Case Law Details

Bank of India Vs Commissioner of GST and Central Excise (CESTAT Chennai)

CESTAT Chennai held that the service tax not leviable on Indian Bank on the commission charges in respect of granting credit facility to Foreign Service recipient. Accordingly, tax paid allowed as refund provided Indian Bank has not recovered service tax from Foreign Service recipient.

Facts- The appellant had issued Standby Letter of Credit (SBLC) in favour of M/s. Aban Singapore Pte. Ltd., which is a subsidiary of M/s. Aban Offshore Ltd. Chennai. The above SBLC was issued to Bank of India, Singapore Branch for a period of seven years as security for all payment obligations of M/s. Aban Singapore Pte. Ltd. It appears that M/s. Aban Singapore Pte. Ltd. had paid commission to the Bank on quarterly basis in convertible Foreign Exchange. The Bank remitted the service tax on the commission received from M/s. Aban Singapore Pte. Ltd. When the Bank has realised that it was not liable to pay service tax on the commission so received in terms of provisions of Export of Services Rules, 2005, the service tax paid has been claimed as refund.

After the due process of adjudication, the Original Authority has rejected the entire refund claim filed for Rs.20,84,750/-, holding that the appellant has not complied with the provisions of Export of Services Rules, 2005.The refund claim filed by the appellant was found to be ineligible for the service tax paid on the commission received from M/s. Aban Singapore Pte. Ltd.

Conclusion- Held that the appellant has satisfied all the conditions for treating the service as export of service but there is a need to verify whether the service tax paid has been recovered or not from M/s. Aban Singapore Pte. Ltd., to be eligible for refund. As per the terms and conditions M/s. Aban Singapore Pte. Ltd. has to pay the commission quarterly in advance along with applicable service tax. Whether the commission has been paid along with the service tax by M/s. Aban Singapore Pvt. Ltd. has to be verified by the Refund Sanctioning Authority.

Held that the appellant is eligible for refund of service tax paid on the commission charges in respect of granting credit facility to M/s. Aban Singapore Pte. Ltd., subject to conducting verification whether the appellant has recovered the service tax paid from M/s. Aban Singapore Pte. Ltd., or not. The matter is remanded for the limited purpose of verifying whether the service tax was collected by the appellant. Needless to say, if not collected, the appellant is eligible for refund.

FULL TEXT OF THE CESTAT CHENNAI ORDER

M/s. Bank of India, Corporate Banking Branch, Chennai (the appellant herein) have filed this appeal assailing the Order-in-Appeal No. 24/2015 dated 16.01.2015 of the Commissioner of Service Tax (Appeals), Nungambakkam, Chennai who have upheld the Order-in-Original No. 28/2011 dated 24.01.2011 rejecting the refund claim filed for Rs.20,84,750/-.

2.1 Briefly stated the facts are that the appellant had issued Standby Letter of Credit (SBLC) in favour of M/s. Aban Singapore Pte. Ltd., which is a subsidiary of M/s. Aban Offshore Ltd. Chennai. The above SBLC was issued to Bank of India, Singapore Branch for a period of seven years as security for all payment obligations of M/s. Aban Singapore Pte. Ltd. It appears that M/s. Aban Singapore Pte. Ltd. had paid commission to the Bank on quarterly basis in convertible Foreign Exchange. The Bank remitted the service tax on the commission received from M/s. Aban Singapore Pte. Ltd. When the Bank has realised that it was not liable to pay service tax on the commission so received in terms of provisions of Export of Services Rules, 2005, the service tax paid has been claimed as refund.

2.2 A perusal of the records indicate that the appellant has received commission on which service tax was paid as per the table given below:-

| S. No. | Service Tax Amount | Paid on |

| 1 | Rs.2,69,148/- | 05.07.07 |

| 2 | Rs.2,62,073/- | 03.10.07 |

| 3 | Rs.2,59,962/- | 05.01.08 |

| 4 | Rs.2,24,209/- | 31.03.08 |

| 5 | Rs.2,41,260/- | 04.08.08 |

| 6 | Rs.2,69,320/- | 04.11.08 |

| 7 | Rs.2,72,582/- | 06.01.09 |

| 8 | Rs.2,86,196/- | 31.03.09 |

2.3 A Show Cause Notice dated 22.03.2010 was issued proposing to reject major part of the refund claim on the ground of limitation in terms of Section 11B as refund of the service tax paid should be claimed within one year from the date of payment of service tax. Out of total amount of refund claimed for Rs.20,84,750/-, the Show Cause Notice proposed to reject Rs.15,25,972/- on the ground of time-bar.

2.4 However, after the due process of adjudication, the Original Authority has rejected the entire refund claim filed for Rs.20,84,750/-, holding that the appellant has not complied with the provisions of Export of Services Rules, 2005, in as much as, the appellant had not produced the ‘original request’ of M/s. Aban Singapore Pte. Ltd. for sanction of credit facilities. Further, the Bank’s sanction Letter was sent to the office of the holding company in Chennai, clearly evidencing that the request for provision of services had been made by the recipient of service from an office in India. Further, the appellant had obtained as security, the assets of the holding company in Chennai and the appellant has even conducted inspection of the secured assets of the holding company in India. As the recipient of services has not made order for provision of services from outside India, so, the Original Authority had arrived at the conclusion that services could not be considered as export of service in terms of the proviso to Rule 3(iii) of the Export of Services Rules, 2005 and that the requirements of Notification No. 11/2005-ST have not been fulfilled. So, the refund claim filed by the appellant was found to be ineligible for the service tax paid on the commission received from M/s. Aban Singapore Pte. Ltd.

3. The Ld. Advocate Shri N. Viswanathan representing the appellant have argued: –

i. that the Original Authority has traversed beyond the Show Cause Notice issued to them and also without putting them to notice in deciding the question as to whether the transaction fell within the ambit of Rule 3 of the Export of Services Rules, 2005 which is not permissible and as such, the order merits to be set aside.

ii. that the Appellate Authority have decided that the provisions of limitation as provided under Section 11B of the Central Excise Act, 1944, would not govern their claim and so ought to have allowed their claim in toto.

iii. that the facts on record show that they had not collected the tax from M/s. Aban Singapore Pte. Ltd.

iv. that the admitted facts indicate that they had only provided the services to M/s. Aban Singapore Pte. Ltd. and received the commission in Foreign Exchange and they also produced the Letter dated 20.06.2007 received from M/s. Aban Singapore Pte. Ltd.

v. that the Appellate Authority committed gross error in holding that they have not produced any documentary evidence to show that both the companies M/s. Aban Singapore Pte. Ltd. and M/s. Aban Offshore Ltd., Chennai are separate entities.

vi. that mere addressing of the Letter to their customer at Singapore to their holding company in Chennai even when the services were admittedly provided abroad and payment received in convertible foreign currency cannot be held to be in violation of the proviso to Rule 3 of the Export of Services Rules, 2005 which only provide that the order for services should come from the overseas company.

vii. and that the reasoning recorded in the impugned order dated 16.01.2015 that the properties of the Indian company were offered as collateral security could in no way deny them the benefit of the Export of Services Rules, 2005 and the Circular of the Board and also the decisions of the Tribunal in the cases of ABS India Ltd. Vs. Commissioner of Service Tax, Bangalore [2009 (13) STR 65 (Tri. – Bang.)] and Lenovo (India) Pvt. Ltd. Vs. Commissioner of Central Excise, Bangalore [2010 (20) STR 66 (Tri. Bang.)].

4. The Ld. Authorised Representative Shri Anoop Singh representing the Department has filed his written submissions and reiterated the findings of the Lower Authorities. He has argued that on the basis of documents enclosed with the refund claim, the Recipient of service has a commercial establishment or other office relating thereto, in India and order for provision of such service is made from such commercial establishment or office located inside India. He has informed that M/s. Aban Singapore Pte. Ltd. is a 100% subsidiary of Aban Holdings Pte. Ltd., Singapore, which in turn is a 100% subsidiary of Aban Offshore Ltd. Chennai. He has submitted that the request for credit facility has been made by the recipient of service from an office in India and Bank has obtained as security the assets of the holding company in Chennai. Further, the Letter, sanctioning the credit facility was addressed by the appellant Bank to Indian entity which is not the recipient of service. It is submitted that no documents on record to show that the request was made by any office located outside India. Further, the appellant has carried out inspection of the secured assets within India. As the recipient of service has not made any request for provision of service from outside India, so the service rendered is not to be considered as export of service in terms of Rule 3(iii) Export of Services Rules, 2005. He further submitted that if there are any defaults in making repayment of the amount, the Security or Insurance cover provided by assets of Aban Offshore Ltd., Chennai, would operate in favour of the appellant, and as such, M/s. Aban Singapore Pte. Ltd. and Aban Offshore Ltd., Chennai are related entities and both were acting jointly or India entity is acting on behalf of Singapore entity. The Ld. AR has prayed for rejecting the appeal by upholding the impugned order dated 16.01.2015.

5. Heard both sides and considered the evidences on record.

6. The main issues that are to be decided in this appeal are: –

i. whether the services rendered are to be treated as export of service in terms of Export of Services Rules, 2005, and

ii. whether the appellant is eligible for refund of the service tax paid on the services rendered to M/s. Aban Singapore Pte. Ltd.

7. The Notification No. 11/2005-ST dated 19.04.2005 which governs the rebate of service tax paid on the export of service prescribes certain conditions to be fulfilled so as to claim the rebate. Besides the other conditions, the one which is prescribed for treating a service as export of service is as follows:-

“2. Conditions and limitations:-

a) that the taxable service has been exported in terms of rule 3 of the said rules and payment for export of such taxable service has been received in India in convertible foreign exchange;”

8. In terms of Rule 5 of Export of Services Rules, 2005, where any taxable service is exported, rebate of service tax paid on such service shall be granted subject to such conditions or limitations and fulfilment of procedure in Notification No. 11/2005-ST dated 19.04.2005. The said Notification stipulates the following substantial conditions: –

– the taxable service should have been exported in terms of Rule 3 of the Export of Services Rules and payment for such taxable service has been received in convertible foreign exchange and

– the service tax and cess, rebate of which is claimed, have been paid on the exported service.

9. As per the conditions laid down, the service shall be treated as export of service only when the taxable service has been exported in terms of Rule 3 of the Export of Services Rules, 2005 and payment for such export of service has to be received in convertible foreign exchange which reads as under:-

“3. Export of taxable service. – (1) Export of taxable services shall, in relation to taxable services‚–

…

…

(iii) specified in clause (105) of section 65 of the Act, but excluding‚–

(a) sub-clauses (zzzo) and (zzzv);

(b) those specified in clause (i) of this rule except when the provision of taxable services specified in sub-clauses (d), (zzzc), (zzzr) and (zzzzm) does not relate to immovable property; and

(c) those specified in clause (ii) of this rule, when provided in relation to business or commerce, be provision of such services to a recipient located outside India and when provided otherwise, be provision of such services to a recipient located outside India at the time of provision of such service:

Provided that where such recipient has commercial establishment or any office relating thereto, in India, such taxable services provided shall be treated as export of service only when order for provision of such service is made from any of his commercial establishment or office located outside India:”

10. A perusal of the above indicates that if the service is provided to the recipient located outside India and such recipient has commercial establishment or any office relating thereto in India, such taxable services provided shall be treated as export of service only when the order for provision of such service is made from any of his commercial establishment or office located outside India. The Original Authority held that the services could not be considered as export of service in terms of proviso to Rule 3(iii) of Export of Services Rules, 2005 and rejected the claim.

11. As such, what requires to be examined is whether the appellant is eligible for the refund claim and whether the Bank has fulfilled the conditions stipulated in Export of Services Rules, 2005.

12. A perusal of the records in this appeal indicates that the appellant has issued a Standby Letter of credit vide their Letter dated 01.06.2007 and reportedly this Letter was addressed to M/s. Aban Offshore Ltd., Chennai. So, the appellant was asked to produce a copy of the original request from M/s. Aban Singapore Pte. Ltd., for such service provided by them. It appears that the appellant had not produced a copy of original request Letter addressed by M/s. Aban Singapore Pte. Ltd. which was finally submitted during the adjudication proceedings which was also found to be dated 20.06.2007 which was after the date of issue of the Standy Letter of Credit (SBLC) which was dated 01.06.2007. As such, the Lower Appellate Authority has concluded that the request for the service provided has not been received from M/s. Aban Singapore Pte. Ltd. as no documents to prove that request was made by any office located outside India. In support of his view that M/s. Aban Singapore Pte. Ltd. had not originally requested the BOI to provide the credit facility, the Lower Appellate Authority has relied upon the facts that M/s. Aban Offshore Ltd., Chennai stood as a guarantor for the credit facility extended to M/s. Aban Singapore Pte. Ltd. and its assets were given as a security which were also inspected by the appellant’s team for sanction of the credit facility to M/s. Aban Singapore Pte. Ltd. The Lower Appellate Authority has also observed that no documentary evidence was produced to prove that both the companies are separate entities and M/s. Aban Offshore Ltd., Chennai has acted as a commercial establishment of M/s. Aban Singapore Pte. Ltd. He has finally held that the appellant has not received any request letter from any office outside India and the service provided by the appellant is not qualified as export of service in terms of Rule 3(iii) of Export of Services Rules, 2005, and as such, the appellant was not eligible for rebate of service tax paid in terms of Notification No. 11/2005-ST dated 19.04.2005.

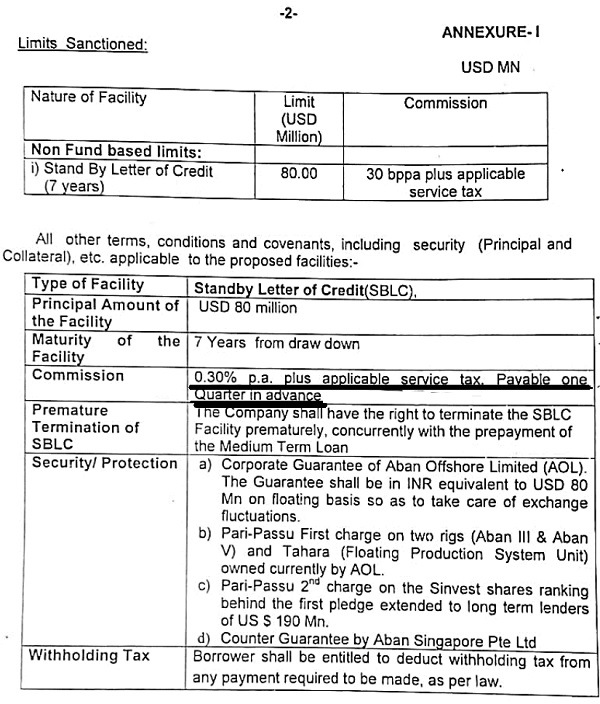

13. There is no dispute that the Bank of India, Corporate Banking Branch, Chennai has sanctioned SBLC to M/s. Aban Singapore Pte. Ltd. for an amount of $80 Million for seven years through Bank of India, Singapore Branch guaranteeing payment obligations of M/s. Aban Singapore Pte. Ltd. On the issue whether the request for extending such credit facility has been made by M/s. Aban Singapore Pte. Ltd. or not, the appellant has submitted the following Letters which clearly evidence that the appellant is the service provider and M/s. Aban Singapore Pte. Ltd. is the service Recipient and the consideration is the commission received in foreign exchange for extending the credit facilities to M/s. Aban Singapore Pte. Ltd. :-

–

–

–

14. We have gone through all the correspondence, submissions of the appellant addressed to the Original Authority and the records. Though, the appellant has not provided the original request Letter by M/s. Aban Singapore Pte. Ltd. requesting for extension of credit facility and also the Bank’s Sanction Letter was addressed to M/s. Aban Singapore Pte. Ltd. care of M/s. Aban Offshore Ltd., Chennai, it cannot be interpreted that the loan facility was not granted at the request of M/s. Aban Singapore Pte. Ltd. or to M/s. Aban Singapore Pte. Ltd. M/s. Aban Offshore Ltd., Chennai which is a holding company of the service Recipient cannot be treated as a commercial establishment or an office of M/s. Aban Singapore Pte. Ltd., being an incorporated company under the laws of Singapore.

15. Thus, the appellant has satisfied the twin conditions of rendering services abroad and receipt of consideration in the form of commission in convertible foreign exchange. Extending credit facility to M/s. Aban Singapore Pte. Ltd. which is located abroad and producing Foreign Inward Remittance Certificates (FIRC) before the Departmental Authorities satisfy these main conditions for treating the service rendered as export of service.

16. The appellant accepting or inspecting the assets of their parent company M/s. Aban Offshore Ltd., Chennai as a guarantee for extending such credit facility, will not alter the situation, as to who is the service provider and who is the service recipient. A perusal of the Annexures to the appellant’s Letter dated 01.06.2007 supra clearly gives all the details as to the limit sanctioned, commission payable, maturity of the facility, terms and conditions as to the insurance and penal rate,

17. As such, we are of the opinion that the appellant has provided services to an entity outside India and has received the consideration in the form of commission in foreign exchange. Though, the appellant has intimated M/s. Aban Singapore Pte. Ltd., regarding sanction of credit facility may be care of address at Chennai. During the hearing before the Tribunal, the Ld. Counsel has submitted copies of the Deed of Counter Guarantee cum Indemnity executed by M/s. Aban Singapore Pte. Ltd., a copy of the Loan Agreement between M/s. Aban Singapore Pte. Ltd. and the Bank of India, Singapore Branch and a copy of the Certificate evidencing that M/s. Aban Singapore Pte. Ltd. was incorporated under the Companies Act of Singapore w.e.f. 18.11.2005 which are considered to conclude that credit facilities were extended to M/s. Aban Singapore Pte. Ltd.

18. So, the observation of the Lower Appellate Authority that M/s. Aban Singapore Pte. Ltd. and M/s. Aban Offshore Ltd., Chennai are not two different corporate entities is incorrect. In view of the above discussion, we hold that the appellant has satisfied all the conditions for treating the service rendered to M/s. Aban Singapore Pte. Ltd. as export of service in terms of Notification No. 11/2005-ST dated 19.04.2005. As such, the impugned Order-in-Appeal No. 24/2015(STAX-II) dated 16.01.2015 passed by Commissioner Service Tax (Appeals-II), cannot sustain and so, ordered to be set aside.

19. But, we find that there are contradictory findings as to whether the Bank has paid the service tax at its own cost on the commission received or whether it has recovered the same from M/s. Aban Singapore Pte. Ltd. The Lower Appellate Authority has observed as follows:-

p15. Further, without prejudice to the above findings, it is noticed from the documents of Standby Letter of Credit, that the amount of service tax was collected from the recipient of Service. The Section 11 B of the Central Excise Act, 1944 is the only provision which permits refund of duty paid on the exported goods even when the incidence of such duty has also been passed on. When such, provision is not applicable to this case, the benefit provided in that section could not be extended. In this case, the appellant collected the service tax from their customer as is evidenced from the terms and conditions of the SBLC. Thus, the appellant tried to enjoy the double benefit by collecting the service tax from the customer and also claiming refund under the Notification ibid. As per Section 73 A of the Finance Act, 1994, once an amount is collected in the name of service tax, it has to be paid to the credit of Central Government. In these circumstances, if the refund is sanctioned, the appellants are unjustly enriched with double benefit, which is not permitted under the law. The service tax collected from the customer has been paid to the credit of the exchequer and therefore, the appellants are not entitled for refund of the same under Section 73A ibid.”

20. The above finding of the Commissioner of Service Tax (Appeals-II) has been vehemently countered by the Ld. Advocate in his submissions stating that the appellant Bank has not collected the service tax on the commission earned by them in foreign exchange from M/s. Aban Singapore Pte. Ltd. He has argued that the Lower Appellate Authority ‘was in gross error rendering the above finding without verifying the true facts involved which if done would have clearly shown that the appellant herein did not collect the service tax on the commission earned by them in foreign exchange which failure has resulted in his recording the above incorrect finding contrary to fact.” It has to be noted that as per the terms and conditions (page No. 11 of this order), the service recipient is liable to pay commission inclusive of applicable service tax. We could not find any document or letter as to whether the appellant has collected or not the service tax along with the commission charged. It is not clear as to whether M/s. Aban Singapore Pte. Ltd., has paid the commission plus service tax applicable or not as the invoices purportedly raised by the appellant are not available on the appeal records.

21. We conclude that the appellant has satisfied all the conditions for treating the service as export of service but there is a need to verify whether the service tax paid has been recovered or not from M/s. Aban Singapore Pte. Ltd., to be eligible for refund. As per the terms and conditions M/s. Aban Singapore Pte. Ltd. has to pay the commission quarterly in advance along with applicable service tax. Whether the commission has been paid along with the service tax by M/s. Aban Singapore Pvt. Ltd. has to be verified by the Refund Sanctioning Authority.

22. To sum up, we hold that the appellant is eligible for refund of service tax paid on the commission charges in respect of granting credit facility to M/s. Aban Singapore Pte. Ltd., subject to conducting verification whether the appellant has recovered the service tax paid from M/s. Aban Singapore Pte. Ltd., or not. The matter is remanded for the limited purpose of verifying whether the service tax was collected by the appellant. Needless to say, if not collected, the appellant is eligible for refund. In case, it is found that the appellant has recovered the commission charges along with the service tax paid, the appeal fails. Thus, the appeal is disposed of in the above terms.

(Order pronounced in open court on 01.08.2024)