Form GSTR 1

♦ GSTR 1 shall contain the details of outward supplies and it shall be furnished monthly or quarterly as the case may be.

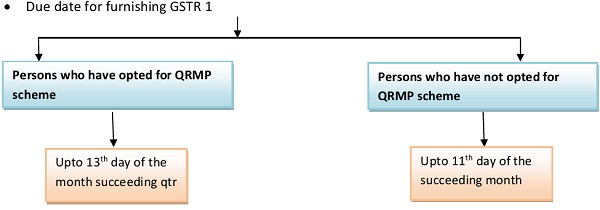

♦ Persons who have opted for QRMP scheme shall furnish GSTR 1 quarterly.

♦ Persons who have opted for QRMP scheme may furnish the details of B2B supplies (upto cumulative value of 50 lakhs in each month) for the first and second months of quarter using invoice furnishing facility (IFF). IFF can be used from 1st day of succeeding month till 13th day of such month.

♦ It may be noted that after 13th of the month, this facility for furnishing B2B supplies using IFF for previous month would not be available.

♦ Continuous upload of invoices would also be provided for the registered persons wherein they can save the invoices in IFF from 1st day of the month till 13th day of the succeeding month.

♦ B2B supplies furnished using IFF for the first and second months of a quarter, shall not be furnished in GSTR 1 for the said quarter.

♦ IFF facility is not mandatory and is only an optional facility made available to the persons exercising QRMP scheme.

Form GSTR 2

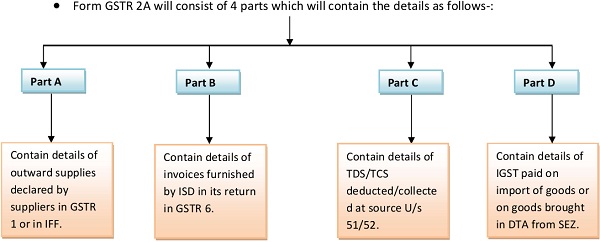

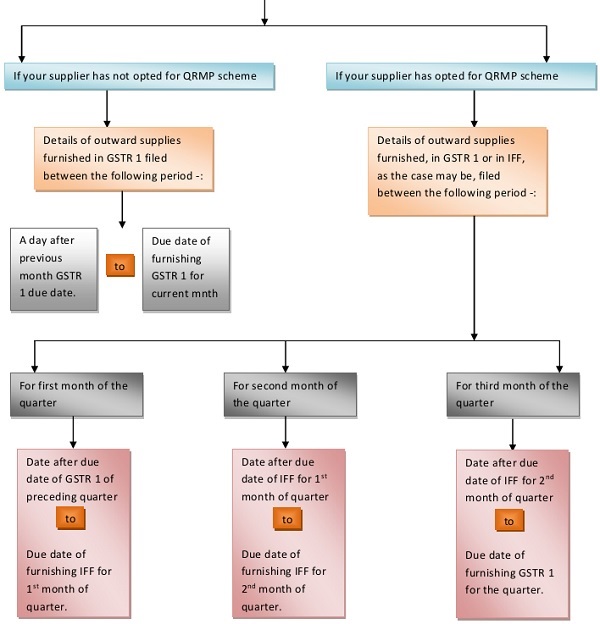

- Details of outward supplies furnished by the suppliers in GSTR 1 or in IFF shall be made available to registered persons in GSTR 2A or GSTR 4A or GSTR 6A, as the case may be

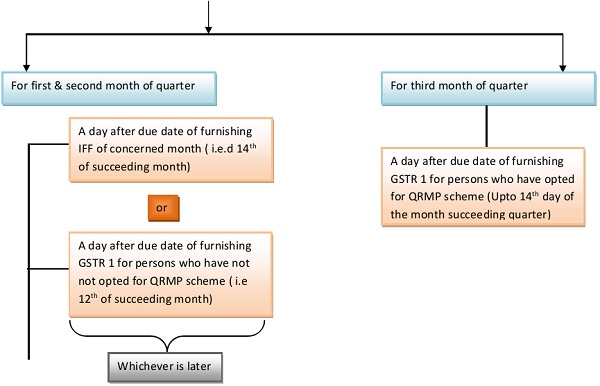

An Auto drafted ITC statement i.e GSTR 2B shall be made available to registered persons for every month as follows-:

An Auto drafted ITC statement i.e GSTR 2B shall be made available to registered persons for every month as follows-:

- GSTR 2B for every month shall consists the details in following manner-:

Form GSTR 3B

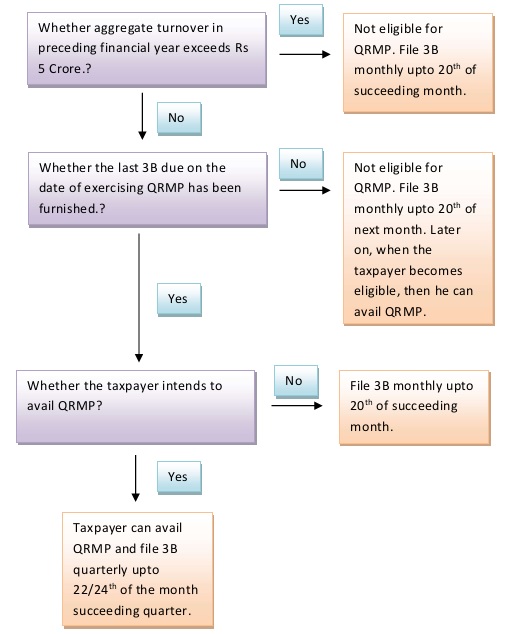

- Flowchart to explain the process of GSTR 3B is as follows -:

- How to avail the QRMP scheme

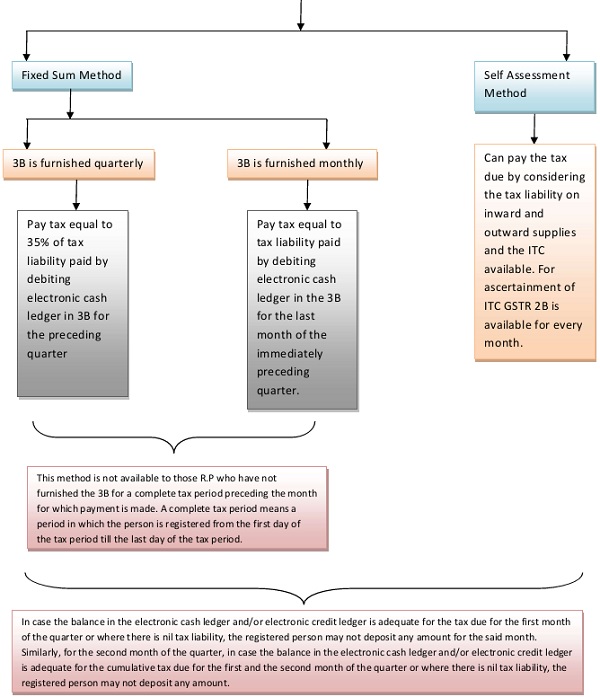

- How to make payment of taxes under QRMP scheme

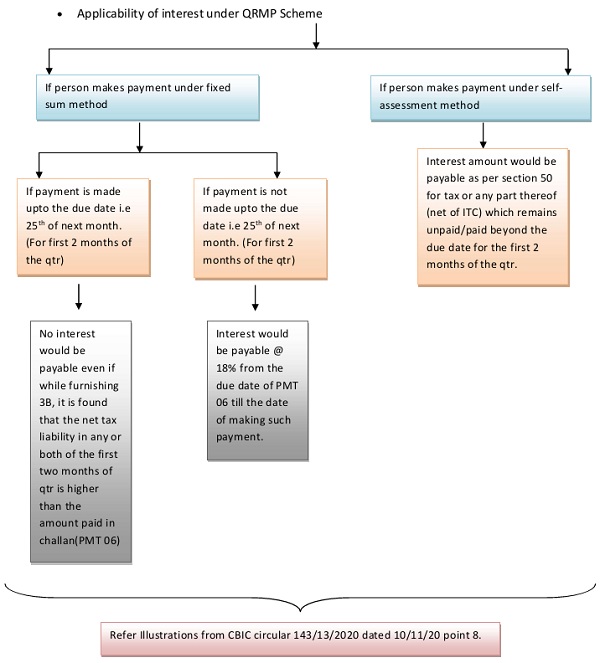

i. For the first two months of the quarter the payment of taxes shall be done in Form GST PMT-06 upto 25th of next month.

ii. For the payment of tax for the first two months of the quarter the registered person is free to avail any of the following method in any of the two months-:

–

- Some more additional points with respect to QRMP scheme-:

i. A registered person whose aggregate turnover crosses 5 crore during a quarter in a F.Y shall not be eligible for QRMP from the first month of the succeeding quarter. He shall opt out from the scheme electronically on common portal. Such opt out shall be made b/w the first day of second month of preceding quarter to the last day of the first month of the quarter.

ii. A registered person who voluntarily wishes to opt out from the QRMP scheme can do so. Such opt out shall be made electronically on portal, b/w the first day of second month of preceding quarter to the last day of the first month of the quarter.

iii. While generating PMT 06 taxpayers should select “Monthly payment for quarterly taxpayer” as reason for generating the challan

Sir,

Recently GST State Tax Officers has started sending Notices to Pharmacies/Medical Stores That They are Not Eligible for ITC. And has send the Demand to Pay Tax for Utilising ITC.

Pls Advise.

Sir,

May i know the grounds on which the officers are disallowing the ITC. As such there is no provision to disallow the ITC to pharmacies/Medical stores

Sir,

If your supplier raises the eway bill and is such eway bill transaction type is selected as “Bill to ship to” (Refer below) then there is no need to separately generate the eway bill by you

1. Bill to – Your details will be given

2. Ship to – Your customer details will be given

However, if your supplier doesn’t raise the eway bill under the transaction type “Bill to Ship to” then you should generate the eway bill and select the transaction type as “Bill from Dispatch from” (Refer below)

1. Bill from – Your details will be given

2. Dispatch from – Your supplier details will be given

3. Ship to – Your customer details will be given

Hi, when my supplier delivers goods to my customer on my behalf, do l still need to generate EWB?

Sir,

If your supplier raises the eway bill and in such eway bill transaction type is selected as “Bill to Ship to” under which in “Bill to” section your details will be provided and in “Ship to” section your customer details will be provided, then in such a case there is no need to separately generate the eway bill by you.

However if your supplier doesn’t generates the eway bill under the transaction type “BIll to Ship to”, then you should generate the eway bill and select the transaction type as “Bill from Dispatch from” under which in “Bill From” section your details will be provided and in “Dispatch from” section your supplier details will be provided and in “Ship to” section your customer details will be provided.

Sir,

If your supplier raises the eway bill and is such eway bill transaction type is selected as “Bill to ship to” (Refer below) then there is no need to separately generate the eway bill by you

1. Bill to – Your details will be given

2. Ship to – Your customer details will be given

However if your supplier doesn’t raises the eway bill under the transaction type “Bill to Ship to” , then you should generate the eway bill and select the transaction type as “Bill from Dispatch from” (Refer below)

1. Bill from – Your details will be given

2. Dispatch from – Your supplier details will be given

3. Ship to – Your customer details will be given

Sir,

If your supplier raises the eway bill and is such eway bill transaction type is selected as “Bill to ship to” then there is no need to separately generate the eway bill by you 1. Bill to – Your details will be given 2. Ship to – Your customer details will be given

However if your supplier doesn’t raises the eway bill under the transaction type “Bill to Ship to” , then you should generate the eway bill and select the transaction type as “Bill from Dispatch from” 1. Bill from – Your details will be given 2. Dispatch from – Your supplier details will be given 3. Ship to – Your customer details will be given

Sir,

If your supplier raises the eway bill and is such eway bill transaction type is selected as “Bill to ship to” (Refer below) then there is no need to separately generate the eway bill by you

1. Bill to – Your details will be given

2. Ship to – Your customer details will be given

However, if your supplier doesn’t raise the eway bill under the transaction type “Bill to Ship to” , then you should generate the eway bill and select the transaction type as “Bill from Dispatch from” (Refer below)

1. Bill from – Your details will be given

2. Dispatch from – Your supplier details will be given

3. Ship to – Your customer details will be given

Greetings.

Let me try to explain my queries .

As an individual. I have booked one flats in Thane area in 2011 and it was promised for possession in 2014.

For any reason . It wss delayed and as per agreement final possession date was 2017.

.

My query.

For some reasons. If I failed to make instalment raised via demands latter for particular area completed along with architects certificate.

Builder has charged interest for dealing payment from outside along work GST on delayed payment.

Pls guide me now.

It’s now officially 4 years delayed from Builder side. We have filed a RERA case and Builder has to pay for delayed possession.

.

At what rate Builder should pay gst and how and where to deposit this amount. I have filed.as an individual person and definitely I don’t any Registered GST number.

Gut all this amount should go to Government Account.

But how.

Please share your valuable feedback on most priority basis.

.or share concern authorities contact number so that I can explain them properly.

.

Or

Arrange call back on following number.

.

Suresh Manani

9773752200

Dear Sir,

Pardon me , but i cannot get your query exactly