CA Monika Thakkar

Introduction:

Objective of Amendment in section 43B(h):

To Promote timely payments to Micro and Small Enterprises Section 43B of the Act provides for certain deductions to be allowed only on actual payment.

It is proposed to insert a new clause (h) in section 43B of the Act, to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act 2006 shall be allowed as deduction only on actual payment. However, it is also proposed that the proviso to section 43B of the Act shall not apply to such payments.

Section 15 of the MSMED Act mandates payments to micro and small enterprises within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, then it mandates that the payment shall be made within 15 days.

Thus the proposed amendment to section 43B of the Act will allow the payment as on accrual basis only if the payment is made within the time limit prescribed under section 15 of the MSMED Act. This amendment will take effect from 1st April2024 and will accordingly apply to the assessment year 2024-25 and subsequent assessment years.

Act:

Section 43B: Certain deductions to be only on actual payment.

… any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006),

shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him :

Provided that nothing contained in this section [[except the provisions of clause(h)]] shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub-section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return…

Analysis:

1. Section 43B of the Act provide the list of expenses which is allowed as a deduction, if payment is made on or before due date of filling of Return of Income i.e. on payment basis.

Basis of Deduction:

(a) In Mercentile system of Accounting, Income Tax Act allows deduction of expenses in accordance with the accrual basis and

(b) In Cash System of Accounting, Income Tax Act allows deduction of expenses in accordance with the actual payment basis.

From introduction of clause h of Section 43B of Act, For Micro & Small enterprise: if payment is outstanding beyond the time limits prescribed in (section 15 of MSME Act) then deduction of expenditure is allowed only in the year of payment. i.e. on the payment basis. [Proviso to the section 43B is not applicable for the clause h. Hence, irrespective of the payment made on or before due dates of filling of Return of Income, such expenditure is disallowed if payment is not made in accordance with the prescribed timelines (Section 15 of MSME Act). Therefore, disallowance of clause (h) will lead to higher tax burden for the taxpayer.]

2. What are MSMEs:

Reference MSME Act: Classification of Enterprises (w.e.f. 01.07.2020):

|

Enterprises |

Investment in plant and machinery / Equipment (in Rs.) | Turnover (in Rs.) |

| Micro Enterprises | Up to 1 crore | Up to 5 crores |

| Small Enterprises | Up to 10 crores | Up to 50 crores |

| Medium Enterprises | Up to 50 crores | Up to 250 crores |

Time prescribed under section 15 of MSME Act:

|

Sr No. |

Particulars | Time Limit for payment | Note |

| 1 | Whether Business Enterprise has written agreement | Yes | Consider the time as per written agreement but up to 45 days from the acceptance of the bill. [i.e if agreement is of 75 days then also 45 days to be considered for the timely payment] |

| 2 | Whether Business Enterprise has written agreement | No | Payment should be made within 15 days from the acceptance of the bill or the day of deemed acceptance of Good or Services |

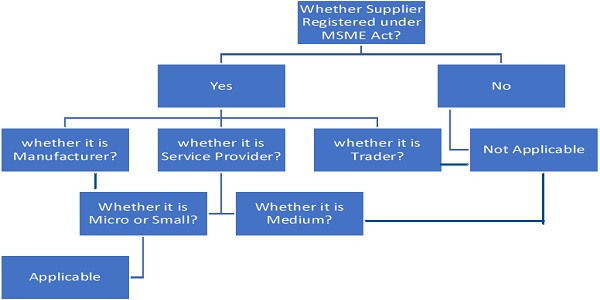

Applicability of Section 43B(h)

Notes to be considered:

I. For the compliance of this section, business entities are advisable to take an Annual Declaration from their supplier indicating that they are micro or small enterprises registered under the Micro, Small and Medium Enterprises Development Act, 2006.

II. This section applies to Micro and Small Enterprise only hence any amount payable to medium enterprises will not be governed by section 43B(h).

III. To avail the benefit of section 43B(h), Udyam registration is mandatory. In case where Udyam registration is surrendered by an enterprise then all past transaction are under the ambit of section 43B(h) subject to the declaration of supplier.

IV. Although the payment is made after 15/45 days but before filing a return of income, the deduction can only be claimed in the year of actual payment is made and not in the year of accrual.

V. This section is not applicable to those enterprises who show their income under presumptive basis (i. e 44AD/44ADA/44AE). This section is also not applicable to Charitable institution. (covered us 11 & 13 of Income Tax Act).

VI. For previous outstanding payment as on 0 1/04/2023 and new liability of the current year shall be discharged on FIFO basis.

VII. For the GST component: GST collected on sale is the liability of supplier, hence it is not an expense for buyer and not to charged as a deduction and hence, section 43B(h) is not applicable on GST payable amount.

VIII. In case there is a dispute between buyer and supplier, in that case as per MSMED Act the day on which such objection is removed by the supplier shall be treated as day of acceptance and the payment has to be made before the appointed day which will be day following immediately after the expiry of the period of fifteen days from the day of acceptance.

IX. This section is not applicable for Capex expenditure.

Recommendations

A. From Buyer’s point of view:

- Send Declaration form to verify supplier’s status, whether it has Udyam registration or not, in which category it is registered and what is the registration number,

- Maintain the books of accounts with the proper bifurcation of supplier, registered under Udhyam and not registered under Udhyam,

- Maintain the track record for the registered supplier in the terms of out standing dues and payment cycles, Outstanding shall not exceed beyond 15/45 days,

- Maintain the written agreement with the supplier if any.

B. From Supplier’s point of view:

- Mention Udyam registration number on invoice and if possible, specifically mention credit period on the invoice itself (max 45 days) (in case of huge number of buyers and written agreement is not possible for one-on-one basis).

- Inform buyers of registration status on Udhyam.

Conclusion: The amendment in Section 43B(h) brings a focused approach to promote timely payments to MSMEs. While enhancing compliance measures, it requires businesses to adapt their accounting practices, emphasizing the significance of Udyam registration and adherence to prescribed timelines. The recommendations aim to guide both buyers and suppliers in navigating these changes effectively.

***

Declaimer: The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this article are for general informational purposes only