Case Law Details

Danamma @ Suman Surpur vs Amar (Supreme Court of India)

The law relating to a joint Hindu family governed by the Mitakshara law has undergone unprecedented changes. The said changes have been brought forward to address the growing need to merit equal treatment to the nearest female relatives, namely daughters of a coparcener. The section stipulates that a daughter would be a coparcener from her birth, and would have the same rights and liabilities as that of a son. The daughter would hold property to which she is entitled as a coparcenary property, which would be construed as property being capable of being disposed of by her either by a will or any other testamentary disposition. These changes have been sought to be made on the touchstone of equality, thus seeking to remove the perceived disability and prejudice to which a daughter was subjected. The fundamental changes brought forward about in the Hindu Succession Act, 1956 by amending it in 2005, are perhaps a realization of the immortal words of Roscoe Pound as appearing in his celebrated treaties, The Ideal Element in Law, that “the law must be stable and yet it cannot stand still. Hence all thinking about law has struggled to reconcile the conflicting demands of the need of stability and the need of change.”

Section 6, as amended, stipulates that on and from the commencement of the amended Act, 2005, the daughter of a coparcener shall by birth become a coparcener in her own right in the same manner as the son. It is apparent that the status conferred upon sons under the old section and the old Hindu Law was to treat them as coparceners since birth. The amended provision now statutorily recognizes the rights of coparceners of daughters as well since birth. The section uses the words in the same manner as the son. It should therefore be apparent that both the sons and the daughters of a coparcener have been conferred the right of becoming coparceners by birth. It is the very factum of birth in a coparcenary that creates the coparcenary, therefore the sons and daughters of a coparcener become coparceners by virtue of birth. Devolution of coparcenary property is the later stage of and a consequence of death of a coparcener. The first stage of a coparcenary is obviously its creation as explained above, and as is well recognized. One of the incidents of coparcenary is the right of a coparcener to seek a severance of status. Hence, the rights of coparceners emanate and flow from birth (now including daughters) as is evident from sub-s (1)(a) and (b).

Hence, it is clear that the right to partition has not been abrogated. The right is inherent and can be availed of by any coparcener, now even a daughter who is a coparcener.

In the present case, no doubt, suit for partition was filed in the year 2002. However, during the pendency of this suit, Section 6 of the Act was amended as the decree was passed by the trial court only in the year 2007. Thus, the rights of the appellants got crystallised in the year 2005 and this event should have been kept in mind by the trial court as well as by the High Court. This Court in Ganduri Koteshwaramma & Anr. v. Chakiri Yanadi & Anr.8 held that the rights of daughters in coparcenary property as per the amended S. 6 are not lost merely because a preliminary decree has been passed in a partition suit. So far as partition suits are concerned, the partition becomes final only on the passing of a final decree. Where such situation arises, the preliminary decree would have to be amended taking into account the change in the law by the amendment of 2005.

JUDGMENT

A.K. SIKRI, J.

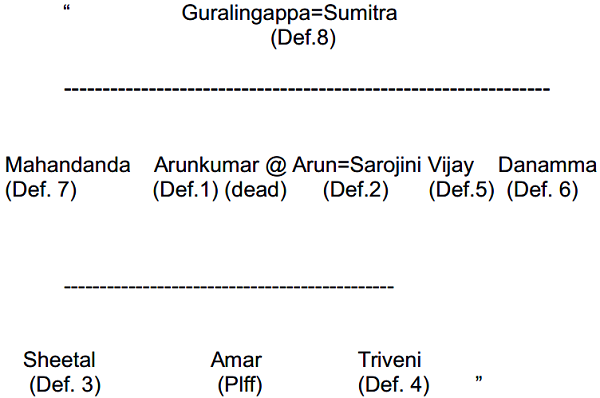

The appellants herein, two in number, are the daughters of one, Gurulingappa Savadi, propositus of a Hindu Joint Family. Apart from these two daughters, he had two sons, namely, Arunkumar and Vijay. Gurulingappa Savadi died in the year 2001 leaving behind the aforesaid two daughters, two sons and his widow, Sumitra. After his death, Amar, S/o Arunkumar filed the suit for partition and a separate possession of the suit property described at Schedule B to E in the plaint stating that the two sons and widow were in joint possession of the aforesaid properties as coparceners and properties mentioned in Schedule B was acquired out of the joint family nucleus in the name of Gurulingappa Savadi. Case set up by him was that the appellants herein were not the coparceners in the said joint family as they were born prior to the enactment of Hindu Succession Act, 1956 (hereinafter referred to as the ‘Act’). It was also pleaded that they were married daughters and at the time of their marriage they had received gold and money and had, hence, relinquished their share.

2) The appellants herein contested the suit by claiming that they were also entitled to share in the joint family properties, being daughters of Gurulingappa Savadi and for the reason that he had died after coming into force the Act of 1950.

3) The trial court, while decreeing the suit held that the appellants were not entitled to any share as they were born prior to the enactment of the Act and, therefore, could not be considered as coparceners. The trial court also rejected the alternate contention that the appellants had acquired share in the said properties, in any case, after the amendment in the Act vide amendment Act of 2005. This view of the trial court has been upheld by the High Court in the impugned judgement dated January 25, 2012 thereby confirming the decree dated August 09, 2007 passed in the suit filed for partition.

4) In the aforesaid backdrop, the question of law which arises for consideration in this appeal is as to whether, the appellants, daughters of Gurulingappa Savadi, could be denied their share on the ground that they were born prior to the enactment of the Act and, therefore, cannot be treated as coparceners? Alternate question is as to whether, with the passing of Hindu Succession (Amendment) Act, 2005, the appellants would become coparcener “by birth” in their “own right in the same manner as the son” and are, therefore, entitled to equal share as that of a son?

5) Though, we have mentioned the gist of the lis involved in this case along with brief factual background in which it has arisen, some more facts which may be necessary for understanding the genesis of issue involved may also be recapitulated. We may start with the genealogy of the parties, it is as under:

6) Respondent No. 1 herein (the plaintiff) filed the suit on July 01, 2002 claiming 1/15th share in the suit schedule properties. In the said suit, he mentioned the properties which needed partition.

7) The plaint schedule C compromised of the house properties belonging to the joint family. The plaint schedule D comprised of the shop properties belonging to the joint family. The plaint schedule E comprised of the machineries and movable belonging to the joint family. The plaintiff averred that the plaint schedule properties belonged to the joint family and that defendant no. 1, the father of the plaintiff was neglecting the plaintiff and his siblings and sought partition of the suit schedule properties. The plaintiff contended that all the suit schedule properties were the joint family properties. The plaintiff contended in para 5 of the plaint that the propositus, Guralingappa died 1 year prior to the filing of the suit. In para 7 of the plaint, the plaintiff contended that defendant no. 1 had 1/3rd share and defendant no. 5 and 8 had 1/3rd share each in the suit schedule properties. The plaintiff also contended that defendants 6 and 7 did not have any share in the suit schedule properties.

8) Defendant no. 1 (father of the plaintiff) and son of Guralingappa Savadi did not file any written statement. Defendant nos. 2, 3 and 4 filed their separate written statements supporting the claim of the plaintiff. Defendant no. 5 (respondent no. 5 herein and son of Guralingappa Savadi), however, contested the suit. He, inter alia, contended that after the death of Guralingappa, an oral partition took place between defendant no. 1, defendant no. 5 and others and in the said partition, defendant no. 1 was allotted certain properties and defendant no. 5 was allotted certain other properties and defendant no. 8, Sumitra, wife of Guralingappa Savadi was allotted certain other properties. Defendant no.5 further contended that defendant nos. 6 and 7 were not allotted any properties in the said alleged oral partition.

9) Defendant no. 5 further contended that one of the properties, namely, C.T.S. No. 774 and also certain other properties were not joint family properties.

10) The appellants claimed that they were also entitled to their share in the property. After framing the issues and recording the evidence, the trial court by its judgment and decree dated August 09, 2007 held that the suit schedule properties were joint family properties except CTS No. 774 (one of the house properties in plaint C schedule).

11) The trial court held that the plaintiff, defendant nos. 2 to 4 were entitled to 1/8th share in the joint family properties. The trial court further noted that defendant no. 8 (wife of Gurulingappa Savadi) died during the pendency of the suit intestate and her share devolved in favour of defendants no. 1 and 5 only and, therefore, defendant nos. 1 and 2 were entitled to 1/2 share in the said share. The trial court passed the following order:

“The suit of the plaintiff is decreed holding that the plaintiff is entitled for partition and separate possession of his 1/8th share in the suit ‘B’, ‘C’ and ‘D’ schedule properties (except CTS No. 774) and also in respect of the Machinery’s stated in the report of the commissioner. The commissioners report Ex. P16 which contains the list of machinery’s to form part of the decree.

The defendants 2 to 4 are each entitled to a/8th share and the 5th defendant is entitled for 4/8 share in the above said properties.”

12) The trial court, thus, denied any share to the appellants.

13) Aggrieved by the said judgment and decree of the trial court, the defendant nos. 6 and 7 filed an appeal bearing R.F.A. No. 322 of 2008 before the High Court seeking equal share as that of the sons of the propositus, namely, defendant nos. 1 and 5.

14) The High Court by its impugned judgment and order dated January 25, 2012 dismissed the appeal. Thereafter, on March 04, 2012 defendant nos. 6 and 7 filed a review petition bearing no. 1533 of 2012 before the High Court, which met the same fate.

15) We have heard the learned counsel for the parties. Whereas, the learned counsel for the appellants reiterated his submissions which were made before the High Court as well and noted above, learned counsel for the respondents refuted those submissions by relying upon the reason given by the High Court in the impugned judgment.

16) In the first instance, let us take note of the provisions of Section 6 of the Act, as it stood prior to its amendment by the Amendment Act, 2005. This provision reads as under:

“6. Devolution of interest in coparcenary property.—When a male Hindu dies after the commencement of this Act, having at the time of his death an interest in a Mitakshara coparcenary property, his interest in the property shall devolve by survivorship upon the surviving members of the coparcenary and not in accordance with this Act:

Provided that, if the deceased had left him surviving a female relative specified in Class I of the Schedule or a male relative specified in that class who claims through such female relative, the interest of the deceased in the Mitakshara coparcenary property shall devolve by testamentary or intestate succession, as the case may be, under this Act and not by survivorship.

Explanation 1.—For the purposes of this section, the interest of a Hindu Mitakshara coparcener shall be deemed to be the share in the property that would have been allotted to him if a partition of the property had taken place immediately before his death, irrespective of whether he was entitled to claim partition or not.

Explanation 2.—Nothing contained in the proviso to this section shall be construed as enabling a person who had separated himself from the coparcenary before the death of the deceased or any of his heirs to claim on intestacy a share in the interest referred to therein.”

17) No doubt, Explanation 1 to the aforesaid Section states that the interest of the deceased Mitakshara coparcenary property shall be deemed to be the share in the property that would have been allotted to him if the partition of the property had taken place immediately before his death, irrespective whether he was entitled to claim partition or not. This Explanation came up for interpretation before this Court in Anar Devi & Ors. v. Parmeshwari Devi & Ors.1. The Court quoted, with approval, the following passage from the authoritative treatise of Mulla, Principles of Hindu Law, 17th Edn., Vol. II, p. 250 wherein the learned author made following remarks while interpreting Explanation 1 to Section 6:

“…Explanation 1 defines the expression ‘the interest of the deceased in Mitakshara coparcenary property’ and incorporates into the subject the concept of a notional partition. It is essential to note that this notional partition is for the purpose of enabling succession to and computation of an interest, which was otherwise liable to devolve by survivorship and for the ascertainment of the shares in that interest of the relatives mentioned in Class I of the Schedule. Subject to such carving out of the interest of the deceased coparcener the other incidents of the coparcenary are left undisturbed and the coparcenary can continue without disruption. A statutory fiction which treats an imaginary state of affairs as real requires that the consequences and incidents of the putative state of affairs must flow from or accompany it as if the putative state of affairs had in fact existed and effect must be given to the inevitable corollaries of that state of affairs.”

7. The learned author further stated that:

“[T]he operation of the notional partition and its inevitable corollaries and incidents is to be only for the purposes of this section, namely, devolution of interest of the deceased in coparcenary property and would not bring about total disruption of the coparcenary as if there had in fact been a regular partition and severance of status among all the surviving coparceners.”

8. According to the learned author, at pp. 253-54, the undivided interest

“of the deceased coparcener for the purpose of giving effect to the rule laid down in the proviso, as already pointed out, is to be ascertained on the footing of a notional partition as of the date of his death. The determination of that share must depend on the number of persons who would have been entitled to a share in the coparcenary property if a partition had in fact taken place immediately before his death and such person would have to be ascertained according to the law of joint family and partition. The rules of Hindu law on the subject in force at the time of the death of the coparcener must, therefore, govern the question of ascertainment of the persons who would have been entitled to a share on the notional partition”.

18) Thereafter the Court spelled out the manner in which the statutory fiction is to be construed by referring to certain judgments and summed up the position as follows:

“11. Thus we hold that according to Section 6 of the Act when a coparcener dies leaving behind any female relative specified in Class I of the Schedule to the Act or male relative specified in that class claiming through such female relative, his undivided interest in the Mitakshara coparcenary property would not devolve upon the surviving coparcener, by survivorship but upon his heirs by intestate succession. Explanation 1 to Section 6 of the Act provides a mechanism under which undivided interest of a deceased coparcener can be ascertained and i.e. that the interest of a Hindu Mitakshara coparcener shall be deemed to be the share in the property that would have been allotted to him if a partition of the property had taken place immediately before his death, irrespective of whether he was entitled to claim partition or not. It means for the purposes of finding out undivided interest of a deceased coparcener, a notional partition has to be assumed immediately before his death and the same shall devolve upon his heirs by succession which would obviously include the surviving coparcener who, apart from the devolution of the undivided interest of the deceased upon him by succession, would also be entitled to claim his undivided interest in the coparcenary property which he could have got in notional partition.”

19) This case clearly negates the view taken by the High Court in the impugned judgment.

20) That apart, we are of the view that amendment to the aforesaid Section vide Amendment Act, 2005 clinches the issue, beyond any pale of doubt, in favour of the appellants. This amendment now confers upon the daughter of the coparcener as well the status of coparcener in her own right in the same manner as the son and gives same rights and liabilities in the coparcener properties as she would have had if it had been son. The amended provision reads as under:

“6. Devolution of interest in coparcenary property.―(1) On and from the commencement of the Hindu Succession (Amendment) Act, 2005 (39 of 2005), in a Joint Hindu family governed by the Mitakshara law, the daughter of a coparcener shall,―

(a) by birth become a coparcener in her own right the same manner as the son;

(b) have the same rights in the coparcenery property as she would have had if she had been a son;

(C) be subject to the same liabilities in respect of the said coparcenery property as that of a son,

and any reference to a Hindu Mitakshara coparcener shall be deemed to include a reference to a daughter of a coparcener:

Provided that nothing contained in this sub-section shall affect or invalidate any disposition or alienation including any partition or testamentary disposition of property which had taken place before the 20th day of December, 2004.

(2) Any property to which a female Hindu becomes entitled by virtue of sub-section (1) shall be held by her with the incidents of coparcenary ownership and shall be regarded, notwithstanding anything contained in this Act or any other law for the time being in force, as property capable of being disposed of by her by testamentary disposition.

(3) Where a Hindu dies after the commencement of the Hindu Succession (Amendment) Act, 2005 (39 of 2005), his interest in the property of a Joint Hindu family governed by the Mitakshara law, shall devolve by testamentary or intestate succession, as the case may be, under this Act and not by survivorship, and the coparcenery property shall be deemed to have been divided as if a partition had taken place and,―

(a) the daughter is allotted the same share as is allotted to a son;

(b) the share of the pre-deceased son or a pre-deceased daughter, as they would have got had they been alive at the time of partition, shall be allotted to the surviving child of such pre-deceased son or of such pre-deceased daughter; and

(c) the share of the pre-deceased child of a pre-deceased son or of a pre-deceased daughter, as such child would have got had he or she been alive at the time of the partition, shall be allotted to the child of such pre-deceased child of the pre-deceased son or a pre-deceased daughter, as the case may be.

Explanation.―For the purposes of this sub-section, the interest of a Hindu Mitakshara coparcener shall be deemed to be the share in the property that would have been allotted to him if a partition of the property had taken place immediately before his death, irrespective of whether he was entitled to claim partition or not.

(4) After the commencement of the Hindu Succession (Amendment) Act, 2005 (39 of 2005), no court shall recognise any right to proceed against a son, grandson or great-grandson for the recovery of any debt due from his father, grandfather or great-grandfather solely on the ground of the pious obligation under the Hindu law, of such son, grandson or great-grandson to discharge any such debt:

Provided that in the case of any debt contracted before the commencement of the Hindu Succession (Amendment) Act, 2005 (39 of 2005), nothing contained in this sub-section shall affect―

(a) the right of any creditor to proceed against the son, grandson or great-grandson, as the case may be; or

(b) any alienation made in respect of or in satisfaction of, any such debt, and any such right or alienation shall be enforceable under the rule of pious obligation in the same manner and to the same extent as it would have been enforceable as if the Hindu Succession (Amendment) Act, 2005 (39 of 2005) had not been enacted.

Explanation.―For the purposes of clause (a), the expression “son”, “grandson” or “great-grandson” shall be deemed to refer to the son, grandson or great-grandson, as the case may be, who was born or adopted prior to the commencement of the Hindu Succession (Amendment) Act, 2005 (39 of 2005).

(5) Nothing contained in this section shall apply to a partition, which has been effected before the 20th day of December, 2004.

Explanation.―For the purposes of this section “partition” means any partition made by execution of a deed of partition duly registered under the Registration Act, 1908 (16 of 1908) or partition effected by a decree of a court.]”

21) The effect of this amendment has been the subject matter of pronouncements by various High Courts, in particular, the issue as to whether the right would be conferred only upon the daughters who are born after September 9, 2005 when Act came into force or even to those daughters who were born earlier. Bombay High Court in Vaishali Satish Gonarkar v. Satish Keshorao Gonarkar2 had taken the view that the provision cannot be made applicable to all daughters born even prior to the amendment, when the Legislature itself specified the posterior date from which the Act would come into force. This view was contrary to the view taken by the same High Court in Sadashiv Sakharam Patil v. Chandrakant Gopal Desale3. Matter was referred to the Full Bench and the judgment of the Full Bench is reported as Badrinarayan Shankar Bhandari v. Omprakash Shankar Bhandari4. The Full Bench held that clause (a) of sub-section (1) of Section 6 would be prospective in operation whereas clause (b) and (c) and other parts of sub-section (1) as well as sub-section (2) would be retroactive in operation. It held that amended Section 6 applied to daughters born prior to June 17, 1956 (the date on which Hindu Succession Act came into force) or thereafter (between June 17, 1956 and September 8, 2005) provided they are alive on September 9, 2005 i.e. on the date when Amended Act, 2005 came into force. Orissa, Karnataka and Delhi High Court have also held to the same effect5.

22) The controversy now stands settled with the authoritative pronouncement in the case of Prakash & Ors. v. Phulavati & Ors.6 which has approved the view taken by the aforesaid High Courts as well as Full Bench of the Bombay High Court. Following discussion from the said judgment is relevant:

“17. The text of the amendment itself clearly provides that the right conferred on a “daughter of a coparcener” is “on and from the commencement of the Hindu Succession (Amendment) Act, 2005”. Section 6(3) talks of death after the amendment for its applicability. In view of plain language of the statute, there is no scope for a different interpretation than the one suggested by the text of the amendment. An amendment of a substantive provision is always prospective unless either expressly or by necessary intendment it is retrospective. [Shyam Sunder v. Ram Kumar, (2001) 8 SCC 24, paras 22 to 27] In the present case, there is neither any express provision for giving retrospective effect to the amended provision nor necessary intendment to that effect. Requirement of partition being registered can have no application to statutory notional partition on opening of succession as per unamended provision, having regard to nature of such partition which is by operation of law. The intent and effect of the amendment will be considered a little later. On this finding, the view of the High Court cannot be sustained.

18. The contention of the respondents that the amendment should be read as retrospective being a piece of social legislation cannot be accepted. Even a social legislation cannot be given retrospective effect unless so provided for or so intended by the legislature. In the present case, the legislature has expressly made the amendment applicable on and from its commencement and only if death of the coparcener in question is after the amendment. Thus, no other interpretation is possible in view of the express language of the statute. The proviso keeping dispositions or alienations or partitions prior to 20-12-2004 unaffected can also not lead to the inference that the daughter could be a coparcener prior to the commencement of the Act. The proviso only means that the transactions not covered thereby will not affect the extent of coparcenary property which may be available when the main provision is applicable. Similarly, Explanation has to be read harmoniously with the substantive provision of Section 6(5) by being limited to a transaction of partition effected after 20-12-2004. Notional partition, by its very nature, is not covered either under the proviso or under sub-section (5) or under the Explanation.

19. Interpretation of a provision depends on the text and the context. [RBI v. Peerless General Finance & Investment Co. Ltd., (1987) 1 SCC 424, p. 450, para 33] Normal rule is to read the words of a statute in ordinary sense. In case of ambiguity, rational meaning has to be given. [Kehar Singh v. State (Delhi Admn.), (1988) 3 SCC 609 : 1988 SCC (Cri) 711] In case of apparent conflict, harmonious meaning to advance the object and intention of legislature has to be given. [District Mining Officerv. TISCO, (2001) 7 SCC 358]

20. There have been number of occasions when a proviso or an explanation came up for interpretation. Depending on the text, context and the purpose, different rules of interpretation have been applied. [S. Sundaram Pillai v. V.R. Pattabiraman, (1985) 1 SCC 591]

21. Normal rule is that a proviso excepts something out of the enactment which would otherwise be within the purview of the enactment but if the text, context or purpose so require a different rule may apply. Similarly, an explanation is to explain the meaning of words of the section but if the language or purpose so require, the explanation can be so interpreted. Rules of interpretation of statutes are useful servants but difficult masters. [Keshavji Ravji & Co. v. CIT, (1990) 2 SCC 231 : 1990 SCC (Tax) 268] Object of interpretation is to discover the intention of legislature.

22. In this background, we find that the proviso to Section 6(1) and sub-section (5) of Section 6 clearly intend to exclude the transactions referred to therein which may have taken place prior to 20-12-2004 on which date the Bill was introduced. Explanation cannot permit reopening of partitions which were valid when effected. Object of giving finality to transactions prior to 20-12-2004 is not to make the main provision retrospective in any manner. The object is that by fake transactions available property at the introduction of the Bill is not taken away and remains available as and when right conferred by the statute becomes available and is to be enforced. Main provision of the amendment in Sections 6(1) and (3) is not in any manner intended to be affected but strengthened in this way. Settled principles governing such transactions relied upon by the appellants are not intended to be done away with for period prior to 20-12-2004. In no case statutory notional partition even after 20-12-2004 could be covered by the Explanation or the proviso in question.

23. Accordingly, we hold that the rights under the amendment are applicable to living daughters of living coparceners as on 9-9-2005 irrespective of when such daughters are born. Disposition or alienation including partitions which may have taken place before 20-12-2004 as per law applicable prior to the said date will remain unaffected. Any transaction of partition effected thereafter will be governed by the Explanation.”

23) The law relating to a joint Hindu family governed by the Mitakshara law has undergone unprecedented changes. The said changes have been brought forward to address the growing need to merit equal treatment to the nearest female relatives, namely daughters of a coparcener. The section stipulates that a daughter would be a coparcener from her birth, and would have the same rights and liabilities as that of a son. The daughter would hold property to which she is entitled as a coparcenary property, which would be construed as property being capable of being disposed of by her either by a will or any other testamentary disposition. These changes have been sought to be made on the touchstone of equality, thus seeking to remove the perceived disability and prejudice to which a daughter was subjected. The fundamental changes brought forward about in the Hindu Succession Act, 1956 by amending it in 2005, are perhaps a realization of the immortal words of Roscoe Pound as appearing in his celebrated treaties, The Ideal Element in Law, that “the law must be stable and yet it cannot stand still. Hence all thinking about law has struggled to reconcile the conflicting demands of the need of stability and the need of change.”

24) Section 6, as amended, stipulates that on and from the commencement of the amended Act, 2005, the daughter of a coparcener shall by birth become a coparcener in her own right in the same manner as the son. It is apparent that the status conferred upon sons under the old section and the old Hindu Law was to treat them as coparceners since birth. The amended provision now statutorily recognizes the rights of coparceners of daughters as well since birth. The section uses the words in the same manner as the son. It should therefore be apparent that both the sons and the daughters of a coparcener have been conferred the right of becoming coparceners by birth. It is the very factum of birth in a coparcenary that creates the coparcenary, therefore the sons and daughters of a coparcener become coparceners by virtue of birth. Devolution of coparcenary property is the later stage of and a consequence of death of a coparcener. The first stage of a coparcenary is obviously its creation as explained above, and as is well recognized. One of the incidents of coparcenary is the right of a coparcener to seek a severance of status. Hence, the rights of coparceners emanate and flow from birth (now including daughters) as is evident from sub-s (1)(a) and (b).

25) Reference to the decision of this Court, in the case of State Bank of India v. Ghamandi Ram7 in essential to understand the incidents of coparceneryship as was always inherited in a Hindu Mitakshara coparcenary:

“According to the Mitakshara School of Hindu Law all the property of a Hindu joint family is held in collective ownership by all the coparceners in a quasi-corporate capacity. The textual authority of the Mitakshara lays down in express terms that the joint family property is held in trust for the joint family members then living and thereafter to be born (See Mitakshara, Ch. I. 1-27). The incidents of coparcenership under the Mitakshara law are: first, the lineal male descendants of a person up to the third generation, acquire on birth ownership in the ancestral properties is common; secondly, that such descendants can at any time work out their rights by asking for partition; thirdly, that till partition each member has got ownership extending over the entire property, conjointly with the rest; fourthly, that as a result of such co-ownership the possession and enjoyment of the properties is common; fifthly, that no alienation of the property is possible unless it be for necessity, without the concurrence of the coparceners, and sixthly, that the interest of a deceased member lapses on his death to the survivors.”

26) Hence, it is clear that the right to partition has not been abrogated.

The right is inherent and can be availed of by any coparcener, now even a daughter who is a coparcener.

27) In the present case, no doubt, suit for partition was filed in the year 2002. However, during the pendency of this suit, Section 6 of the Act was amended as the decree was passed by the trial court only in the year 2007. Thus, the rights of the appellants got crystallised in the year 2005 and this event should have been kept in mind by the trial court as well as by the High Court. This Court in Ganduri Koteshwaramma & Anr. v. Chakiri Yanadi & Anr.8 held that the rights of daughters in coparcenary property as per the amended S. 6 are not lost merely because a preliminary decree has been passed in a partition suit. So far as partition suits are concerned, the partition becomes final only on the passing of a final decree. Where such situation arises, the preliminary decree would have to be amended taking into account the change in the law by the amendment of 2005.

28) On facts, there is no dispute that the property which was the subject matter of partition suit belongs to joint family and Gurulingappa Savadi was propositus of the said joint family property. In view of our aforesaid discussion, in the said partition suit, share will devolve upon the appellants as well. Since, Savadi died leaving behind two sons, two daughters and a widow, both the appellants would be entitled to 1/5th share each in the said property. Plaintiff (respondent No.1) is son of Arun Kumar (defendant No.1). Since, Arun Kumar will have 1/5th share, it would be divided into five shares on partition i.e. between defendant No.1 Arun Kumar, his wife defendant No.2, his two daughters defendant Nos.3 and 4 and son/plaintiff (respondent No.1). In this manner, the plaintiff/respondent No.1 would be entitled to 1/25th share in the property.

29) The appeals are allowed in the aforesaid terms and decree of partition shall be drawn by the trial court accordingly.

No order as to costs.

Notes:

1 (2006) 8 SCC 656

2 AIR 2012 Bom 110

3 2011 (5) Bom CR 726

4 AIR 2014 Bom 151

5 AIR 2008 Ori 133: Pravat Chandra Pattnaik v. Sarat Chandra Pattnaik; ILR 2007 Kar 4790: Sugalabai v. Gundappa A. Maradi and 197 (2013) DLT 154: Rakhi Gupta v. Zahoor Ahmad

6 (2016) 2 SCC 36

7 AIR 1969 SC 1330.

8 (2011) 9 SCC 788