There was a slight change in procedure of filing GSTR 3B from today i.e. 21.02.2018 what GSTN termed as ‘Filing GSTR 3B is now made more user friendly’. This write the highlights of the changes made in procedure and also detail walk through by way of screenshots of the changed procedure.

Highlights of Changes–

1. No ‘Submit’ process now

2. Cash ledger balances shall appear on the screen while payment of tax

3. Tax payable as per data entered will automatically be filled along with ITC utilisation.

4. ITC utilisation can be edited

5. Preview of GSTR 3B is available now

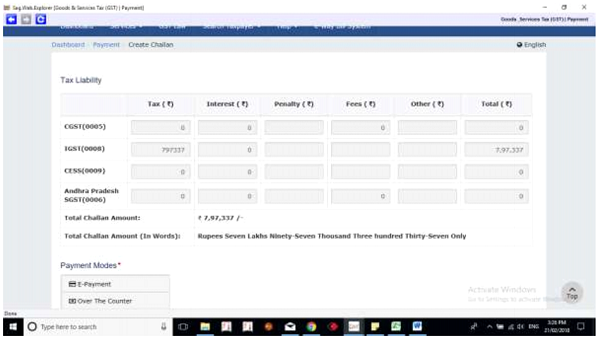

6. Challan will be automatically generated filling the correct columns for any short in payment of tax in Electronic Cash Ledger

7. Late fee is not appearing in the normal process of filing. Hope the same will be rectified soon.

8. As soon as payment is offset, NO reversal again

9. No option to Reset GSTR 3B

Screenshots of the process are hereunder:-

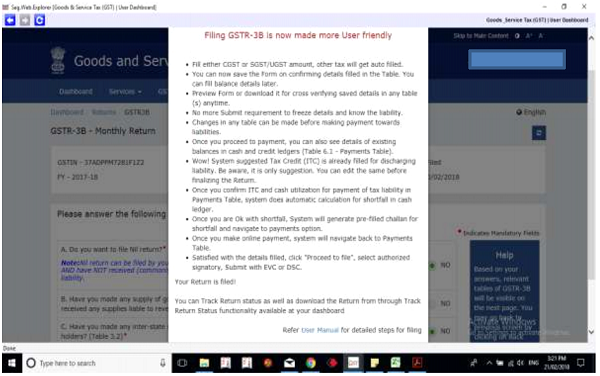

As soon as we select GSTR 3B tile, the following screen appears:

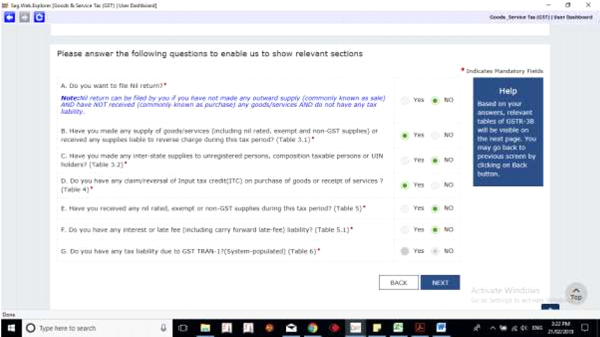

As soon as we click ‘OK’ on reading the new procedure, the old screen which asks for questions for which required tables only will be displayed appears.

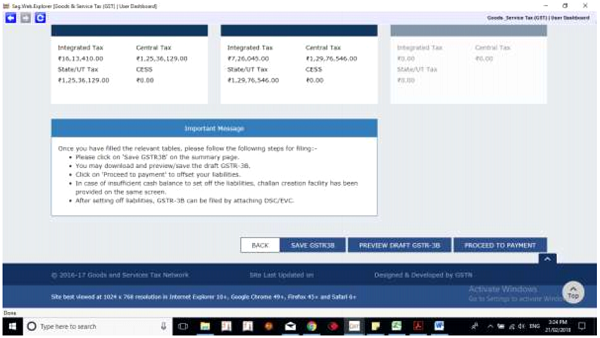

After filing the data in the relevant tables, four options appear

- Save GSTR 3B

- Preview Draft GSTR 3B

- Proceed to Payment

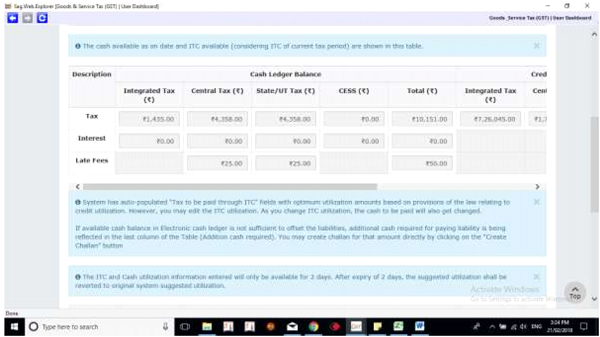

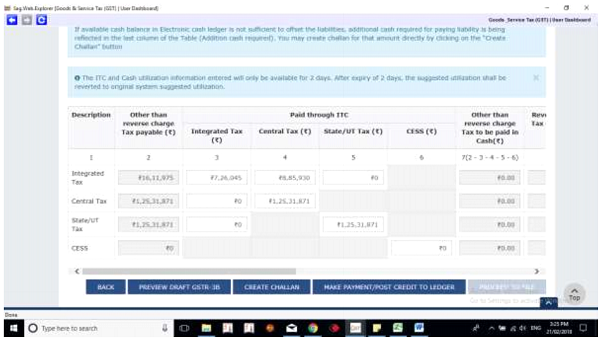

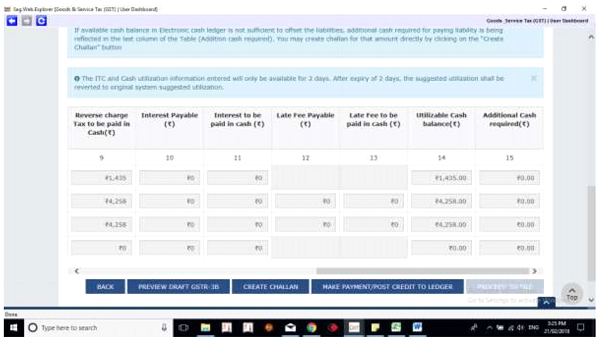

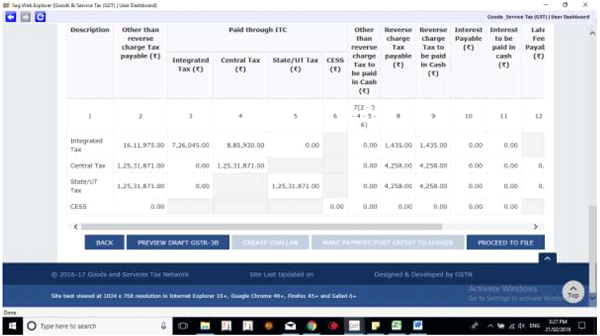

As soon as we click on ‘Proceed to Payment’, the following screen appears which shows the electronic cash ledger and electronic credit ledger balances under various heads.

Below the ledger balances, the payable amount as per data filled in this month GSTR 3B automatically offset by available ITC balance and available cash balance appears. Last column shows the amount payable in cash.

We have now 4 options available

- Back

- Preview Draft GSTR 3B

- Create Challan

- Make Payment/Post Credit to Ledger

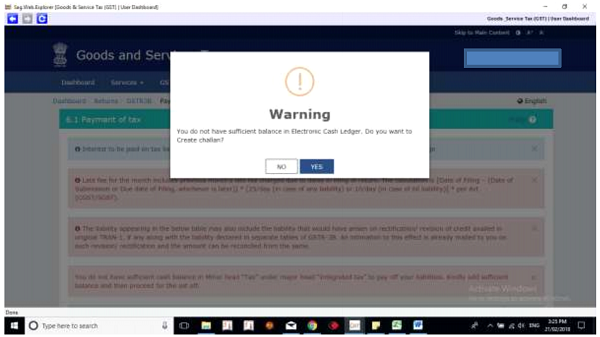

Whenever, balances are not sufficient to offset liability, warning appears as folllows:-

The challan is created filling the necessary taxes or fee or interest or penalty to be paid. This reduces the risk of payment under wrong heads which inturn reduces waiting time for refund f tax paid under wrong head.

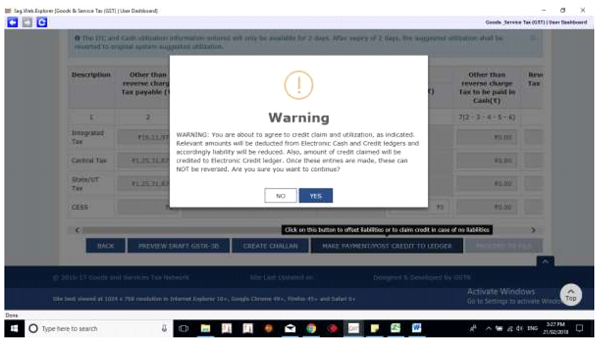

When the sufficient balance is available, the following warning appears as soon as ‘Make Payment/Post credit to ledger’ button is clicked.

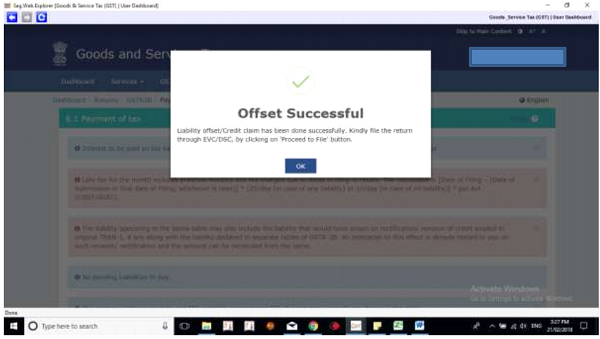

As soon as balances are offset, the following message appears.

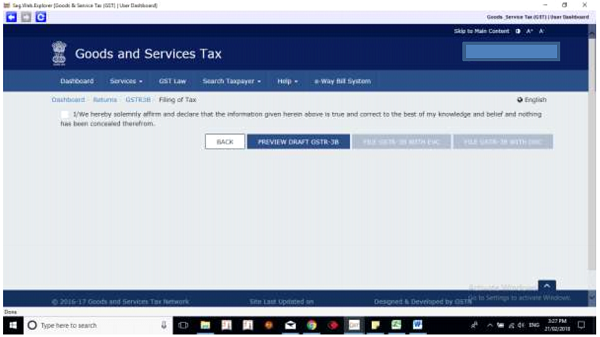

Next is to ‘Proceed to file’

As we are already aware, we have 2 options of signing the return

- EVC (Electronic Verification Code)

- DSC (Digital Signature Certificate)

Date and time of filing along with ARN (Application Reference Number) appears on the screen.

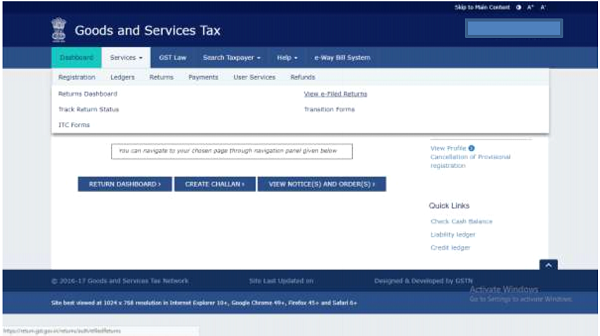

Even one misses to save their ARN after filing of return, now GSTN has provided a facility under head ‘ Services’, then ‘Returns’ and ‘View E-Filed Returns’ which lists all the returns filed along with their ARN

(The author can be reached at ca.vinaygandhi@gmail.com)

HOW TO RESET GSTR3B AFTER SUBMITTING

i want to revise the amount in GSTR 3B .So please help me out.how to rectify.i have submitted the file but yet not filed.

I HAVE SUBMITED GSTR3B COT 2018 WRONG NOT FILE YET SO WHAT CAN POSSIBLE RESET

I have submitted the 3b get return but itc value of sales tax and central tax are wrong what should I do

I have wrongly entered values in GSTR3b. I have not yet filed it but cannot reset to enter the correct amount. Can you please help.

Sir, While filing gstr3b with only exempted purchases and exempted sales the following error is generating

“System Error”

Unable to file GSTR3b due to above error

I had submiited the gstr3b for the month of november,2017 on dtd.18/02/18,but not filled,Now the gstr3b format change on 21/02/18.So, the system can not load the the gstr 3b and error appear in the screen “You need to save your form after page load.”

sir i have a doubt after payment of november penalty the form is saying that you need to save page after reload and noot getting offset pls help me in this error

Nice information sir

but i have one query , when i have to file nil return there is also two option preview draft & proceed to payment , which option should i choose .