After the 50 day Tests, it’s time for a 50-over match: All you need to know about the Pradhan Mantri Garib Kalyan Yojana, 2016

After the 50 day Tests, it’s time for a 50-over match: All you need to know about the Pradhan Mantri Garib Kalyan Yojana, 2016

Introduction:

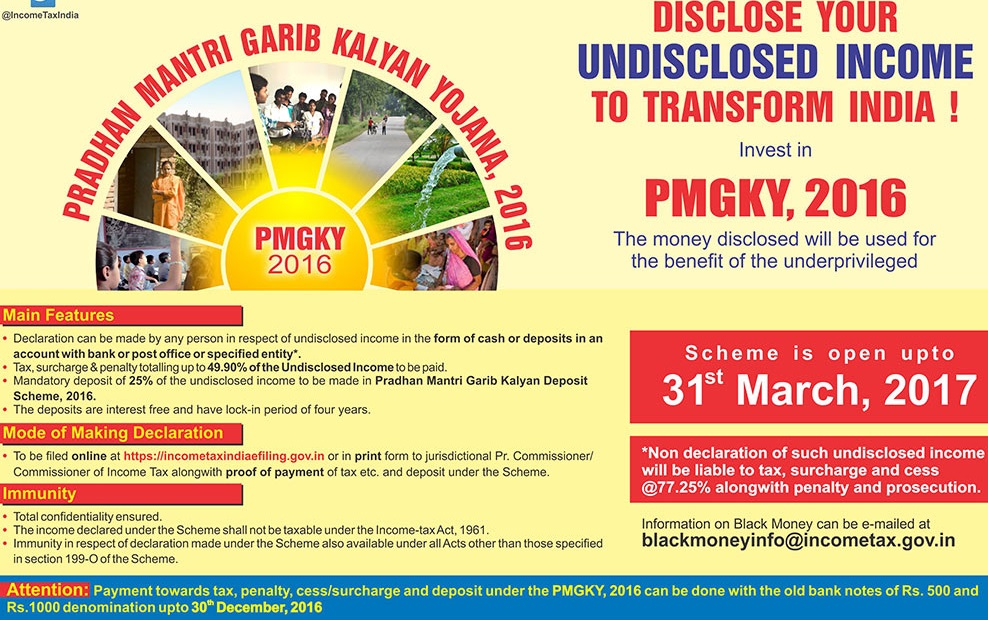

It’s time to be back to one-day matches after scruffing it out for almost 50 days during the demonetisation cycle. The Govt. has opened up its window for disclosures of income with a 49.9% tax rate under the Pradhan Mantri Garib Kalyan Yojana, with a stern motive of helping out the poor and eliminate that “too big a gap” amongst the masses in terms of income. Let us discern what is there in the Pradhan Mantri Garib Kalyan Yojana, 2016 and would the results of this scheme be the same like the IDS that left the Govt. lamenting on how to put a stranglehold on black money. The whole article has been divided into set of 2 question power plays consisting of 10 questions each for easy and quick understanding.

Power Play Questions 1-10:

Question 1: What is Pradhan Mantri Garib Kalyan Yojana, 2016 (‘PMGKY, 2016’)?

Answer: This Scheme is an opportunity for persons having undisclosed income in form of cash or deposits in an account maintained with specified entities (which includes RBI, Banks, Post-offices etc.) to declare such income and pay tax, surcharge and penalty on such declared income.

Question 2: When will PMGKY commence?

Answer: As per Govt. notification, the Scheme has commenced on 17th December 2016 and shall remain open for declarations/deposit up to 31st March, 2017.

Question 3: Who is a declarant under PMGKY, 2016?

Answer: As per Section 199B, a ‘declarant’ means a person making declaration under the Scheme, in respect of any income in the form of cash or deposit.

Question 4: What is the scope of PMGKY, 2016?

Answer: A declaration under the aforesaid scheme may be made in respect of any income in the form of cash or deposit in an account maintained by the person with a specified entity.

Question 5: For which Assessment years, can the declarations be made?

Answer: Declarations can be made for any income chargeable to tax under the Income Tax Act for any assessment year commencing on or before the 1st day of April, 2017.

Question 6: Can a declarant claim deduction in respect of any expenditure or allowance against the declared income?

Answer: No deduction can be claimed in respect of any expenditure or allowance against the income for which a valid declaration is made.

Question 7: Can a declarant set-off losses against the declared income?

Answer: No set-off of losses is allowed against the income for which a valid declaration is made.

Question 8: What is the meaning of specified entities?

Answer: Following entities are covered as specified entities;

(A) Reserve Bank of India

(B) Banks

(C) Post-office

(D) Any other entity as may be notified in this behalf

Question 9: What is the Tax rate under the Scheme?

Answer: As per Section 199D, the person making a declaration under the Scheme would be chargeable to tax at the rate of thirty percent of the undisclosed income.

Question 10: What is the rate of surcharge and penalty levied under the Scheme?

Answer: As per Section 199D (2), the amount of tax chargeable under the Scheme shall be increased by a surcharge, to be called Pradhan Mantri Garib Kalyan Cess calculated at the rate of thirty-three percent of such tax. In addition to this, as per Section 199E, penalty at the rate of ten percent, of the undisclosed income shall be payable. Thus, tax, surcharge and penalty totalling in all to 49.9 percent of declared income needs to be paid.

Power Play Questions 11-20:

Question 11: What is PMGKY Deposit Scheme, 2016?

Answer: As per Section 199F, the declarant shall be required to deposit an amount not less than 25% of the undisclosed income in the PMGKY Deposit Scheme, 2016. The deposit shall bear no interest and the amount deposited will have a lock-in period of four years from the date of deposit.

Question 12: What is the Time-limit for making declarations under PMGKY, 2016 and whether tax, surcharge and penalty needs to be paid first?

Answer: The declarations can be made any time before 31st March 2017. However, it may be noted that the tax, surcharge and penalty payable under this Scheme and deposit to be made in the Deposit Scheme, shall be paid before filing of declaration under the Scheme. Thus, declaration is to be accompanied by proof of payment of tax and proof of deposit in the PMGKY Deposit Scheme, 2016.

Question 13: How to make declarations and who can sign the declaration?

Answer: A declaration under this Scheme is to be made in Form-1 and after making such declarations the Principal CIT/CIT will issue an acknowledgement in Form-2 to the declarant within 30 days from the end of the month in which declaration is made.

Further, as per Section 199G, a declaration shall be made by a person competent to verify the return of income under Section 140 of the Income Tax Act, 1961.

Question 14: What are the modes available for filing of declarations?

Answer: Declaration can be filed in the following ways:

- Electronically under Digital Signature at https://incometaxindiaefiling.gov.in/.

- In a print form to Jurisdictional Principal Commissioner of Income Tax.

Question 15: What are the cases in which declarations are not eligible?

Answer: Declarations are not eligible in following cases:

- Person in respect of whom an order of detention has been made under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974.

- An offence punishable under Chapter IX or Chapter XVII of IPC, the Narcotic Drugs and Psychotropic Substances Act, 1985, Unlawful Activities (Prevention) Act, 1967, Prevention of Corruption Act, Benami Act and PMLA, 2002

- Person notified under Section 3 of the Special Court(Trial of Offences Relating to Transactions in Securities) Act, 1992

- Undisclosed foreign income or asset chargeable to tax under Black Money (UFIA) and Imposition of Tax Act, 2015.

Question 16: What are the circumstances where declaration shall be invalid?

Answer: As per Section 199, a declaration shall be void where a declaration has been made by misrepresentation or suppression of facts or without payment of tax and surcharge or penalty or without depositing the requisite amount in the PMGKY Deposit Scheme.

Question 17: Is tax, surcharge or penalty payable under the Scheme refundable?

Answer: As per Section 199K, any amount of tax, surcharge or penalty paid under the Scheme shall not be refundable under any circumstances.

Question 18: Will the amount of undisclosed income be included in the total income of the declarant under the Income-tax Act for any assessment year?

Answer: As per Section 199-I, the amount of undisclosed income shall not be included in the total income of the declarant under the Income-tax Act for any assessment year.

Question 19: Can a declarant in respect of undisclosed income referred to in section 199C or any amount of tax and surcharge paid thereon, file for re-opening of any assessment or reassessment made under the Income-tax Act or the Wealth-tax Act, 1957, or to claim any set-off or relief in any appeal, reference or other proceeding in relation to any such assessment or reassessment?

Answer: As per Section 199J, a declarant under this scheme shall not be entitled in respect of undisclosed income referred to in section 199C or any amount of tax and surcharge paid thereon, to re-open any assessment or reassessment made under the Income-tax Act or the Wealth-tax Act, 1957, or to claim any set-off or relief in any appeal, reference or other proceeding in relation to any such assessment or reassessment.

Question 20: Can the declarations made under the Scheme be admissible in evidence against the declarant for the purpose of any proceeding under any Act other than Acts mentioned in Question 15 above?

Answer: No, the contents of the declaration shall not be admissible in evidence against the declarant for the purpose of any proceeding under any Act other than the Acts referred in answer to Question 15 above.

Concluding remarks:

The Govt. with the PMGKY, 2016 has provided another opportunity for those persons who have deposited the money in their accounts with specified entities and want to declare such undisclosed income. This presents them with a chance of getting their past sins forgotten by paying half of their hard earned black money to the Government. However, just like what happened with IDS which ended in September 2016, it is highly unlikely that people will be coming forward in making PMGKY at least a success. By nature, if they have not made the disclosures in IDS, they will surely not be doing it even under the PMGKY, 2016. Let us wait how the Govt. reacts and encircles such persons who have got their undisclosed income in the form of cash and deposits with the specified entities. The ball is in their Court, if not 50%, they will be taxing such income at minimum 77.25% along with penalty and prosecution.

(The author is a practising Chartered Accountant based in Delhi and can be reached at guptaakarsh92@gmail.com or +91 9717244288)

Disclaimer: The contents of this document are solely for informational purpose. While due care has been taken in preparing the above article, possibility of any errors and omissions cannot be ruled out. Moreover, the views expressed herein above are solely author’s personal views. No part of it should be copied or reproduced without written or express permission of the Author.

Can the currency in old notes be declared as income under PMGKY 2016?