The Securities and Exchange Board of India (SEBI) has issued an order prohibiting IIFL Securities Limited (formerly India Infoline Limited) from onboarding new clients for a period of two years. The order comes after inspections revealed violations related to the segregation of client funds and misuse of credit balances.

Analysis: The order outlines the thematic inspection conducted by SEBI, which examined the compliance of IIFL with SEBI Circulars and regulations regarding the segregation of funds and securities. It highlights the failures of IIFL in segregating its own funds from clients’ funds, misuse of credit balances, and inappropriate designation of client bank accounts. The order elaborates on the violations and their impact on the fair conduct of business as a stock broker.

Furthermore, the order addresses the breaches of the Code of Conduct for Stock Brokers, including the lack of integrity, promptitude, fairness, due skill, care, and diligence displayed by IIFL in its business operations. It emphasizes the importance of upholding the provisions of the SEBI Act and regulations issued by SEBI and the stock exchanges.

The order acknowledges the corrective steps taken by IIFL to rectify the wrongdoing, such as transferring proprietary trades to a separate entity and restructuring its business. It also notes the compliance with the Enhanced Supervision Circular and absence of non-compliance findings in subsequent inspections. However, it highlights the significance of holding IIFL accountable for its past violations to maintain trust and integrity in the securities market.

Conclusion: Based on the findings and considerations, SEBI has imposed a two-year prohibition on IIFL Securities Limited from onboarding new clients as a stock broker. The order aims to address the gravity of the violations committed by IIFL while recognizing the corrective measures taken. By issuing this order, SEBI emphasizes the need for market intermediaries to comply with regulations and act in the best interests of their clients and the overall development of the securities market.

Securities And Exchange Board of India

ORDER

UNDER SECTION 12(3) OF SECURITIES AND EXCHANGE BOARD OF INDIA ACT, 1992 READ WITH REGULATION 27 OF SECURITIES AND EXCHANGE BOARD OF INDIA (INTERMEDIARIES) REGULATIONS, 2008

In respect of:

| S. No. | Name of the Noticee | Registration no. |

| 1. | IIFL Securities Limited (earlier known as India Infoline Limited) | INZ0001 64132 |

Background in brief

1. India Infoline Limited (hereinafter referred to as “IIFL”/“Company”/“Noticee”) is registered with Securities and Exchange Board of India (hereinafter referred to as “SEBI”) as a stock broker with registration number INZ000164132. IIFL is also a member of the stock exchanges viz. the BSE Limited (hereinafter referred to as “BSE”), National Stock Exchange of India Ltd. (hereinafter referred to as “NSE”), Multi Commodity Exchange of India Limited (hereinafter referred to as “MCX-SX”) and United Stock Exchange of India. Further, it is also registered with SEBI as a depository participant (in short ‘DP’) and is working as a DP of National Depository Services Limited (hereinafter referred to as “NSDL”) and Central Depository Services (India) Ltd. (hereinafter referred to as “CDSL”). Along with these, IIFL is also registered with SEBI as a research analyst, an investment advisor, a mutual fund and as a portfolio management service provider.

2. SEBI had conducted a thematic inspection of the books of accounts of IIFL during the period of January 30 to February 03, 2014 (hereinafter referred to as ‘Thematic Inspection’) wherein the records and the processes of IIFL during the period of April 01, 2011 to December 31, 2013 were inspected. The purpose of the said inspection was to examine as to whether IIFL was working in compliance with the provisions of the SEBI Circular ref. SMD/SED/CIR/93/23321 dated November 18, 1993 (hereinafter referred to as the “SEBI 1993 Circular”) as well as SEBI circular ref. MRD/DoP/SE/Cir- 11/2008 dated April 17, 2008 as far as segregation of funds and securities of clients are concerned. In the said inspection conducted at the Corporate Office of IIFL viz. B Wing, Trade Centre, Kamala Mills Compound, off Senapati Bapat Marg, Lower Parel, Mumbai, it was noticed that the actions of IIFL were not in compliance with the provisions of the aforementioned SEBI 1993 circular read with clauses A(1), A(2) and A(5) of the code of conduct for stock brokers as stipulated in Schedule II of the Securities and Exchange Board of India (Stock Broker) Regulations, 1992 (hereinafter referred to as “Broker Regulations”) as the records of IIFL were found to be lacking in the following aspects:

2.1. Failure to segregate its own funds from clients’ funds;

2.2. Misuse of credit balances in clients’ funds for the benefit of clients having debit balance; and

2.3. Inappropriate designation of the client bank accounts.

3. Based on the outcome of the above limited inspection, it was decided to have a comprehensive inspection of books of accounts of IIFL and the same was conducted on a series of dates including August 7, 12-13, 21-22, 26, 27 and September 19, 2014 (hereinafter referred to as ‘Comprehensive Inspection’) simultaneously at 4 different offices of IIFL including at its aforementioned corporate office, two branch offices and office of a sub-broker of IIFL. The said comprehensive inspection was conducted in order to examine if IIFL was maintaining its books of accounts and other records in the manner required to be maintained under the Broker Regulations and whether the said maintaining of records were in compliance with the provisions of securities laws, regulations, rules, circulars, bye-laws and directions issued by SEBI and the stock exchanges from time to time. The findings of this comprehensive inspection were supplemented by three (3) supplementary inspections, covering the aforesaid total period covered under Thematic Inspection and Comprehensive Inspection viz. April 01, 2011 to June 30, 2014, and additionally one more inspection was also done covering a period from April 01, 2015 to January 31, 2017, as per the details given below:

| # | Type and date of inspection | Period of inspection | Place inspected (if any) | Purpose of inspection |

| 1. | Supplementary Inspection I | April 01, 2011 to June 30, 2014 | Data was requisitioned through emails. |

Examination of sample top 20 days with highest pay-in obligation of the Company on proprietary account along with clients’ obligation to the stock exchange.(hereinafter referred to as “Supplementary Inspection I”) |

| 2. | Supplementary Inspection II | April 01, 2011 to June 30, 2014 | Data was requisitioned through emails. |

Examination of sample top 105 days with highest pay-in obligations of the Company on proprietary account and clients’ obligation to the stock exchange.

(hereinafter referred to as “Supplementary Inspection II”) |

| # | Type and date of inspection | Period of inspection |

Place inspected (if any) | Purpose of inspection |

| 3. | Supplementary Inspection III | April 01, 2011 to June 30, 2014 (except the days which were inspected during Supplementary Inspection I and II) | Data was requisitioned through emails. |

Examination was carried out to calculate the wrongful gains made by IIFL during the entire period of inspection except the days already inspected at the time of Supplementary Inspections I and II.

(hereinafter referred to as “Supplementary Inspection III”) |

| 4. | Inspection (Dates of inspection: March 27, 30 and 31, 2017) |

April 01, 2015 to January 31, 2017 | Data was requisitioned through emails. |

Examination was carried out to verify whether IIFL has complied with the regulations and circulars issued in respect of segregation of funds and securities of clients.

(hereinafter referred to as “March 2017 Inspection”) |

4. In light of the findings and violations of provisions of law observed during the course of these six inspections, two separate enquiry proceedings were initiated against the Noticee in terms of provisions of Securities and Exchange Board of India (Intermediaries) Regulations, 2008 (hereinafter referred to as ‘Intermediaries Regulations’). While the violations alleged on the basis of Thematic Inspection, Comprehensive Inspection and Supplementary Inspections I and II were covered under the first Enquiry Proceedings (hereinafter referred to as ‘Enquiry Proceeding I’), the violation alleged on the basis of Supplementary Inspection III and March 2017 Inspection were dealt with in second Enquiry Proceedings (hereinafter referred to as ‘Enquiry Proceeding

II’). In accordance with the provisions of Intermediaries Regulations, two separate Show Cause Notices (in short ‘SCNs’) dated May 02, 2017 and October 28, 2021 were issued by the Designated Authority (in short ‘DA’) to the Noticee with respect to Enquiry Proceeding I and Enquiry Proceeding II respectively. In the meanwhile, the Noticee had filed separate settlement applications under the available mechanism, expressing its willingness to settle the findings covered and allegations made under Enquiry Proceeding I and Enquiry Proceeding 2 respectively. The said Settlement Applications were, however, rejected by SEBI and such decision of rejection of the aforementioned settlement applications was communicated to the Noticee vide email dated August 23, 2021.

5. Subsequently, both the Enquiry Proceedings were resumed for further It is noticed that in response to the SCNs dated May 02, 2017 (Enquiry Proceeding I) and October 28, 2021 (Enquiry Proceeding II), the Noticee had submitted its replies vide letters dated December 22, 2017 (refuting the allegations made in SCN dated May 02, 2017) and on January 29, 2022 (refuting the allegations made in SCN dated October 28, 2021). Thereafter, a personal hearing was granted to the Noticee on March 14, 2022 and, during the said personal hearing, the Noticee sought some time to make his post hearing submissions, which was duly granted by the DA. Subsequently, a common post hearing letter dated March 30, 2022 was submitted by the Noticee, dealing with the allegations made in both the SCNs viz. the SCNs dated May 02, 2017 and October 28, 2021.

6. Taking in account all the findings mentioned in the inspection reports, observations of SEBI, allegations mentioned in the two SCNs dated May 02, 2017 and October 28, 2021 and the various submissions of the Noticee, two separate enquiry reports dated April 29, 2022 and May 27, 2022 were submitted by the DA in terms of provisions of Regulation 26 of Intermediaries Regulations with respect to the Enquiry Proceedings I and Enquiry Proceedings II In both these enquiry reports, having considered the oral as well as written submissions advanced by and on behalf of the Noticee, the DA has recommended to cancel the certificate of registration of the Noticee.

7. Pursuant to the submissions of the reports by the DA recommending cancellation of certificate of registration of the Noticee, two separate post-enquiry SCNs were issued to the Noticee on July 18, 2022 (dealing with the violations dealt with in Enquiry Proceedings I) and on July 04, 2022 (dealing with the violations dealt with in Enquiry Proceedings II), in terms of provisions of Regulation 27(1) of the Intermediaries Regulations.

8. The allegations levelled against the Noticee in the aforementioned two SCNs dated July 18 and July 04, 2022 as well as in the enquiry reports dated April 29, 2022 and May 27, 2022 are the following;

8.1. It was noticed that, out of the 45 client bank accounts examined during inspections, 26 client bank accounts were not titled as “client account”. This was despite the fact that BSE had issued a warning to the Noticee with respect to the aforesaid issue. While the Noticee had submitted evidence of renaming of certain accounts as “client account”, the Enquiry Report I found out that there was one account with Citi Bank, which the Noticee has claimed to have been closed, but no evidence showing closure of the said account has been submitted by the Noticee. Similarly, the Noticee didn’t make any submissions regarding its account with South Indian Bank. In view of this, it has been alleged that the Noticee has violated provisions of the SEBI 1993 Circular by failing to designate bank accounts used for client transactions as client accounts.

8.2. It was seen that funds were regularly being transferred from client bank accounts and clients’ dividend accounts to the Pool/Control Accounts of IIFL, which were managed and controlled by IIFL as its own bank account.

At the same time, funds were transferred from Noticee’s own bank accounts to the same control accounts, where clients’ funds were also being collected, and then to the settlement account of the stock exchange/clearing house. In light of this, it has been alleged that the Noticee has violated the provisions of the SEBI 1993 Circular by failing to segregate client funds, mixing its own funds with client funds by transferring its own funds and client funds to common pool accounts which are owned by the Noticee, and then to common control account which was the actual pool account for purpose of settlement of trades.

8.3. Further, the inspection team also observed that funds lying in these Pool/Control Accounts were inter alia being used by IIFL for its own purposes including for the following types of transactions:

8.3.1. Investments in and redemptions of mutual funds units, investment in bonds, metal trusts and IIFL income opportunities fund.

8.3.2. Transfers to and from IIFL Commodities.

8.3.3. Transfers to and from for insurance.

8.3.4. Transfers to and from IIFL Wealth Management Ltd.

8.3.5. Transfers to and from IIFL Realty Ltd.

8.3.6. Transfers to and from foreign remittance expenses.

8.3.7. Transactions pertaining to fixed deposits, inter-corporate deposits, overdraft, bank charges (for XT-border wire FT) and transactions with other group companies of IIFL, etc.

8.3.8. Transfers to and from bank accounts categorized by IIFL as expenses and salary account;

In light of this, it was alleged that IIFL has violated provisions of the SEBI 1993 Circular by mixing clients’ funds with its own funds in Pool/Control Account and by using those mixed funds for its own purposes.

8.4. It was also observed that in certain instances, funds pay out from the stock exchange towards client trades were not transferred to the designated “client bank account”. Further, ‘G’ value1 of trades on a number of days had come out negative. Therefore, it is alleged that the funds of credit balance clients of IIFL were being utilized for settlement obligations of debit balance clients.

8.5. Similar to the above, it was also observed during inspection that the funds transferred from own account of IIFL to the settlement account were less than the proprietary trade obligation of the Noticee. When calculation was made keeping in mind the funds of IIFL and its collateral available with the Exchanges, it was alleged that IIFL had misutilized the credit clients’ funds for the settlement obligation of its proprietary trades.

8.6. Therefore, in summary, it is alleged that IIFL had violated the provisions of the SEBI 1993 Circular by the following acts:

(i) By mixing clients’ funds with proprietary funds by routing transactions through common control accounts; and

(ii) By utilizing funds of credit balance clients for settlement obligation of debit balance clients; and

(iii) By utilizing funds of credit balance clients for settlement obligation of proprietary trades; and

9. In view of the aforesaid allegations that have been brought in the two enquiry reports and corresponding SCNs, the Noticee was called upon to show cause as to why suitable directions should not be issued against it in terms of recommendation given by DA or any other direction that is deemed fit in the facts and circumstances of the matter.

10. Both the post enquiry SCNs dated July 18, 2022 and July 04, 2022 were delivered to the Noticee at its email address. In response to that, the Noticee has submitted a common reply dated October 31, 2022. Thereafter, as the recommendation made by DA was for cancellation of registration of the Noticee in both the enquiry reports, a common personal hearing was granted to the Noticee in respect to both the aforementioned post-enquiry SCNs, in terms of provisions of Regulation 27(4) of Intermediaries Regulations. The said hearing was scheduled on January 10, 2023, which was duly attended by the Authorized Representatives of the During the personal hearing, the Noticee has reiterated the submissions made through its reply dated October 31, 2022 and further sought time to make post-hearing submissions which was duly granted. Subsequently, the Noticee made its post hearing submissions vide letter dated January 12, 2023.

11. The submissions of the Noticee before me, by way of two separate letters dated October 31, 2022 and January 12, 2023, that are relevant for the purpose of instant proceedings, are captured in brief hereunder:

11.1. At the start, the Noticee has brought to my attention that two separate adjudication orders have been passed by SEBI against it for the same alleged violations as mentioned in the two enquiry reports and the Adjudicating Officer has imposed a penalty of INR 1 Crore in each of these adjudication orders. Against these Orders, the Noticee has preferred Appeals before Securities Appellate Tribunal (in short ‘SAT’). The said Appeals have been admitted by the Hon’ble SAT and interim stay has been granted against the two aforesaid adjudication Orders. The Noticee has submitted that the subject matter of the present Enquiry Reports is identical to the matters pending before the Hon’ble SAT.

11.2. Subsequent to the aforementioned information, the Noticee has made a preliminary submission that the very basis of the allegation of misuse of clients’ funds in both the Enquiry Reports is a retrospective application of a method, which was introduced by SEBI for the first time in September 2016. Using the said methodology and prescription, it has been wrongly alleged that there has been misuse of clients’ funds during 2011-2017, a period when the said Circular dated September 26, 2016 had not even come into force.

11.3. Coming back to the merits of the matter, the Noticee has submitted that, on November 18, 1993, SEBI issued a circular (SEBI/SED/CIR/93/23321) prescribing maintenance of separate client accounts and also prescribing in detail as to in what cases funds/securities can be deposited/withdrawn from client accounts etc. Subsequent to this, the Noticee has been subjected to over 100 inspections by BSE, NSE and SEBI over last 18 years (i.e. from the time of its incorporation till 2017) of its carrying the business of a stock broker and no fault has been found by any agency pointing out mistakes, if any, in the manner of calculation of the clients’ funds by the Noticee or the process being followed by the Noticee while transferring clients’ funds to the Exchanges/clearing corporations or vice-versa.

11.4. Moving on to the alleged violations one by one, the Noticee has started its submission by first refuting the allegation that two of its Bank accounts of Citi Bank and South Indian Bank, which were “client accounts”, did not contain the words “client” in the title of these accounts. In this regard, the Noticee has made its submissions regarding these two bank accounts in following terms:

11.4.1 . The Citi Bank Account could not be relabeled as Client Bank Account due to operational issues posed by Citi Bank. Therefore, the Noticee has closed the account. In support of this, the Noticee has submitted a copy of the letter/email evidencing the closure of the said bank Account.

11.4.2. Insofar as the account with South Indian Bank is concerned, the Noticee has submitted that the nomenclature in the said account was indeed changed to Client Account. Subsequently, the said account was also closed on January 07, 2021. In support of this, the Noticee has submitted a copy of the letter/email evidencing the closure of the said bank Account.

11.5. Keeping these facts and evidences on record, the Noticee has submitted that the allegation is a technical and venial one and does not warrant any punitive intervention of nature like the one recommended by the DA. Summarizing the whole issue, the Noticee has submitted that, out of the 45 client accounts flagged by SEBI during inspection, 42 accounts were already designated by it as the Client accounts before submission of Enquiry Report I by the DA and for rest of three client accounts, in one account, the nomenclature was indeed changed, in another account, the bank posed issues and in the third instance, it is an acknowledged position that it was solely used as a client account in full compliance with the 1993 Circular. Therefore, there was no intention on the part of the Noticee not to label the clients’ accounts appropriately. The account number of these three accounts were reported to the stock exchanges as client accounts and there has never been a single allegation of any unauthorized use of funds from these accounts.

11.6. With respect to the allegation of pooling of clients’ and its own funds in pool/control accounts with Citi Bank, Axis Bank, ICICI Bank and HDFC Bank, the Noticee has firstly contended that the pool accounts were not ‘clients’ accounts’. Secondly, the moneys transferred from clients’ accounts to pool accounts were for transfer to settlement account and therefore was “money properly required for payment to or on behalf of clients”, which was permissible under SEBI 1993 Circular, and no fault can be found with the transfer of said money from clients’ accounts to pool accounts.

11.7. The Noticee has further submitted that Clauses 1(C) and 1(D) of SEBI 1993 Circular deal with credits to and debits from “client account” only. Therefore, the restrictions mentioned in SEBI 1993 Circular apply only to “client accounts” and there is nothing in the said Circular, which prohibits a Stock Broker from keeping a middle layer of pool account before transferring the monies to settlement account and the same is a factor of internal control and procedure of the Noticee.

11.8. Notwithstanding these submissions, the Noticee has intimated that, with effect from April 2014, it had shifted its proprietary trading under separate membership namely 5paisa Capital Limited (formerly IIFL Capital Limited). Therefore, from April 2014 onwards, the Noticee was neither undertaking proprietary trading nor were there any instances of usage of clients’ funds for settlement obligations towards proprietary positions. As a result, there has not been a single trade in the proprietary account of the Noticee since April 01, 2014. Therefore, any apprehension of mixing of client funds and own funds at this stage is hollow and without any basis.

11.9. At the same time, to segregate the broking business from investment banking and investments in its subsidiaries, it has been submitted that the Noticee had restructured the holding company with effect from February 2014, whereby the broking business was demerged into a 100% subsidiary with the name India Infoline Ltd. and investment related business has been kept with the holding company i.e. IIFL Holdings Ltd.

11.10. It has further been submitted that the Noticee had simultaneously implemented the process of pool account balance reconciliation and has ensured a system-based tracking and maintenance of balances in clients’ bank accounts to ensure that the net credit balances of clients’ accounts are maintained in the clients’ bank accounts separately and exclusively. For that purpose, it was maintaining separate bank accounts for pooling clients’ funds whereas for its own funds, separate bank accounts are maintained. The aforesaid clients’ accounts are separate from its own bank accounts from where any shortfall in clients’ pay-in are made. This ensures that the pool accounts are maintained only for pay-in and pay-out of clients’ funds and its own funds are transferred from/to separate bank account.

11.11. Placing these details on record, the Noticee has emphasized that in any case, the issue of mixing of clients’ funds with its own funds is a historical relic and, post restructuring of IIFL group in 2014, there is no chance of reoccurring of the aforementioned aberrations. Nevertheless, the inspection reports of NSE and BSE do not record any adverse observations regarding the non-segregation of clients’ funds from own funds, pay-in and pay- out of clients’ funds etc., hence, the apprehension of SEBI is unfounded.

11.12. With respect to repeated findings of misuse of credit balance clients’ funds for purpose of debit balance clients as well as for proprietary trading, the Noticee has submitted that the period of inspection for Supplementary Inspections I and Supplementary Inspection II was same viz. April 1, 2011 to June 30, 2014.

11.13. Regarding the allegation of misuse of funds, the Noticee has sought to draw attention to the fact that the Enhanced Supervision Circular of SEBI was issued on September 26, 2016 and the same was made effective from July 01, 2017. This shows that these aforesaid two supplementary inspections relate to a period when the Enhanced Supervision Circular had not even come into force.

11.14. The Noticee has strenuously contended that the formula for calculation of position of clients’ funds were introduced for the first time through the Enhanced Supervision Circular and the said Circular of 2016 is not a mere reiteration of SEBI 1993 Circular.

11.15. In support of this contention, the Noticee has submitted that, while calculating the value of the bank guarantee, the 2016 Circular and the Enquiry Reports have taken only the funded portion of the bank guarantee and have completely ignored the non-funded portion. Conversely, the contemplation of exclusion of non-funded portion of bank guarantee was introduced for the first time by way of the Enhanced Supervision Circular dated September 26, 2016 and the same was never a part of the SEBI 1993 Circular.

11.16. Prior to Enhanced Supervision Circular dated September 26, 2016, Bank Guarantee was considered as cash and cash equivalent while giving margin as the said amount is available to the exchange as and when they want it. This was clearly mentioned in SEBI circular dated June 20, 2003. The same has been reiterated by SEBI in its Circular dated February 23, 2005.

11.17. The Noticee has further responded to the allegation that how it chooses to fund the temporary deficit of debit balance clients to the Exchange was an internal matter of the Noticee. In support of this contention, the Noticee has put forward an example that if it had obtained an Over Draft or a Cash Credit facility from its bank and instead of a bank guarantee and if it had preferred to use that Over Draft facility to make payments to the Exchanges instead of placing Bank Guarantees, SEBI would have no fault in its fund utilization. Logically, there is no difference between a Fixed Deposit and a Bank Guarantee given to the Exchange as both of them entitle the Exchanges to recover the full amount as and when it becomes due and is necessary. Therefore, the system of using only the funded portion of bank guarantee is faulty.

11.18. In support of its submission that the Enhanced Supervision Circular was not a mere reiteration of the SEBI 1993 Circular, the Noticee has also stated that SEBI had to extend the timelines for implementation of the Enhanced Supervision Circular and BSE and NSE had to issue a plethora of clarifications on the implementation of the said circular. If the Enhanced Supervision Circular was nothing but a mere reiteration of SEBI 1993 Circular, there was no question of giving such extensions and clarifications.

11.19. In fact, whenever SEBI issues a circular, which is in continuation of previous circulars, the same is explicitly stated in the later circular. However, no such iteration has been made evident in Enhanced Supervision Circular of 2016 that it is in continuation with 1993 Circular.

11.20. As a consequence of these submissions, the Noticee has submitted that if the 100% of the Bank Guarantee is considered, there is hardly any client shortfall. Alternatively, if net creditors are considered then too there is no shortfall of funds.

11.21. Regarding the Enquiry Reports’ seeking reliance on the findings of the Hon’ble SAT made in the matter of Arihant Capital Markets Ltd. vs. SEBI (Appeal No. 521 of 2019, decided on October 21, 2021), the Noticee has submitted that the appellant in that case had used the funds of its clients for the payment of dues of its associates and/or group company, etc., and the ground of retrospective use of the said formula of Enhanced Supervision Circular of 2016 was being taken for the first time in appeal. The case of the Noticee is distinguishable on facts from the abovementioned matter. At the same time, penalty of INR 5 Lakhs was imposed in the case of Arihant Capital (supra), whereas the punishment of cancellation of registration of certificate is severest and incompatible to the aberrations observed qua the acts of the Noticee in the present matter.

11.22. In the end, the Noticee has submitted that the methodology of calculation for the purpose of computing misuse of clients’ funds was made applicable only in July 2017. Since that time, the Noticee has been following the same methodology, reorganized its affairs and evidently there is no allegation that after the implementation of the enhanced supervision circular, the Noticee has ever had Negative ‘G value’.

Background of the matter and Preliminary Objections

12. Having summarized the submissions of Noticee, it is important to narrate in brief, the background facts which have ensued the matter to reach the extant stage, before proceeding to examine and adjudicate the issues in the matter. To begin with, it is noticed that SEBI had conducted thematic inspection of IIFL from January 30, 2014 to February 03, 2014 at the office of IIFL at Senapati Bapat Marg, Lower Parel, Mumbai. The purpose of the Thematic Inspection was to examine as to whether the acts of IIFL were in compliance of the provisions of the SEBI 1993 Circular and SEBI circular dated April 17, 2008 with respect to segregation of funds and securities of clients, during the period of April 01, 2011 to December 31, 2013. In the said inspections, SEBI noticed that IIFL had not nomenclated 26 of its 45 clients’ accounts as ‘client account’ in bank record despite issuance of a warning by BSE.

13. It is noticed that the system of assigning a clear-cut nomenclature of clients’ accounts was introduced in order to prevent misuse of clients’ funds lying in these It was also prescribed to facilitate conducting a Regulatory exercises, such as inspections, to become easier in the light of clear cut identification of clients’ accounts. Also, it would be easier to find out usage of funds from those clients’ account and to prevent mischief on the part of a stock broker, if any, to hide some of the clients’ accounts from regulatory oversight.

14. Therefore, upon finding evidence of wrong nomenclature having been assigned to the clients’ bank accounts, it was felt necessary to examine the possibility of misuse of clients’ funds by IIFL from these accounts. For the said end, SEBI conducted a Comprehensive Inspection of IIFL for the period of April 01, 2013 to June 30, 2014. The said comprehensive inspection was carried out simultaneously at three offices of IIFL viz. its earlier mentioned Corporate Office, and two of its branch offices, and the office of one of its sub-brokers was also inspected. The said inspection was conducted on various dates in the months of August and September 2014. The purpose of comprehensive inspection was to examine if IIFL was maintaining its books of accounts and other books in the manner required under the Stock Broker Regulations and if it was in compliance with the provisions of other securities laws, regulations, rules, circulars, bye-laws and directions issued by SEBI and the stock exchanges from time to time.

15. In the said comprehensive inspections, SEBI found out that IIFL was following a complicated procedure of transfer of funds wherein, it had opened four accounts with Axis Bank, Citi Bank, HDFC Bank and ICICI Bank, all were nomenclated as ‘control accounts’. IIFL was collecting funds of its own as well as of its clients in the aforesaid four accounts, before transferring funds to ‘Exchange Settlement Accounts’, maintained by IIFL. Thus, IIFL was mixing funds of its own with its clients’ funds before transferring them in ‘Exchange Settlement Accounts’ and was also found making payments for its own overheads and investments from the said control accounts.

16. Upon finding evidences of mixing of funds and usage of money from such mixed funds for proprietary use of the Noticee, a need was felt to examine if clients’ funds were being misused after such mixing. To that end, Supplementary Inspection I of IIFL was carried out, wherein examination of a sample of top 20 days with the highest pay-in obligation of IIFL in its own proprietary account along with clients’ obligation to the stock exchange during the period of April 01, 2011 to June 30, 2014, was undertaken. The said examination was done to assess if the funds of credit balance clients of IIFL were misused for its debit balance clients or for its own proprietary trades. In the data collected from IIFL, it has been noticed that there were 5 days on which funds transferred by IIFL from its own account were less than its proprietary obligations. Therefore, a data of 10 days, including those 5 days wherein funds transferred by IIFL were less than proprietary obligation and also for another 5 days immediately after these days, were sought from IIFL. From the examination of these data, misutilization of funds of clients having credit balance, for settlement obligation of clients having debit balance for 7 days out of these 10 days was observed.

17. Upon finding evidences of misuse of credit balance clients’ funds, Supplementary Inspection II of IIFL was carried out, for the same period as was adopted for Supplementary Inspection I wherein, sample data of top 105 days (besides the data of days collected earlier in Supplementary Inspection I) with highest pay-in obligations of IIFL on its proprietary account as well as towards clients’ obligation to the stock exchanges was obtained. In the said Supplementary Inspection II, out of a sample of 105 days, it was noticed that IIFL had misutilized the funds of clients having credit balances to meet the settlement obligation of debit balance clients for 101 days which amounts to 96% of the total selected sample days. At the same time, IIFL was also found to have misutilized the funds of credit clients for the settlement obligation of its own proprietary trades on 13

18. Further, upon finding misuse of funds of credit balance clients for the benefit of debit balance clients and also for its proprietary trades, in order to identify the true extent of misuse of clients’ funds, Supplementary Examination III of IIFL was carried out for the same period as that of the earlier two supplementary inspections, during which data for all the trading days except for the earlier collected 115 days (10 days in Supplementary Inspection I and 105 days in Supplementary Inspection II) was collected. In these 695 trading days, for which data was collected, IIFL was found to have misused the credit clients’ funds for the settlement obligation of debit balance clients on 687 days which was 98.85% of the total aforesaid sample days. At the same time, on 29 days, IIFL was also found to have misused the funds of credit clients for the settlement obligation of proprietary trades.

19. Finally, one more round of Inspection was carried out on March 27, 30 and 31, 2017 for the period of April 01, 2015 to January 31, 2017 during which an examination was carried out so as to verify as to whether IIFL was in compliance with the regulations and circulars issued in respect of segregation of funds and securities of clients during the next two Financial Years, subsequent to period of first five inspections. On a sample based analysis of top 30 days that have witnessed highest turnover/pay-in obligations during the two Financial Years viz. FY 2015-16 and 2016-17, IIFL was again found to be misusing credit balance clients’ funds for settlement obligation of debit balance clients on all these 30 highest turnover/pay- in obligation days.

20. In all these inspections, certain contraventions have been observed on the basis of which, two separate Enquiry Proceedings had been initiated against IIFL, which resulted into two separate Enquiry Reports and in both the reports the DA has recommended cancellation of certificate of registration of IIFL as a stock The violations so observed can be broadly classified into the following heads :-

20.1. Failure to appropriately nomenclate clients’ bank accounts,

20.2. Mixing of its own funds with clients’ funds and use of those mixed funds for own use,

20.3. Misuse of funds of clients having credit balances for the benefit of clients having debit balances,

20.4. Misuse of funds of clients having credit balances for settlement of proprietary trades.

21. Before moving ahead, I find that the Noticee had initially raised a number of preliminary objections before the DA, which have been duly dealt with by the DA in Enquiry Reports I and II. I don’t find any necessity to reiterate the said objections and the grounds for their rejection by the DA, in the present order, more so in light of the fact that those objections have not been raised by the Noticee in its submissions before me nor has it pointed out any illegality or irregularity in the observations of DA with respect to his dealing of those preliminary objections.

22. However, the Noticee has submitted that two separate adjudication orders have already been passed against it on the facts similar and identical to the present It is noticed that in both the aforementioned matters, vide Adjudication Orders dated May 20, 2022 and May 30, 2022, penalties of INR 1 Crore were imposed upon the Noticee in each of these proceedings. Against these Orders, the Noticee has stated to have preferred appeal before the Hon’ble SAT which, vide its order dated July 18, 2022, has stayed the operation of the said Adjudication Orders, in following terms:

“3. Considering the facts and circumstances that have been brought on record, in the meanwhile, the appellant shall deposit 50% of the penalty amount within six weeks from today. The amount so deposited shall be kept in an interest bearing account which shall be subject to the result of the appeal. If the 50% of the penalty amount is deposited, the balance amount shall not be recovered during the pendency of the appeal. The urgency application is disposed of.”

Having gone through the same, it is observed that the Hon’ble Tribunal has stayed the operation of the Adjudication Orders by stating that, in case the Noticee deposits 50% of total penalty amount within six weeks from the date of the aforementioned order, no steps shall be taken by SEBI during the pendency of the appeal to recover the balance 50% of amount imposed under the respective orders passed by the Adjudicating Officer imposing monetary penalty. Even though, the instant proceedings have arisen out of same facts and allegations, it is very much permissible under the framework of the SEBI Act as there is no restriction on initiation of adjudication and enquiry proceedings simultaneously. In any event, the present proceedings are different from the aforementioned Adjudication Orders and the stay granted by Hon’ble SAT on the implementation of the said Adjudication Orders does not come in the way of continuation of the present proceedings.

23. Now, coming to the first issue of failure of the Noticee to properly name the clients’ bank accounts i.e. names of some of the bank accounts where clients’ funds were kept were not observed to be in terms of the requirement of SEBI 1993 Circular. In this regard, I find that clause 1(B) of the SEBI 1993 Circular clearly states that every member broker is required to pay money to an account kept in the name of the member wherein the title should include the word “client”.

24. I find it necessary to mention here that inspection of records of any market intermediary is a time bound exercise, wherein the regulator is constrained of time. Keeping this fact in light, SEBI has introduced a number of measures over the period to ease out regulatory exercises with respect to compliance of law by respective market intermediaries so that maximum details can be scrutinized in minimum possible time.

25. In this regard, I find it necessary to mention at this stage itself, that the requirement of assigning proper nomenclature to the bank accounts, where clients’ money is kept by a stock broker, was introduced as one of the tools to prevent misuse of clients funds and for the purpose of ease of regulatory oversight for SEBI as well as the stock exchanges, as this would make it easy to identify such accounts on the basis of their nomenclature, and examine the misuse of such clients’ funds lying in those accounts, if any. At the same time, it becomes difficult for an errant stock broker to hide such accounts in which it had deposited clients’ funds and had misused the same.

26. In this context, I note that SEBI had noticed in the course of Thematic Inspection that the Noticee had not designated 26 bank accounts as “client account”, wherein it was depositing clients’ funds. I note that after the aforesaid inspection, IIFL had informed SEBI vide its letter dated July 11, 2014, that it had submitted the request to its bankers for changing the title of the aforesaid 26 bank accounts to “client account” and provided supporting document which contained status of 45 bank accounts. I find from the Enquiry Report I dated April 29, 2022 that the DA had accepted the submissions of IIFL that it had changed title of 24 out of these 26 clients’ accounts. However, with respect to the two clients’ bank accounts the Noticee was still in the process of changing the title to “client bank account”. The said two bank accounts were of Citi Bank (Account No. 857764118) and South Indian bank (Account No. 25073000002308), wherein the process of changing of title of bank accounts was not completed.

27. In this circumstance, the Noticee had submitted before the DA that it had closed its Citi Bank Account, as the said account could not be relabeled as “Client Account” due to operational issues posed by the Citi Bank. However, in support of the above claim, no evidence was submitted by the Noticee before the DA. In this respect, it is further noticed that the Noticee, in its reply dated October 31, 2022, has submitted a copy of the letter/email dated July 09, 2022, perusal of which shows that Citi Bank has intimated that the name of the account was changed to ‘India Infoline Limited Client A/C’ on January 10, 2018. Under the circumstances, no infirmity can be observed in the observation of the DA that was made based on available evidence and the claim of the Noticee was lacking in supporting evidences at that time so as to have its acceptance by the DA as the said evidence was not placed before the DA. However, at the same time, the evidence placed on record now before me can’t be overlooked and brushed aside completely. Having considered the same, it is observed that the said account with Citi Bank was nominated as Client account as on January 10, 2018 and therefore, it was classified as client accounts’ by the Noticee only from January 10, 2018.

28. Insofar as the account with South Indian Bank is concerned, the Noticee has submitted that the nomenclature in the said account was indeed changed to Client Account. Subsequently, the said account was also closed on January 07, 2021. In support of this, the Noticee has submitted a copy of the email dated July 11, 2022 from South Indian Bank, evidencing the closure of the Account and the fact of change of name of the aforementioned account can also be traced out from the said email submitted by the Noticee. However, from the perusal of the evidence submitted in support of the same, it is observed that while the said email confirms that the name in the said bank account was changed as per the requirement of SEBI 1993 Circular, it does not disclose the exact date of such change of name of the said account. Having considered all these facts together, I find that the Noticee was in violation of the provisions of Clause 1(B) of SEBI 1993 Circular for a considerable period of time, in respect of which a total of 26 such bank accounts were identified by SEBI during Thematic Inspection wherein the Noticee had kept clients’ money and withdrew the same and yet without properly nomenclating the said bank accounts in the manner prescribed by SEBI 1993 Circular. The same is evident from the fact that the Noticee has carried out necessary corrective steps only subsequent to issuance of Inspection Report of Thematic Inspection. Therefore, the Noticee itself has implicitly admitted that it was not in compliance with the provisions of Clause 1(B) of SEBI 1993 Circular for a considerable point of time.

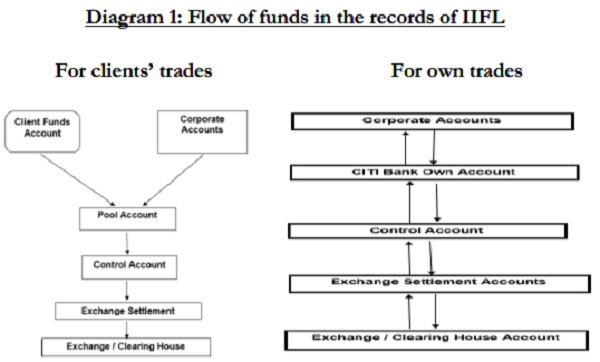

29. Moving on to the Comprehensive Inspection, I find that certain violations with respect to settlement of clients’ funds have been observed during the Comprehensive During this inspection, the Noticee had explained the procedure followed by it for settlement of clients’ funds. The procedure adopted by the Noticee was that, in order to meet the pay-in obligations of clients, it used to transfer the funds from clients’ accounts as well as from its own accounts to four different accounts, nomenclated as ‘Pool Accounts’. Subsequently, from the said ‘Pool Accounts’, money was transferred to a common account, nomenclated as ‘Control Account’. At the same time, the Noticee was transferring funds for its own proprietary trades to the ‘Control Account’. From the ‘Control Account’, the money was eventually transferred to the stock exchange settlement account, which account was used by the Noticee to settle the trades of its own as well as of its clients. The above mechanism is explained through the flowchart given below:

30. It has been alleged on the basis of the findings during Comprehensive Inspection that the Noticee had four accounts nomenclated as ‘Pool Accounts’ viz. Citi Bank pool account bearing account no. 340369173, Axis Bank pool account bearing account no. 4010300022224, ICICI Bank pool account bearing account no. 451000496 and HDFC Bank pool account bearing account no. 00600130000728. It was noticed during Comprehensive Inspection that funds were being flown out from the aforesaid Pool Accounts and the same were being used for own purposes of IIFL such as investment in mutual funds, transfers to group companies, foreign remittance expenses, salary and accounts etc. On the basis of this finding, it has been alleged that the Noticee has mixed its own funds with its clients’ funds in complete violation of the provisions of the SEBI 1993 Circular and it has been noticed that such mixed funds (that includes clients’ funds also) have been used by the Noticee for its own purposes such as investments, vendor payments, salary etc.

31. I find that the Noticee in its reply before the DA has claimed that though the money from the Pool Accounts were used for investments, vendor payments, salary etc., however, while using the same, funds of clients were not used. It has further been submitted that it had its own surplus funds lying deposited in the Pool Account, which were used for the above mentioned purposes and it had not used the clients’ funds lying in the Pool Accounts for such purposes. The above submission, though looks impressive on its face, however, I am constrained to observe that such an explanation is evasive in nature and is fraught with contradictions as the Noticee has failed in its replies before the DA as well as before me to address the specific allegations levelled against it.

32. It is noticed that the allegation levelled against the Noticee in the SCN is that the Noticee was not keeping the fund of its clients separately and depositing the funds of clients and its own funds in common Pool Accounts and thereafter, the said mixed funds were used to meet various obligations that included; settlement of clients’ trades; its own trading obligations as well as non-trading purposes, which is in violations of SEBI 1993 Circular. In its submissions before me refuting the above allegation, the Noticee has contended that SEBI 1993 Circular nowhere prohibits keeping a middle layer of pool account before transferring monies to settlement account, and the same was done by the Noticee as a part of its internal control and procedures. It has been contended that the restriction mentioned in SEBI 1993 Circular apply only on clients’ accounts and there is no prohibition upon a broker to maintain a pool/control account.

33. In this regard, first of all I note that clause 1 of SEBI 1993 Circular in specific term makes it compulsory for a stock broker “to keep the money of the clients in a separate account and their own money in a separate account.” Further, clause 1(D) of the aforementioned circular lays down the circumstances in which, funds can be withdrawn from clients’ accounts and the said permitted circumstances are the following:

(i) money required for payment to or on behalf of clients; or

(ii) for or towards payment of a debt due to the Member from clients; or

(iii) money drawn on client’s authority, or

(iv) money in respect of which, there is a liability of clients to the Member, However, the above stated permitted circumstances allowing withdrawal of money from clients’ accounts should not, in any case, exceed the total amount of the money so held for the time being for each such client.

Reading the two provisions together, it is evident that there was no ambiguity and the law was explicitly providing that clients’ funds cannot be co-mingled with proprietary funds and further, funds of clients cannot be used for purposes other than those mentioned therein and in none of the case, a stock broker was permitted to use the funds of any client for its own purpose.

34. Keeping this position of law in sight, I find from the Comprehensive Inspection that the Noticee was undisputedly placing its own funds as well as its clients’ funds in the four Pool Accounts opened and maintained with Citi Bank, Axis Bank, ICICI Bank and HDFC Bank. It has also been seen that out of the collected funds, the Noticee was using the same for several of its own purposes such as Investments in mutual funds units, bonds, metal trusts, IIFL income opportunities fund; transfers to and from IIFL Commodities, insurance, IIFL Wealth Management Ltd., IIFL Realty Ltd., foreign remittance expenses; transfers to and from bank accounts categorized by IIFL as expenses and salary account etc. It is found from the afore cited provisions of law that clients’ funds were required to be kept and maintained separately and not permitted to be mixed with any other funds so as to make them vulnerable to be used for purposes other than those mentioned in the circular. However, it remains beyond dispute that the Noticee had not kept the funds of clients separately and instead, had mixed them with its own funds in the Pool Account and the funds lying with the said Pool Accounts were in turn used for various sundry purposes other than dealing in securities.

35. In this regard, the only submissions of the Noticee was that it was using its own funds from the aforesaid Pool Accounts and the funds of its clients were not used for meeting the aforementioned expenses and therefore, there is no violation of law in such usage. Before moving forwards, it is found necessary to reiterate that the extant law in this regard, in very unambiguous terms provides that every Stock Broker is required to keep the money of its client separately from its own money, in separate accounts and the said regulatory provision has not carved out for any exception for mixing of funds of clients with its own funds. As far as the justification that funds of clients were not used to meet its personal/proprietary obligations, it is well established fact that money is fungible i.e. money of two persons can be replaceable with each other and the same is mutually interchangeable. Fungibility can also be defined as the ability of a good or asset to be interchanged with other individual goods or assets of the same type.

Fungibility implies equal value between the assets. This means that money, once collected from two or more persons and kept in one Pool, becomes unidentifiable and it cannot be identified as to which part of money belongs to whom. In these scenarios, the arguments of the Noticee hold no ground that it was using its own money only and not the money of its own clients, as the said Pool Accounts into which funds of clients and the Noticee were being transferred did not have any means to demarcate and distinguish the funds of the clients from that of the Noticee. Thus, after mixing of funds in one Pool account, it becomes difficult to pin point as to which part of such pooled funds belongs to which client and which part belongs to the Noticee. This also means that money of clients of a stock broker, so mixed with other funds, becomes susceptible to misuse by the operator of such a pooled account. Keeping in mind the possibility of such mischief that may be committed by stock Brokers, SEBI had mandated the prohibition of mixing of funds of clients’ with the brokers’ own funds to avoid misuse of clients’ funds by stock broker.

36. It is further observed that the above provision was brought in effect in the year 1993 itself and the Noticee, despite being aware of the aforementioned requirement of law, was continuously using funds from the Pool Accounts for its own purposes and to meets its own expenses. These funds comprised of funds received from its clients as well as own funds of the Noticee. Assuming its claim of using only its own funds to meet the aforementioned expenses of the Noticee to be correct, I see no reason as to why the Noticee used the funds from the Pool Accounts to meet its personal obligations when it could have very well used funds directly from its own accounts to meet its proprietary or personal expenses. However, the use of funds from the Pool Accounts (which also contained clients’ funds) for its own purposes has certainly paved the way for the possible misuse of clients’ funds by the Noticee, glimpses of which were noticed in the subsequent Supplementary Inspections I, II and III and in the Enquiry Reports I and II of DA, which I have dealt with in detail in the later paragraphs of this Order. Nevertheless, irrespective of whether the Noticee has utilized the funds of its clients to meet its own obligation, I find that the Noticee has failed to refute the allegation made in the SCN that it has not kept the funds of its clients separately from its own funds and has used the mixed funds to meet its own trading obligations as well as for the purposes of meeting various other expenses which are not permitted under the SEBI 1993 Circulars.

37. In the light of the above discussion, I find that, by mixing its own funds with client funds and by not keeping the money of its clients in a separate and distinct account, the Noticee has violated the provisions of clause 1 and 1(D) of the SEBI 1993 Circular.

38. However, I also note from the submissions of the Noticee that, from 2014 onwards, it has implemented the process level changes to ensure seamless flow of funds from/to client accounts and from/to exchange settlement account. As a part of said change, the Noticee had segregated its proprietary trading into a separate membership, viz:- 5paisa Capital Limited (formerly IIFL Capital Limited). At the same time, it has also indulged in withdrawal of funds towards brokerage charges, depository charges etc. from the client pool account to Noticee’s own account on a fortnightly basis.

39. The Noticee has also segregated its broking business from investment banking business and its own investments in its subsidiaries. For the said purpose, the Noticee has submitted to have restructured the holding company, whereby the broking business was demerged into a 100% subsidiary with the name India Infoline Ltd. and all the investment related business has been transferred to the holding company named as IIFL Holdings Ltd.

4. The Noticee has also submitted to have streamlined the process of pool account balance reconciliation and it has implemented a system based tracking and maintenance of balances in client bank accounts. For this purpose, the Noticee is stated to have been maintaining separate bank accounts for pooling client funds and for its own funds. These accounts are separate from its own bank accounts from where, any shortfall in clients pay-in obligations are made. This ensures that the pool accounts are being maintained to meet only for pay-in and pay-out obligations of clients and its own funds are transferred from/to separate bank accounts.

41. Now moving on to the Supplementary Inspections I, II and III, I find that the same were conducted in the light of the suspicion that arose due to finding of mixing of clients’ funds with proprietary funds by the The suspicion was regarding misuse of clients’ funds for its own purposes, as money was being mixed in pool accounts and money was flowing out for meeting Noticee’s own expenses. Therefore, SEBI initially sought data for a sample of 10 trading days during Supplementary Inspection I, including the data regarding aggregate value of debit balances of all clients, aggregate value of credit balances of all clients, total fund balance available in all clients’ bank accounts and aggregate value of collaterals deposited with clearing corporations in the form of cash and cash equivalents etc.

42. On the basis of the data, it was observed that the aggregate of the ‘end of day’ balance in all clients’ accounts along with the collaterals deposited with the clearing corporation/clearing member was less than aggregate clients’ credit balances as per the clients’ ledgers. Therefore, it has been alleged that the funds of credit balance clients were misutilized by the Noticee for settlement obligation of debit balance clients for 7 days out of these 10 sample trading days for which data was collected during Supplementary Inspection I.

43. As noted earlier, considering the above findings, it was thought proper to expand the scope of examination and therefore, in order to examine the extent of misuse of clients’ funds, more specifically funds of clients who were having credit balances in the records of the Noticee, data for top 105 days with the highest pay-in obligations of the Noticee on proprietary account and those of clients’ obligations to the stock exchanges was obtained from the Noticee, as it was felt that there was more probability of misuse of clients’ funds on the days when the Noticee had maximum settlement obligation towards the stock exchanges/clearing corporations.

44. Upon analysis of the data for the aforementioned dates taken up for inspection on a sample basis, SEBI observed that, out of the aforementioned sample of 105 days, the Noticee had misutilized the credit clients’ funds for the settlement obligation of debit balance clients for 101 days which amounted to 96% of the total number of selected sample days. It was found from inspection that the amount of credit clients’ funds misutilized by the Noticee during these 101 sample days ranged from INR 1.09 crores to INR 397.02 crores. At the same time, SEBI also observed that, out of 105 sample days for which data was collected during Supplementary Inspection II, the Noticee had also misused credit balance clients’ funds for 13 days, for fulfilling settlement obligation of its own proprietary trades.

45. Looking at the extent of misuse and the amount misused by the Noticee for funding its own trades and for funding of the trading of its debit balance clients, out of the money deposited by credit balance clients, it was decided to examine the extent of wrongdoing by the Therefore, data for all the trading days during the inspection period, except for the days for which data was already examined during the Supplementary Inspection I and II, were sought by SEBI during Supplementary Inspection III, which resulted into the Noticee furnishing data in respect of 695 trading days.

46. From the analysis of such data as submitted by the Noticee during the Supplementary Inspection III, it has been noticed that out of the 695 trading days under examination, the Noticee had misused the credit clients’ funds for the settlement obligation of debit balance clients on as many as 687 days which constituted 9 8.85% of all sample days, as indicated above, and the amount of such funds misutilised by the Noticee ranged from INR 0.58 crores to INR 309.23 crores during these 687 trading days. At the same time, for 29 days out of these 695 days, the Noticee was also found to have misused funds of credit balance clients towards the settlement obligation of its proprietary trades.

47. Thereafter, during the March 2017 inspection, SEBI attempted to examine if the said mistilization of funds of credit balance clients had stopped after the aforesaid inspection period (April 01, 2011 to June 30, 2014) or the same wrongful practice continued even after that period. For the said purpose, SEBI sought data from the Noticee in respect of top 15 trading days that witnessed highest turnover/payin obligation of the Noticee during each of the two Financial Years viz. 2015-2016 and 2016-2017 implying thereby, data was called for a total number of 30 trading days, spread over a period of two years recording high turnover/pay-in obligation for the

48. Upon analysis of the said data, SEBI observed that, out of the said sample 30 days of Financial Years 2015-16 and 2016-17, the Noticee had misused the credit clients’ funds for meeting the settlement obligations of debit balance clients for all those 30 days which amounted to 100% of the total selected sample days. Upon examination of the amount that the Noticee had misutilized on these days, it was found that, the Noticee had misused the credit clients’ funds in the range of INR 26.04 crores to INR 294.73 crores as noticed on those selected sample days.

49. On the basis of all these observations, it has been alleged that, by using the funds of credit balance clients for settlement obligation of debit balance clients as well as for settlement obligation of its own proprietary trades, the Noticee has violated the provisions of SEBI 1993 Circular.

560. Before moving further, it is pertinent to explain the methodology adopted by SEBI for calculating the use or misuse of clients’ funds in the present matter and the same is tabulated as below:

Table 1: Calculation method for misuse of clients’ funds

| Date | Aggregate Clients Debit Balances as per Trial Balance (After adjusting for open bills & uncleared cheques) | Aggregate Clients Credit Balances as per Trial Balance (After adjusting for open bills & uncleared cheques) | Total of Client Bank Balances | Collateral Deposited with Exchanges by IIFL | Total Cash available with Exchange after adjusted 50% BG | Total Cash available with broker | Broker used client funds |

| A | B | C | D | E | F=E+C | G=F-B |

In all the calculations, the aforementioned formulated table has been used in one or other minor variations, with the basic principle being maintained as per the provisions of SEBI 1993 Circular regarding permitted usage of clients’ funds.

51. The idea behind the aforementioned calculation is that for every 100 Rupees deposited by a client with a stock broker, the stock broker should be able to provide account of every single rupee used by it towards the trade obligations of such client.

52. In this regard, I find it necessary to mention here that at the end of every trading day, a stock broker may have a client having credit balance in his account and also may have certain clients having debit balances in their books. Credit balance clients are those clients of the stock broker to whom the stock broker owes payment after the settlement of trades of that particular day. This may be due to their having deposited money in the ledger of stock broker or due to them being seller of certain securities on that particular trading day. Debit balance clients are those clients which owe funds to the stock broker (clients which are under obligation to pay to the stock broker) due to their trading of securities on the stock exchange on the said trading day or due to their previous debit balances in the ledger of a stock broker. As far as these debit balance clients are concerned, the stock broker is allowed to provide margin money to them to enable them to trade in securities, within the permitted limit, as prescribed by relevant provisions of law, issued by SEBI from time to time. However, the funds for such margin funding are required to be arranged by stock broker on its own. The stock broker is not allowed to use funds of clients having credit balances in the ledgers of the stock broker, to fund either the trades of its own or for the trades of its clients which are having debit balances in its ledger. This principle was implicitly laid down in SEBI 1993 Circular wherein a list of specific circumstances was provided under which the funds were allowed to be withdrawn from the account of a clients.

53. For further elaboration, I find it necessary to mention here that the SEBI 1993 Circular provides that no money shall be drawn from clients’ accounts other than under the following circumstances –

a. money required for payment to or on behalf of clients or for or towards payment of a debt payable to the Member/Broker from clients or money drawn on client’s authority, or money in respect of which there is a specific liability of clients to the Member/Broker, provided that money so drawn shall not in any case exceed the total of the money so held for the time being for such each client;

b. such money belonging to the Member/Broker as may have been paid into the client account for the purpose of opening or maintaining the account or a cheque or draft received by the Member/Broker representing in part money belonging to the client and in part money due to the Member/Broker.; and

c. money which may by mistake or accident have been paid into such account other than such amounts that are required to be paid into clients account.

It clearly shows that there is a prohibition on withdrawal of money from one client’s account for the purpose of meeting trade obligations or otherwise of another client. Thus, the funds of credit balance clients can never be used for purposes other than those specifically mentioned and permitted under SEBI 1993 Circular. The above mentioned circular does not permit the usage of funds of clients to meet the settlement or other obligation of either the stock broker or other clients of the stock broker who are lacking funds in their accounts maintained with the Stock Broker to meet their obligations arising out of their trading in securities.

54. Keeping the aforesaid principle in mind, I note that, at any point of time, the funds available with a stock broker are kept in two forms viz. in the form of balance in clients’ bank account maintained with the stock broker or in the form of deposits being made by the stock broker with the exchange/clearing corporation, be it in any form like cash, Fixed Deposit, Bank Guarantee etc.

55. Emerging out of the aforementioned principle, that the funds of credit balance clients cannot be used for debit balance clients, is another principle, which is relevant for the present proceedings, which says that at no point of time, the funds available with a stock broker should be less than the aggregate of its liabilities towards its credit balance clients. To simplify this, I take a numerical Let’s say that a stock broker has assets worth INR 100 lying with stock exchange/clearing corporation. At the same time, it has INR 100 lying in its clients bank accounts. Supposing at the end of a trading day, the stock Broker is liable to give INR 130 to its credit balance clients. This means that out of INR 200 in its hands, INR 130 belong to its credit balance clients and the rest is its own money, which the Broker is free to use for its own purposes or to fund its debit balance clients.

56. Now taking into consideration another scenario, with the same INR 200 balance in the hands of the stock broker, the liability of the stock broker towards its credit balance clients at the end of trading day is INR 230. This means that the broker should have had at least INR 230 in its hands at that moment (end of trading day) as the same belonged to its credit balance clients and the said money was not allowed to be used by the stock broker for any other purposes. The fact that money in the hand of stock broker is less than INR 230, it shows that money of its credit balance clients have been taken away to use for purposes not authorized under SEBI 1993 Circular. In that scenario, it is presumed that the stock broker has misused the funds of credit balance clients to the extent to INR 30 (INR 230- INR 200) most likely to fund the trades of debit balance clients or to fund its own proprietary trades or for any other possible use that is not permissible under the exiting rule.

57. Taking this example ahead, I now take up two scenarios. Firstly, I take a scenario wherein the liabilities of debit balance clients of the broker are more than INR In that scenario, it is presumed that the funds of credit balance clients have been misused for the trading of debit balance clients. This presumption is drawn on the rationale that no person (stock broker) will fund the trades of its debit balance clients at the cost of its own proprietary trades. Normally, a stock broker will fulfill its own obligations first from its own money, before putting its own money for its debit balance clients. In such a scenario, it is natural corollary that the stock broker will have to arrange external resources to fund its debit balance clients. In that situation, the stock broker will attempt to use funds of its credit balance clients, already available within its reach & control, to fund the trades of its debit balance clients, even though the same is not allowed under the law.

58. Moving on to the second scenario, I note that the liabilities of debit balance clients of the stock broker is less than INR 30. However, the funds missing from the records of the stock broker are INR 30. This leads to the next level presumption that the broker, after funding its debit balance clients, has misused the funds of credit balance clients to fund its own proprietary trades.

59. Keeping the aforesaid logical principles in mind and superimposing the same on the data pertains to the Noticee as gathered during the inspection and posted in Table 1, the principle explained above through an example would require that the total available funds i.e. cash and cash equivalents with the stock broker (including clients’ balances) and with the clearing corporation/clearing member (F) should always be equal to or greater than credit Clients’ funds as per the ledger balances (B). This means that the calculation of G= F-B must always be in positive.

60. In a scenario where the ‘G’ value comes out to be in negative, such negative value certainly would imply that the total available funds with the stock broker are less than the ledger credit balances of the clients or in other words, lower than its liability towards its credit balance clients. Such negative value of G clearly indicates utilization of credit clients’ funds for other purposes i.e. funds of credit balance clients being utilized either for settlement obligations of debit balance clients or for the stock brokers’ own purposes. Thereafter, the absolute value of G is compared with debit balance of all clients as per client ledger (A). If the absolute value of (G) is lesser than the liability of debit balance clients towards the stock broker (A), then the stock broker has possibly utilized funds of credit balance clients towards settlement obligations of debit balance clients to the extent of value of G. If the absolute value of (G) is greater than liability of debit balance clients of stock broker (A), then the stock broker has possibly utilized a part of funds of credit balance clients towards settlement obligations of debit balance clients and the remaining part for its own purposes. Therefore, in case the amount has been used for other purposes, the same shall reflect in “G Value” (mentioned at the last column of Table 1) being negative and its comparison with the liability of debit balance clients of the stock broker.

61. I note that the Noticee has submitted that the allegation of violation of provisions of SEBI 1993 Circular has been based on retrospective application of SEBI Circular ref. no. SEBI/HO /MIRSD/MIRSD2/ CIR/P/201 6/95 dated September 26, 2016, (mandating calculation of ‘G’ value as explained above) which was made applicable from July 01, 2017. As per the submissions of the Noticee, the method of calculation of ‘G Value’, the negative value of which denotes that the funds of clients having credit balance in their accounts have been misused by the stock broker, was brought to be enforced for the first time in the aforementioned SEBI Circular dated September 26, 2016. Therefore, any calculation of misutilization of funds using the said formula for the period of operation of the Noticee from April 2011 to January 2014 would amount to retrospective application of SEBI Circular dated September 26, 2016.

62. In this regard, I find from Enquiry Reports I and II that the DA has already comprehensively dealt with and rejected this submission of the Noticee. In support of his observations, the DA has also cited certain Orders of the Hon’ble SAT such as Order dated October 21, 2021 of the Hon’ble SAT passed in the matter of Arihant Capital Markets Ltd. vs. SEBI (Appeal No. 521 of 2019) wherein the said contention was categorically rejected by the Hon’ble SAT in the following terms:

“8. The learned counsel for the appellant submitted before us that in the show cause notice the respondent had relied on a formula which, in fact, was not in existence at the time of the disputed period but was incorporated in circular dated September 26, 2016 which is brought into effect from July 1, 2017. He submitted that the formula would show that so far as the bank guarantee is concerned, only 50% of the same is required to be considered and not 100% which has been considered in the cases of Axis Bank as detailed (supra).

….

10. Upon hearing both sides and upon perusing the relevant circulars, in our view, the order cannot be faulted with. The earlier circular had clearly stated that the funds of the client cannot be applied for any other purposes. The appellant’s case was that the funds were applied by it for the dues for their associates, group company, etc. Now, during the arguments only, the issue of nonexistence of formula in the previous circular is brought up. In fact, the said formulization is nothing but the crystallization of the earlier circular.”

63. The Noticee has made a meek attempt before me to distinguish the aforementioned Order of the Hon’ble SAT on the ground that in Arihant Capital (supra), the allegation was of misuse of clients’ funds by way of diversion of such funds to the group company, associates, subsidiaries, directors of the stock broker and their family members whereas no such allegation is there in the present However, the above submission is not convincing enough to be considered favorably, as any utilization of funds beyond the purposes mentioned under Clause 1(D) of SEBI 1993 Circular amounts to misuse of such funds and consequently, leads to violation of such provision of law. The purpose for which such funds have been misutilized is irrelevant for establishment of a violation.

64. The Noticee has also submitted that in Arihant Capital (supra), the contention of retrospective use of Enhanced Supervision Circular dated September 26, 2016 was raised at the very last stage before the Hon’ble SAT. I find that the said submission is without any merit as the said submission was properly considered and rejected by the Hon’ble SAT and the Hon’ble Tribunal has categorically held that the said formulation under the 2016 circular is nothing but the crystallization of the intent of earlier circular, as the 2016 circular has not laid down any new law but only crystalized the existing provision and made its reporting mandatory.

65. Further, I find it necessary to explain the purpose of SEBI 1993 Circular and the formula iterated under Enhanced Supervision Circular dated September 26, 2016. It is a well-established fact that the relation between a stock broker and its clients is of trust. Believing that the stock broker will act in the best interest of its clients, a client deposits his money with the stock broker believing that his interest will be protected in the best possible manner. Keeping such trust reposed by the client in view, the law was framed wherein, the stock brokers were instructed to use the funds of its clients only for certain purposes listed out in Clause 1(D) of SEBI 1993 Circular. Subsequently, vide circular issued on September 26, 2016, a sophisticated alerting and reconciliation mechanism was created wherein the stock brokers have been mandated to regularly furnish data to the stock exchanges regarding utilization of clients funds. For the said purpose, dedicated portals and other facilities have also been created by stock exchanges. Through this method, a regular supervision of stock brokers has been made possible to detect and deal with the instances of misultilization of clients’ funds, which has already been prohibited under SEBI 1993 Circular.