As a step forward to curb black money, bank notes of existing series of denomination of the value of five hundred rupees and one thousand rupees (hereinafter referred to as specified bank notes) issued by the Reserve Bank of India have been ceased to be legal tender with effect from the 9th November, 2016.

In the wake of declaring specified bank notes as not legal tender, there have been representations and suggestions from experts that instead of allowing people to find illegal ways of converting their black money into black again, the Government should give them an opportunity to pay taxes with heavy penalty and allow them to come clean so that not only the Government gets additional revenue for undertaking activities for the welfare of the poor but also the remaining part of the declared income legitimately comes into the formal economy.

Therefore, an alternative scheme namely, the ‘Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016‘ (PMGKY) is introduced in the Bill.

The salient features of the aforesaid scheme is as follows:

- Any person may make, after commencement of this scheme a declaration in respect of any income, in the form of cash or deposit in an account, which is chargeable to tax under Income tax act for AY 2016-17 or any earlier AY.

- No deduction in respect of any expenditure or allowance or setoff of any loss shall be allowed against the declared income.

- The undisclosed income declared under this scheme will be chargeable to tax @ 30%.

- Penalty @ 10% of undisclosed income will be levied.

- Further, a surcharge to be called ‘Pradhan Mantri Garib Kalyan Cess’ @ 33% of tax amount is also proposed to be levied.

- So effectively a total of 49.90% of declared undisclosed income will be payable as tax, surcharge and penalty.

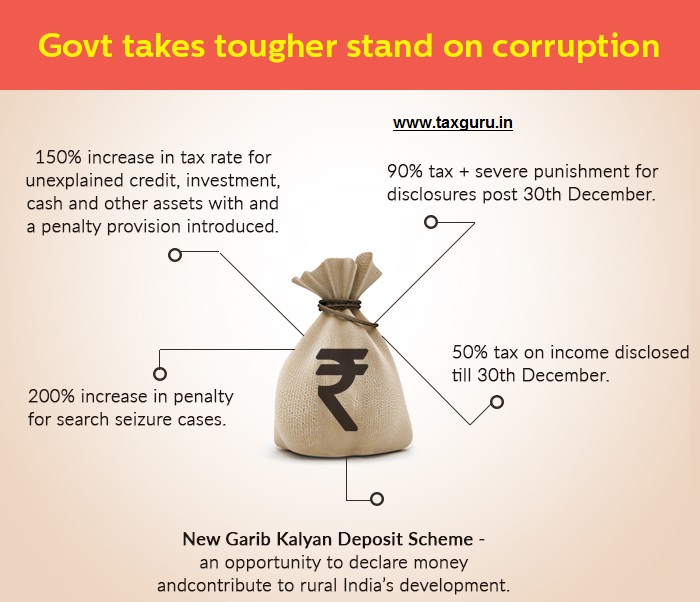

- In addition to tax, surcharge and penalty, the declarant shall have to deposit at least 25% of undisclosed income in ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’.

- The deposit shall bear no interest and the amount deposited shall be allowed to be withdrawn after four years from the date of deposit.

- The tax, surcharge and penalty payable in respect of the undisclosed income, shall be paid before filing of declaration.

- The amount of at least 25% of deposit will also have to be deposited before the filing of

Further the tax and penal provisions of Income Tax Act has been proposed to be more stringent in case a person does not declare his undisclosed Income in accordance with aforesaid scheme. Some significant amendments proposed to be made in Income Tax Act is as follows:

♦ Amendment in Section 115BBE:

Where the total income of an assesse, whether reflected in the ROI furnished under sec 139 or determined by AO, includes any income referred to in section 68, 69, 69A, 69B, 69C or 69D, the income tax payable shall be aggregate of-

i. Amount of Income tax calculated on the above referred income at the rate of 60%; and

ii. Amount of income tax with which the assesse would have been chargeable had his total income been reduced by the amount of income referred in clause (i) above.

Hence the earlier rate of 30% in case of income referred to in Section 68 etc has proposed to be increased to 60%.

♦ Amendment in Section 271AAB:

- In case of search proceedings, the earlier provision of levy of penalty of

- 10% of undisclosed income in case assesse admits such income in a statement under sec 132(4), and specifies & substantiates the manner in which such income has been derived and pays the tax together with interest in respect of undisclosed income along with furnishing of ROI declaring such undisclosed income;

- 20% of undisclosed income in case assesse does not admits such income, but pays the tax together with interest in respect of undisclosed income along with furnishing of ROI declaring such undisclosed income;

- 30% to 90% in all other cases,

is made applicable only if search proceeding have been instituted before the date on which the Taxation Laws (Second Amendment) Bill, 2016 receives the assent of the President

- A new clause has been introduced to levy penalty after the date on which the aforesaid bill got president nod, which are as follows:

- Penalty of 30% of undisclosed income in case assesse admits such income in a statement under sec 132(4), and specifies & substantiates the manner in which such income has been derived and pays the tax together with interest in respect of undisclosed income along with furnishing of ROI declaring such undisclosed income;

- 60% in all other cases.

♦ Introduction of a new section 271AAC:

- The Assessing Officer may, direct that, in a case where the income determined includes any income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D for any previous year, the assessee shall pay by way of penalty, in addition to tax payable under section 115BBE, a sum computed at the rate of 10% of the tax payable (i.e.10% of that 60%).

- Provided that the aforesaid penalty shall not be levied to the extent such income has been included by the assessee in the return of income under section 139 and the tax in accordance with section 115BBE has been paid on or before the end of the relevant previous year.

(Disclaimer: This write up is based on the understanding and interpretation of author and the same is not intended to be a professional advice.)

[The author is a Chartered Accountant and can also be reached at canitingoyal1994@gmail.com]