CS Rashmi H

Analysing the importance of CSR Spending and Consequences of Non-compliance of Section 135 of the Companies Act, 2013 (Corporate Social Responsibility).

Introduction:

Corporate Social Responsibility (CSR) is no longer just a compliance requirement in the modern world; it forms an integral part of the United Nations Sustainable Development Goals (UN-SDGs), aimed at achieving “peace and prosperity for people and the planet”. CSR initiatives support economic growth while addressing climate change, preserving oceans and forests, and fostering social welfare. CSR aligns the environmental, social, and economic aspects of sustainable development.

CSR Compliance under Section 135 of the Companies Act, 2013:

Every company having:

- a net worth of ₹500 crore or more, or

- a turnover of ₹1,000 crore or more, or

- a net profit of ₹5 crore or more

during the immediately preceding financial year is required to spend at least 2% of the average net profits of the company made during the three immediately preceding financial years on CSR activities.

- Set off of Excess CSR Spending

Where a company spends an amount in excess of the required 2% of average net profits, the Board of Directors may set off the excess against the CSR obligation of the succeeding three financial years, subject to the following conditions:

1. Such excess amount must not include any surplus arising out of CSR activities.

2. A Board Resolution must be passed approving the set-off and specifying the amount involved.

- Treatment of Unspent CSR Amount

If the company fails to spend the CSR amount during the relevant financial year, the Board must:

1. Specify the reasons for not spending the amount in its Board Report; and

2. Transfer the unspent amount to any of the following Central Government funds as specified in Schedule VII:

-

- Clean Ganga Fund

- Prime Minister’s National Relief Fund

- PM CARES Fund

- Any other fund set up by the Central Government for socio-economic development and the welfare of SC/ST, OBCs, minorities, and women.

- Timeline for transfer of CSR amount to fund specified above:

| Sl.no | Particulars | Timeline to transfer to fund as specified in Schedule VII |

| 1. | CSR Amount remaining unspent Other than ongoing CSR projects | Within 6 months from the end of the financial year |

| 2. | CSR Amount remaining unspent pursuant to ongoing project | Transfer to the Unspent CSR Account within 30 days from the end of the financial year.

↓ Amount to be spent for meeting CSR obligations as per the CSR policy by the Company within 3 Financial Years from the date of transfer the end of the financial year ↓ If the company fails to spend the amount within 3 years as its CSR amount, Company must transfer the amount to a Schedule VII fund within 30 days from the date of completion of the 3rd financial year. |

- Consequences of Non-transfer of the CSR amount unspent pertaining to ongoing and other than ongoing project as per sub-section (7) of section 135 of the Companies Act, 2013:

Company liable to pay penalty, Lower of below two:

| Twice the amount required to be transferred by the company to the Fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account (including unspent CSR amount of the previous years) | Rs.1 Crore |

*Officer in Default: Liable to penalty Lower of below two:

| 1/10th of the amount required to be transferred by the company to the Fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account (including CSR amount of the previous years) | Rs.2 Lakhs |

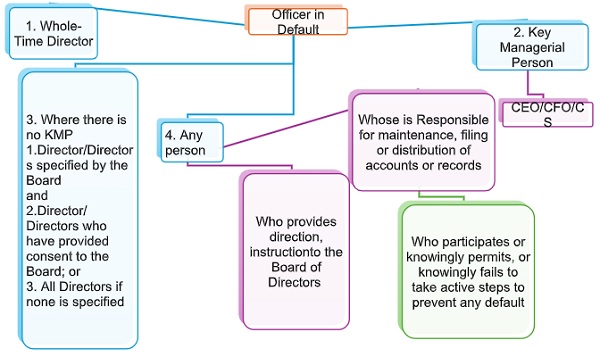

*Identification of Officer in default as per 2(60) of the Companies Act, 2013:

The following officers of the Company shall be liable to any penalty, or punishment for default of the provisions of the Companies Act, 2013:

ROC adjudication order to pay penalty for violation of 135(7) of the Companies Act, 2013 in the matter of Pace Digitek Limited, under the ROC Bangalore:

Pace Digitek Limited, a Public Company incorporated in 2007 with its registered office in Bangalore, Karnataka, falls under the jurisdiction of the Registrar of Companies, Bangalore. In its order dated 17th October 2025, the ROC, Bangalore imposed penalties on the Company and the Managing Director for violating Section 135(7) of the Companies Act, 2013. The violation pertained to the Company’s failure to spend 2% of the average net profits of the three immediately preceding financial years on CSR activities, as well as its failure to transfer the unspent CSR amount to the designated fund as required under Sections 135(5) and 135(6) of the Act.

Details of Company’s unspent CSR:

| FY | CSR obligation | Amount actually spent | Remark |

| 2020-21 | Rs. 7,39,697 | NIL | Violation of Rs. 7,39,697 |

| 2021-22 | Rs. 8,95,598 | NIL | Violation of Rs. 16,35,295 (7,39,697+8,95,598) |

| 2022-23 | Rs. 16,50,000 | 30,15,000 | Excess available for set-off for succeeding years Rs. 13,50,000 (30,15,000-16,50,000) |

| 2023-24 | Rs. 23,93,000 | 10,28,000 | Shortfall after set off (23,93,000-13,50,000= 10,28,000) |

| Amount to be transferred to Schedule VII | |||

| FY | Amount to be transferred | Remark | |

| 2020-21 | 7,39,697 | Not transferred | Total Amount transferred to Prime Minister’s National Relief Fund on 04/09/2025 |

| 2021-22 | 8,95,598 | Not transferred | |

| 2023-24 | 10,28,000 | Not transferred | |

- Details of Penalty levied on the company and the Managing Director as follows:

Amount unspent to be transferred to fund as per section 135(7): Rs. 26,63,295, accordingly, the penalty levied on the Company for violation of 135(7) for the Company and Officer in default:

| Twice the amount required to be transferred by the company to the Fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account (including amount of the previous years) | Rs.1 Crore |

| 2x of 26,63,295= 53,26,590 | Rs.1 Crore |

| Lowest of the above two, Rs.1 Crore | |

Officer in default:

| 1/10th of the amount required to be transferred by the company to the Fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account (including amount of the previous years) | Rs.2 Lakhs |

| 1/10th of 26,63,295=266,329.50 | Rs.2 Lakhs |

| Lowest of the above two, Rs.2 Lakhs | |

- Concept of CSR, beyond the horizon of Compliance:

Beyond compliance, CSR contributes meaningfully to society, enhances corporate reputation, and helps uplift underprivileged communities, thereby contributing to the nation’s socio-economic development.

CSR also supports the Government of India’s vision under Viksit Bharat@2047, particularly the pillar of Sustainable Development & Energy, including goals such as:

- Transitioning to net-zero emissions by 2070

- Accelerating solar, wind, and bio-energy projects

- Promoting circular economy and green lifestyles

CSR, when implemented effectively, not only ensures compliance but also fosters long-term value creation and sustainable growth for the country.