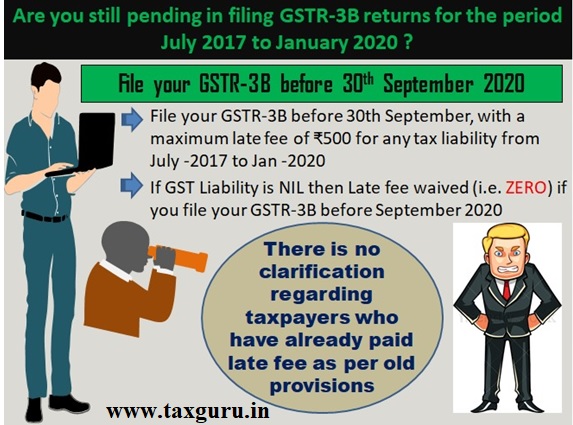

The CBIC has waived/reduced late fees for the late filing of GSTR-3B returns for the period July 2017 to January 2020

CBIC has waived/reduced late fees for the late filing of GSTR-3B returns for the period July 2017 to January 2020

(Notification No. 57/2020, Dt. 30.06.2020)

> If GST liability is Nil, and the GSTR-3B return is filed between 1st July, 2020 and 30th September, 2020, then the amount of late fees stands waived.

> If the GST liability is not Nil, and the GSTR-3B return is filed between 1st July, 2020 and 30th September, 2020, then the amount of late fees stand waived in excess of Rs.250* under the CGST Act.

*Rs.500 will be the total amount payable, Rs.250 under CGST and Rs.250 under SGST.

Unfortunately there is no clarification regarding taxpayers who have already paid late fee as per old provisions.

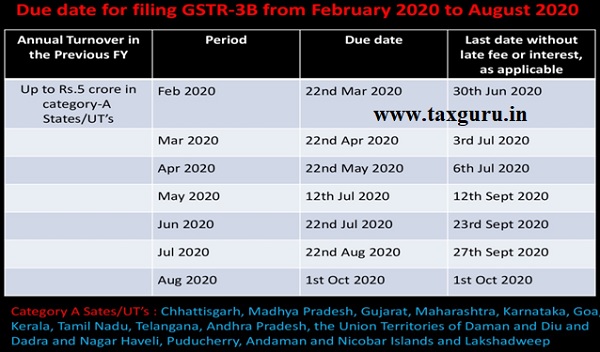

The maximum late fee to be capped at Rs500 per return, for the tax periods given below, filed after the deadlines given in notification 52/2020 but before 30th September 2020, whereas nil return to not be charged any late fee.

(Notification No. 58/2020, Dt. 01.07.2020)

> For turnover more than Rs 5 crore: May 2020 – July 2020

> For turnover equal to or below Rs 5 crore: February 2020 – July 2020

The CBIC has notified the due dates applicable, with regard to interest and late fees for filing GSTR-3B. Here is a list of the notified dates from February to August 2020

–

–

Amount of Late fees applicable

FOR ALL GST RETURNS EXCEPT GST ANNUAL RETURNS(GSTR-9)

As per the Acts, for intra-state supplies, both the CGST and SGST Act prescribes following late fees:

| Name of the Act | Late fees for every day of delay |

| Central Goods and Services Act, 2017 | Rs 100* |

| Respective State Goods and Services Act, 2017 (or) Union territory Goods and Services Act, 2017 | Rs 100* |

| Total Late fees to be paid | Rs 200* |

| The law has fixed a maximum late fees of Rs5,000. This means that in any case, the maximum late fees that can be charged by the Government is Rs5,000 each return being filed under each Act. | |

As per the IGST Act, for inter-state supplies, the late fee is approximately equal to the sum of fees prescribed under both CGST and SGST Act. Hence, Late fee is:

| Name of the Act | Late fees for every day of delay |

| Integrated Goods and Services Act, 2017 | Rs200* |

| The law has fixed a maximum late fees of Rs 5,000. This means that in any case, the maximum late fees that can be charged by the Government isRs 5,000 each return being filed under the Act. | |

Nil filers must note late fee applicable as follows:

| For Nil Return filers | |

| Name of the Act | Late fees for every day of delay |

| CGST Act | Rs 50 |

| SGST Act | Rs 50 |

| IGST Act | Rs 100 |

For example:

A Taxpayer has filed GSTR-3B for the month of January- 2017 (due date 20th Feb 2018) on 23rd Feb 2018.

Amount of late fees to be paid:

Rs. 50` per day 3 days = Rs. 150 (Rs. 75 CGST + Rs. 75 SGST)

If the above return was a return with ‘Zero’ tax liability then late fees would be:

Rs. 20` per day 3 days = Rs. 60 (Rs. 30 CGST + Rs. 30 SGST)