Case Law Details

Sushil Kumar and others Vs Suman Villas Private Limited (NCLT Chandigarh)

The case of Sushil Kumar and Others vs. Suman Villas Private Limited was brought before the National Company Law Tribunal (NCLT), Chandigarh, for the approval of a resolution plan under Sections 30(6) and 31 of the Insolvency and Bankruptcy Code, 2016 (IBC). The resolution professional, Mr. Sanjay Garg, acting on behalf of Suman Villas Private Limited (the “Corporate Debtor”), sought approval for the resolution plan submitted by Max Heights Infrastructure Limited.

Background

Suman Villas Private Limited, a real estate company incorporated on March 9, 2006, faced financial difficulties, leading to the initiation of the Corporate Insolvency Resolution Process (CIRP) under Section 7 of the IBC. The application was admitted on April 8, 2022, with Mr. Sanjay Garg appointed as the Interim Resolution Professional (IRP). A moratorium under Section 14 of the Code was imposed to protect the company from further legal actions during the insolvency process.

Claims and Creditors

The resolution professional received claims from various creditors, including unsecured financial creditors and operational creditors. The total amount claimed was approximately INR 1,393.35 crores, with INR 946.96 crores admitted. The details of these claims were verified and reported by the resolution professional to the Committee of Creditors (CoC).

Resolution Process

An Expression of Interest (EOI) was invited on July 20, 2022, and five parties expressed interest, of which four were found eligible. The CoC held several meetings to discuss and evaluate the resolution plans. After a detailed examination, the plan submitted by Max Heights Infrastructure Limited was approved with an 86.67% majority through an e-voting process.

Financial Proposal

The approved resolution plan included key financial proposals:

- An upfront consideration of INR 10 crores to be paid into the corporate debtor’s account.

- Payment of INR 1.50 crores to unsecured financial creditors.

- 100% payment to workmen and employees for parity dues.

- INR 10 crores or more to be invested by the successful resolution applicant (SRA) to complete the pending infrastructure, with costs recovered from outstanding dues of homebuyers.

Approval and Compliance

The resolution plan was submitted to the NCLT for approval. The tribunal reviewed the plan and found that it complied with all mandatory provisions of the IBC. No objections were raised against the approval of the plan. The tribunal, therefore, approved the resolution plan, marking a significant step towards the revival of Suman Villas Private Limited.

Conclusion

The approval of the resolution plan by the NCLT Chandigarh is a crucial development in the insolvency proceedings of Suman Villas Private Limited. The successful implementation of this plan will aid in addressing the claims of the creditors and ensure the completion of pending projects, ultimately benefiting all stakeholders involved.

FULL TEXT OF THE NCLT JUDGMENT/ORDER

This application has been filed by the Sanjay Garg, Resolution Professional (Herein referred to as the “Applicant”) of Suman Villas Private Limited (hereinafter referred to as “Corporate Debtor”) for the approval of resolution plan, under Section 30(6) and Section 31 of the Insolvency and Bankruptcy Code, 2016 (hereinafter referred to as the ‘Code’) read with Regulation 39 of the IBBI (Insolvency Resolution Process for Corporate Persons), Regulations, 2016, by this Adjudicating Authority.

2. The relevant facts as stated in the application are as below-

A. The corporate debtor is a private limited company incorporated on 09.03.2006 having CIN: U45201HR2006PTC036085 and is engaged in the business of real estate. A copy of master data extracted from the website of the ministry of corporate affairs is annexed as Annexure 1 of the application. This Adjudicating Authority admitted the application filed by the financial creditors under the provisions of section 7 of the code on 08.04.2022 and appointed Mr. Sanjay Garg, IP having IBBI Registration no. IBBI/IPA-001/IP-P01865/2019-2020/12919 to act as interim resolution professional and imposed moratorium under section 14 of the code. A copy of the order dated 08.04.2022 is annexed as Annexure 2. In compliance of the said order, the applicant has made a public announcement on 10.04.2022 in two newspapers namely Financial Express and Jansatta. A copy of the public announcement is annexed as Annexure 3 of the application. Thereafter, the applicant filed the report certifying the constitution of the committee of creditors on 30.04.2022 before this Adjudicating Authority.

B. The claims from the creditors were received after the last date of the submission of the claims i.e. 22.04.2022. The details of the claims received by the applicants until 11.01.2023 are as follows-

| S.No. | Particulars | Amount claimed | Amount admitted |

| 1. | Secured financial creditor belonging to any class of creditors | 0 | 0 |

| 2. | Unsecured financial creditor belonging to any class of creditors | 1,01,02,61,839 | 77,12,38,372 |

| 3. | Secured financial creditors (other than financial creditors belonging to any class of creditors) | 0 | 0 |

| 4. | Unsecured financial creditors (other than financial creditors belonging to any class of creditors) | 38,12,47,955 | 17,41,01,116 |

| 5. | Operational creditors (Workmen) | 0 | 0 |

| 6. | Operational creditors (Employees) | 0 | 0 |

| 7. | Operational creditors (Government dues) | 0 | 0 |

| 8. | Operational creditors (Other than Workmen, Employees and Government dues) | 8,29,693 | 6,13,693 |

| 9. | Other Creditors, if any (Other than financial and operational creditors) | 10,12,502 | 10,12,502 |

| Total | 1,39,33,51,989 | 94,69,65,681 |

A latest and updated list of claims as on the date of approval of the resolution plan is attached as Annexure 4 of the application.

C. The applicant has filed 20 progress reports in terms of the direction given vide order dated 08.04.2022 containing the actions taken by the applicant and details of claims received during CIRP verified and collated by the applicant. The applicant also prepared information memorandum and addendum to information memorandum of the corporate debtor and shared with the CoC members for their consideration after receiving the confidential undertaking. The copy of the information memorandum and addendum to information memorandum is annexed as Annexure 5 (colly).

D. The applicant published an invitation of expression of interest in form G on 20.07.2022 in Financial Express (English) and Jansatta (Hindi) and the copy of the same is annexed as Annexure 6 of the application. The applicant received expression of interest from five parties namely; Krishna Builders, Max Heights Infrastructure Limited, One City Infrastructure Private Limited, Engineering Project (India) Limited & Aadi Propbuild Private limited (Consortium) and Nakshatra Corporate Advisers Limited. Out of which, the first four were found eligible and emerged as prospective resolution applicants.

E. The Resolution Plan was received from M/s Max Heights Infrastructure Limited. The applicant has conducted seven meetings of CoC in compliance with section 24 of the code read with regulation 18 of IBBI (Insolvency Resolution Process for Corporate persons) Regulations, 2016 as stated in detail in the application.

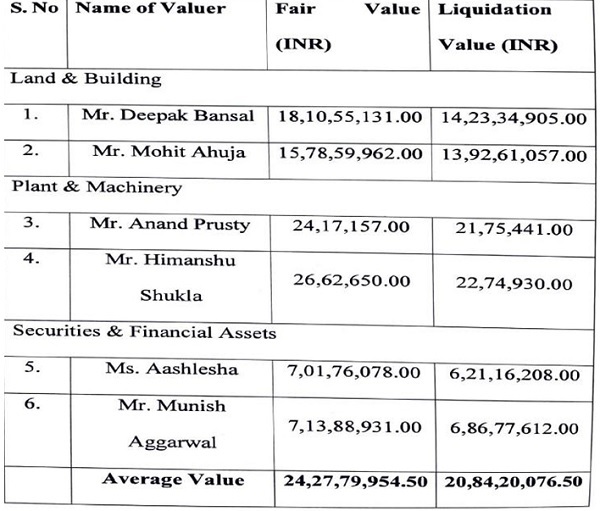

F. The applicant appointed two registered valuers for computation of fair value and liquidation value of all three classes of assets of the corporate debtor. The summary of value computed by the valuers in their respective valuation reports are as follows-

G. The CoC in its fourth meeting resolved to appoint an independent consultant namely C&L Law Offices for conducting the due diligence of all prospective resolution applicants under section 29A of the code and legal vetting of resolution plan submitted by them. A copy of the same is annexed as Annexure 9 (colly) of the application. The CoC in the same meeting also resolved to extend the CIRP period for 90 days in light of interest received from prospective resolution applicants for submission of plans. Accordingly,

the Applicant had preferred an application being IA no. 1574/2022 which was allowed vide order dated 02.12.2022 by this Hon’ble Adjudicating Authority inter alia allowing the extension of 90 days in the CIRP from 06.10.2022 to 03.01.2023. Further the committee of creditors in its 6th meeting which was held on 26.12.2022 again agreed & resolved to extend the corporate insolvency resolution process period for further 60 days in order to finally approve the plans after all the corrections and negotiations held with the PRA. Thereafter, the Applicant filed an application vide diary no. 03367 on 03.01.2013 before this Adjudicating Authority within the expiry of extended period of 90 days. The said application was pending. However, even during the pendency, and in the interest of the CIRP of the Corporate Debtor, the Applicant pursued the CIRP and held the meetings of CoC thereafter. The present application is thus being filed within the said period of 60 days for which extension application is yet to be allowed. It is submitted by the applicant that during the said period of 60 days i.e. the time period for which the Applicant has sought extension upon directions of the CoC, the CoC has approved the resolution plan and it is in the interest of the process that the extension may be allowed. It is pertinent to mention here that IA no. 319/2023 (second extension application) was listed on 08.02.2023 before this Adjudicating Authority, however on the said date, the matter could not reach due to paucity of time. In fact, as on the date of this Application, on the last few dates, the matter could not be heard due to paucity in time with this Bench. During the pendency of present application, the said IA no. 319/2023 was disposed of vide order dated 13.04.2023 and the extension sought was granted.

H. In the 7th Meeting of the Committee of Creditors held on 31.01.2023, the prospective resolution applicant namely M/s Max Heights Infrastructure Limited was invited to participate in the CoC meeting in terms of Section 30(5) of the code to discuss and address with the members of CoC and explain the salient features of the resolution plan. Thereafter, the Resolution Plan submitted by PRA was put for e-voting and as per the result of e-voting, the plan was approved with a majority of 86.67% and passed following resolution:

“Resolved that in pursuant to section 30(3) of the Insolvency and Bankruptcy Code, 2016 read with regulation 39(2) of the Insolvency and Bankruptcy Board of India (Insolvency resolution process for corporate persons) Regulations, 2016, the consent of the members of the CoC be and is hereby accorded to approve the final resolution plan submitted by Max heights Infrastructure Limited.”

“Resolved further that in terms of Sub-section 4 of section 30 of Insolvency and Bankruptcy Code, 2016 the committee of creditors has considered the resolution plan and found it feasible and viable.”

“Resolved further that pursuant to the provisions of section 3(6) and other applicable provisions of the Insolvency and Bankruptcy code 2016 and the rules and regulations framed thereunder the resolution professional be and is hereby authorised to submit the resolution plan as approved by the Committee of creditors to the Hon’ble Adjudicating Authority and to do all such acts, deeds and things as may be required or considered necessary or incidental thereto.”

The copy of the minutes of seventh meeting of CoC alongwith e-voting results is annexed as Annexure 10 (Colly). A copy of resolution required to submit while submitting the resolution plan is annexed as Annexure 11 (Colly).

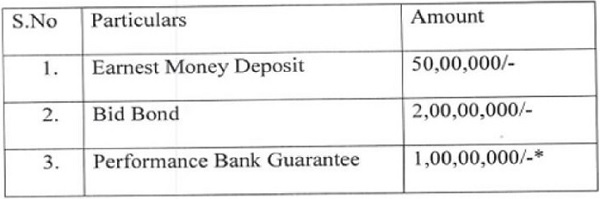

I. Subsequent to the approval of the resolution plan submitted by the successful resolution applicant (hereinafter referred to as SRA), the applicant issued the letter of intent (LOI) vide email dated 14.02.2023 to the SRA and requested him to submit the performance bank guarantee as obligated in request for resolution plan documents. A copy of the same is annexed as Annexure 12 (Colly). The details of amount received from SRA are as follows-

*At the request of SRA the Performance bank guarantee amounting to Rs. 1 Crore was adjusted with the amount received as earnest money deposit and bid bond and the same was confirmed to SRA. A copy of relevant part of bank statement of the corporate debtor evidencing the amount of earnest money deposit and bid bond is annexed as Annexure 13 of the application and a copy of mail requesting the adjustment of performance guarantee and confirmation of the same to SRA is annexed as Annexure 14.

J. The applicant sent a copy of resolution plan vide email dated 24.02.2023 to the income tax department and a copy of the same is annexed as Annexure 15.

3. As per the approved resolution plan, the SRA shall bring in an amount of agreed upfront consideration equivalent to 10,00,00,000/- (Rs. Ten crores only) (upfront amount) in an account of a corporate debtor controlled by the monitoring committee (CD Account). A summary of financial proposal/payment under the resolution approved by the SRA is as follows-

| Sr.No | Particulars | Amount (In crores) (INR) |

| 1. | CIRP Cost | 0.50 |

| 2. | Payment to secured financial creditors | NA |

| 3. | Payment to unsecured financial creditors | 1.50 |

| 4. | Payment to unsecured financial creditors (Home buyers/plot buyers) | Offer of possession/registration shall be done phase wise in total period of 24 months from effective date |

| 5. | Operational creditors including workmen and employees parity dues | 100% to workers, Rupees 5L or 1% of Admitted amount (whichever is less) to statutory claims 5% of admitted amount claims to OC and other creditors =0.05 |

| 6. | Other creditors | Nil |

| 7. | Contingency | 1.00 |

| Total | 3.05* |

*The SRA proposes to induct Rs. 10 Crore to successfully implement the resolution plan. In addition, the SRA will spend Rs. 10 Crore or any higher amount as may be required to complete the incomplete flats/infrastructure which will be recovered from the payments receivable from the outstanding dues of homebuyers.

4. It is submitted that pursuant to section 30(1) of the code, the SRA has submitted an affidavit confirming his eligibility to submit Resolution plan under Section 29A of the code. The copy of the said affidavit is annexed as Annexure 16 of the application.

5. It is submitted that as per Resolution plan those creditors who remain, as per the provisions of code, Resolution applicant proposes to make payment of liquidation value. The value to be paid to such creditors will be deducted from the total amount to be paid to the financial creditors. However, it is submitted that there were no dissenting financial creditors.

ANALYSIS

6. We have heard learned counsel for the applicant/Resolution Professional and learned counsel for the Successful Resolution Applicant. We have also gone through the record placed before this Adjudicating Authority and have considered the submissions made by learned counsel for the parties. This Adjudicating Authority is of the considered view that, no specific objections as to the approval of the proposed resolution plan is raised, therefore there is no impediment in proceeding with examining the Resolution Plan vis-à-vis with the mandatory compliance under the Code and the Regulations made thereunder.

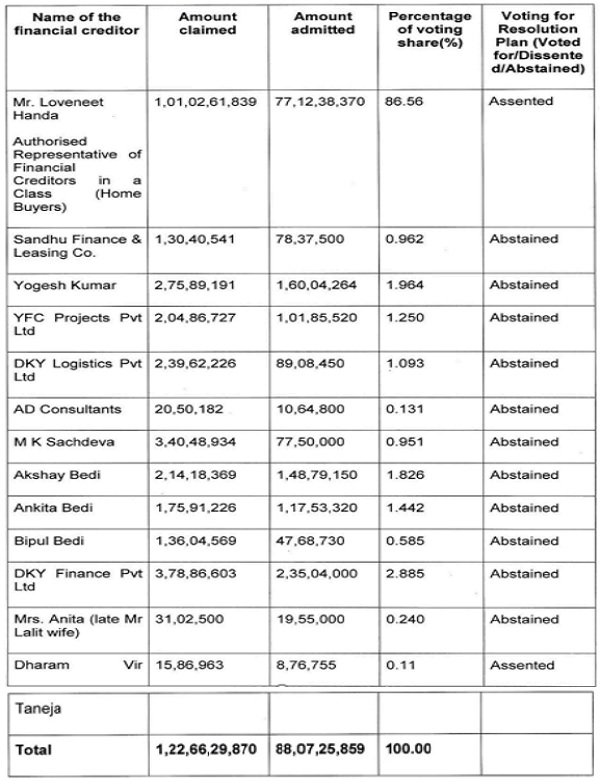

7. The CIRP proceedings under Section 7 of the Code, against the corporate debtor were initiated vide order dated 08.04.2022 and Committee of Creditors was constituted on 29.04.2022. The list of financial creditors of M/s Suman Villas Private Limited, being members of the committee of creditors and distribution of voting share among them is as under:-

8. The Resolution Plan includes a statement under Regulation 38(1A) of the CIRP Regulations as to how it has dealt with interests of all stakeholders in compliance with the Code and Regulations made thereunder. The amounts provided for the stakeholders under the Resolution Plan, as given in Para 7 of Form H, is as under:-

| S.No. | Category of creditor | Amount of claim | Claim admitted | Amount provided in the plan | % of claim admitted | Payment term |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| 1 | Insolvency Resolution process cost |

NA | NA | 0.50 | NA | 60 days from the effective date |

| 2 | Operational creditor (Other than workmen and employees) | 8,29,693 | 6,13,693 | 30,685 | 5 | 60 days from the effective date |

| 3 | Operational creditor (Government Dues) | 0 | 0 | Nil | Nil | Nil |

| 4 | Operational Creditor (only workmen and employees) | 0 | 0 | Nil | Nil | Nil |

| 5 | Financial Creditor (Other than the | 21,47,81

,068.00 |

10,86,10,

734.00 |

1.50 | 13.81 | Up to 24 months |

| financial creditors belonging to the class of creditors) | from the effective date | |||||

| 6 | Financial Creditor | 16,48,79 | 6,46,13,6 | Nil | Nil | Nil |

| (Other than the financial creditors belonging to the class of creditors)-Relate d parties | ,924 | 27 | ||||

| 7 | Financial Creditor | 1,01,02, | 77,12,38, | Offer of | NA | In total |

| (Financial Creditors belonging to the class of creditors) | 61,839 | 370 | possessio n/registrat ion shall be done phase wise in total period of | period of 24 months from effective date | ||

| 24 months from effective date | ||||||

| Total-A(1+2+3+4 | 1,39,33, | 94,69,65, | 2.05 | |||

| +5+6+7) | 51,989 | 681 | ||||

| B | Contingent | NA | NA | 1 | NA | |

| Liabilities | ||||||

| Total B | NA | NA | 1 | NA | ||

| Total to be paid | 1,39,33, | 94,69,65, | 3.05 | |||

| (A+B) | 51,989 | 681 |

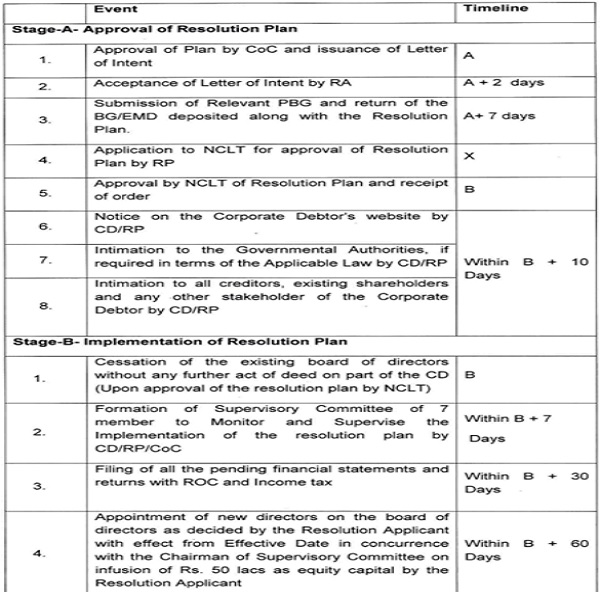

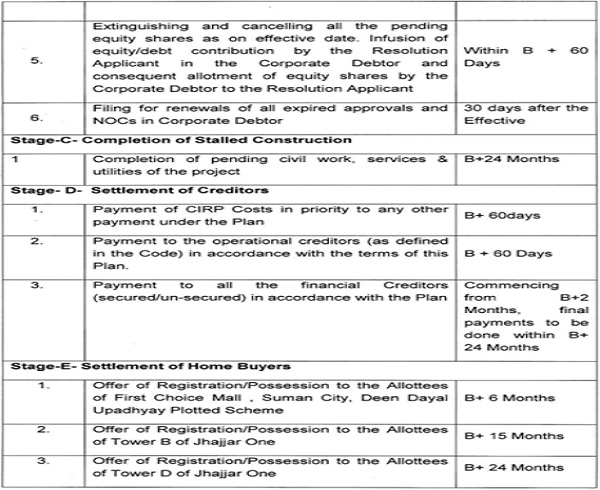

9. As provided in Clause 16 of the Resolution plan, the timeline for the Implementation of the Resolution Plan is as follow:-

–

10. In view of Section 31 of the Code, the Adjudicating Authority, before approving the Resolution Plan, is required to examine that a Resolution Plan which is approved by the CoC under Section 30 (4) of the Code meets the requirements as referred under Section 30 (2) of the Code.

Section 30 (2) is quoted below: –

“(2) The resolution professional shall examine each Resolution Plan received by him to confirm that each Resolution Plan –

(a) provides for the payment of insolvency resolution process costs in a manner specified by the Board in priority to the payment of other debts of the corporate debtor;

(b) provides for the payment of debts of operational creditors in such manner as may be specified by the Board which shall not be less than-

(i) the amount to be paid to such creditors in the event of a liquidation of the corporate debtor under section 53; or

(ii) the amount that would have been paid to such creditors, if the amount to be distributed under the Resolution Plan had been distributed in accordance with the order of priority in sub-section (1) of section 53,

whichever is higher, and provides for the payment of debts of financial creditors, who do not vote in favour of the Resolution Plan, in such manner as may be specified by the Board, which shall not be less than the amount to be paid to such creditors in accordance with sub-section (1) of section 53 in the event of a liquidation of the corporate debtor.

Explanation 1. — For removal of doubts, it is hereby clarified that a distribution in accordance with the provisions of this clause shall be fair and equitable to such creditors.

Explanation 2. — For the purpose of this clause, it is hereby declared that on and from the date of commencement of the Insolvency and Bankruptcy Code (Amendment) Act, 2019, the provisions of this clause shall also apply to the corporate insolvency resolution process of a corporate debtor-

(i) where a Resolution Plan has not been approved or rejected by the Adjudicating Authority;

(ii) where an appeal has been preferred under section 61 or section 62 or such an appeal is not time barred under any provision of law for the time being in force; or

(iii) where a legal proceeding has been initiated in any court against the decision of the Adjudicating Authority in respect of a Resolution Plan;]

(c) provides for the management of the affairs of the Corporate debtor after approval of the Resolution Plan;

(d) The implementation and supervision of the Resolution Plan;

(e) does not contravene any of the provisions of the law for the time being in force

(f) conforms to such other requirements as may be specified by the Board.

Explanation. — For the purposes of clause (e), if any approval of shareholders is required under the Companies Act, 2013 (18 of 2013) or any other law for the time being in force for the implementation of actions under the Resolution Plan, such approval shall be deemed to have been given and it shall not be a contravention of that Act or law.]”

11. The compliances of Section 30(2) are as follows:

A. In respect of compliance of Section 30(2)(a) of the Code, it is seen that there is a provision in clause 7 (Payment to insolvency resolution process Cost) of the Resolution Plan wherein it provides that the Resolution Applicant proposes to pay the unpaid CIRP cost till the effective date which as per estimates should be about Rs. 50 Lacs in top priority.

B. In respect of compliance of Section 30(2)(b) of the Code, it is seen that there is a provision in clause 10 of the Resolution Plan wherein it provides as follow:-

Clause 10- Operational Creditors (including employees, contractors , suppliers, statutory dues, workmen dues) –

As per the Resolution plan, the Resolution Professional has admitted the claims of operational creditors amounting to Rs.16 Lakhs. The settlement proposed is 5% of the claims admitted before the effective date and the amount will be paid within 90 days of the effective date. The admitted claims for workmen and employees, statutory dues are nil as on date.

C. In respect of compliance of Section 30(2)(c) and 30(2)(d) of the Code, it is seen that the manner of implementation and supervision of the Resolution Plan has been provided in detail in Clause 15 (3) (Supervision of implementation of the resolution plan). It provides for the Supervisory Committee which shall be formed within 7 days of effective date, consisting of total 7 (seven) members comprising of: (A) 3 (three) members from class of financial creditors (Homebuyers) to be nominated by CoC; (B) 3 (three) members to be appointed as representatives of the Resolution Applicant; and (C} the Resolution Professional to be appointed as Chairman of the supervisory committee (in case RP decides to not become a member of committee then an independent person/agency shall be appointed in his place). The implementation of the resolution plan shall be carried out by the resolution applicant under the supervision of the supervisory committee till the completion of all the resolution proposals as mentioned in the Resolution plan.

D. In respect of compliance of Section 30(2)(e) and Section 30(2)(f) of the Code, it is seen that the information provided in declaration provided under table 6B of the Resolution Plan, it is stated that the Resolution Plan is in compliance with the applicable laws.

12. The compliance of resolution plan has been given in Para 9 of the Form H, which is as under:-

| Section of the Code/Regulation No. | Requirement with respect to the Resolution Plan |

Clause of Resolution Plan | Compliance (Yes/No) |

| 25(2)(h) | Whether the Resolution Applicant meets the criteria approved by the CoC having regard to the complexity and scale of operations of business of the CD? |

Yes | |

| Section 29A | Whether the Resolution Applicant is eligible to submit resolution plan as per final list of Resolution Professional or Order, if any, of the Adjudicating Authority? | Page 220 of Paper book | Yes |

| Section 30(1) | Whether the Resolution Applicant has submitted an affidavit stating that it is eligible? | Format IIIA | Yes |

| Section 30(2) | Whether the Resolution Plan- | ||

| (a) provides for the payment of insolvency resolution process | Page 19 | Yes | |

| b) provides for the payment to the operational creditors? |

Page 27 | Yes | |

| (c) provides for the payment to the financial creditors who did not vote in favour of the resolution plan? |

Page 16 | Yes | |

| (d) provides for the management of the affairs of the corporate debtor? |

Page 41 | Yes | |

| (e) provides for the Implementation and supervision of the Resolution plan? |

Page 41 | Yes | |

| (f) Contravene any of the provisions of the law for the time being in force? | Page 17 | No | |

| Section 30(4) | Whether the Resolution Plan | ||

| (a) is feasible and viable, according to the CoC? |

Page 17 | Yes | |

| (a) has been approved by the CoC with 66% voting share? | Yes | ||

| Section 31(1) | Whether the Resolution Plan has provisions for its effective implementation plan, according to the CoC? | Section 15-Page 41 Section-16-P age 45 | Yes |

| Regulation 35A | Where the resolution professional made a determination if the corporate debtor has been subjected to any transaction of the nature covered under Sections 43, 50 or 66 before the one hundred and fifteenth day of insolvency commencement date, under intimation to the Board? |

Clause 6 of

Page 17 |

Yes |

| Regulation 38(1) | Whether the amount due to the operational creditors under the resolution plan has been given priority in payment over financial creditors? |

Page 27 | Yes |

| Regulation 38(1A) | Whether the resolution plan includes a statement as to how it has dealt with the interests of all stakeholders? |

Page 3 | Yes |

| Regulation 38(1B) | (i) Whether the Resolution Applicant or any of its related parties has failed to implement or contributed to the failure of implementation of any resolution plan approved under the Code. |

Page 17 | No |

| (ii) If so, whether the Resolution Applicant has submitted the statement giving details of such non-implementation? |

NA | NA | |

| Regulation 38(2) | Whether the Resolution Plan provides: | ||

| (a) the term of the plan and its implementation schedule? |

Page 41 | Yes | |

| (b) for the management and control of business of the corporate debtor during its term? | Page 41 | Yes | |

| (c) adequate means for supervising its implementation? |

Page 41 | Yes | |

| 38(3) | Whether the resolution plan demonstrates that- | ||

| (a) it addresses the cause of default? |

Page 10 | Yes | |

| (b) it is feasible and viable? |

Page 17 | Yes | |

| (d) it has provisions for its effective implementation? |

Page 41 | ||

| (e) It has provisions for approvals required and the timeline for the same? | Section 15-Page 41

Section-16-P age 45 |

||

| (f) the resolution applicant has the capability to implement the resolution plan? |

Section 15-Page 41 | Yes | |

| 39(2) | Whether the RP has filed applications in respect of transactions observed, found or determined by him? |

Application filed separately on 27.02.2023 | |

| Regulation 39(4) | Provide details of performance security received, as referred to in sub-regulation (4A) of regulation 36B. |

RA has deposited Rs. 2.5 Crore in the shape of EMD and Bid Bond and has requested to transfer Rs. 1 Crore as performance security deposit from this amount vide his letter dated 20.02.2023. The amount has been apportioned to performance guarantee account. |

13. On perusal of Form-H annexed as Annexure-18 at page no. 249-257, It is stated that the Fair Market Value of the Corporate Debtor is Rs.24,27,79,954.50/-and the Liquidation Value of the Corporate Debtor is Rs. 20,84,20,076.50/-.

14. On perusal of the proposed Resolution Plan, it is noted that clause 6 of the Resolution Plan be deemed to have been received for the benefit of all provides that, “that if the claim of any Financial creditor of any class of category is ever detected fraudulent, dubious, illegal and admitted against the prevailing financial commercial taxation laws prevailing as on date such claim shall not be given any resolution amount, whatsoever and shall be treated as null and void-ab-initio pass through of receipts from litigation/ recovery process of avoidance transactions under Chapter III or fraudulent or wrongful trading under Chapter VI of part-II of the code, the resolution applicant/ corporate debtor shall pass on 100% of the receipts from litigation/recovery process of avoidance transactions under chapter III or fraudulent/wrongful trading under Chapter VI of the part-II of the code, to the financial creditors after deducting the applicable taxes incident on such receipt and the expenses incurred by the resolution applicant/corporate debtor in the process. The Resolution Applicant shall earmark a sum of Rs. 10 Lacs only from the contingency funds to support the Financial creditors in their litigations/recovery of the avoidance transactions and/or fraudulent or wrongful transactions. For ample clarity, it is reiterated that all litigation/recovery processes of avoidance transactions and/or fraudulent or wrongful transactions shall be managed and pursued by the financial creditors and the recoveries, if any shall be distributed only in proportion to their admitted claims.”

15. It is submitted by learned counsel for the Resolution Professional that the resolution plan has been approved by a vote of 86.67% voting share of the financial creditors, therefore, the conditions provided for by Section 30(4) of the Code are satisfied.

16. Accordingly, subject to the aforesaid observations, we hereby approve the Resolution Plan dated 13.02.2023 (‘Approved Resolution Plan’), which shall be binding on the Corporate Debtor and its employees, shareholders of corporate debtor, creditors including the Central Government, any State Government or any Local Authority to whom statutory dues are owed, guarantors, Successful Resolution Applicant and other stakeholders involved. Resultantly, I.A. 863/2023 stands allowed. It is declared that the moratorium order passed by this Adjudicating Authority under Section 14 of the Code shall cease to have effect from the date of pronouncement of this order.

17. We hereby reiterate that the Approved Resolution Plan shall not constitute any waiver to any statutory obligations/liabilities arising out of the approved resolution plan and the same shall be dealt in accordance with the appropriate authorities concerned as per relevant laws. We are of the considered view that if any waiver is sought in the Approved Resolution Plan, the same shall be subject to approval by the concerned authorities. The same view has been held by the Hon’ble Supreme Court in Ghanshyam Mishra and Sons Private Limited vs. Edelweiss Asset Reconstruction Company Limited and Embassy Property Development case ((2021) 9 SCC 657).

18. Accordingly, MoA and AoA of the Corporate Debtor shall be amended and filed with the RoC for information and record as prescribed. While approving the Approved Resolution Plan as mentioned above, it is clarified that the Successful Resolution Applicant shall pursuant to the Resolution Plan approved under section 31(1) of the Code, 2016, obtain all the necessary approvals as may be required under any law for the time being in force within the period as provided for such in law.

19. The Resolution Professional shall forward all records relating to the Corporate Insolvency Resolution Process of the Corporate Debtor and the Approved Resolution Plan to IBBI to be recorded at its database in terms of Section 31(3)(b) of the Code. The Resolution Professional is further directed to handover all the records, premises, properties of the corporate debtor to the Successful Resolution Applicant to ensure a smooth implementation of the resolution plan.

20. The approved ‘Resolution Plan’ shall become effective from the date of passing of this order. The CoC Approved Resolution Plan shall be part of this order, subject to our observations regarding concessions, reliefs and waivers sought therein.

21. The Supervisory Committee is directed to file the monthly status report with regard to the implementation of the approved plan before this Adjudicating Authority.

22. In view of the above, the I.A. 863/2023 stands allowed in terms of aforesaid discussion.

Let the copy of the order be served to the parties.