Sponsored

Section 43A Rule 36(4) of the CGST Act, 2017 and CGST Rules, 2017 – Restricting the Input Tax Credit (ITC) limit to 20% of the eligible ITC which is as per GSTR-2A.

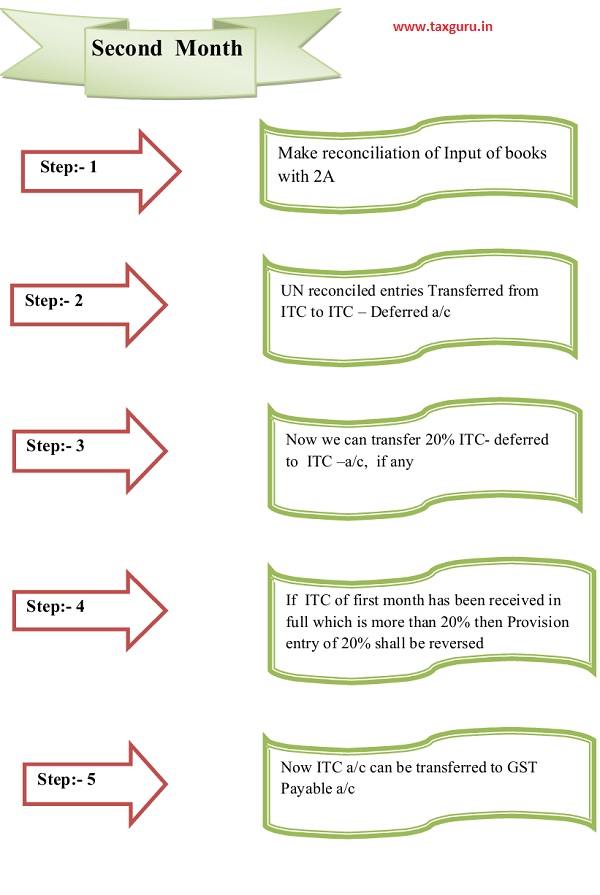

GST Payable now shall be paid. ITC Deferred a/c balance left out now shall be recoverable in next months as when appear in Fom-2A.

Let’s Take an Example for better understanding

Let’s Take an Example for better understanding

Make Entry in Books after the Reconciling of Form -2A [ Amount in Rs.]

| 1. ITC – Deferred | 50 Dr. |

| ITC | 50 Cr. |

| 2. ITC | 10 Dr. |

| ITC-Deferred | 10 Cr. |

| 3. GST Payable a/c | 60 Dr. |

| ITC | 60 Cr. |

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.