How to Pay GST Demand and Taxes in Installment –Section 80 of CGST Act 2017

Dear readers, after the implementation of GST Act, many dealers has done mistake in complying with GST law, due to unawareness of law or due to mala fide intention. When they come to the notice of department, the department will take necessary action for the recovery of dues from the dealer. In some cases the recoverable amount of taxes/ demand raised is of such high value that, the dealer is not in a position to pay the same at same point of time or if paid in one installment then it will adversely affect the business of the dealer.

To overcome such kind of situation, the GST Department has given some relief to the dealer which is specified in Section 80 of CGST Act 2017. Under this section, department gives an opportunity to the dealer to pay due taxes/demand in installment, however the dealer as to comply with condition as specified in Section 80 of CGST Act 2017 and applicable rules.

Highlights of Section 80 of CGST Act 2017 are as follows:

On an application filed by a taxable person, the Commissioner may, for reasons to be recorded in writing, extend the time for payment or allow payment of any amount due under this Act:

√ Other than the amount due as per the liability self assessed in any return means any taxes due payable at time of return filing (self assessed) is not covered under this section

√ The maximum monthly installment under this section will be 24

√ The dealer has to pay interest under Section 50 on these installments

Precaution to take after availing this opportunity

Provided that where there is default in payment of any one installment on its due date, the whole outstanding balance payable on such date shall become due and payable forthwith and shall, without any further notice being served on the person, be liable for recovery.

As per Rule No – 158 (1) of CGST Rules 2017, for availing benefit of section 80 of CGST Act 2017, a dealer has to make an application electronically in Form GST DRC-20, seeking extension of time for the payment of taxes or any amount due under the Act or for allowing payment of such taxes or amount in installments.

Steps for Filing DRC-20 are as follows:

Step 1 – Login into dealer GST Portal

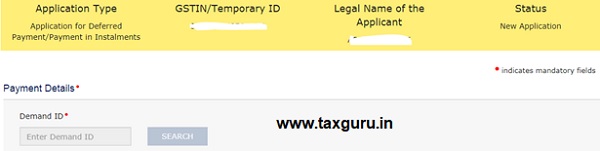

Step 2 – Go to Dashboard and Click on Payment option and select Application for Deferred Payment/ Payment in Installment

Step 3 – Provide the required detail as asked in the Form

Step 4 – After filing the all required details submit the form

Step 5 – After submission of form, your details are forwarded to the Commissioner, who shall call for a report from the jurisdictional officer about the financial ability of the taxable person to pay the said amount.

Step 6 – After considering the dealer reasons and Jurisdictional officer report, the Commissioner may issue his order in Form GST DRC -21 either accepting his request or rejecting his application.

Note: In following circumstances the dealer in not allowed to file his application under Section 80 of CGST Act 2017

> If the dealer has already defaulted on the payment of any amount under the Act and for which the recovery process is already initiated

> the taxable person has not been allowed to make payment in installments in the preceding financial year under the Act or the IGST Act, or UTGST Act or SGST Act 2017

> the amount for which installment facility is sought is less than 25,000/-

This article is for the purpose of information and shall not be treated as a solicitation in any manner and for any other purpose whatsoever. It shall not be used as a legal opinion and not be used for rendering any professional advice. This article is written on the basis of the author’s personal experience gained. Adequate attention has been given to avoid any clerical/arithmetical error, however; if it still persists kindly intimate us to avoid such error for the benefits of other readers.

The Author can be reached at mail –shivsharma786@gmail.com and Mobile/Whatsapp – 9911303737 / 9716118384