GOVERNMENT OF TAMIL NADU

COMMERCIAL TAXES DEPARTMENT

OFFICE OF THE COMMISSIONER OF COMMERCIAL TAXES

EZHILAGAM, CHENNAI- 600 005

PRESENT: Thiru M.A. SIDDIQUE I.A.S ,

PRINCIPAL SECRETARY/ COMMISSIONER OF COMMERCIAL TAXES

Circular No: 27/2021 – TNGST

(PP2/GST-15/24/2021-ADC (P&P))

Date: 29.10.2021

Sub: TNGST Act,2017- Standard Operating Procedure for Faceless Refund -certain guidelines issued – certain issues raised by the Joint Commissioners-Further instructions- Issued

Ref: Circular No.22/2021 – TNGST (PP2/GST-15/24/2021) dated: 26.09.2021

******

During the meeting with the Joint Commissioners (Territorial) on the introduction of faceless refund, they have brought to notice some issues which have cropped up while following the circular issued in the reference cited on the procedure for faceless refund implemented from 4th Oct.2021

2. In order to address those issues and to implement the faceless refund in a smooth and hassle-free manner, the following instructions are issued as addendum to the procedure for faceless refund:

i) In para 4.2 of the circular cited, in Scenario-3 it has been stated that “Even in the case of acceptance of rejection by the taxpayer, P0-1 shall recommend for personal hearing.” This is modified as below:

” When the taxpayer has given acceptance of rejection of refund amount claimed in writing to the P0-1, it tantamounts to adhering to the principle of having heard the taxpayer since the taxpayer had already been put on notice for rejection of refund amount with reasons by the P0-1 and his acceptance of such rejection was given in writing. In these cases, P0-1 himself will issue orders and shall not transfer task to P0-2. This has been brought into production with effect from 27-10-2021. Further, the P0-1 is responsible for issue of refund where refund is fully allowed, partially allowed and accepted by the taxpayer and fully disallowed but accepted by the taxpayer and hence the transfer of task to P0-2 shall be decided by the P0-1 based on the circumstances of the facts of the case.”

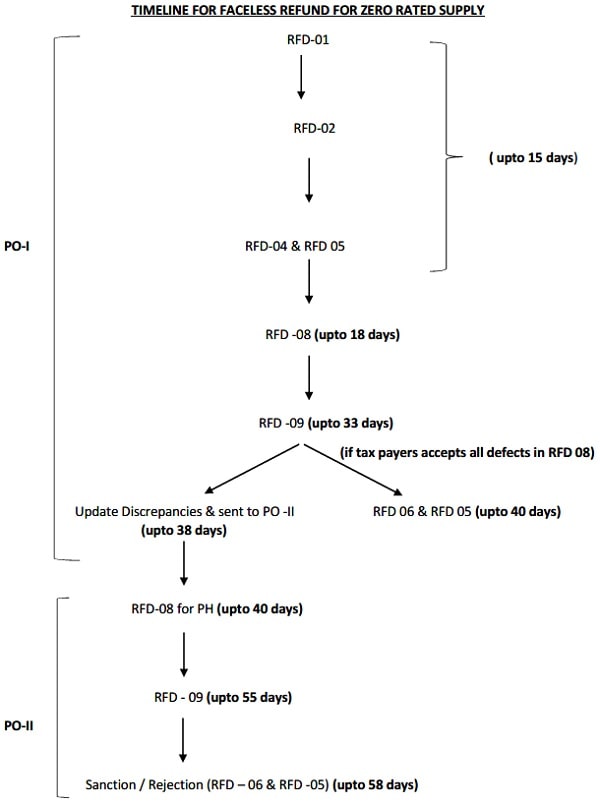

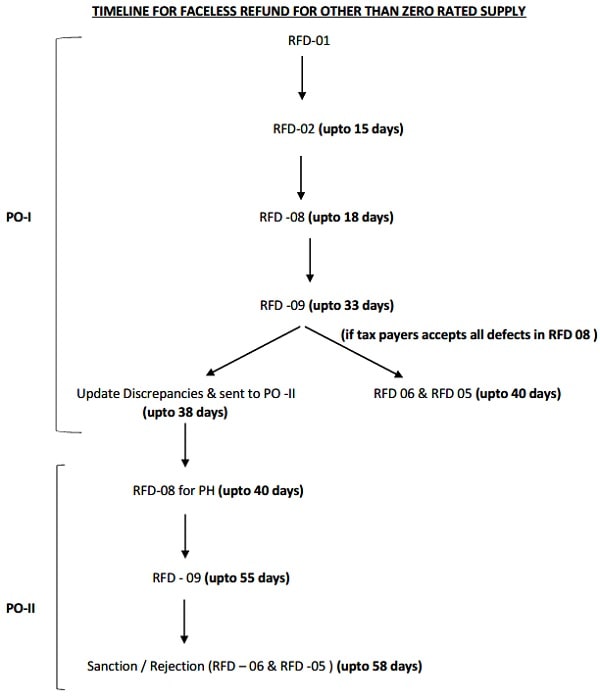

(ii) Time-line for issue of refund relating to zero rated supply and refund relating to other than zero rated supply is enclosed for strict adherence of total time limit of 60 days from the date of recipient of application for refund as provided in section 54(7) of the TNGST Act,2017.

The JCs territorial are requested to issue suitable instructions to their proper officer to implement the faceless refund pilot module successfully without any hindrance to the taxpayer.

Sd/-M.A.Siddique

Principal Secretary/

Commissioner of Commercial Taxes

To

All the Joint Commissioners (ST), Territorial

The Joint Commissioner (ST),LTU, Chennai

Copy to:

1. All Additional Commissioners, 0/o the PS/CCT, Ezhilagam, Chennai – 600 005.

2. All the Joint Commissioners (ST), Intelligence in the State

3. The Director, Commercial Tax Staff Training Institute, Chennai-6

4. The Joint Commissioner (Advance Ruling Authority), Elephant Gate, Chennai-79

5. The Joint Commissioner, (CS), Chennai-6 for uploading in the intranet Website

6. All the Deputy Commissioners (ST) in the State (both Territorial and Intelligence)

7. All the heads of assessment circles

8. Stock file/PP2

//Forwarded by Order//

Deputy Commissioner (P&P)