Directorate General of Systems and Data Management

CENTRAL BOARD OF INDIRECT TAXES & CUSTOMS

Date: 1st March,2022

Advisory No: 07/2022

Category: Customs Issued

by: ICEGATE

Subject: Advisory for IGCR Admin officers to access IGCR (Import of Goods at Concessional Rate of duty) module at ICEGATE

IGCR module is developed by ICEGATE, CBIC to provide a digital service to importers to avail benefits under the IGCR Rules (Import of Goods at Concessional Rate of Duty).

The broad provisions are as under:

I. Available post log in on ICEGATE for importers in their existing account, registered with valid DSC.

II. Provision of declaration of advance intimation of Import of Goods at concessional rate of duty.

III. Generation of a unique IIN for a Financial Year with facility to amend as and when required.

IV. A continuity Bond of IGCR Bond Type is created or amended by the Importer.

V. Bond Management Module

VI. Multiple Details are auto populated in the monthly statement.

VII. Interface of details entered by the user provided to the jurisdictional Customs officer

2. This advisory is a complete step-by-step guide for the designated admin user of IGCR module to view the prior intimation declaration by the importers, view the monthly returns filed by the users, approve or reject the bond requests initiated by the users.

A. Access IGCR Module

Step 1: Click on department login on the ICEGATE portal.

Step 2: Select IGCR module.

Step 3: Admin user will be able to view the following services available under the IGCR module.

a) IGCR officer mapping- This functionality is restricted only to the nodal officer of the IGCR who will map the concerned officers of the jurisdiction with the importers’ requests. The nodal officer will be provided the role of Bond Administrator (BNDADM) at ICES. This role will be assigned by the System Manager of the focal existing Customs House location in ICES. The nodal officer under this role in ICES will be able to access the functionality of IGCR role mapping and can appoint/remove designated jurisdictional customs officer in ACP role mapped by the focal existing Customs House location in ICES. For details ICES advisory issued in this regard be refrred. These officers under ACP role will be mapped by the nodal officer for respective EP divisions on ICEGATE. The appointed officers will only be allowed the services mentioned in b, c and d. All the departmental officers will be able to log in using their existing SSO id and Password.

b) Prior Intimation – To view the prior intimations declared by the importers in the jurisdiction of the customs officer.

c) IGCR Bond Request – To view the bond requests initiated by the importers in the jurisdiction of the customs officer.

d) IGCR Monthly Return statement- To view the Monthly return statements filed by the users in the jurisdiction of the customs officer.

A. Officer Mapping for IGCR

This functionality is restricted only to the nodal officer of the IGCR who will map the concerned officers of the jurisdiction with the importers’ requests. The nodal officer will be provided the role of Bond Administrator (BNDADM) at ICES. The officer will be able to appoint/remove designated jurisdictional customs officer in ACP role at ICES. The officers in ACP role will be able to use other IGCR services as mentioned in Part B, C and D of the document.

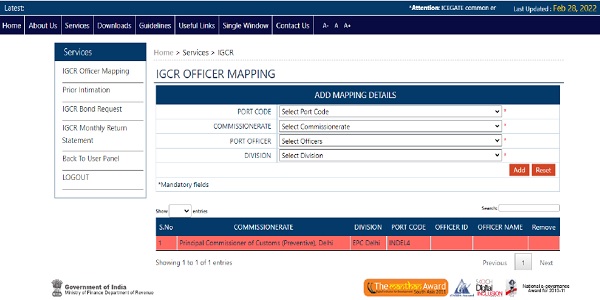

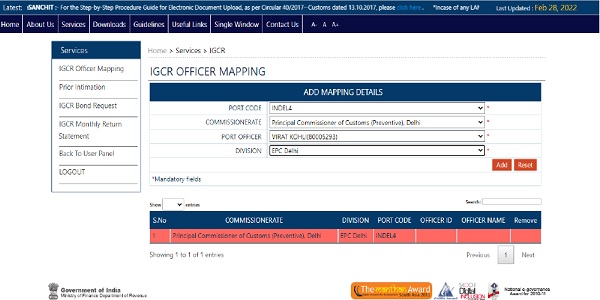

Step 1. Select “IGCR Officer Mapping” from left panel.

Step 2: Page will show the mapping of officer at division that are mapped to ports. Ports are mapped to officer with role “BNDADM”. Bond Admin officer can manage the IGCR officer (jurisdictional customs officer in ACP role) for mapped division. Rows are highlighted to those division which don’t have any IGCR officers mapping.

Step 3: Select port code from drop down then select the Commissionerate, Port officer and division to map officer to selected division by clicking the “ADD” button.

On successfully mapping the jurisdictional customs officer, the row will not be highlighted. Officer can click on remove button to remove the mapping of an officer on division.

(Kindly note that this screen will not be visible to the jurisdictional customs officer. It will only be visible to Nodal Officer for mapping the other officers to perform other activities related to IGCR in their jurisdiction.)

B. Viewing Prior Intimations declared by the Importers

Prior intimation is declared by the importer at the user ICEGATE portal to share the details of the goods intended to be imported. ICEGATE system in return generates an IIN or IGCR Identification Number for the user. This is valid for a financial year and can be amended as per the import by the importers. Admin officer can view the Prior Intimation requests generated by the Importers in his jurisdiction by following the steps as below.

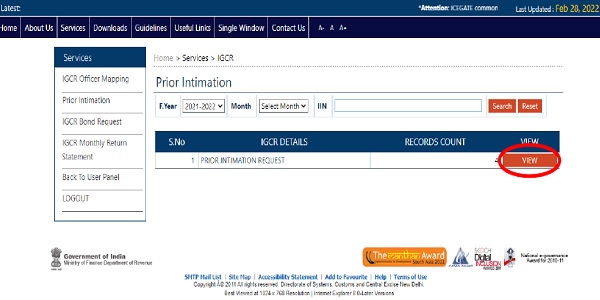

Step 1: Select “Prior Intimation” from the left panel.

Step 2: Select the Financial Year/month to display the list of IINs generated through the requests of the importers in the jurisdiction. Admin officer can also enter a particular IIN to search a record.

Step 3: A dashboard will be displayed to the admin with count of the Prior Intimation requests submitted by the importers in his jurisdiction. Admin can click on “View” button to view list of prior intimation requests.

Step 4: A list of all the requests initiated IIN wise will be displayed to the admin user. Admin can click on “View” button to get a detailed view of the prior intimation requests.

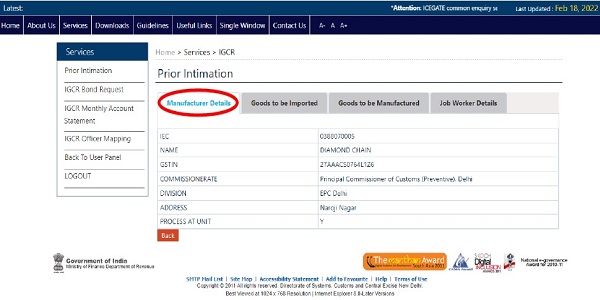

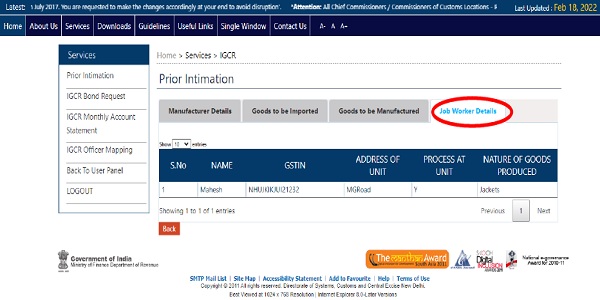

Step 5: Admin can click on different tabs to view the following details.

a. Manufacturer Details – This section has details of the Importer.

b. Goods to be Imported – This section has details of goods intended to be imported under IGCR.

c. Goods to be manufactured – This section has the details of the final goods intended to be manufactured by the importer.

d. Job Worker details- This section has the details of the job workers involved if any for the processing of the imported goods.

C. IGCR Bond Request

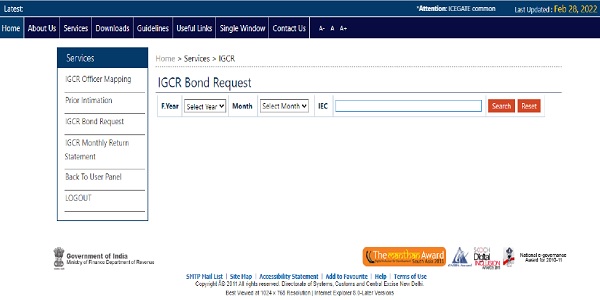

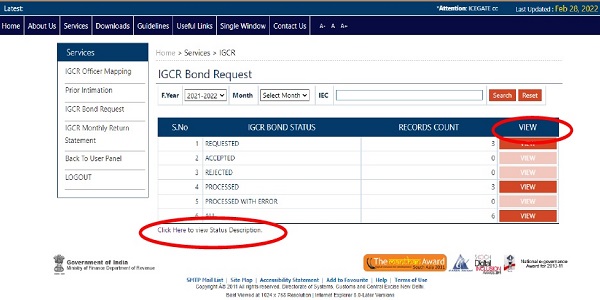

Step 1: Select “IGCR Bond Request” from the left panel.

Step 2: Select the Financial Year/month to display the bond requests generated by the importers in the jurisdiction. Admin officer can also enter a particular IEC to search a record.

Step 3: A dashboard with details of total bond requests as per the bond status will be visible to the admin user. Click on “Click Here” link to view status descriptions.

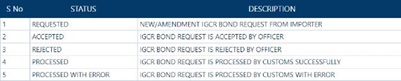

Status Description Page.

Step 4: Click on “View” button to view list of bond requests with their status.

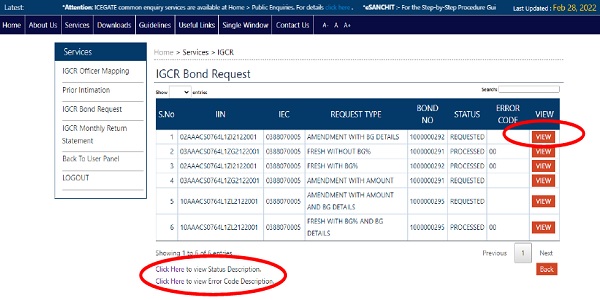

Step 5: A dashboard with details of bond requests is displayed as per the IIN. Click on “View” button to view details of bond requests. Click on “Click Here” link to view error codes descriptions.

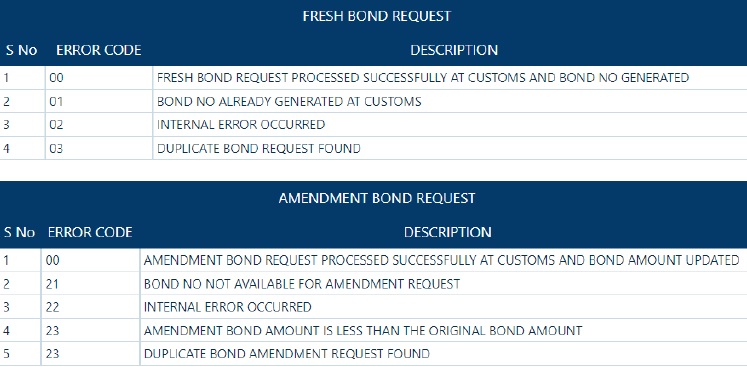

Error Code description

Step 6: Admin can accept or reject the bond request in “REQUESTED” status. Provide comments then click on “ACCEPT” or “REJECT” button to accept or reject the bond request.

–

The following message will be displayed on the screen on accepting/rejecting the Bond Request.

–

D. IGCR Monthly Return Statement

Jurisdictional Customs officer can view the Monthly statements submitted by the importers in his jurisdiction. This interface also provisions alerts for the admin officer in case the importer has defaulted in the submission of his returns as per the IGCR rules.

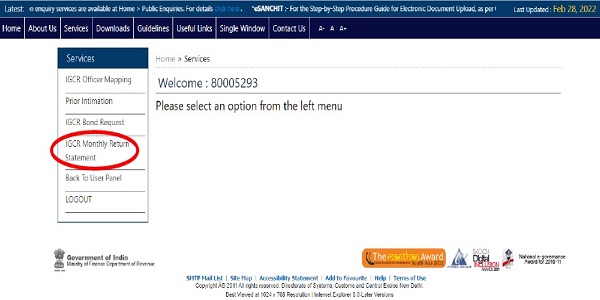

Step 1: Select “IGCR Monthly Return Statement” from left panel.

Step 2: Select year and month to search monthly return details and press search button.

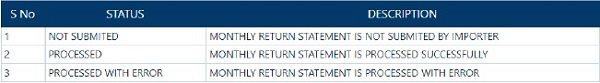

Step 3: A dashboard with count of all the monthly returns submitted by the importers in the jurisdiction will be displayed. This is divided into three categories (Not submitted, Processed, Processed with error) explained as follows.

Click on “View” button to view list of return statement with their status. Click on “Click Here” link to view status descriptions.

–

Step 4: Admin can click on “View” button to view details of monthly return statement.

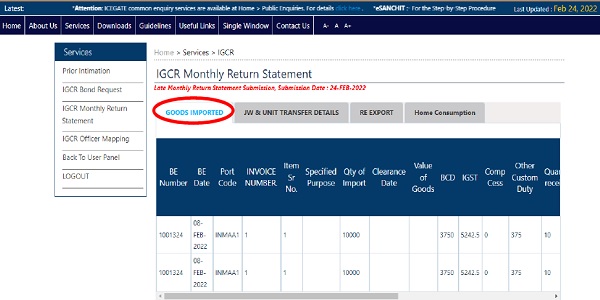

Step 5: Monthly return submitted by the importer corresponding to the IIN will be displayed to the admin. Click on mentioned tab to view the following details.

a. Goods Imported – Details of goods imported by the importer

b. JW and Unit Transfer details – Details of the goods involved in the job work

c. Re-export – Details of the goods re-exported with the corresponding export details

d. Home Consumption – Details of the goods cleared for home consumption on payment of duty

–

In case the importer defaults any IGCR rule, the corresponding rows will be highlighted for the admin to view the corresponding alert message as described below.

hi.. it is about IGCR new update in icegate, where we can check the notification numbers, as we tried with all the notifications but it is not working..