GOVERNMENT OF TAMIL NADU

COMMERCIAL TAXES DEPARTMENT

OFFICE OF THE COMMISSIONER OF COMMERCIAL TAXES

EZHILAGAM, CHENNAI- 600 005

PRESENT: Thiru M.A. SIDDIQUE I.A.S,

PRINCIPAL SECRETARY/ COMMISSIONER OF COMMERCIAL TAXES

Circular No: 22/2021 – TNGST

(PP2/GST- 15/24/2021)

Date: 26.09.2021

Sub: TNGST Act,2017- Standard Operating Procedure for Faceless Refund -certain guidelines issued regarding

Ref: Minutes of the meeting convened by the Principal Secretary/Commissioner of Commercial Taxes dated 25.03.2021, 29.03.2021, 01.04.2021 and 08.04.2021

******

I. Objectives of Faceless Process:

1.1 At present, the refund process under GST Law is system-based, but the process requires involvement of the jurisdictional proper officer and his possible meeting with the taxpayers leading to possible harassment and other unwarranted situations. Under faceless refund process, the tax payer does not have to meet any official and report his grievance or enquire about status. In order to deal with such grievances, a separate Grievance Redressal Cell for this purpose will be made operational by the department. The details of e-mail id for GRC is dealergrievances@ctd.tn.gov.in and contact toll free number is 18001036751.It is only by electronic mode through which the tax payer interacts with the officials. The required documents will be uploaded electronically and the taxpayers can contact the department from their premises anytime he wants. The taxpayer will get the response for his query through his registered email id. All the responses will be available online and thus the need to contact an official will be removed.

1.2 The objectives to introduce faceless refund to the taxpayer are to improve service delivery for the taxpayers, to promote exports in Tamil Nadu, to avoid harassment to the tax payer, to reduce service turnaround time with minimal physical interaction and to ensure transparent and an effective Service delivery.

1.3 As far as faceless refund for the department is concerned, it will ensure even work load distribution to proper officers, enable system driven decision making in core tax administration activities, simplify and streamline the procedures of the department, reduce cumbersome, time-consuming and non-value adding activities of the department and enhance quality output and productivity due to Centralised and Integrated Task Management system.

II. Refund Process for Faceless Refund

2.1. Assessment of Faceless Readiness in System and Statutory Process:

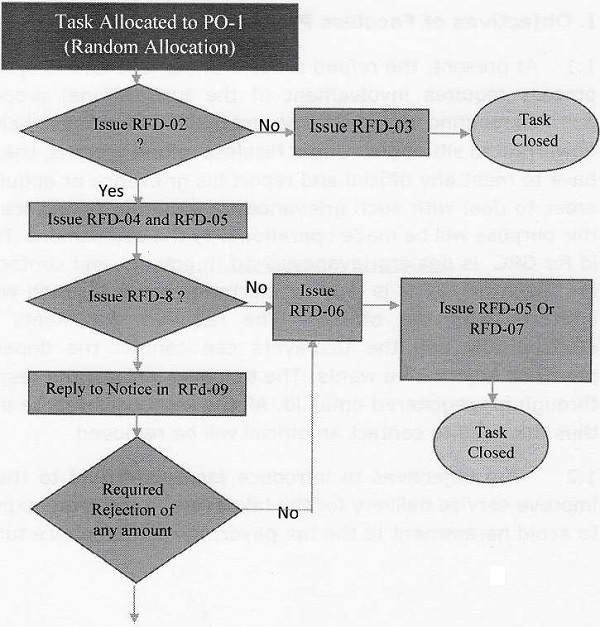

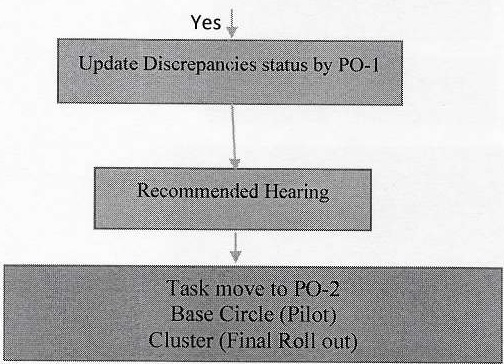

The process flow chart for faceless refund module is as follows:

Flow Chart of Refund application process : P0-1

Other than ZERO RATED SUPPLY

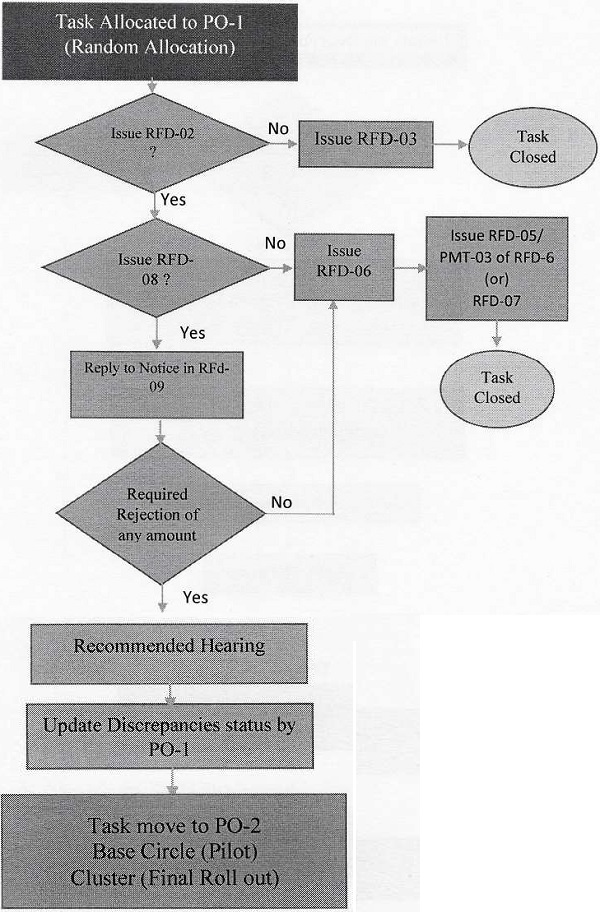

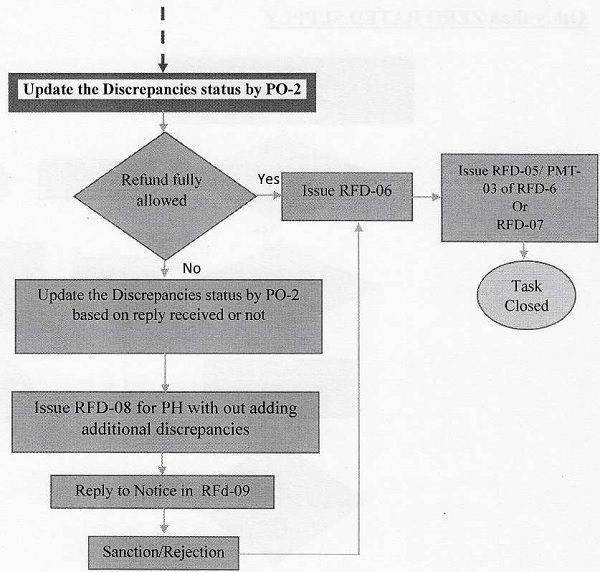

Flow Chart of Refund application process: P0-2

2.2 The zero rated supply has been defined in section 16 of the IGST Act, 2017 and it comprises of export of goods or service or both and supply of goods or services or both to SEZ unit or SEZ developer. The refund relating to zero rated supply shall be claimed as eligible as stipulated in sub-section (3) of section 16 of the IGST Act, 2017. The refund relating to other than zero rated supply, as eligible as per section 54 of the TNGST Act, 2017 may also be claimed. Under the faceless refund, the refund claims falling under both zero rated supply and other than zero rates supply would be covered. As per circular No. 1/(2019)2020, PP6/35622/2019) TNGST dated 23/3/2020 the various categories of refund falling under these two heading are as follows:

I. Refund relating to Zero rated supply as defined in section 16(1) of the IGST Act,2017:

a) Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

b) Refund of tax paid on export of services with payment of tax;

c) Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax;

d) Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax;

II. Refund relating to other than zero rated supply:

a) Refund of unutilized ITC on account of accumulation due to inverted tax structure;

b) Refund to supplier of tax paid on deemed export supplies;

c) Refund to recipient of tax paid on deemed export supplies;

d) Refund of excess balance in the electronic cash ledger;

e) Refund of excess payment of tax;

f) Refund of tax paid on intra-State supply which is subsequently held to be inter-State supply and vice versa;

g) Refund on account of assessment/provisional ssessment/appeal/any other order;

h) Refund on account of assessment/provisional assesment.

i) Refund on account of ” any other ” ground or reason

2.3 It is needless to say that the proper officer may sanction of refund in full, if he satisfied that the application for claim of refund fulfil the conditions stipulated in the Act, rules and relevant circulars issued. However where the proper officer rejects the refund claim in full or partial, personal hearing should be afforded as provided in the provisions of the proviso to Rule 92(3) of the TNGST Rules, 2017. It may also be noted that when the applicant claiming refund desires for a personal hearing, he must be heard in person as a principle of natural justice.

2.4 Perusal of refund data generated from the system during the period from April 2020 to March 2021, depicts that out of 15000 refund applications received, Form GST RFD 08 were issued for 4181 cases, Form GST RFD 08 issued after Form GST RFD 09 for 3334 cases and personal hearing conducted for only 2.53% of the cases. Based on the above data, it is observed that all SCNs issued have not resulted in affording personal hearing but only in very minimum number of cases.

2.5 The procedure for claiming refunds and documents that may be required to be uploaded by the tax payer along with the application under all categories has been elaborately prescribed in the circulars issued under the GST Acts for the purpose of issue of refund. In the common portal, the taxpayer filing application for refund can upload up to 10 documents either prior and post issue of SCN with maximum size of 5 MB per document. The present available space is adequate to upload the documents and there will not be any constraint in implementing faceless refund module.

3. Faceless Refund Implementation Approach:

3.1. Acceptance of Refund Application

i. Under the Faceless refund process, the application for refund in Form GST RFD-01 will be randomly allocated for refund tasks to any of the proper officers in the State and the Proper Officer to whom the application gets assigned by the randomization is termed as Proper Officer-1 ( hereinafter mentioned as PO-1)]

ii. P0-1 shall issue either Acknowledgement in Form GST RFD-02 or Deficiency Memo in Form GST RFD-03 after verification of Refund application.

iii. If a tax payer withdraws refund application in Form GST RFD-01W, PO-1 shall verify and close the task.

3.2. Procedure for Disbursal of Refund:

a) Zero rated Supplies

i. For those cases involving Zero rated Supplies, P0-1 shall issue provisional refund order in Form GST RFD-04 within 7 days from the date of issuance of Form GST RFD-02 under sub-section (6) of section 54(6) of the TNGST Act, 2017.

ii. If no discrepancy is found in the refund claim application, P0-1 shall issue final refund order in Form GST RFD-06 along with payment order in Form GST RFD-05.

iii. In case of partial sanction or rejection of refund claim, the P0-1 shall issue SCN in FORM GST RFD-08 with reasons for rejection of claim of refund.

iv. If the reply of the tax payer filed in Form GST RFD-09 is fully acceptable, P0-1 shall sanction the refund claim completely and issue refund order in Form GST RFD-06.

v. If the reply of the tax payer is partially acceptable /not fully acceptable, P0-1 shall record the reasons therefor and initiate personal hearing to the tax payer as mandated in the proviso to Rule 92(3) of the TNGST Rules, 2017. In the system, P0-1 has to choose “Recommend Hearing”.

vi. If a case is selected for “Recommend Hearing”, the system will transfer the task to a compatible proper officer named as Proper Officer-2 (hereinafter P0-2) at base jurisdiction in the pilot roll out of faceless refund system. In the Final roll out, the system will transfer the task to a compatible proper officer (P0-2) randomly falling in a cluster of locations which comprises the base circle of the taxpayer. The demarcation of clusters for the entire state will be communicated separately and this process will be in place till the integration of virtual hearings in the system.

vii. The P0-2 shall issue Form GST RFD-08 without adding any fresh issue and only for the purpose of affording personal hearing. Based on the available records including the objections, if any filed by the taxpayer against SCN, the P0-2 shall finalise and issue final refund order in Form GST RFD-06.

b) In case of withholding of any refund wholly/partially, P0-1 / P0-2 as the case may be, shall issue order in Form GST RFD-07 for withholding of the refund depends of the stage of process. At present, this process is yet to be implemented and hence this will be implemented at a later stage.

c) Other than Zero rated Supplies :

Except Form GST RFD-04, all processes namely Form GST RFD-08, Form GST RFD-06, Form GST RFD-05, and Form GST RFD-07 are applicable as stated in the “Zero rated supply” refund .

4. In order to explain the above process, an illustration is provided below for the sake of clarity:

4.1 The refund task gets randomly assigned to the P0-1 who will complete the refund process and issue provisional/final refund order in Form GST RFD-04/Form GST RFD 06. But if P0-1 decides to issue show cause notice (hereinafter mentioned as SCN), he will issue such notice in Form GST RFD-08.

- Let us assume that P0-1 has raised 5 issues in the SCN.

- Scenario: 1 Tax payer has not accepted any issue by giving documentary proof in support of the objections.

- Scenario: 2 Tax payer has accepted 2 issues and objected to 3 issues by giving documentary proof for those 3 issues in support of the objections.

- Scenario:3 Tax payer accepted all 5 issues .

- Scenario:4 Tax Payer has not filed any reply/objections.

4.2 Now the following course of action may be taken by P0-1.

a) Scenario : 1

– In case of agreement with the reply/objections filed by the tax payer, P0-1 will sanction the refund completely and issue Form GST RFD-06 with Form GST RFD-05.

– In case of the P0-1 has accepted partially or not accepted fully, then P0-1 shall recommend for personal hearing.

b) Scenario : 2

– In case of acceptance of rejection by the taxpayer or non-acceptance by the taxpayer, P0-1 shall recommend for personal hearing.

c) Scenario : 3

– Even in the case of acceptance of rejection by the taxpayer, P0-1 shall recommend for personal hearing.

d) Scenario : 4

– P0-1 shall recommend for personal hearing, even though the taxpayer has not filed reply/objections against the proposal for rejection.

4.3 After this, the task would get randomly transferred to the second processing officer namely P0-2 along with the reasons recorded by the P0-1. Say for instance, in scenario-2 the tax payer has accepted the restriction of refund claim for 2 issues and P0-1 has accepted the tax payer’s objection for 1 issue. Then P0-1 has to record his findings for the balance 2 issues proposed to be rejected by him. Thereafter, the task will be assigned to P0-2. Now the following course of action may be taken by P0-2.

a) The P0-2 shall issue notice for affording personal hearing only for the 2 issues proposed to be rejected by P0-1 and he should not suo-motu intervene in the already agreed 3 issues [Two rejected by P0-1 and agreed by the tax payer and one case agreed by the P0-1 based on the reply given by the tax payer].

b) However, if the tax payer raises disputes regarding the previously accepted 2 issues in favour of revenue, then P0-2 can reopen these 2 issues. Hence all the 5 issues will be made available to P0-2 with the provision for recording his findings for Four disputed issues only [Two escalated by P0-1 and Two now escalated by tax payer before the P0-2 but which were already agreed before P0-1 in favour of the Revenue]. In case of change of opinion of the tax payer at the time of hearing, P0-2 shall record his findings and issue orders accordingly on merits.

c) After affording the personal hearing and finalising the issues, P0-2 will issue the final refund order in Form GST RFD- 06.

5. It is relevant to mention that the responsibility of P0-2 is confined to 4 issues only and P0-1 will be held accountable for the 1 issue accepted by him. It is also informed that accountability for any monetary loss identified during Review/ Audit lies with the respective proper officer only.

6. The transfer of refund tasks should be done from one proper officer in the cadre of AC to another proper officer in the cadre of AC only, from randomly allotted P0-1 to the cluster based P0-2 for affording personal hearing. Cross assignment of task from an AC to CTO will be done in exceptional instances only when official of the said cadre is not available in the cluster.

7. Due to any contingency warranting change of task option within the assessment circle as exists now, shall be continued for the faceless implementation too.

8. It is reiterated that the process of affording personal hearing should be mandatorily followed in case of full or partial rejection of refund claim and there shall not be any deviation in this regard.

9. With regard to issue of notice to the applicant, it is to be borne in mind by the proper officer (P0-1) that only one SCN can be issued to a taxpayer as being allowed now in the portal. The P0-1, who issues notice in GST RFD-08, should mandatorily furnish reasons for each of the issues identified from the verification of refund application. The P.0.1 has to examine the refund application thoroughly and all defects must find place in the SCN issued by him since in faceless process, the P.0.2 will not issue any SCN except for the purpose of informing personal hearing. Any additional issues may likely arise only in exceptional cases. Hence these exceptional cases should not delay the whole process as 15 days’ time is required to be given for every SCN issued and such exceptional cases will be dealt with in review/audit process. Even where new issues are identified by the P02, such cases should be recommended for review. The JC IT should provide in the application for a mechanism to capture the additional issues if any, identified by P0-2 and the same should be made available to the reviewing authority.

10. Timely issuance of Form GST RFD-04:

The Application has been designed in such a way that in case of refunds relating to zero rated supply, provisional refund in Form GST RFD-04 should be issued on or before the 7th day from the date of issue of Form GST RFD-02 (Acknowledgement). If there is any failure on the part of P0-1 in issuing provisional refund within the stipulated time of 7 days, the Form GST RFD-04 will be issued automatically from the system and the P0-1 will be held responsible for such issue of automated provisional refund.

11. Review and Audit Process:

It is needless to state that every refund order must be reviewed. As the refund is being provided from the Consolidated Fund of the State, review is indispensable. As the review is arising from the faceless refund process, review tasks are also be made faceless by randomly allocating the tasks among review authorities.

12. In the system, P0-2 shall be given provision to enter the additional issues identified by him before passing the final refund order in Form GST RFD- 06. As stated supra, any additional issues identified by P02 shall be communicated to the Review Authority. Further, if there is any additional issue raised by the P0-1, in exceptional cases, the same will be communicated to the Review Authority.

13. Till the process of faceless implementation is fully stabilized, the Jurisdiction DC would handle the review process.

14. The proper officer should strictly adhere to the procedure specified in the guidelines and circulars already issued for the purpose of issue of refund.

15. This Faceless implementation for refund will not be applicable to the taxpayers in LTU circles until further orders.

16. In case of appeal cases, court cases and Audit paras arising out of faceless refunds, the respondent would be the jurisdictional proper officer. Likewise revision, if any, under section 108 of the TNGST Act, 2017 will be taken up by the jurisdictional JC only.

17. It is also emphasized again that the Government has to pay interest to the taxpayer if the refund claimed is not refunded within 60 days from the date of receipt of application and hence, both proper officers, P0-1 and P0-2 shall ensure that the above time line is adhered to while processing faceless refund cases.

Sd/- M.A.Siddique

Principal Secretary/

Commissioner of Commercial Taxes

To

All the Joint Commissioners (ST) (Territorial) in the state including LTU

Copy to:

1. The Principal Secretary to Government, CT & R Department, Chennai – 6009.

2. All Additional Commissioners, 0/0 the CCT, Ezhilagam, Chennai – 600 005.

3. The Joint Commissioner (CS) to host in the departmental website

4. The Director, Commercial Tax Staff Training Institute, Chennai-6

5. The Secretary, TNSTAT, Chennai 600 104.

6. All the Joint Commissioners (ST) (Intelligence) in the state

7. All the Deputy Commissioners (ST) in the State including intelligence

8. All the heads of assessment circles Stock file

/ forwarded by order/

Deputy Commissioner (P&P)