The GST regime continues to promote the scheme of self-assessment like erstwhile indirect tax laws and Audit of records of tax payers is the basis for the proper functioning of self-assessment based tax system. As per section 2(13) of CGST Act, 2017. GST Audit means examination of records, returns and documents maintained and furnished by registered person to check the following:-

(a) Verify the correctness of turnover declared.

(b) Input tax credit availed and utilized.

(c) Exemptions and deductions claimed.

(d) Rate of tax applied in respect of supply of goods or services etc.

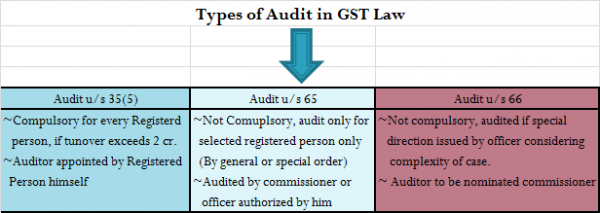

The following three types of GST audit are envisaged under the GST Law:-

1.GST Audit u/s 35(5) of Act, if turnover exceeds prescribed limit (i.e Rs. 2 Crore)

2. GST Audit by tax authorities u/s 65.

3. Special GST audit direction from department u/s 66.

1. GST Audit u/s 35(5)

As per section 35(5) with rule 80, in case registered person whose aggregate turnover during the financial year exceeds Rs. 2 crore, he shall get his accounts audited by Chartered Accountant or Cost Accountant. Here the term used is aggregate turnover and not turnover in state. Aggregate turnover is computed on all India basis having same PAN. Therefore, if a registered person is liable to gets his accounts audited under section 35, then all the registration obtained under same PAN will also be liable to GST audit. For example, if a company XYZ Ltd has operations in two states Haryana and Rajasthan, and turnover in Haryana is 3.75 crore and in Rajasthan is 25 lakh, then GST audit to be conducted for both the states. GST Audit under this section to be conducted GSTIN wise.

The registered person whose accounts are to be audited, he shall submit audited accounts along with his annual return in Form GSTR-9C and a reconciliation statement reconciling turnover in audited financial statement and return furnished for financial year.

2. GST Audit by Tax Authorities u/s 65

It is important tool in tax administration to ensure compliance of law and prevent revenue leakage. This section authorizes conduct of GST audit by commissioner or any officer authorized by him of transactions of registered person only. It means GST audit of unregistered person cannot be carried out under this section even if he is liable to register. The commissioner may issue general or specific order to authorize officers to conduct GST audit. GST Audit under this section be conducted for a financial year or multiple thereof and manner of GST audit is not prescribed yet.

Before commencement of audit, proper officer will issue a notice in form ADT-01 at least 15 days prior to commencement of audit. The audit may be conducted at place of business of registered person or in the office of proper officer. During audit, officer will ensure correctness of turnover declared, input tax credit availed and utilized, deductions and exemptions claimed etc. The GST audit under this section be completed within 3 months (subject to extension by commissioner) from commencement of audit. On completion of audit, officer will inform the discrepancy noticed with registered person and after considering reply of registered person, his findings to be finalize. The proper officer will inform the final findings of his audit to the registered person in form ADT-02.The finding under GST audit may be used by proper officer to initiate action u/s 73 or 74.

3. Special GST audit direction by department u/s 66

Special GST audit direction under this section is issued to registered person only when any proceeding (being scrutiny, enquiry, investigation or any other proceeding) is pending before him and having regard to nature and complexity of case and interest of revenue , he is of opinion that

- Value has not been correctly declared OR

- Credit availed is not within normal limits

In such a case, proper officer with prior approval of commissioner, issue direction to registered person in form ADT-03 to get his records including accounts audited by Chartered Accountant or cost Accountant as nominated by commissioner (Auditor is not choosed by registered person). The audit direction under this section may be issued even if accounts/records of such person is already audited under this act or any other act. On completion of audit, Auditors will submit his report to proper officer within 90 days (subject to extension) and registered person will be informed of finding in form ADT-04. Opportunity of being heard is given to person, if officer intends to use material gathered during GST audit in any proceeding. The proper officer may initiate proceeding u/s 73 or 74 on the basis of finding of special GST audit.

Audit officer visits the place of business of a taxable person for audit u/sec 65 (ex 1st June), but due to some genuine reason the taxable person could not produce some documents and has furnished the same for verification after one month ( ex 10 July). In this scenario which is date of commencement of business. 1st June or 10th July

PLEASE ENROLL MU NAME

Congratulations bro nice article

Very helpful. Thanks for sharing.

Good Article.?