Charitable Trusts De-Registration (Cancellation) Drive By Charity Commissioner, Maharashtra

(For violation of sec. 22(3A) and 22(3B) of the Bombay Public Trusts Act, 1950)

1. Background:

The Hon’ble Charity Commissioner, Maharashtra State, Mumbai vide Notification dated DGIPR/2016-2017/4109 had notified the Special Drive, 2017 Scheme for speedy disposal of all the Change Reports (Change in Trustees / Properties) during the period 01/01/2017 – 31/01/2017. Mode details about the same can be read here:

https://taxguru.in/income-tax/charity-commissioner-maharashtra-state-special-drive-2017.html/

The Scheme was a super-hit Scheme in the history of the Charity Office Compliances, which saw huge numbers of orders being passed approving the changes in Schedule – I (Record of Trustees / Properties) of various Trusts. The Special Drive had also made it mandatory to file the Audit Reports with the Charity Office.

Thereafter, by Circular dated 22/06/2017, the Ho. Charity Commissioner Maharashtra State made it mandatory for all the Trusts to submit the Trust Accounts online on the website: https://charity.maharashtra.gov.in. It is evident that the office of the Charity Commissioner is moving towards complete digitization and all the records of the Trust shall be held online.

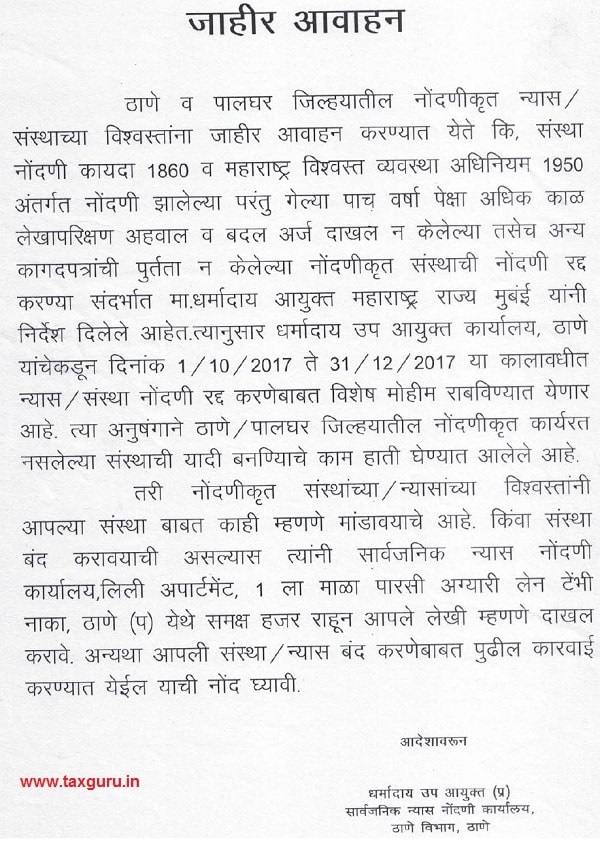

Vide Circular Notification No. 4082/2017 (Serial 506) dated 01/08/2017, the Charity Commissioner, Maharashtra State has started De-Registration Drive of all the non-compliant and erring Trusts. Many regional Dy. / Asst. Charity Commissioner Offices have given last opportunity to clear the compliances of the Trust during 01/10/2017 to 31/12/2017.

2. Need for De-Registration of the Trusts:

With the increasing number of the NGOs (mainly, Trusts registered under the Bombay Public Trusts Act, 1950), the office of the Charity Commissioner has come under earnest responsibility of overlooking the functioning of such public charitable trusts.

In many cases, it is found that the Trust is existent only on paper and no actual activity is being carried out by the Trust and therefore such Trusts have ceased to be useful for the charity of the general public at large. In some cases, it is found that there is financial embezzlement, in terms of the properties of the Trust being taken by the Trustees under the garb of use for public charitable purposes. In few cases it is also observed that the activities of the Trust are in violation of the directions of the Charity Commissioner.

The government is heavily dependent on the Office of the Charity Commissioner to ensure that the donations / grants / contributions of such charitable institutions reach to the general public and welfare activities is carried out at grass-root level.

It is estimated that more than 50% of the Trusts have not filed their Accoun78ts with the Charity Commissioner or Change Reports (in Schedule III / III-A) for recording the change in Trustees / Properties on the record of the Trust.

In order to weed out such Trusts from the working and compliant Trusts, the Charity Commissioner, Maharashtra State has taken steps to de-register / cancel the registration of such Trusts.

It is pertinent to note that recently the Ministry of Corporate Affairs (‘MCA’) which exercise power over the Sec. 8 companies, i.e. charitable companies, had cancelled registration of many such sec. 8 companies for failure to file their Annual Returns and other such statutory compliances.

3. Steps to take to avoid cancellation of Trust Registration:

The Trusts are requested to forthwith undertake the following compliances without any further delay:

- Accounts of the Trusts be submitted online on the website https://charity.maharashtra.gov.in for atleast five (5) years, irrespective of the fact that such accounts have been duly submitted physically to the office of the respective Deputy / Asst. Charity Commissioner; In case Accounts of the Trust are not audited, immediate steps shall be taken for drawing up of Financial Statements and Audit of such Accounts.

- Upon Filing of Accounts, Trust Accounts can be generated on the aforesaid website. The Trustees are requested to file all the Change Reports from the beginning (inception of the Trust till date) and update the Schedule – I of the Trust online on the portal; Alternatively, the Trust may file the pending Change Reports physically for the time-being and simultaneously file the same online.

- Complete records of the Trust’s movable and immovable properties is maintained in the Register specified.

4. Advantages of the Scheme:

- This Special Drive shall help facilitate various stakeholders in ascertaining the genuine Trusts from other non-compliant Trusts.

- Complete digitization of records is ensured and all the details of all the Trusts are available online at the click of single button. Presently, Accounts of the Trusts which are filed online can be viewed by the general public free-of-cost.

- All future Change Reports (to record change in Trustees / Properties) shall be done online which shall facilitate early disposals of such Change Applications in Schedule – III. Currently, it is observed that change reports of certain Trusts have been pending for more than 10 years. Online Applications for change are easy to track and hence, such disposal time is expected to drop shortly to less than 3 (three) months.

5. Consequences of not filing Change reports / Audit Reports:

Failing to file the Change Reports/Audit Reports may give rise to Assessment by Charity commissioner Authority which may lead to fines and penalties. Chapter VI of the Bombay Public Trusts Act, 1950 empowers the Charity Commissioner Authorities to make requisite enquiries by grating powers of inspection & supervision (sec. 37), soliciting explanations on accounts (sec. 38), to institute inquiries (sec. 41B), suspension / removal of Trustees (sec/ 41D) among others.

The process of cancellation of registration of the Trusts, which have failed to file the Audit Reports for the past years, has already started and Notices are being sent to the erring Trusts. Upon cancellation of the Trust Registration, the properties of the Trust shall be transferred to the custody of the Charity Commissioner and the Trustees shall cease to exercise the power over such Trust properties.

It is observed that some of the Trusts have huge properties in the nature of Immovable Properties, Bonds, Unit Trusts but have failed to file accounts or record changes in Trustees / Properties. In such cases, the properties shall be transferred to the custody of the Charity Commissioner and the Trustees shall cease to exercise their power over such properties including the Bank and Fixed Deposit Accounts.

DETAILS ABOUT THE AUTHOR

|

|

| CA Navinchandra Premji Dedhia | CA Rohan Navin Dedhia |

| ICAI Membership No. 037421 | ICAI Membership No. 160814 |

| Address: 125 / 126, Ganesh Tower, Dada Patil Road, Thane West – 400602. | |

|

Email id: navin@ndcca.in |

|

|

Mobile: 9892678133 |

|

how to find the list of deregistration trust of mumbai year 1960 to 2022

how to find a trust live/dead status through online ? registration number is D-3, Nagpur

charity.maharashtra.gov.in this website is not working.

It is an old trust with no activity at all as only few now living. What site do we have to cancel or de-register trust on-line. Our CA says he has filed all returns every year including current year. Trust office orally says nothing filed. How do we verify? Shall be obliged for your help.Thanks.

Sir,

We are an NGO (regd under 80 G)receiving money to conduct workshops .Do we have to charge gst for workshops? we credit donation a/c.

Please advise.

can i get a draft of application to de register the trust??

Sir thanks for a very well informative and narrated article. Great job by you sirs. Please keep guiding us.

Hope the trust registration no. F 46795 Mumbai must be De register immediately.

Hope साधना charitable trust is out of this list.

Sir very nice and informative Article.