COVID-19 has been declared as a pandemic by WHO (the World Health Organisation) owing to its spread across the continents. Due to the imposition of lockdown in major economies of the world, people have been sacked, received pay cuts and have been put on furloughs without pay till the situation normalises.

For the emerging economies like India, the scenario is getting worse and calls for an immediate relief package and stimulus from the government. For people who are not left with much cash every month end due to their financial commitments and fragile nature of their jobs, the central government organisation EPFO has permitted partial withdrawal of their PF deductions in the form of an ‘advance’ to save their coffers.

A non-refundable withdrawal to the extent of the basic wages and dearness allowance for three months or up to 75% of the amount standing to member’s credit in the EPF account, whichever is less, is allowed.

We will take you through the withdrawal process for the same which is an online process and all such claims are processed on a priority basis by the EPFO. So far 3.31 lac PF withdrawal claims have been processed by the EPFO in 15 days.

‘Process Outline’

1. Access the URL https://unifiedportal-mem.epfindia.gov.in/memberinterface/as below:

2. Login with your UAN credentials. UAN (Universal Account Number) is a 12-digit number which is provided to each member of the EPFO through which he can manage his PF accounts. Make sure you have linked your Aadhaar with your bank account which is mentioned in your EPF enrolment formand have completed your KYC.

You will find the below screen once you login:

3. Go to “Online Services” dropdown and click on ‘CLAIM (Form-31,19,10C&10D).

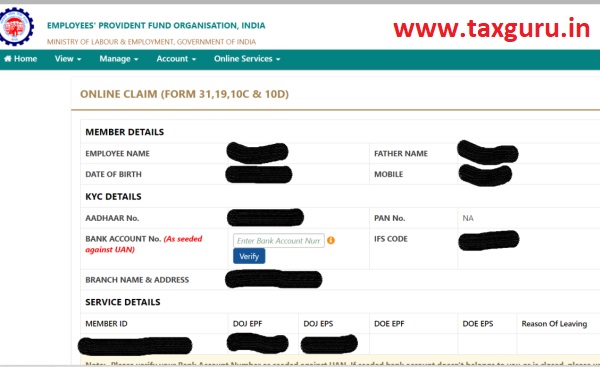

4. You will get the below screen where you have to fill in your “Bank Account Number” which is linked with the UAN. Once you verify the bank account number you will get the “Proceed for online claim” option at the bottom of the page.

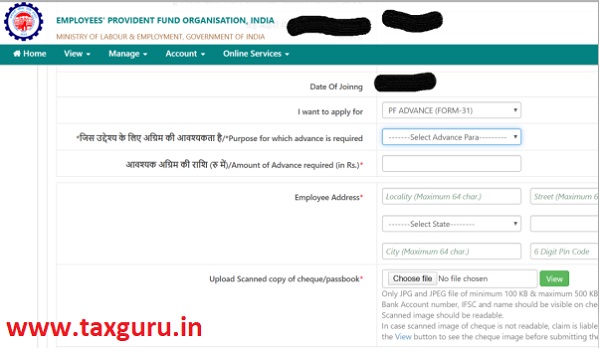

5. Once you complete step 4, you will get the below screen where you have to select the dropdown option PF ADVANCE (FORM-31) against “I want to apply for” row description.

- Select OUTBREAK OF PANDEMIC (COVID-19) against “purpose for which advance is required”. Please note that only ‘one advance’ is admissible under this scheme.

- Enter the amount of advance as per the guidelines shared in the first paragraph.

- Fill out “employee address” as per your Aadhaar Card.

- Upload a scanned copy of cheque/passbook for the bank account linked to Aadhaar and UAN. Make sure Bank Account number, IFSC and name should be visible on cheque/passbook.

6. Once you fill out all the details as per Point 5 above, you can proceed as below:

- Tick mark the declaration as given above

- Generate Aadhaar OTP which will be sent to your registered mobile number.

7. Enter the OTP and submit the claim. The claim usually takes 5-7 working days to be credited to your account.

If you find this post useful, kindly share it with your friends/colleagues.

For any related queries, the author can be reached at kalpit.shah9@gmail.com

Withdrawal from EPF after leaving job.