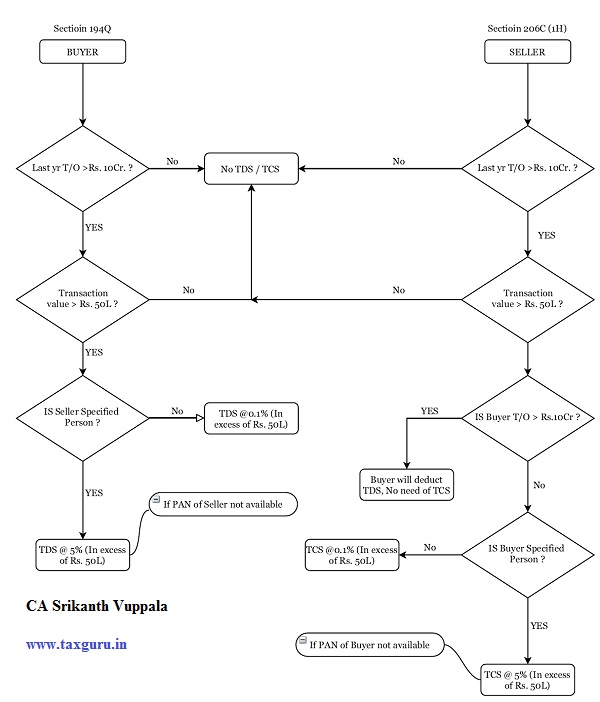

‘194Q. (1) Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 per cent. of such sum exceeding fifty lakh rupees as income-tax.

| Specified Person :

1. Failed to file IT return for both 2 P.Y (A.Y 2019-20, 2020-21) within Due date AND 2. The aggregate TDS & TCS (in 26AS) is Rs. 50,000/- or more in EACH of the 2 P.Y (A.Y 2019-20, 2020-21) |

Section 206 C (1H) Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax:

Nice

What is the applicability of sec 194 Q on purchase of insurance policies from insurance company.

It would be on Taxable Value or Taxable Value + GST.

Refer Circular No. 13 of 2021 dated 30th June 2021.

Good

So the rate of 5% is chargeable only if the person (Deductee) is the specified person.

Nicely Presented