1st July will always be remembered by all the stake holders including trade & industries, tax administrations and also all the consumers, since the dream of One-Nation-One-Tax was achieved in the federal structure of India. Therefore, 1st July should be dedicated to the memory of Late Arun Jaitely. The dream of implementing One-Nation-One-Tax was achieved only due to skill of Late Arun Jaitelyji of achieving the consensus amongst all members of GST Council having different political background and agenda.

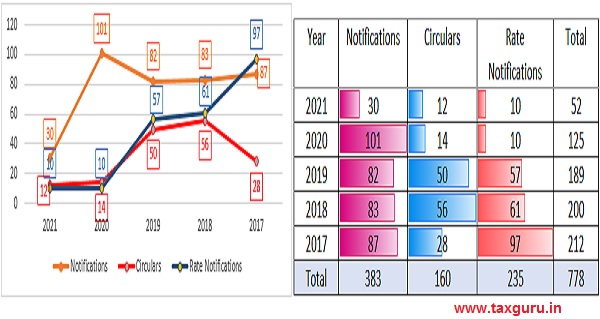

GST was designed to be “Good & Simple Tax” and to ensure lowest compliance cost. However, due to technical glitches and difficulties in the network and software developed have caused lot of hardship to the taxpayers. Therefore, new returns in the form of GSTR-3B was required to be introduced without having backup of transactions which has resulted into fake invoices rackets and therefore, was required to insert rules like Rule 36(4), 86A, 86B of CGST Rules without having any such provisions in the CGST Law and as such un-constitutional provisions. Silver line on such black shade was positive approach of the tax administration i.e. policy makers resolving the issues faced by trade and industries including lowering of taxes, frequent changes in GSTN, frequent issue of various notifications, issuing various circulars and therefore, taxpayers and tax practitioners have to face lot of difficulties. The data given below will be the mirror of frequent changes.

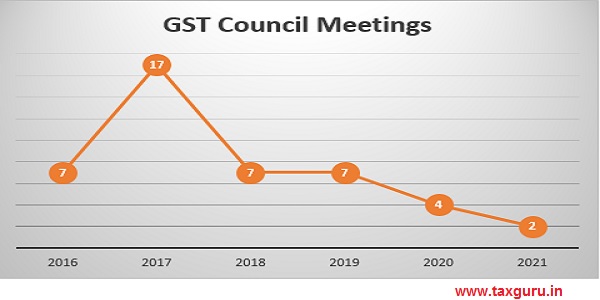

Frequent GST Council Meetings, where issues faced by trade & industries were getting addressed and frequency of such meeting was also high but now a days, what is observed is, frequency of the meeting is too low and subsequent interviews by some of the GST Council members reveals that there is no consensus and number of issues are deferred. It gives the worry of continuing the co-operative federalism, which we used to boost when GST was implemented.

During the 4 years, since the design which was planned could not be implemented due to technology issues, huge racket of fake invoicing and availing wrong credit has been detected. Further to resolve such issues of fake invoice and availing Input Tax Credit without receipt of goods & services, E-Way bill was introduced and subsequently, E-Invoicing has been introduced in the staggered manner based on the turnover. Now, E-invoice has been made mandatory, when aggregate turnover is more than Rs 50 Cr.

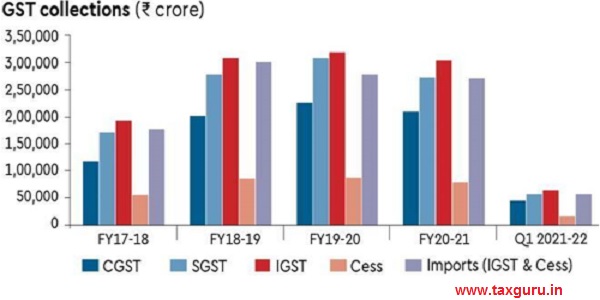

After introduction of GST, whole world has faced recessionary trend followed by pandemics of COVID and such pandemics if continued even after 1st wave and now alarms has been raised for 3rd wave. Success of GST can be measured through the consistent collection over Rs 1 Lac Cr every month, which can be seen from the following chart.

Had there might not been the pandemics continued, government definitely might have achieved the revenue objectives and sharing to the states might have been fair. Further, GST Council and Govt needs to be applauded for certain concessions given on late filing the returns, reducing the interest rate during such period has helped trade and industries including MSME, but majority of the states have been experiencing difficulties in managing their fiscal position and have been requesting the Centre to step in to assist them. The Centre has also been finding it difficult to manage the assured compensation to states from the Compensation Cess Fund (CCF) collected on certain products and has borrowed to fund the deficit in the CCF and this has created turbulence and instability to concept of co-operative federalism.

Further, more confusions have been created by different state advance ruling authorities, which do not have any judicial member and giving contrary decision and more prone to the revenue collection than that of deciding matters judicially. More than 1300 Advance Ruling Judgements were delivered, but it has not achieved the objective to have better clarity on the tax determination and to avoid litigation. It has caused more problems than that of solutions. It was necessary to form National Advance Ruling Authority consisting judicial members therein, which will definitely help to reduce the litigations and re-impose the faith of taxpayers to avail benefit of Advance Ruling Authorities for tax certainty.

The important un-resolved problems so far, are discussed below:

♦ Input Tax Credit:

Object of introduction of GST was to achieve seamless flow of credit and no cascading effect of taxes on the cost of goods in the hands of consumers and thereby reduction of cost. However, the same could not be achieved on the following reasons:

1) The design, which was planned could not be achieved: In terms of Business Process Reports, Draft GST Act and CGST Act 2017, it was expected GSTR-1 will be filed by supplier , recipient will receive GSTR-2 and recipient will accept / reject / modify the transactions and supplier will get GSTR-1A which he will confirm or modify, based on the same GSTR-3 will be auto-populated and provisional ITC will be allowed and mismatch report will be sent to the supplier and recipient and thereupon mismatch will be removed within 6 months, otherwise ITC will be reversed alongwith interest. However, due to GSTN glitches, this was never implemented and rather the whole system has been changed. GSTR-3B was introduced and matching concept has not been brought in, in terms of provisions of the sections, but Rule 36(4), Rule 86A, Rules 86B of CGST Rules 2017 was introduced without having either backing of the section or under the legal framework. All these rules are unconstitutional and the same has been held by number of high courts. Thereafter, New Section 16 (aa) has been inserted to give legal back up for matching of the credit / Rule 36 (4). however this section is yet to be notified

2) Fake Invoices were issued by some of the taxpayers and undue credit was availed by such persons and therefore honest taxpayers have to suffer by way of receiving notices in Form ASMT-10 and un-necessarily reversal of ITC.

3) Blocked Credit: List of blocked credit is increasing and thereby object of seamless credit has been lost.

4) Limitation on availament of ITC: The ITC is allowed to the extent of 120% which was subsequently reduced to 110% and further 105% of matched credit with GSTR-2A, which has resulted in blockage of liquidity.

5) Suo-muto cancellation of Registration: ITC is getting disallowed on account of receipt of goods or services from taxpayer whose registration is cancelled. Surprisingly, GSTN allows them to file the return and also such transactions are reflected in GSTR-2A but subsequently notices are issued to taxpayers for reversing the ITC on account of suo-moto cancellation of such suppliers. Taxpayer has to suffer even if there is no fault from their end.

6) Rectification in GSTR-3B and ITC-04: Sometimes ITC sis availed wrongly and therefore there should be a window for rectification of GSTR-3B and such window should be open till the time due date of next return. It will avoid interest. Further, ITC-04 return is for job work and there are lot of technical glitches and hence there is no mechanism to rectify the mistakes. Therefore, rectification of ITC-04 should also be allowed.

♦ Refund:

Though Section 54 of CGST Act 2017 allows to avail refund of accumulated credit either on account of exports or inverted duty structure, rules were made contradictory to the provisions of the sections. There were frequent changes in Rule 89 and Rule 96 taking / reversing the stand taken earlier. Further, refund on account of accumulation of ITC on account of services were dis-allowed as far as inverted duty structure is concern. Further provision for realization of export proceed within specified period has been brought in. Due to confusion created by the department while changing the notification, number of exporters who has availed the benefit of EOU / advance authorisation and exported on payment of duty under the claim of refund, have been issued the notices asking them to pay back refund amount paid to them alongwith interest.

♦ Litigation on account of different decisions of Advance Ruling Authorities and subsequent decision of High Courts and Supreme Courts:

More than 1300 decisions of advance ruling were given in last 4 years and most of the judgements are pro-revenue without appreciating legal provisions. Therefore, there was a demand of setting up of “National Advance Ruling Authority” having judicial member therein, but so far there is no progress in this matter.

Taxpayers are often faced with ambiguous or conflicting legal provisions—with not much guidance from the GST administration. They are now relying on the judiciary to obtain certainty on a host of issues such as those relating to IGST on ocean freight and price reduction under anti-profiteering measures. Simplification of such provisions will assist taxpayers in complying with the law. Setting up the GST Appellate Tribunal as well as streamlining the Advance Ruling mechanism will provide much-needed predictability.

♦ Tax Administration:

Certain Taxpayers are under the jurisdiction of CGST officers and certain taxpayers are under the jurisdiction of SGST Officers. There is no common mechanism and understanding between central and state tax administration. Rather there are such incidences, that some of the State Govt has issued different trade notices / circulars / instructions than that of issued by CBIC. Further, exporters have to run from pillar to post for obtaining the refund of CGST portion separately and SGST portion separately. Further, there are no common standard operating procedure for addressing the issues, handling the departmental audit, resolving the taxpayer’s grievances etc. etc. and therefore there is a need to issue common standard operating procedure by GST Council which will have binding effect on all officers of tax administration.

♦ Un-Constitutional Provisions:

There is a need to re-look and re-visit the provisions of law including but not limiting to restriction on ITC, blocking of utilization of ITC, provisions of Sec 13(8)(b) of IGST Act 2017 read with Section 2(13) of IGST Act 2017 . Payment of tax on reverse charge basis on ocean freight, provision w.r.t. transitional credit, denial of refund of input tax credit on services for refund under inverted duty structure, imposition of IGST on oxygen concentrator imported by individual as a gift for personal use, issue of cross-charge etc. etc. There has to be clarity in the legal framework.

♦ Interface with Tax Administration:

It was expected that there will be no interface required with any of the office of the tax administration. However, even as on date, for obtaining the refund, issues of registration, etc. etc. interface has been made mandatory and hence it defeats the very purpose of open and transparent system and objective of implementing Good & Simple Tax. However, it is very important to note faceless assessment needs to be introduced but it should not be headless has been observed while implementing faceless income Tax Assessment and Adjudication, which was prevalent from number of high court decisions passing the strictures against the tax administration.

♦ Reconciliation of Annual Accounts with Audited Financial Statement:

GSTR-9C was required to be submitted duly certified by Chartered Accountant or Cost Accountant, which was the protecting shield to the taxpayers. Rather than waiting for departmental person to find out errors and omissions and thereafter mandatory penalty and interest till that time is payable. Therefore, it was beneficial and protecting provision to the taxpayers to get annual return duly reconciled with financial statement from the experts to avoid the further cost of interest and mandatory penalty for un-intentional errors and omissions. But this requirement was withdrawn from the FY 2020-21.

Path Ahead:

1. Remove difficulties and resolve un-resolved issues as mentioned above.

2. More friendly GSTN Helpdesk.

3. Deploying Data Analytics Tool to ease the burden of compliant & honest taxpayer.

4. Introduce the GST Rating System of taxpayer as envisaged.

5. Integrating the principles of design thinking in the GST compliance processes by way of pre-filled returns.

6. Establishing and fostering mutual trust and understanding with the taxpayer.

7. Re-establishing consensus and trust amongst all GST council members.

8. Resolving the issues of unpaid compensation cess to the states.

9. Quick resolution and redressal mechanism of queries and issues faced by the taxpayer

10. Inviting suggestions from trade and industries much before GST Council Meeting and decision should be taken in such meeting

11. Constitution of National Advance Ruling Authorities consisting of judicial members

12. Formation of GST Tribunals having equal representation of judiciary and technical members

13. Re-introduction of submission of GSTR-9C, which is certified by Chartered Accountant or Cost Accountant providing reconciliation of Annual Accounts with Audited Financial Statement.

14. Coverage of petroleum products in the GST Era for seamless flow of input tax credit and reduction of cost.

15. Removal of blocked credit provision

If immediate action plan is made on the above path, then real dream of implementation of good & simple tax will be achieved, which will boost industrial growth, tax collection and also achieve the goal of making Indian economy of USD 5 trillion economy and making India superpower.