Case Law Details

In re Abhay Singh Gill (GST AAR Chhattisgarh)

The AAR, Chhattisgarh in the matter of M/s. Abhay Singh Gill [Advance Ruling No. STC/AAR/07/2021 dated November 25, 2021] has ruled that a bus operator is entitled to avail Input Tax Credit (“ITC”) on the rent bill issued by the service provider, who provides buses on rent charging Goods and Services Tax (“GST”) at the rate of 18%, subject to fulfilment of conditions stipulated under Section 16 read with Section 17 of the

(“the CGST Act”).

Facts:

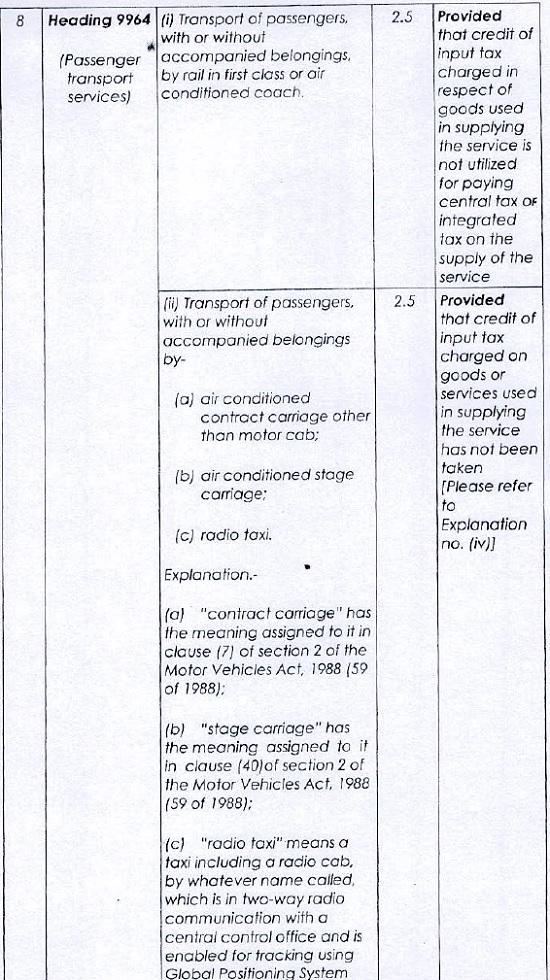

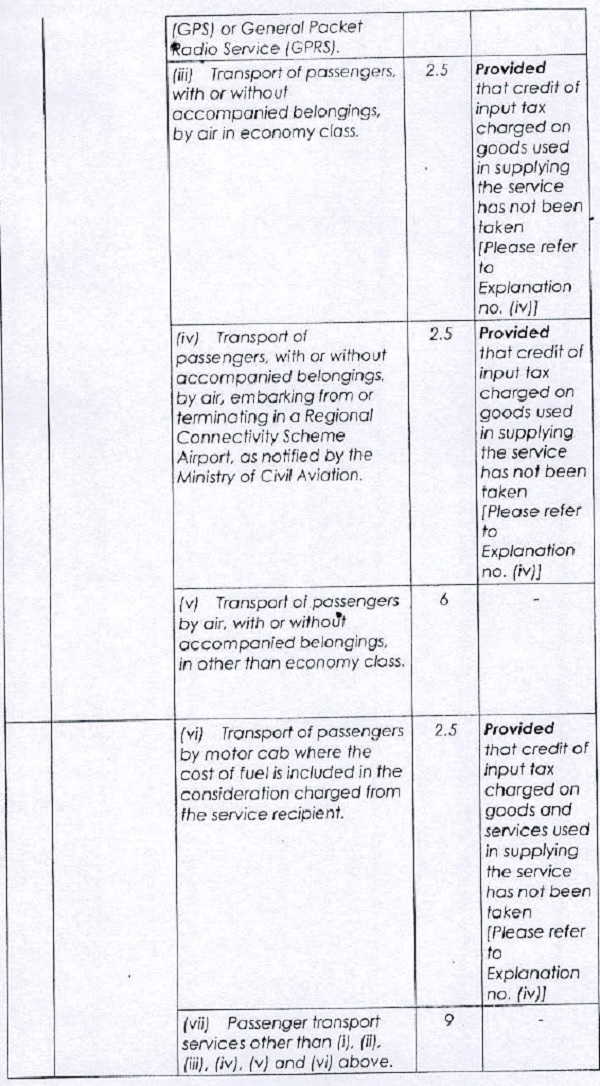

M/s Abhay Singh Gill (“the Applicant”) is engaged in the service of transportation of passengers by air conditioner buses which falls under the SAC code 9964 and was charging consideration from passengers inclusive of fuel cost, thereby paying GST at the rate of 5%. The buses were taken on rent by the Applicant from another service provider for which they were issued bill of rent along with GST at the rate of 18%.

It was contended by the Applicant that SI. No. 8(vi) of the Notification No. 11/2017-Central Tax (Rate) dated June 28, 2017 (“the Services Rate Notification”) provides credit of input tax charged on services by another service provider for transporting passengers in a motor vehicle or renting of a vehicle, accordingly, the Applicant is entitled to avail ITC of GST paid at the rate of 18% on the rent bill issued by the other service provider with regard to renting of buses.

Issue:

Whether the Applicant is entitled to avail ITC of GST paid at the rate of 18% to the service provider on renting of buses?

Held:

The AAR, Chhattisgarh in Advance Ruling No. STC/AAR/07/2021 held as under:

- Noted that, the eligibility to claim ITC is stipulated under Section 16 of the CGST Act which provides that every registered person shall be entitled to claim ITC on any supply of goods and services which are used or intended to be used for furtherance of his business and certain exceptions to claim ITC is prescribed under Section 17 of the CGST Act.

- Opined that, the eligibility or otherwise of the tax rate as per the Services Rate Notification is subject to the pre-condition that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business, has not been taken.

- Stated that, the Applicant is under a misplaced notion that the eligibility to claim ITC on the renting service of buses is covered under the Services Rate Notification, on the contrary, the eligibility to claim ITC is covered under Chapter V relating to ITC vide Section 16 and Section 17 of the CGST Act.

- Further stated that, the eligibility to the tax rate as stated in the Sr. No. 8(vi) of the Services Rate Notification is fully dependent on the conditions of availment of ITC as prescribed in Section 16 read with Section 17 of the CGST Act.

- Held that, the Applicant would be entitled to avail ITC on the input services, provided they fulfil the conditions as stipulated under Section 16 read with Section 17 of the CGST Act.

Relevant Provisions:

Sr. No. 8(vi) of the Services Rate Notification:

|

“Sl No. |

Chapter, Section or Heading | Description of Service | Rate (per cent) | Condition |

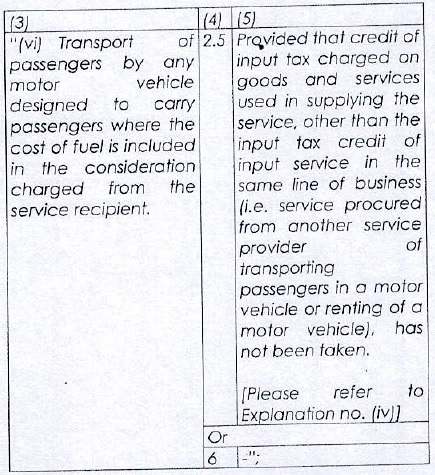

| 8 | Heading 9964 (Passenger transport services) | (vi) Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient. | 2.5 | Provided that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken.

Please refer to Explanation no. (iv)” |

Section 16 of the CGST Act:

“Eligibility and conditions for taking input tax credit-

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless––

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37;

(b) he has received the goods or services or both.

Explanation-For the purposes of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services––

(i) where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) where the services are provided by the supplier to any person on the direction of and on account of such registered person.

(ba) the details of input tax credit in respect of the said supply communicated to such registered person under section 38 has not been restricted;

(c) subject to the provisions of section 41, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation of input tax credit admissible in respect of the said supply; and

(d) he has furnished the return under section 39:

Provided that where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or instalment:

Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed:

Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

(3) Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961 (43 of 1961), the input tax credit on the said tax component shall not be allowed.

(4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the thirtieth day of November following the end of financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.”

Section 17 of the CGST Act:

“Apportionment of credit and blocked credits-

(1) Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

(2) Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

(3) The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

Explanation-For the purposes of this sub-section, the expression ‘‘value of exempt supply’’ shall not include the value of activities or transactions specified in Schedule III, except those specified in paragraph 5 of the said Schedule.

(4) A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either comply with the provisions of sub-section (2), or avail of, every month, an amount equal to fifty per cent. of the eligible input tax credit on inputs, capital goods and input services in that month and the rest shall lapse:

Provided that the option once exercised shall not be withdrawn during the remaining part of the financial year:

Provided further that the restriction of fifty per cent. shall not apply to the tax paid on supplies made by one registered person to another registered person having the same Permanent Account Number.

(5) Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely:-

(a) motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), except when they are used for making the following taxable supplies, namely:-

(A) further supply of such motor vehicles; or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles;

(aa) vessels and aircraft except when they are used––

(i) for making the following taxable supplies, namely:-

(A) further supply of such vessels or aircraft; or

(B) transportation of passengers; or

(C) imparting training on navigating such vessels; or

(D) imparting training on flying such aircraft;

(ii) for transportation of goods;

(ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa):

Provided that the input tax credit in respect of such services shall be available-

(i) where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

(ii) where received by a taxable person engaged-

(I) in the manufacture of such motor vehicles, vessels or aircraft; or

(II) in the supply of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him;

(b) the following supply of goods or services or both-

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance:

Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre; and

(iii) travel benefits extended to employees on vacation such as leave or home travel concession:

Provided that the input tax credit in respect of such goods or services or both shall be available, where it is obligatory for an employer to provide the same to its employees under any law for the time being in force.

(c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

(d) goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Explanation––For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

(e) goods or services or both on which tax has been paid under section 10;

(f) goods or services or both received by a non-resident taxable person except on goods imported by him;

(g) goods or services or both used for personal consumption;

(h) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

(i) any tax paid in accordance with the provisions of sections 74, 129 and 130.

(6) The Government may prescribe the manner in which the credit referred to in sub-sections (1) and (2) may be attributed.

Explanation–– For the purposes of this Chapter and Chapter VI, the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes-

(i) land, building or any other civil structures;

(ii) telecommunication towers; and

(iii) pipelines laid outside the factory premises.”

FULL TEXT OF THE ORDER OF AUTHORITY FOR ADVANCE RULING, CHHATTISGARH

M/s Abhay Singh Gill, shop no. 20, Bhaijee complex, Station road, Raipur, Chhattisgarh,[hereinafter also referred to as the applicant] has filed an application U/s 97 of the Chhattisgarh Goods & Services Tax Act, 2017 seeking advance ruling as to whether it can take input tax credit of GST@ 18% (i.e. CGST 9% and SGST 9%) mentioned in the rent bill issued by the service provider who has provided Buses on rent to the applicant?

2. Facts of the case:-The applicant is engaged in the, service of transportation of passengers by air conditioner Buses (i.e. Bus operator) which falls under the SAC code 9964. The applicant charge consideration from passengers which is inclusive of fuel cost and accordingly paying GST @ 5% (i.e. CGST 2.5% and SGST 2.5%). They have taken such Buses on rent from another service provider. Such service provider issued them bill of rent for such buses along with GST @18% (i.e. CGST 9% and SGST 9%) and GST is separately mentioned in hisjent bill.

As per Sr.No.8(vi) of Notification No. 11/2017-CT (Rate) Dated 28.06.2017in case of “Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient”, GST Rate is 5% (i.e. CGST 2.5% and SGST 2.5%). Also a condition mentioned is that “Provided that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service :n the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not beer. taken’.

The applicant seeks advance ruling regarding the availability of input tax credit of GST@ 18% (i.e. CGST 9% and SGST 9%) on the Rent bill issued by the service provider who has given him Buses on rent?

3. Contentions of the applicant: -The applicant is of the opinion that Sr. .No. 8(vi) of Notification No. 11/2017-CT (Rate) Dated 28.06.2017 does not restrict “credit of input tax charged on services by another service provider for transporting passengers in a motor vehicle or renting of a motor vehicle”. In this case the applicant has taken buses on rent and as per Sr.No. 8(vi) of Notification No. 11/2017-CT (Rate) Dated 28.06.2017 credit of input tax charged on renting of a motor vehicle is not denied accordingly they can take input tax credit of GST @ 18% (i.e. CGST 9% and SGST 9%) which is mentioned on the Rent bill by service provider who has given him such Buses on rent.

4. Personal Hearing:-

Keeping with the established principles of natural justice, personal hearing in the matter was extended to the applicant, as requested by them and accordingly, Shri Pravin Kumar Agrawal, C.A. & authorized representative of the applicant appeared before us for hearing on 24.09.2021 in person. The authorized representative of the applicant reiterated their contention that as per Sr.No. 8(vi) of Notification No. 11/2017-CT (Rate) Dated 28.06.2017credit of input tax charged on renting of a motor vehicle is not denied accordingly they can take input tax credit of GST @ 18% (i.e. CGST 9% and SGST 9%) which is mentioned on Rent bill by service provider who has given him such Buses on rent.

5. The legal position, analysis and discussion:-At the very outset, we would like to make it clear that the provisions for implementing the CGST Act and the Chhattisgarh GST Act, 2017 [hereinafter referred to as “the CGST Act and. the CGGST Act”) are similar and thus, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the CGST Act, 2017. Now we sequentially proceed to discuss the issues involved in the ruling so sought by the applicant and the law as applicable in the present case.

5.1 Section 96 of CGST Act, 2017, Authority for advance ruling, stipulates as under:-

Subject to the provisions of this Chapter, for the purposes of this Act, the Authority for advance ruling constituted under the provisions of a State Goods and Services Tax Act or Union Territory Goods and Services Tax Act shall be deemed to be the Authority for advance ruling in respect of that State or Union territory.

Section 97(2) of CGST Act, 2017 stipulates that:-

The question, on which the advance ruling is sought under this Act shall be in respect of—

(a) classification of any goods or services or both;

(b) applicability of a notification issued under the provisions of this Act;

(c) determination of time and value of supply of goods or services or both;

(d) admissibility of input tax credit of tax paid or deemed to have been paid;

(e) determination of the liability to pay tax on any goods or services or both;

(f) whether applicant is required to be registered;

(g) whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

Further 103 of CGST Act, 2017 stipulates about the ruling pronounced as under: -The advance ruling pronounced by the Authority or the Appellate Authority under this Chapter shall be binding only –

a. On the applicant who had sought it in respect of any matter referred to in sub-section (2) of section 97 for advance ruling;

b. On the concerned officer or the jurisdictional officer in respect of the

Thus in view of the above section 103 of CGST Act, 2017, the ruling so sought by the Applicant would be binding only on the Applicant and on the concerned officer or the jurisdictional officer as stipulated above.

5.2 The applicant has furnished a written submission (post hearing) with regard to the captioned subject stating that the above service provision of renting of bus services has not been started till now and no relevant rent agreement has been executed between the parties. He has also submitted the Registration Certificate of both the involved parties.

5.3 In the instant case the applicant is engaged in the service of transportation of passengers by air conditioner Buses (i.e. Bus operator) which falls under the SAC code 9964. The applicant has in their application informed that they are charging an amount (consideration) from passengers inclusive of fuel cost and accordingly paying GST @ 5% (i.e. CGST 2.5% and SGST 2.5%). They have taken such Buses on rent from another service provider. Such service provider issues them bill relating to such services of rent for such buses along with GST @18% (i.e. CGST 9% and SGST 9%) and GST is separately mentioned in such rent bills received.

5.4 It has further been the contention of the applicant that as per SLNo.8(vi) of Notification No. 11/2017-CT (Rate) Dated 28.06.2017, in the case of “Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient”, GST Rate is 5% (i.e. CGST 2.5% and SGST 2.5%) and that also a condition in mentioned that “Provided that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken”. Thus the applicant seeks ruling regarding the availability of input tax credit of GST@ 18%a (i.e. CGST 9% and SGST 9%) mentioned in the Rent bill issued by the service provider on account of providing buses to the applicant on rent.

5.5 Before moving ahead on the issues raised by the applicant, a detailed analysis is essential with regard to the nature of business of the service provider, business details of the service recipient as also Notification No. 11/2017-CT (Rate) Dated 28.06.2017.

5.6 Nature of Service of the Applicant (Service Recipient):- On going through the HSN details provided in the registration profile it is seen that the applicant, M/s Abhay Singh Gill, Raipur, Chhattisgarh„ GSTIN-22BAJPG2742P1ZL has classified their services

under HSN Code- 996411 [service provision of local land transport services of passengers by railways , metro, mono rail, bus, tramp way, services autos, three wheelers, scooters and other motor vehicles] and under HSN Code- 996422 [long distance transport services of passengers through road by bus, car, non scheduled long services distance bus and coach services, stage carriage etc.]

Nature of Service of the Service Provider:-The service provider M/s. Gappu Mahendra Travels Pvt. Ltd. Raipur Chhattisgarh GSTIN: 22AACCG9478P1ZX is engaged in the business of travel agents (other than air /rail travel agents) (HSN code -00440294), Passenger transport services (HSN code -9964) and rental services of road vehicles including buses, coaches, cars, trucks and other motor vehicles, with or without operators (HSN code -996601). As informed by the applicant, the above said service provider is to provide buses on rent to the applicant issuing the relevant rent bills comprising of bus rent and operators salary excluding the cost of fuel.

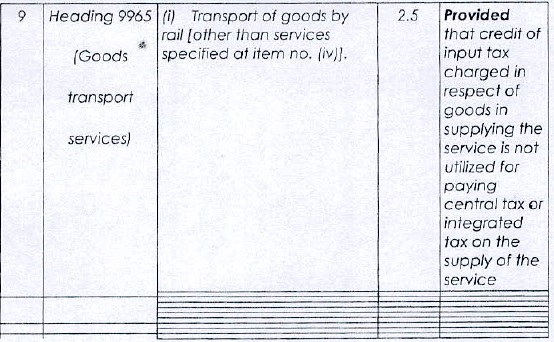

5.7 Notification No. 11/2017-CT (Rate) Dated 28.06.2017, reads as under:-

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 11/2017-Central Tax (Rate)

New Delhi, the 28th June, 2017

G.S.R. 690(E).– In exercise of the powers conferred by sub-section (1) of section 9, sub- section (1) of section 11, sub-section (5) of section 15 and sub-section (1) of section 16 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, and on being satisfied that it is necessary in the public interest so to do, hereby notifies that the central tax, on the intra-State supply of services of description as specified in column (3) of the Table below, falling under Chapter, Section or Heading of scheme of classification of services as specified in column (2), shall be levied at the rate as specified in the corresponding entry in column (4), subject to the conditions as specified in the corresponding entry in column (5) of the said Table:-

–

–

–

2. ……….

3. …………..

4. Explanation.- For the purposes of this notification,-

(i) Goods includes capital goods.

(ii) Reference to “Chapter”, “Section” or “Heading”, wherever they occur, unless the context otherwise requires, shall mean respectively as “Chapter, “Section” and “Heading” in the annexed scheme of classification of services (Annexure).

(iii) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of heading 9988.

(iv) Wherever a rate has been prescribed in this notification subject to the condition that credit of input tax charged on goods or services used in supplying the service has not been taken, it shall mean that,-

(a) credit of input tax charged on goods or services used exclusively in supplying such service has not been taken; and

(b) credit of input tax charged on goods or services used partly for supplying such service and partly for effecting other supplies eligible for input tax credits, is reversed as if supply of such service is an exempt supply and attracts provisions of sub-section (2) of section 17 of the Central Goods and Services Tax Act, 2017 and the rules made there under.

5.8 Above Notification No. 11/2017-CT (Rate) Dated 28.06.2017was amended vide Notification No. 31/2017-C.T. (Rate), dated 13-10-2D17 as under:-

CGST rates for supply of services modified — Amendment to Notification No. 11/2017-C.T (Rate)

In exercise of the powers conferred by sub-section (1) of section 9, subsection (1) of section 11, sub-section (5) of section 15 and sub-section (1) of section 16 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, and on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue) No. 11/2017-Central Tax (Rate), dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 690(E), dated the 28th June, 2017, namely:-

In the said notification,

(a)……………………….

(b)

(c) against serial number 8, for item (vi), in columns (3), (4) and (5) and the entries relating thereto, the following shall be substituted, namely :

5.9 Thus it gets abundantly clear that to avail the benefit of GST @ 5% [2.5% +2.5%], with effect from 13.10.2417, as provided under 8(vi) of aforesaid Notification No. 11/2017-CT (Rate) Dated 28.06.2017 as amended vide Notification No. 31/2017-C.T. (Rate), dated 13-10-2017, the underlying condition that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken read with the condition as stipulated under Explanation no. (iv) is required to be fulfilled.

It is worth mentioning here that eligibility to Input tax credit is not governed under the above Notification No. 11/2017-CT (Rate) Dated 28.06.2017 as amended, rather it is the other way round i.e., entitlement to the tax rate as prescribed under the said Notification is subject to the fulfillment of the fundamental condition of non- availment of input tax credit on input service as stipulated above.

5.10 This authority would like to allude here that eligibility to Input tax credit is governed by the provisions as stipulated under Section 16 of the CGST Act, 2017, which provides that every registered person shall, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business. For ease of reference the provisions of Section 16 ibid is reproduced hereunder: –

SECTION 16. Eligibility and conditions for taking input tax credit. — (1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, —

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other taxpaying documents as may be prescribed;

[(aa)the details of the invoice or debit note referred to in ) clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37;]

(b) he has received the goods or services or both.

[Explanation. —For the purposes of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services —

(i) where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) where the services are provided by the supplier to any person on the direction of and on account of such registered ]

(c) subject to the provisions of [section 41 or section 43A], the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply; and

(d) he has furnished the return under section 39 :

Provided that where the goods against an invoice are received in lots or installments, the registered person shall be entitled to take credit upon receipt of the last lot or installment:

Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed :

Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax pay able thereon.

(3) Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961 (43 of 1961), the input tax credit on the said tax component shall not be

(4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or 1 debit note pertains or furnishing of the relevant annual return, whichever is earlier :

[Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.]

5.11 However, for the availment of input tax credit (ITC), as provided supra, there are exceptions / exclusions prescribed under Section 17(5) of the CGST Act, 2017 which provides as under: –

(5) Notwithstanding anythin9 contained in sub-section (1) of section l6 and sub-section (1) of section 18, input tax credit shall not be available in respect of the following, namely: —

[(a) motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), ,except when they are used for making the following taxable supplies, namely: —

(A) further supply of such motor vehicles; or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles;

(aa) vessels and aircraft except when they are used —

(i) for making the following taxable supplies, namely: —

(A) further supply of such vessels or aircraft; or

(B) transportation of passengers; or

(C) imparting training on navigating such vessels; or

(D) imparting training on flying such aircraft;

(ii) for transportation of goods;

(ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) :

Provided that the input tax credit in respect of such services shall be available —

(i) where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

(ii) where received by a taxable person engaged —

(I) in the manufacture of such motor vehicles, vessels or aircraft; or

(II) in the supply of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him;

(b) the following supply of goods or services or both —

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa: except when used for the purposes specified therein, life insurance and health insurance :

Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre; and

(iii) travel benefits extended to employees on vacation such as leave or home travel concession :

Provided that the input tax credit in respect of such goods or services or both shall be available, where it is obligatory for an employer to provide the same to its employees under any law for the time being in force.]

(c) ……………………

5.12 Thus the eligibility of Input Tax credit is os per the provisions contained under Section 16 subject to the restrictions as stipulated supra under Section 17 of the CGST Act, 2017. It appears that the applicant is under the misplaced notion that eligibility of Input Tax Credit is governed under the provisions of Notification no. 11/2017-CT(Rate) dated 28.6.2007 as amended, whereas it is not so, in as much as non- availment of ITC is a pre-condition for availing the benefit of applicable tax rate for the services rendered by the applicant as provided under the said Notification. On the contrary eligibility to Input tax credit is governed by the provisions as contained under Chapter V relating to Input Tax credit vide section 16 and section 17 of the CGST Act, 2017 and this eligibility to ITC has nothing to do with Notification no. 11/2017-CT(Rate) dated 28.6.2017. For the impugned “Passenger transport services “of Heading 9964, viz. “Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient”, in as much as eligibility to the tax rate as stipulated under sr. no 8(vi) of Notification no. 11/2017-CT(Rate) dated 28.6.2017 as amended is concerned, the same is fully dependent on the condition of availment or otherwise of the Input tax credit by the applicant, as discussed in the preceding para.

6. Thus in view of the above discussions we come to the considered conclusion that the applicant would be eligible to input tax credit on the input services provided they fulfill the conditions as stipulated under section 16 read with section 17 of the CGST Act, 2017, whereas eligibility or otherwise of the tax rate as provided under sr. no. 8(vi) of Notification no. 11/2017-CT(Rate) dated 28.6.2017, as amended vide Notification No. 31/2017-C.T. (Rate), dated 13-10-2017 read with Explanation no. (iv) therein is subject to the pre-condition that Input tax credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken.

Having regard to the facts and circumstances of the case and discussions as above, we pass the following order:-

ORDER

(Under section 98 of the Chhattisgarh Goods and Services Tax Act, 2017)

No.STC/AAR/07/2021 Raipur Dated 25/11/2021

The ruling so sought by the Applicant is accordingly answered as under:

RULING

Applicant would be eligible to input tax credit on the Rent bill issued by the service provider who provides them with buses on rent charging GST@ 18% (i.e. CGST 9% and SGST 9%),subject to fulfillment of the conditions as stipulated under section 16 read with section 17 of the CGST Act, 2017.

Applicability of the tax rate for Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient as provided under sr. no. 8(vi) of Notification no. 11/2017-CT(Rate) dated 28.6.2017 as amended vide Notification No. 31/2017-C.T. (Rate), dated 13-10-2017 read with Explanation no. (iv) therein, to the applicant is subject to the condition that Input tax credit charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken.

*****

(Author can be reached at info@a2ztaxcorp.com)