In this editorial author shall discuss about FLA. Whenever we talk about FLA many questions came into mind like: Which Companies are required to file FLA? What is due date for FLA? It’s an Annual Return on Foreign Liabilities and Assets (FLA) is required to be filed by Indian Company and LLP.

I. Who is Required to file FLA?

Entities who holds foreign assets or liabilities in their financial statements as on 31 March.

The annual return on Foreign Liabilities and Assets (FLA) is required to be submitted by the following entities which have received FDI (foreign direct investment) and/or made FDI abroad (i.e. overseas investment) in the previous year(s) including the current year i.e. who holds foreign assets or/and liabilities in their balance sheets;

- A Company within the meaning of section 1(4) of the Companies Act, 2013.

- A Limited Liability Partnership (LLP) registered under the Limited Liability Partnership Act, 2008

- Others [include SEBI registered Alternative Investment Funds (AIFs), Partnership Firms, Public Private Partnerships (PPP) etc.]

II. Due Date of Filing of FLA:

a) What is the due date of submission of the FLA return?

Ans.: FLA return is mandatory under FEMA 1999 and companies are required to submit the same based on audited/ unaudited account by July 15 every year.

b) What information should be reported in FLA return, if balance sheet of the company is not audited before the due date of submission?

Ans.: If the company’s accounts are not audited before the due date of submission, i.e. July 15, then the FLA Return should be submitted based on unaudited (provisional) account. Once the accounts gets audited and there are revisions from the provisional information submitted by the company,

c) What is the due date of submission of revised FLA return?

Ans.: Companies are supposed to submit the revised FLA return based on audited accounts by end – September i.e. 30th September.

III. Key Points about Return:

- It is online Return through [1]web-based form w.e.f. 29th June, 2019.

- [2]Link of portal :https://flair.rbi.org.in

- Assets and liability as on 31st March shall be considered.

IV. How to Submit FLA Return online through Web Based Portal?

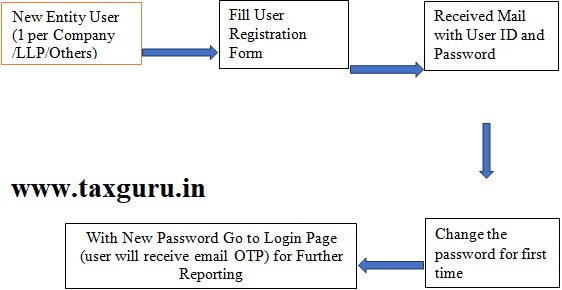

A. When Company Filing First Time:

i. Submit User Registration Form online.

ii. Use have to upload following documents

– SCANNED (as PDF/JPG) and SIGNED authority letter and

– Verification letter (SAVED AS XXXX.PDF (NOT SCANNED), NOT SIGNED)

iii. 3Formats are available on bottom of following link and given at end of editorial https://flair.rbi.org.in/fla/faces/pages/login.xhtml

iv. Fill the form and attach the documents and submit with the RBI.

v. The successful registration on web-portal will enable users to generate RBI-provided login-name and password for using FLA submission gateway.

B. Filing of FLA every year after creation of Log IN:

1 Logging on to FLA online form

– Step 1: Enter your user name, new password and valid Captcha.

(The captcha is case sensitive.)

– Step 2: Enter OTP code

(the user will receive the OTP on registered E-mail ID for login)

1.2 Entry in FLA online form: On successful login, the home page (dashboard) is displayed

– Step 1: Click on the top – left option button to open Menu. Click on “FLA Online Form”.

– Step 2: Then click on “Start Filing FLA form”.

– Step 3: Then fill the required information.[4]

FORMATS

Annex-I

Format of Verification letter

“Name of Company”

Corporate Office / Central Office

VERIFICATION LETTER

The Director

Date xx/xx/xxxx

International Investment Position Division (IIPD)

Department of Statistics and Information Management (DSIM)

Bandra Kurla Complex, Bandra (E), Mumbai

Reserve Bank of India

Dear Sir / Madam

Sub: Verification Letter for CIN / LLPIN / Others UIN(in case of Alternative Investment Fund / Partnership Firm / Public Private Partnership) and PAN of authorised person filing annual FLA form

We hereby authorize Shri. / Smt. / Ms.

Name and Designation: _______________________________

Having Permanent Account Number (PAN)

to register as Business user for submission of annual return on Foreign Liabilities and Assets (FLA) on behalf of our company named

Having CIN / LLPIN / Others UIN

We further confirm that the information provided herein in respect of Name and CIN / LLPIN / Others UINof entity and PAN of authorised person is correct and the same can be treated as verified by us as per the attached authority letter.

Name of Signatory on the attached authority letter: _____________

Address:

(After furnishing all details, convert this word file of Verification Letter into pdf file and then attach the same in FLA user registration form)

Annex-II

Format of Authority Letter

“Name of Company”

Corporate Office / Central Office

AUTHORITY LETTER

The Director

Date: xx / xx / xxxx

International Investment Position Division (IIPD)

Department of Statistics and Information Management (DSIM)

Bandra Kurla Complex, Bandra (E), Mumbai

Reserve Bank of India

Dear Sir / Madam

Sub: Letter of Authorization for filing ofannual return on FLA

We hereby authorize Shri. / Smt. / Ms.

Name and Designation: ________________

Permanent Account Number (PAN)____________

to register as Business user for submission of annual return on Foreign Liabilities and Assets (FLA)on behalf of our company/ LLP/ Others named _________

CIN/ LLPIN/ Others UIN ____________

Registered office at _____________

and PAN of Authorised person ____________

We further confirm that we are liable for and bound by all acts of commission and omission by the authorized representative. All acts committed by the above authorized representative shall be treated as if these acts were committed by the company/ LLP/ Others.

Yours faithfully

(Signature of Managing Director / Director / Head of Institution / Chartered Accountant / Designated Partner in case of LLP / Investment manager or Sponsor for Investment vehicle)

Name:

Designation:

Date:

Seal of the signing authority:

(After furnishing all details, take print out of this word file of authority letter and get it signed from appropriate authority as mentioned above and then scan it. Convert it to PDF and then upload the same in FLA user registration form)

SOME FAQ’S

d) If company issued the shares to non-resident on Non-Repatriable basis, whether that company is required to submit the FLA Return?

Ans.: Shares issued by reporting company to non-resident on Non-Repatriable basis should not be considered as foreign investment; therefore, companies which have issued the shares to non-resident only on Non-Repatriable basis, is not required to submit the FLA Return.

e) Is it required to submit any financial statements like balance sheet or P&L accounts (audited/ unaudited) along with the FLA return?

Ans.: There is no need to attach any Balance Sheet and P&L while filing FLA.

f) Where can we find the detailed description of NIC-2008 code (item-6)?

Ans. In the FLA Return, industry codes are given as per the National Industrial Classification (NIC) -2008 codes. The details on NIC-2008 codes can be accessed through the following link, http://mospi.nic.in/mospi_new/upload/nic_2008_17apr09.pdf.

g) If a company has more than one activity during the year then which NIC code should be reported by company (item-6)?

Ans.: Company will select that activity, from which, they have earned major revenue.

Author – CS Divesh Goyal, GOYAL DIVESH & ASSOCIATES Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com).

[1]https://taxguru.in/rbi/fla-return-e-submitted-online-rbi.html

[2]https://flair.rbi.org.in/fla/faces/pages/login.xhtml

[3] Formats are given below.

[4] Draft form can be check at https://flair.rbi.org.in/fla/faces/pages/login.xhtml

FAQ’s relating to form are given at https://taxguru.in/rbi/annual-return-foreign-liabilities-assets-fla-faqs.html