1) DEFINITIONS (As per Section 2 of the IGST Act, 2017)

EXPORT OF SERVICES

Means the supply of any service when, –

- Supplier of Service = India

- Recipient of Service = Outside India

- Place of supply of service = Outside India

- Mode of Payment received = Convertible Foreign Exchange.

IMPORT OF SERVICES

Means the supply of any service when, –

- Supplier of Service = Outside India

- Recipient of Service = India

- Place of supply of service = India.

INTERMEDIARY

Means a

- Broker,

- An agent or

- Any other person, by whatever name called,

who arranges the supply of goods or services or both, or securities, between two or more persons,

but does not include a person who supplies such goods or services or both or securities on his own account.

2) PLACE OF SUPPLY OF SERVICES WHERE LOCATION OF SUPPLIER OR LOCATION OF RECIPIENT IS OUTSIDE INDIA:

| In case of Intermediary service: | Place of Supply of Service = Location of the Supplier of services. |

| In case of other services: | Place of Supply of Service = Location of the Recipient of services. |

3) ILLUSTRATIONS:

If, intermediary than Place of Supply of service would be location of the supplier of Service; In this case would be India. (IN this case NO EXPORT)

But, if not intermediary than it would be the location of the recipient of the service i.e USA (IN THIS CASE EXPORT SUBJECT TO OTHER CONDITIONS)

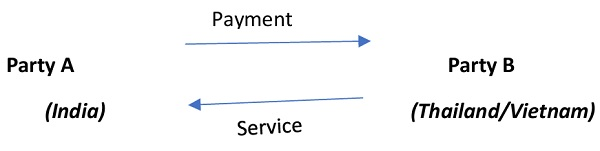

4) ILLUSTRATIONS:

If, intermediary than Place of Supply of service would be location of the supplier of Service; In this case would be Thailand/Vietnam. (IN this case NO IMPORT)

But, if not intermediary than it would be the location of the recipient of the service i.e INDIA (IN THIS CASE IMPORT SUBJECT TO OTHER CONDITIONS) IGST payable on RCM and then input to be claimed.