, that under Agreement Nos. 49971, 80722, and 116443, various dues remain outstanding, which the Corporate Debtor has failed to repay.

8.6. It is contended that due to continued defaults, the Financial Creditor invoked its right of cross-default and, by a letter dated January 30, 2023, demanded payment of overdue instalments and other outstanding charges from the Corporate Debtor, annexed as Annexure ‘J’ to the petition.

8.7. Further, that on August 30, 2023, the financial creditor issued a loan recall notice to the corporate debtor, requiring payment of Rs. 12,35,20,095/- towards due as of July 31, 2023. The notice, received on August 31, 2023, had a compliance deadline of September 5, 2023.

9. Submissions made by the Ld. Sr. Counsel Mr. Joy Saha, on behalf of the Corporate Debtor:

9.1. Mr. Joy Saha, Learned Senior Counsel appearing on behalf of the Corporate Debtor would per contra submit that out of the four contracts, arbitration proceedings have taken place in respect of two agreements i.e., Agreement No. 130853 dated 15th April 2017 and Agreement No. 138524 dated 15th July 2017.

9.2. It is contended that two awards have been passed by the Learned Arbitrator on 17th September 2020 annexed at page 31 of the reply affidavit and on 21st September 2020, annexed at page 43 of the reply affidavit, which have not been stayed by any court or tribunal.

9.3. It is submitted that the Financial Creditor challenged two awards in the Hon’ble Calcutta High Court under Sections 34 and 36 of the Arbitration and Conciliation Act, 1996. The court declined to stay the awards; hence, they are final and binding on this Adjudicating Authority.

9.4. Further, it is undisputed that on 1st July 2019, under contract no. 179066, the amount of Rs. 75 lakh was returned by the Corporate Debtor to the Financial Creditor. There is no debt or default regarding this transaction, and no evidence has been provided by the Financial Creditor to suggest otherwise.

9.5. It is further submitted that under Loan Agreement No. 138478 dated 16th July 2017, the Financial Creditor filed an application on 27th January 2020 with the District Legal Services Authority, Kolkata. The Corporate Debtor was notified to appear before the Lok Adalat for Case No. 128506 of 2020. On 7th February 2020, a settlement for Rs. 14,00,000/- was recorded in Case No. 128506 of 2020, annexed as Annexure “C.”

9.6. That, on 9th February 2020, the Corporate Debtor confirmed the settlement reached at the Lok Adalat, agreeing to pay Rs. 14 lakhs to the Financial Creditor. On 14th February 2020, the Corporate Debtor tendered this amount to the Financial Creditor, asking them to encash a security cheque for Rs. 14 lakhs. The Financial Creditor agreed to this arrangement, as confirmed in an email dated 20th August 2020. Thus, no debt is due from the Corporate Debtor to the Financial Creditor on this account.

9.7. It is submitted that the letter demonstrates that the Corporate Debtor did not dispute the claimants’ demands for money as indicated by the arbitration awards dated 17.09.2020 and 21.09.2020. The Financial Creditor’s demand letter dated 20th September 2022 involves nine contracts, but only two are relevant to the current petition, and the remaining seven are not covered by the arbitration awards. Additionally, the letter mentions contracts involving Highway Roadlines Pvt. Ltd., entity unrelated to the Corporate Debtor. In its reply dated 7th October 2022, the Corporate Debtor requested clarifications and details from the Financial Creditor, which were not provided, and did not admit any liability for the Financial Creditor’s claims.

9.8. It is further submitted that date of default 05.09.23 and the date of default is ex-facie incorrect, and the petition is barred by limitation.

9.9. It is claimed that the Corporate Debtor is a solvent company that cannot be pushed into CIRP for recovery of money which is neither due nor payable.

9.10. It is submitted that Rajneesh Sharma, the Administrator of SREI, lacked the authority to file the Section 7 petition after the resolution plan was approved on 11th August 2023 by this Adjudicating Authority and he was discgared. As such, he also could not have authorized Sohan Lal Jha to file the CP. The Monitoring Committee’s subsequent ratification of this action is invalid, as they had no standing to authorize the filing.

9.11. It is contended that on 11th August 2023 the Adjudicating Authority approved the Financial Creditor’s resolution plan. However, the current petition was filed on 4th November 2023 and is therefore affected by Section 11(ba) of the Code.

10. We have heard the Learned Counsels for parties, considered the rival contentions and perused records.

11. Analysis and Findings

A. On debt or any default

11.1. With regard to the Contract No. 130853 dated 15.04.2017

11.1.1. It is evident that the financial creditor had agreed to extend a loan amounting to Rs. 1,89,88,100/- to the corporate debtor for purchasing one Hyster Reach Stacker Moder 45-27CH Machine. It is contended that the financial creditor had disbursed only an amount of Rs. 57,25,951/- to the corporate debtor.

11.1.2 The financial creditor terminated the agreement by way of issuing a legal notice on 23.05.2018, annexed at page 29 to the Reply Affidavit and invoked the arbitration clause due to failure on part of the corporate debtor to clear the dues. Both the parties jointly nominated Smt. Bandana Ray, Ld. Former District and Session Judge as Sole Arbitrator to adjudicate the dispute between the parties.

11.1.3. We would note that on 17.09.2020, the Ld. Sole Arbitrator passed an arbitral award by dismissing all the claims of the claimant financial creditor. The relevant portion of the award is reproduced verbatim hereunder for clarity:

“4. The respondent states that the claim is made based on mis- representation. In the present issue the claimant is asking for Rs. 1,89,88,100/-which is factually not correct. Bank statement and other collaborated documents reveals and explains that although the Claimant had sanctioned a loan amount of Rs 1.89,88,100/- to the Respondent against loan Agreement no. 130853 dated 15.04.2017. However, the loan amount which actually got disbursed under this loan agreement, and amount that is received by the Respondent from the Claimant, as per their books of accounts, is only Rs. 57,25,951/-.

5. Therefore, the total liability of the Respondent towards the loan amount received under the agreement from the Claimant is only for the principal loan amount of Rs. 57,25,951/- along with interest and other charges and not Rs 1,89,88,100/-.

6. That the respondent states that they have paid Rs 38,00,290/- to the claimant as per the details below:

xxx xxx xxx

7. The surrendered machine is valued at Rs 75,00,000/- and adding the payments made by the Respondent to the Claimant totalling to Rs. 1,13,00,290/- as against the loan amount disbursed to the Respondent amounting to Rs. 57,25,951/-which is much in excess of the value of the loan amount received and the interest and other charges payable under the loan agreement.

Thereby the claimant has paid Rs 55,74,339/ excess towards interest and principal charges. That therefore the respondent states that they have paid back the full amount loan against contract no. 130853 dated 15.04.2017 to the claimant.

8. I find that it is evident from the above facts and records by both the parties that even though the claimant has sanctioned Rs. 1,89,88,100/ towards loan agreement no. 130853 dated 15.04.2017, the respondent been however disbursed only a sum of Rs. 57,25,951/-by the Claimant which is received by the Respondent and reflected in the books of accounts presented by both the parties. This has been accepted by the Claimant.

9. That the respondent has paid the Claimant an amount of Rs. 38.00.290/- towards loan instalments and the Respondent has surrendered machine valued at Rs 75,00,000/-, totalling to Rs. 1.13.00.290/-as the loan paid bank amount.

10. Thus the respondent has paid to the Claimant full amount which includes the principal amount, interest, and other charges against loan agreement no. 130853 dated 15.04.2017.

11. In view of the findings on the above issues, the claimant is not entitled to any of the claims as claimed in the petition.

In view of the fore-going I render the following award:

(A) All the claims of the Claimant are disallowed/dismissed.”

11.1.4. Thus, according to the Ld. Sole Arbitrator Smt. Bandana Ray, the corporate debtor has paid to the financial creditor the full amount including the principal amount, interest, and other charges against loan agreement no. 130853 dated 15.04.2017, the debt claimed to be in default herein does not sustain.

11.2. With regard to Contract No. 138524 dated 15.07.2017.

11.2.1. It is further evident that the corporate debtor availed a loan amounting to Rs. 60 Lakh under this contract for purchasing one second-hand Cargotec Make Reach Stacker being Machine Serial No. 2009-02-080-108. It is contended that the financial creditor had only disbursed an amount of Rs. 13,51,692/- to the corporate debtor.

11.2.2. The financial creditor, due to failure on part of the corporate debtor to clear the dues, had terminated the contract on 23.05.2018 and invoked the arbitration clause by way of a legal notice annexed at pages 41-42 to the Reply Affidavit. Both the parties jointly nominated Smt. Bandana Ray, Ld. Former District and Session Judge as Sole Arbitrator to adjudicate the dispute between the parties.

11.2.3. We find that on 21.09.2020, the Ld. Sole Arbitrator passed the award as follows:

“4. ….. In the present issue the claimant is asking for Rs. 60,00,000/- which is factually not correct. Bank statement and other collaborated documents reveals and explains that although the Claimant had sanctioned a loan amount of Rs. 60,00,000/- to the Respondent against loan Agreement no. 138524. However, the loan amount which actually got disbursed under this loan agreement, and amount that is received by the Respondent from the Claimant, as per their books of accounts, is only Rs. 13,51,692/-.

5. Therefore, the total liability of the Respondent towards the loan amount received under the agreement from the Claimant is only for the principal loan amount of Rs. 13,51,692/- along with interest and other charges and not Rs 60,00,000/-.

6. That the respondent states that they have paid back to the claimant as per the details below:

xxx xxx xxx

7. The payments made by the Respondent to the Claimant amounting to Rs 23,04,625/- as against the loan amount disbursed to the Respondent amounting to Rs 13,51,692/is much in excess of the value of the loan amount received and the interest and other charges payable under the loan agreement. Thereby the respondent has paid Rs 9,52,933/-excess towards interest and principal charges. That therefore the respondent states that they have paid back the full amount loan against contract no. 138524 dated 15.07.2017 to the claimant.

8. I find that it is evident from the above facts and records by both the parties that even though the claimant has sanctioned Rs. 60,00,000/- towards loan agreement no. 138524 dated 15.07.2017. the respondent have been however disbursed only a sum of Rs. 13.51,692/-which is received by the claimant and reflected in the books of accounts presented by both the parties. This has been accepted by the Claimant.

9. That the Claimant has paid the Respondent an amount of Rs. 23,04,625/- towards loan instalments, interest and other charges.

10. Thus, the respondent has paid to the Claimant full amount which includes the principal amount, interest, and other charges against loan agreement no. 138524 dated: 15.07.2017.

11. In view of the findings on the above issues, the claimant is not entitled to any of the claims as claimed in the petition.

In view of the fore-going I render the following award:

(A) All the claims of the Claimant are disallowed/ dismissed.”

11.2.4. Thus, as observed by the Ld. Sole Arbitrator, the corporate debtor has paid to the Claimant financial creditor the full amount which includes the principal amount, interest, and other charges against loan agreement no. 138524 dated 15.07.2017. As such, nothing is left for us to consider in the said contract.

11.2.5 We note the contentions of the Petitioner that both the Arbitration Awards dated 17.09.2020 and 21.09.2020 respectively are obtained fraudulently. It is a settled position of law that this Adjudicating Authority in a summary proceeding cannot adjudicate a disputed questions of facts and decide on issues relating to allegation of fraud. Reliance is placed on Shelendra Kumar Sharma v. DSC Ltd., reported in 2019 SCC OnLine NCLAT 1274, wherein it has been held that “whether the documents are forged or not is concerned, it cannot be determined by the Adjudicating Authority (National Company Law Tribunal) or this Appellate Tribunal and therefore, the Adjudicating Authority rightly not deliberated on such issue.” Also, in Satori Global Limited v. Shailja Krishna reported at 2023 SCC OnLine NCLAT 249, the Hon’ble NCLAT has further held that “At the cost of repetition, any dispute with respect to issues relating to ‘fraud’, ‘manipulation’, and ‘coercion’, and false statements cannot be decided in a summary jurisdiction.”

11.2.6. Further, the NCLT, New Delhi Bench in the case of Shri T.R. Arya v. Dilawari Motors Pvt. Ltd. reported in (2024) ibclaw.in 44 NCLT has held that “This Tribunal is not empowered to adjudicate the issues relating to serious allegations of fraud and forgery.”

11.2.7. We also find that both the Arbitration Awards dated 17.09.2020 and 21.09.2020 respectively were assailed higher up before the Hon’ble High Court at Calcutta and the Hon’ble High Court on 09.07.2024, declined to pass any interim order staying the operation of the said awards. The Hon’ble High Court has observed that:

“There are counter balancing circumstances in favour of both sides in support of the above observations.

Whereas the petitioner claims that the award was disclosed for the first time in the opposition of the respondent in the currently ongoing proceeding under the IBC, fact remains that the award itself discloses the participation of both sides and as such, a presumption of correctness attachable to official and judicial acts is to be lent to the same, unless rebutted by cogent evidence by the present petitioner.

That apart, another circumstance having bearing on the issue is that the petitioner itself, in its previous Avatar under a different management, had taken out two applications under Section 9 of the 1996 Act, thereby indicating the petitioner’s intention to rely on the arbitration clause, which was the very premise on which the arbitral awards were based.

Thus, in the least, it is arguable as to whether the awards were vitiated by fraud or were passed in due course of law. Even the timeline as per the petitioner, prima facie, do not disclose that there was any gross discrepancy in the same so as to vitiate the award by fraud. Even as per the awards, the Arbitrator was jointly appointed on December 29, 2019 whereas the valuation of the assets was done on March 8, 2020. It is plausible that as per the submission of the respondents, the assets were previously dealt with and returned in connection with the Section 9 applications, which facilitated early valuation of the same.

There cannot be any ex facie discrepancy in the stamp paper on which the award was printed being purchased on March 2020 whereas the awards were passed in the month of September 2020.

Undoubtedly, as this premature stage, this Court cannot hold either way beyond doubt as to whether fraud was perpetrated in the matter or not.

That apart, the issue as to fraud is the subject matter of the challenge in the main applications under Section 34 of the 1996 Act and shall have to be conclusively dealt with therein. Any prejudging of the issue will have the effect of finally deciding the said challenges prior to hearing the same on merits.

It would be a precarious exercise if at this stage, prior to permitting the respondents to use their affidavits and bring their version or record, the Court comes to a finding beyond reasonable doubt, testing the same on the anvil of criminal jurisprudence (that is, beyond reasonable doubt), that fraud was indeed perpetrated in passing the award. I am loath to undertake such precarious exercise and deem it better to leave the said issue to be adjudicated along with the final hearing of Section 34 challenges.

Accordingly, the respondents are directed to file their affidavits in opposition to the present applications within three weeks from date. Replies, if any, shall be filed within one week thereafter.

The time for filing affidavits in opposition in connection with the applications under Section 34 is extended for a fortnight from date. Replies thereto, if any, shall be filed also within a week thereafter.

The applications under Section 34 of the 1996 Act shall be listed along with the present applications under Section 36 on August 19, 2024 at 10.30 a.m. for being heard finally.

Learned counsel for the parties are requested to come prepared with their written notes of arguments and file the same at the time of final hearing.

It is further made clear that an hour will be allotted to each of the parties to conclude their oral arguments on the date of hearing. It is also clarified that at this juncture this Court is of the opinion that there is no occasion to pass any interim order as prayed for.”

(Emphasis Added)

11.3. Concerning the Contract No. 179066 dated 01.07.2019.

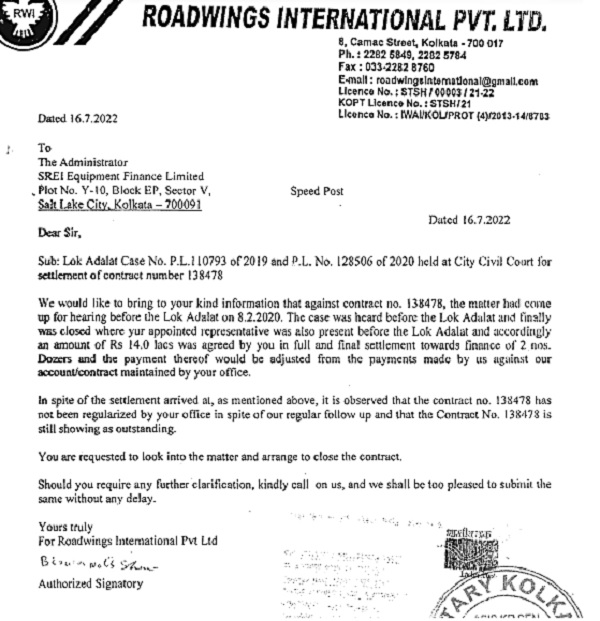

11.3.1. It is further evident that the corporate debtor had availed a facility of Rs. 75 Lakh under this contract. The Ld. Sr. Counsel would submit that on 10.07.2019, the financial creditor disbursed the entire amount of Rs. 75 Lakh to the account of the corporate debtor. The Ld. Sr. Counsel for the corporate debtor would submit that the entire amount disbursed by the financial creditor had been returned and repaid by the corporate debtor on the very same day i.e., on 10.07.2019. To support his contentions, the Ld. Sr. Counsel for the corporate debtor provided us the bank statement of the corporate debtor between 01.07.2019 to 31.07.2019, annexed at pages 52 to the Reply Affidavit. The Ld. Sr. Counsel would further submit that on 16.07.2022, a letter was issued by the corporate debtor intimating the financial creditor to take appropriate action and to rectify their books of accounts. We find the bank statements from 01.07.2019 to 31.07.2019, evincing that the amount of Rs. 75 Lakh was disbursed from the accounts of the financial creditor on 10.07.2019 and on the very same day it was retuned to the financial creditor. Thus, we are satisfied that no debt or default on part of the corporate debtor exists in respect of the contract no. 179066 dated 01.07.2019.

11.4. With regard to the Contract No. 138478 dated 16th July 2017

11.4.1. We find under the Contract No. 138478 dated 16th July 2017; the corporate debtor availed a loan amounting to Rs. 88,12,800/-. Learned Senior Counsel Mr. Joy Saha appearing for the corporate debtor took us through the legal notice dated 23.05.2018, issued by the financial creditor, annexed at pages 1920 to the Reply affidavit dated 25.01.2024, wherefrom it appears that the financial creditor had terminated the agreement due to default committed in the terms of agreement and referred the dispute before the Learned Arbitrator.

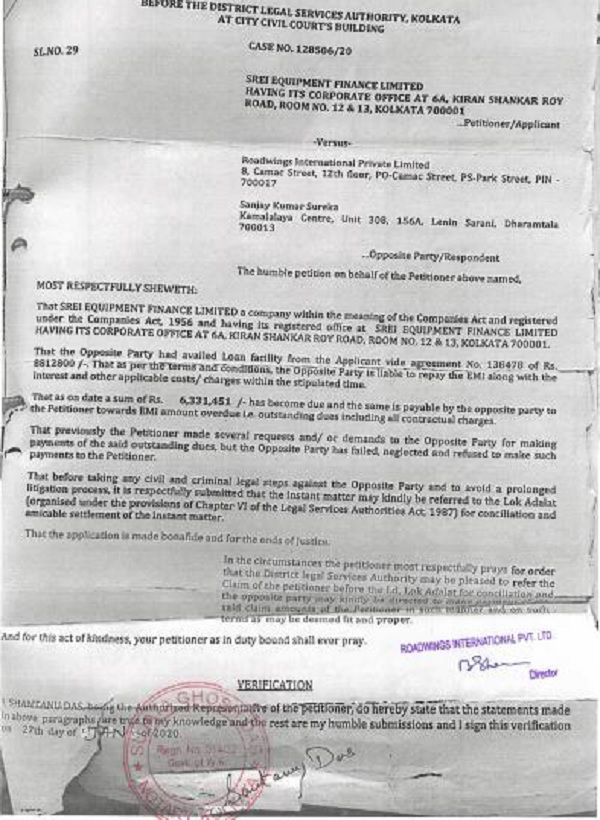

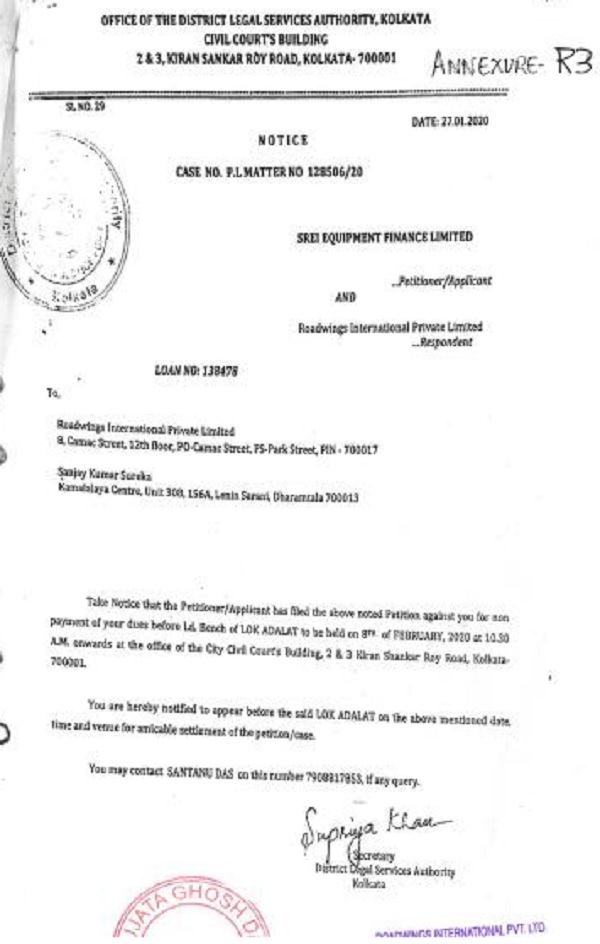

11.4.2. We find that on 27.01.2020, the financial creditor had preferred a petition bearing case no. 128506/20 before the Learned District Legal Services Authority (DLSA) and the Ld. DLSA referred the matter to the Ld. Bench of Lok Adalat and listed the matter on 08.02.2020. The Petition dated 27.01.2020 preferred by the financial creditor before the Ld. DLSA and the letter dated 27.01.2020, issued by the Ld. DLSA are annexed at pages 21 and 22 respectively to the Reply Affidavit, reproduced hereunder:

–

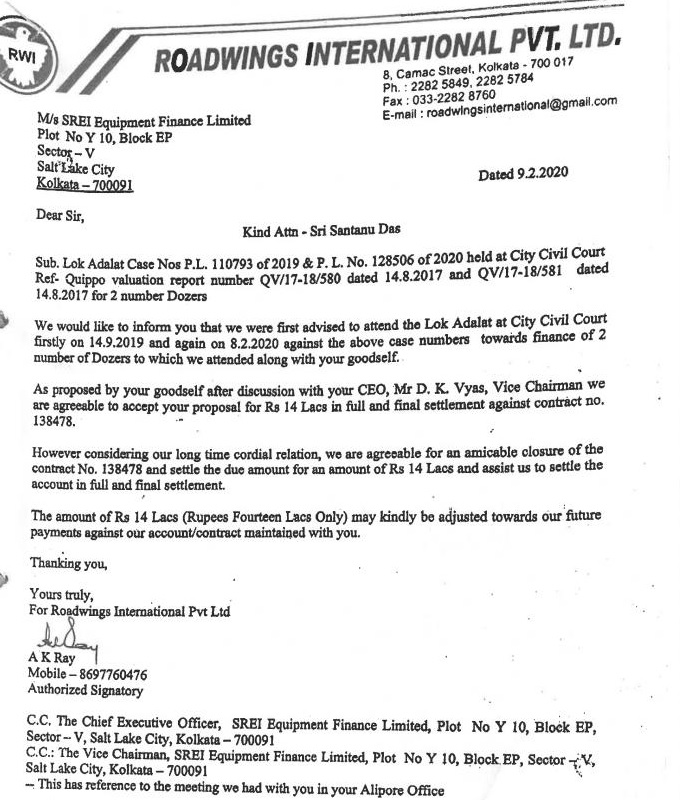

11.4.3. We find that on 09.02.2020, the corporate debtor had issued a letter to the financial creditor annexed at page 23 to the Reply Affidavit wherein it was noted that both the party were agreeable for an amicable closure of the contract no. 138478 and settle the due amount for an amount of Rs. 14 Lakh. The Letter dated 09.02.2020 is reproduced hereunder:

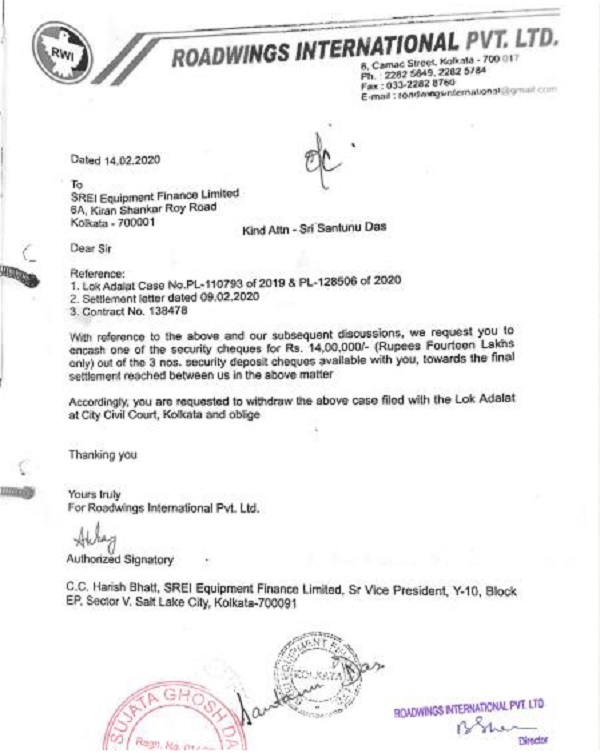

11.4.4. Further, the corporate debtor issued a letter on 14.02.2020 to the financial creditor, annexed at page 24 to the Reply Affidavit, wherein the corporate debtor requested the financial creditor encash one of the security cheques for Rs. 14 Lakh out of three security deposit cheques and to withdraw case filed with the Lok Adalat at City Civil Court, Kolkata. The Letter dated 14.02.2020, is reproduced hereunder:

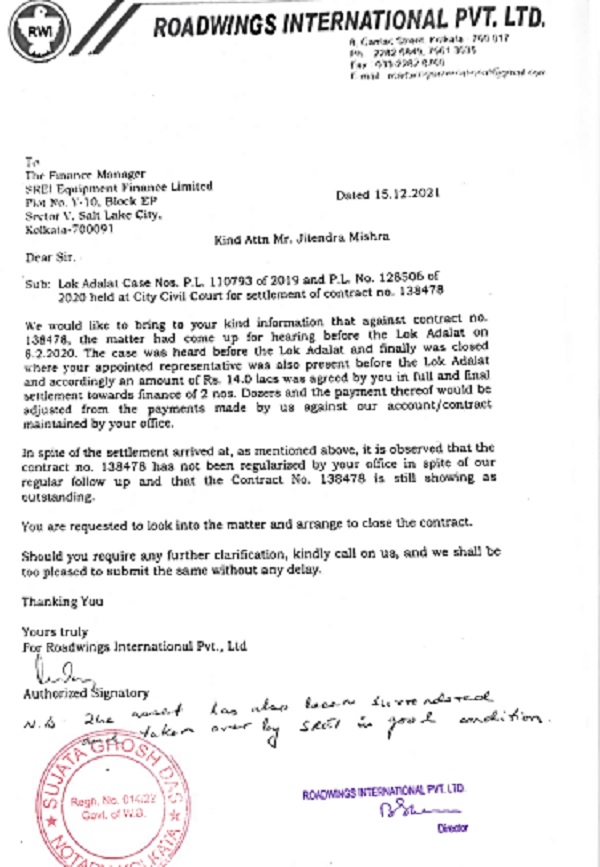

11.4.5. The Ld. Sr. Counsel for the corporate debtor would also take us through the letter issued on 15.12.2021, annexed at page 26 to the Reply Affidavit, which demonstrates that the corporate debtor requested the financial creditor to close the contract no. 138478. The letter dated 15.12.2021 is reproduced hereunder:

11.4.6. Ld. Sr. Counsel for the corporate debtor would further take us through the letter dated 04.08.2022, issued by the corporate debtor to the Ombudsman, RBI, annexed at page 25 to the Reply Affidavit, requesting for the closure of the contract. The letter dated 04.08.2022, is reproduced hereunder for clarity:

11.4.7. However, we find no document or letter issued by either the financial creditor or the RBI to substantiate that the financial creditor has agreed to settle the due raised under the contract no. 138478 for the said amount of Rs. 14 Lakh. The Ld. Sr. Counsel for the corporate debtor would vehemently argue that the due arising out of the contract no. 138478 had been finally settled before the Ld. Lok Adalat and despite settlement, the agreement is till reflecting ‘outstanding’. Further, we also do not find any records of the Ld. Lok Adalat preferred before us bearing out the fact of such settlement between the parties.

11.4.8. The Ld. Sr. Counsel for the corporate debtor would further submit that the corporate debtor had handed over the possession of the assets to the financial creditor on 14.06.2018, which is apparent from the Repossession Inventory list annexed at pages 27-28 to the Reply Affidavit. We note from the contract no. 138478 annexed at pages 67-100 to the petition that the total value of assets is of Rs. 97,79,200/- and the facility disbursed is of Rs. 88,12,800/-. (‘Schedule’ is annexed at pages 96 to the petition). We are of the view that a secured creditor having possession over the assets of the corporate debtor does not lose its rights to file an application under Section 7 of the Code.

11.4.9. It is also axiomatic that a secured creditor in the event, the borrower fails to discharge his liability, can always seek a remedy under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. This is also settled position of law that proceedings under SARFAESI Act is separate and independent with regard to I&B Code process. The Hon’ble Apex Court in the matter of A. Navinchandra Steels Private Limited vs. SREI Equipment Finance Limited and Ors. reported in MANU/SC/0130/2021 has observed that:

“7. …. that Section 7 is an independent proceeding, as has been held in catena of judgments of this Court, which has to be tried on its own merits. Any “suppression” of the winding up proceeding would, therefore, not be of any effect in deciding a Section 7 petition on the basis of the provisions contained in the IBC. Equally, it cannot be said that any subterfuge has been availed of for the same reason that Section 7 is an independent proceeding that stands by itself. As has been correctly pointed out by Shri Sinha, a discretionary jurisdiction under the fifth proviso to Section 434(1)(c) of the Companies Act, 2013 cannot prevail over the undoubted jurisdiction of the NCLT under the IBC once the parameters of Section 7 and other provisions of the IBC have been met. ….”

(Emphasis Added)

11.4.10. Further, the Hon’ble NCLAT in State Bank of India v. Abhijeet Ferrotech Ltd. reported in (2024) ibclaw.in 428 NCLAT, has held that:

“23. …. proceedings under Section 7 can neither be held to be barred by any order passed by DRT under the 1993 Act, nor pendency of proceedings at DRT (which is now pending at the stage of Calcutta High Court) shall preclude decision on Section 7 Application on merits.

xxx xxx xxx

25. There can be no doubt to the proposition laid down by the Hon’ble Supreme Court in Innoventive Industries Ltd. as above, but the question, which have been framed in the present case was as to whether the proceeding under Section 7 is barred in view of the order passed by DRT on 17.06.2022. the judgment of the Innoventive Industries Ltd. does not support the view taken by the Adjudicating Authority in the impugned order.”

(Emphasis Added)

11.4.11. Thus, in view of the dictum supra, we can safely conclude that mere possession of the security assets of the corporate debtor, right of a secured creditor to move an application under Section 7 of the I&B Code does not efface, as a Section 7 proceeding is an independent process.

11.4.12. Ld. Sr. Counsel for the financial creditor through supplementary affidavit dated 18.05.2024, has referred to a letter issued on 16.07.2022 by the corporate debtor wherein the corporate debtor only acknowledges that the amount of Rs. 14 Lakh was for full and final settlement towards finance of 2 nos. Dozers and the payment thereof would be adjusted from the payments made by the corporate debtor against the financial creditor’s account or contract maintained by the office of the financial creditor. The letter dated 16.07.2022 is reproduced hereunder:

11.4.13. Thus, in the absence of any documents to substantiate that the financial creditor has agreed to settle the due for the said amount of Rs. 14 Lakh, and subsequently withdrawn the case before the Ld. Lok Adalat, we are not inclined to believe that the dues arising out of contract no. 138478 has been settled.

11.4.14. The financial creditor has referred to the NeSL report in respect of Contract No. 138478 dated 16.07.2017, annexed at pages 276-283 to the company petition. We find from the Record of Default (Form D) at page 278 to the company petition that in respect of the contract no. 138478 dated 16.07.2017, the total outstanding amount is of Rs. 2,80,53,799/- which is in excess of the prescribed threshold limit as per Section 4 of the I&B Code and the date of default is on 15.09.2018. Further, the authentication status of default of the NeSL report is recorded as “Deemed to be authenticated”.

B. On Limitation:

12. As we have observed that the allegation of default with regard to the contract nos. 130853 dated 15.04.2017, 138524 dated 15.07.2017 and 179066 dated 15.07.2019 are not sustained but the dues under contract no. 138478 seems to be unpaid. Thus, the limitation aspects in respect of contract no. 138478 dated 16.07.2017, has to be determined.

13. It is discernible from the NeSL Report that the date of default is on 15.09.2018 with regard to the contract no. 138478. Admittedly, the financial creditor has preferred a petition before the Ld. DLSA Kolkata for conciliation on 27.01.2020 and the Ld. DLSA issued a notice on 27.01.2020 listed the matter on 08.02.2020.

14. We have noted that the corporate debtor on several occasions i.e., 09.02.2020, 14.02.2020, 15.12.2021, 16.07.2022, issued letters to the financial creditor claiming that the dues arising out of the contract no. 138478 dated 16.07.2017 was full and finally settled for an amount of Rs. 14 Lakh and requested the financial creditor to regularize the contract. Further, the corporate debtor on 04.08.2022 has issued a letter to the Ombudsman, RBI in this regard. The letters dated 09.02.2020, 14.02.2020, 15.12.2021, 16.07.2022 and 04.08.2022 issued by the corporate debtor annexed at pages 23, 24, 26, 53 and 25 to the Reply Affidavit filed by the corporate debtor, confirms the acknowledgment on the part of the corporate debtor. As such the present company petition which has been filed on 04.11.2023, avails a fresh lease of life in terms of Section 18 of the Limitation Act, 1963.

15. Section 18 (1) of the Limitation envisages that “Where, before the expiration of the prescribed period for a suit or application in respect of any property or right, an acknowledgment of liability in respect of such property or right has been made in writing signed by the party against whom such property or right is claimed, or by any person through whom he derives his title or liability, a fresh period of limitation shall be computed from the time when the acknowledgment was so signed.”

16. Thus, in view of above, we are of the view that the present company petition is not barred by limitation.

C. Issue on Section 11 (b) and 11 (ba) of the I&B Code:

17. Ld. Sr. Counsel for the corporate debtor would fervently urge that the present company petition being filed in November 2023, by a corporate person in respect of which a resolution plan has been approved by this Adjudicating Authority on 11.08.2023 in C.P. (IB) No. 294 of 2021, just two months back, is hit by the provisions under Section 11(b) and 11(ba) of the I&B Code and thus this company petition is not maintainable.

18. We would refer to the Section 11 of the Code, quoted verbatim hereunder for clarity:

Section 11: Persons not entitled to make application.

11. The following persons shall not be entitled to make an application to initiate corporate insolvency resolution process under this Chapter, namely:—

(a) a corporate debtor undergoing a corporate insolvency resolution process 1[or a pre-packaged insolvency resolution process]; or

[(aa) a financial creditor or an operational creditor of a corporate debtor undergoing a pre-packaged insolvency resolution process; or] (Ins. by the Insolvency and Bankruptcy Code (Amendment) Act, 2021, w.e.f. 04.04.2021.)

(b) a corporate debtor having completed corporate insolvency resolution process twelve months preceding the date of making of the application; or

[(ba) a corporate debtor in respect of whom a resolution plan has been approved under Chapter III-A, twelve months preceding the date of making of the application; or] (Ins. by the Insolvency and Bankruptcy Code (Amendment) Act, 2021, w.e.f. 04.04.2021.)

(c) a corporate debtor or a financial creditor who has violated any of the terms of resolution plan which was approved twelve months before the date of making of an application under this Chapter; or

(d) a corporate debtor in respect of whom a liquidation order has been made.

Explanation 2[I].—For the purposes of this section, a corporate debtor includes a corporate applicant in respect of such corporate debtor.

[Explanation II.- For the purposes of this section, it is hereby clarified that nothing in this section shall prevent a corporate debtor referred to in clauses (a) to (d) from initiating corporate insolvency resolution process against another corporate debtor.] (The Explanation numbered as Explanation I and thereafter inserted Explanation II by the Insolvency and Bankruptcy Code (Amendment) Act, 2020, w.e.f. 28.12.2019.)

19. It transpires from the language that the Section 11(b) of the Code, employs that a corporate debtor, who has completed its corporate insolvency resolution process twelve months preceding the date of making of the application, shall not be entitled to make an application for initiating CIRP. The provision thus disables a corporate debtor in respect of whom a resolution plan has been approved under Chapter III-A, twelve months preceding the date of making of the application, from preferring an application for initiation of CIRP. We would refer to the Second Explanation of Section 11 which envisages that for the purposes of this section, it is clarified that nothing in this section shall prevent a corporate debtor referred to in clauses (a) to (d) from initiating corporate insolvency resolution process against another corporate debtor. Notably, clause (a) to (d) of Section 11 of the Code includes the clause (ba).

20. We would note that the Second Explanation has been inserted in the year 2019 through the Insolvency and Bankruptcy Code (Amendment) Act, 2020, w.e.f. 28.12.2019, whereas, Section 11(ba) has been legislated in the year 2021, through the Insolvency and Bankruptcy Code (Amendment) Act, 2021, w.e.f. 04.04.2021, after one year of inserting the Second Explanation. It was argued that as the provision of Section 11(ba) came later, the second explanation may not apply to Section 11(ba). We feel in that case, the legislature would have expressly intended not to make the second explanation applicable to Section 11(ba) which has come later, then a clarificatory explanation would have been inserted against the Section 11(ba). However, if we literally go by the language of the statute, the second explanation leaves no ambiguity or ambivalence that nothing in the section 11 of the Code shall prevent a corporate debtor referred to in clauses (a) to (d), which includes Section 11(ba) that has been later introduced, from initiating CIR Process against another corporate debtor. At this juncture, our mind is redolent with the oft-quoted maxims:

i. “A verbis legis non recedendum est”, which means “from the words of the law, there must be no departure”;

ii. “Expressio unius est exclusio alterius”, that means “whatever has not been included has by implication been excluded”;

21. In the present case, resolution plan in respect of Srei Equipment who is the financial creditor herein, has been approved on 11.08.2023 and the present company petition has been filed on 04.11.2023. A combined reading of Section 11(b), (ba) and the second explanation implores us to believe that the Section 11 (a) to (d) does not prevent the corporate debtor to initiate CIRP against another corporate debtor. In the present case, Srei has preferred this application under Section 7 of the Code against Roadwings and accordingly to us, there is no bar on Srei to file this application under Section 7 of the Code.

22. We would further refer to the judgment rendered by the Hon’ble Supreme Court in Manish Kumar v. Union of India, reported in (2021) 5 SCC 1 that:

304. Coming to the facts of the instant case, it is necessary to analyse the limbs of Section 11. Sections 7, 9 and 10, read with Section 5, provide for the procedure to be adopted by the adjudicating authority in dealing with applications for initiating CIRP by the financial creditor, operational creditor and corporate debtor. It is after that Section 11 makes its appearance in the Code. It purports to declare that an application for initiating CIRP cannot be made by categories expressly detailed in Section 11. Section 11(a) vetoes an application by a corporate debtor, which is itself undergoing a CIRP. An argument sought to be addressed by the petitioner is that the purport of the said provision is that it prohibits not only a corporate debtor, which is undergoing a CIRP, from initiating a CIRP against itself, which, but for the fact, it is undergoing a CIRP, would be maintainable under Section 10 of the Code, but it also proscribes an application by a corporate debtor for initiating a CIRP against another corporate debtor. It appears to be clear to us, and this will be corroborated by the further provisions as well, that the real intention of the legislature was that the prohibition was only against the corporate debtor, which is already faced with the CIRP filed by either a financial creditor or operational creditor, jumping into the fray with an application under Section 10. This appears to be clear from the reports which have been placed before us.

305. Coming to Section 11(b), it again disables a corporate debtor which has completed CIRP twelve months preceding the date of the making of the application from invoking the Code. It may be demystified as follows:

305.1. On the strength of the application made under Sections 7, 9 or 10, CIRP is initiated and it is completed at a certain point of time. This section is aimed at preventing a further application not eternally but for a period of twelve months after the expiry of the insolvency resolution process. Quite apart from the fact that even the petitioners do not lay store by Section 11(b) and their case is premised on Sections 11(a) and 11(d), the importance of Section 11(b) is that it sheds light regarding the intention of the legislature to be that the corporate debtor cannot initiate CIRP against itself under any of the limbs of Section 11, in the circumstances detailed therein. Section 11(c) again disentitles corporate debtor, apart from a financial creditor who has violated any terms of a resolution plan, which was approved twelve months before the making of the application.

305.2. In other words, after the adjudicating authority approves a resolution plan under Section 31 of the Code, should a corporate debtor, inter alia, transgress upon any of the terms of the resolution plan and it still ventures to again approach the adjudicating authority with an application under Section 10 and attempt to restart the process all over again within a period of twelve months from the date of approval, this is declared impermissible under Section 11(c).

307. Now, let us turn to the first Explanation. The Explanation declares that for the purpose of Section 11, a corporate debtor includes a corporate applicant in respect of such corporate debtor. There is an argument raised on behalf of the petitioners which surrounds the word “included”. The contention appears to be that before the insertion of Explanation II, which is challenged before us, under Section 11, not only was an application for initiating CIRP by a corporate debtor against itself prohibited in the circumstances referred to in Section 11 but it also contemplated that the CIRP could not be filed by the corporate debtor in circumstances covered by Section 11 against another corporate debtor. Otherwise, there was no meaning in using the word “includes”.

310. Now, let us consider finally the impugned Explanation. The impugned Explanation came to be inserted by the impugned amendment. Apparently, interpreting Section 11, there appears to have been some cleavage of opinion. This is apparent from the case set up on behalf of the petitioners and the case set up on behalf of the Union of India. The intention of the legislature was always to target the corporate debtor only insofar as it purported to prohibit application by the corporate debtor against itself, to prevent abuse of the provisions of the Code. It could never have been the intention of the legislature to create an obstacle in the path of the corporate debtor, in any of the circumstances contained in Section 11, from maximising its assets by trying to recover the liabilities due to it from others. Not only does it go against the basic common sense view but it would frustrate the very object of the Code, if a corporate debtor is prevented from invoking the provisions of the Code either by itself or through his resolution professional, who at later stage, may, don the mantle of its liquidator. The provisions of the impugned Explanation, thus, clearly amount to a clarificatory amendment. A clarificatory amendment, it is not even in dispute, is retrospective in nature. The Explanation merely makes the intention of the legislature clear beyond the pale of doubt. The argument of the petitioners that the amendment came into force only on 28-12-2019 and, therefore, in respect to applications filed under Sections 7, 9 or 10, it will not have any bearing, cannot be accepted. The Explanation, in the facts of these cases, is clearly clarificatory in nature and it will certainly apply to all pending applications also.”

(Emphasis Added)

D. On Authorization:

23. Now we would proceed to consider the issue whether there was a proper authorization to file the present application.

24. Ld. Sr. Counsel for the corporate debtor would vociferously argue that the petitioner neither has the locus nor the authorization to file the present company petition. It is argued that the present company petition has been affirmed by one Sohan Kumar Jha on 04.11.2023, purportedly as the Power of Attorney (PoA) Holder of the financial creditor granted on 28.03.2023 while the validity of the said PoA has come to an end on the date of the approval of the Resolution Plan of the financial creditor by this Adjudicating Authority, i.e., on 11.08.2023.

25. Ld. Sr. Counsel for the corporate debtor would further place the board resolution dated 17.08.2023 passed by the Implementation and Monitoring Committee (IMC) of the financial creditor vide which the IMC has ratified and confirmed the PoA and authorized Shri Rajneesh Sharma, the erstwhile Administrator to file documents, to authorize any person to act on his behalf to initiate or defend any litigation pertaining to the ordinary course of business of the financial creditor. It is argued that a monitoring committee cannot authorize any person to file a section 7 petition as it is not a part of the financial creditor company, it is an independent agency set up for implementing the resolution plan, and is constitution is not guided by the Code.

26. Per contra, the Ld. Sr. Counsel for the financial creditor would place a Supplementary Affidavit dated 18.05.2024, to submit that the present company petition has been filed in November 2023 and in terms of the plan submitted by the NARCL (the successful resolution applicant) approved by this Adjudicating Authority, the IMC was responsible to oversee the management of the affairs of the financial creditor company on and from the approval date till the closing date. Thus, the IMC is deemed to have all the power that are vested with an RP under the provisions of the Code which includes the power to initiate proceedings under the Code.

27. It is submitted that on 26.02.2024, a fresh Board of Directors has been constituted and on the very same day, the IMC upon handover of the management stood dissolved. A Copy of the Board Resolution dated 26.02.2024 is annexed at page 6 to the Supplementary Affidavit dated 18.05.2024. Further, on the very same day the new Board has ratified and accepted all the acts of IMC by another resolution placed at pages 7-11 to the Supplementary Affidavit dated 18.05.2024. The new Board further on 28.03.2024, passed a resolution placed at pages 18-20 to the Supplementary Affidavit dated 18.05.2024, authorizing its Chief Executive Officer (CEO) to take all the action relating to legal and regulatory matters of the company. The newly authorized CEO issued a fresh Power of Attorney on 16.04.2024, annexed at pages 12-17 to the Supplementary Affidavit dated 18.05.2024, in terms of the resolution dated 28.03.2024 to Mr. Sohan Kumar Jha.

28. Ld. Sr. Counsel Mr. Joy Saha argues that a Monitoring Committee set up after the approval of a resolution plan, to monitor its implementation, shall have no power to authorize any person (including the RP) to file a fresh litigation or application for CIRP under the I&B Code on behalf of the Corporate Debtor. A Monitoring Committee is constituted under sub clause 8 of Clause V of Schedule of Insolvency and Bankruptcy Board of India (Model Bye-Laws and Governing Board of Insolvency Professional Agencies) Regulations, Responsibility of a Monitoring Committee is of the management of the corporate debtor and implementation and supervision of the resolution plan till the closing date. A Monitoring Committee has a limited power which is confined to the implementation and supervision of the resolution plan till the closing date.

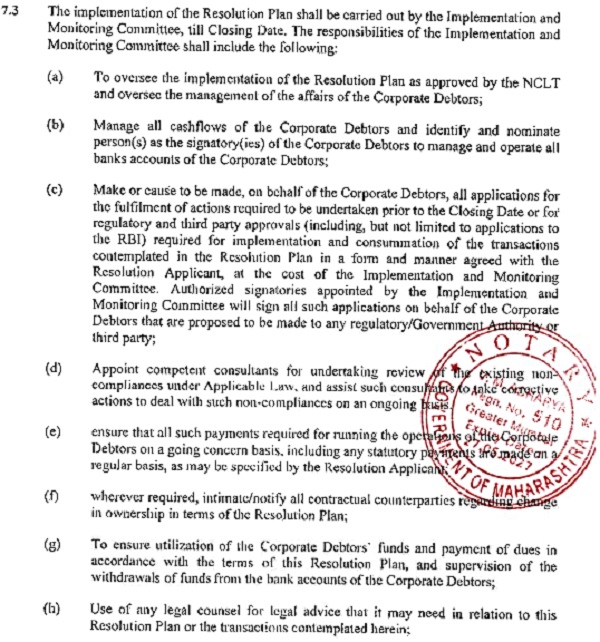

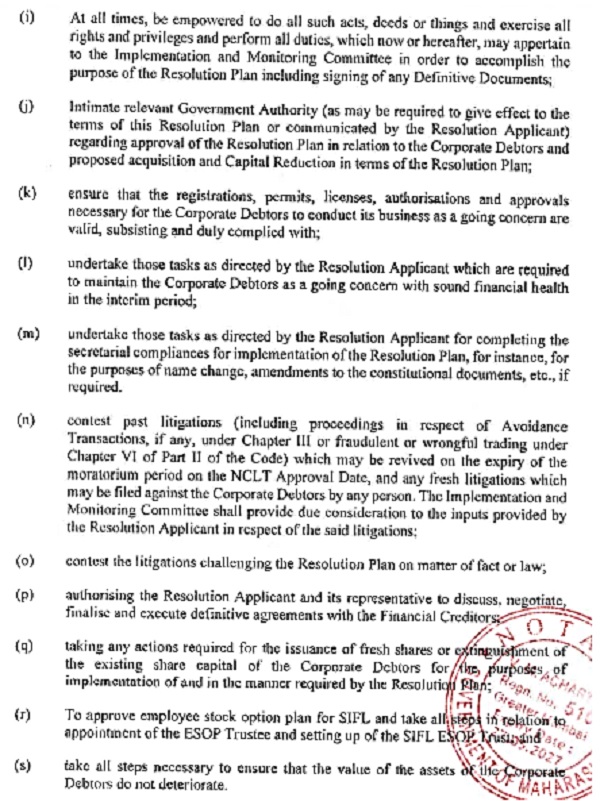

29. We find that the Resolution Plan submitted by the NARCL that was approved on 11.08.2023 by this Adjudicating Authority provides a provision of “Supervision and Implementation of the Resolution Plan” (at pages 87-89, Section 7 of the Resolution Plan submitted by the NARCL). The Sub-section 7.3 of the plan provides the responsibilities of the Monitoring Committee which are reproduced hereunder:

–

30. From the list above, we fail to decipher any right or obligation primarily accorded to the IMC of filing a fresh application for initiating CIRP against any third entity, on behalf of the Corporate Debtor.

31. It is evident and palpable that the Monitoring Committee is empowered to take all necessary steps to “make or cause to be made” on behalf of the corporate debtor, all applications for fulfilment of actions, or for “regulatory and third-party approvals” required for a limited purpose of “implementation and consummation of the transactions contemplated in the resolution plan” in a form and manner agreed with the Resolution Applicant, nothing more and nothing less.

32. If the IMC was not authorized to file an application to initiate CIRP on behalf of the corporate debtor, it could not have delegated any authority to any person to file as such. Even assuming that the IMC was authorized to initiate a CIRP through its Chairman (the RP or Administrator), it could not have delegated the power further to a third party neither the RP himself could have delegated his power to a third party, in absence of any expressed provision. At this juncture, we would rely on a well-known legal maxim i.e., “Delegatus non potus delegare” which means “a delegate/ deputy cannot appoint another” or “a delegated authority cannot be re-delegated”. Further, we would refer to the judgment rendered by the Hon’ble Apex Court in The Barium Chemicals Ltd. and Ors. vs. The Company Law Board and Ors. reported in MANU/SC/0037/1966, wherein, it has been observed that:

“34-A. As a general rule, whatever a person has power to do himself, he may do by means of an agent. This board rule is limited by the operation of the principle that a delegated authority cannot be re-delegated, delegatus non potest delegare. The naming of a delegate to do an act involving a discretion indicates that the delegate was selected because of his peculiar skill and the confidence reposed in him, and there is a presumption that he is required to do the act himself and cannot re-delegate his authority. […]

xxx xxx xxx

36. But the maxim “delegatus non potest delegare” must not be pushed too far. The maxim does not embody a rule of law. It indicates a rule of construction of a statute or other instrument conferring an authority. Prima facie, a discretion conferred by a statute on any authority is intended to be exercised by that authority and by no other. But the intention may be negatived by any contrary indications in the language, scope or object of the statute. The construction that would best achieve the purpose and object of the statute should be adopted.”

(Emphasis Added)

33. Further, the Hon’ble Rajasthan High Court in Mahendra Singh vs. Hari Prasad and Ors. reported in MANU/RH/0160/1964, has laid down that:

“13. It may however be mentioned that even if it is assumed, for the sake of argument, that the Panchayat Samiti had delegated its powers of control over the Primary School teachers to the Standing Committee, a serious question would arise whether such a power could be re-delegated by the Standing Committee to the Pradhan. “Delegates potestas non potest-delegari” is a well-known maxim to the effect that a delegated authority cannot be re-delegated. Then there is the further maxim “delegatus non potest delegare” according to which the person to whom any office or duty is delegated cannot lawfully devolve the duty on another, unless he be expressly authorised so to do. Mr. Rastogi tried to get round this difficulty by arguing that such a re-delegation would be permissible under subsection (3) of section 84 of the Act which is to the following effect:–”

(Emphasis Added)

34. It was argued that find that this application has been preferred by virtue of an authorization given by the Implementation and Monitoring Committee (IMC) which the IMC, has a limited scope after approval of the plan, limited only to implement and supervise the plan. It was further argued that the IMC could not have authorized any person including the RP to file a fresh application under the Code for initiation of CIRP against any third person and thus, the present application filed without proper authorization during the filing of the application, was not maintainable. A subsequent ratification by the SRA cannot cure the defect that existed on the date of filing.

35. We would discern that this application has been preferred by Shri Sohan Kumar Jha on 07.11.2023 by the virtue of the Power of Attorney (annexed at pages 42-58 to the application), granted on 28.03.2023 by the Administrator of the Srei Equipment Finance Limited Mr. Rajneesh Sharma, prior to the approval of the resolution plan on 11.08.2023. With the approval of the resolution plan on 11.08.2023, Shri Rajneesh Sharma stood discharged as an Administrator and simultaneously his authority on 28.03.2023 would have come to an end. Nevertheless, the IMC granted a fresh lease of life to all the PoAs granted by the Administrator on 17.08.2023, whereafter the present company petition was filed. Hence, the same Power of Attorney as on 28.03.2023, will not continue. However, the IMC through its board resolution on 17.08.2023 (which was issued on 22.08.2023), annexed at pages 5758 to the application, has authorized the Administrator to continue to undertake various activities as are required to ensure the company’s status as a going concern during the implementation of the resolution plan which includes the filing of applications for initiating any litigations pertaining to the ordinary course of business of Srei.

Conclusion:

36. In terms of enumerations supra, we find that the present application has been filed without a subsisting valid authorization.

37. In view of the above, the present application is dismissed and disposed of. Liberty is however given to prefer a fresh application as per law.

38. Certified copies of this order, if applied for with the Registry, be supplied to the parties upon necessary compliance with all requisite formalities.

39. The Corporate Debtor Roadwings International Pvt. Ltd. by way this application preferred under Section 65 of the I&B Code against the Financial Creditor Srei Equipment Finance Limited has sought for rejection of the company petition being C.P. (IB) No. 224/KB/2023, on the ground that there is no existence of debt and default as claimed in the company petition and the financial creditor has fraudulently and maliciously preferred the Section 7 application for initiation of CIR Process in respect of the corporate debtor.

40. The gist contentions of the applicant (corporate debtor) in this interlocutory application are, as under:

a) That, the debt and default arisen out of the four agreements in dispute were settled and paid off by the corporate debtor and there is no debt and default in respect those four agreements as claimed by the financial creditor.

b) The financial creditor has preferred the present company petition on 04.11.2023 through one Sohan Kumar Jha whose authorization is invalid and ended on the date of approval of the resolution plan by this Adjudicating Authority, i.e., on 11.08.2023. Thus, the company petition is not maintainable due to lack of valid authorization.

41. We have considered the rival contentions and passed a detailed and reasoned order in the company petition above.

42. In view of such, the present interlocutory application is disposed of.

43. Certified copies of this order, if applied for with the Registry, be supplied to the parties upon necessary compliance with all requisite formalities.

This Order is signed on the 21th Day of November 2024.