We receive lost of questions regarding disclosure of Preliminary Expenses in Balance Sheet as per Revised Schedule VI. Every one have different opinion on how to disclose the same in revised schedule VI. In our view Miscellaneous / Preliminary Expenditure should be disclosed as follows in revised schedule VI :-

In Profit and Loss Account :- Preliminary Expenditure written off during the year should be shown in notes Under ‘Other Expenses’.

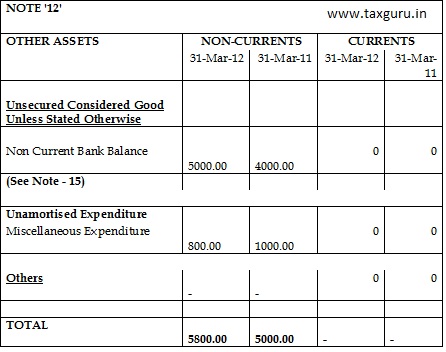

In Revised Balance Sheet :- In Revised Balance Sheet it should be shown as ‘Other Assets’ and its amount should be shown in non current Assets column.

A Format of such Presentation is as follows :-

In Our View AS 26 do not cover the following :-

Alternative option for Presentation of the Preliminary Expenses in Balance Sheet :– We may take the same as covered by Accounting Standard 26 of ICAI on Intangible Assets and write off the expense fully in the year of occurrence.

I have small section 8 company for which promoters have incurred all preliminary expenses & all such expenses not shown in the 1st financial statements of the company. Now this is 2nd year of the company. can i show the same in current year??

If the business doesn’t commence in the same year, then there is no question of preparing Profit & Loss Account. What is the treatment then?

What is the treatment of pre-operative Exp. as per revised schedule VI.????

WHY CAN’T INSTITUTE ISSUE A GUIDELINE REGARDING THIS POINT OF DEPICTION OF PRELIMINARY EXPENSES OR OTHER MISCELLANEOUS EXPENDITURE NOT WRITTEN OFF.

There is no scope for preliminary expense being carried forward in the balance sheet (revised Sch VI): with reference to as 26 following is deduced:

Preliminary Expenses

Preliminary expenses are the expenses relating to the formation of an enterprise. For example, in the case of a company, preliminary expenses would normally include the following.

(a) Legal cost in drafting the memorandum and articles of association.

(b) Fees for registration of the company.

(c) Cost of printing of the memorandum and articles of association and statutory books of the company.

(d) Any other expenses incurred to bring into existence the corporate structure of the company.

Paragraph 55 of AS 26 requires that expenditure on an intangible item should be recognised as an expense when it is incurred unless:

(a) it forms part of the cost of an intangible asset that meets the recognition criteria laid down in paragraphs 19‑54 of AS 26; or

(b) the item is acquired in an amalgamation in the nature of purchase and cannot be recognised as an intangible asset. If this is the case, this expenditure (included in the cost of acquisition) should form part of the amount attributed to goodwill (capital reserve) at the date of acquisition.

Paragraph 56 ofAS 26 provides some examples where the expenditure is recognised as an expense when it is incurred. The examples given include, expenditure on start‑up of activities (start‑up costs), unless the expenditure is included in the cost of an item of fixed asseet under AS 10. Start-up costs may consist of preliminary expenses incurred in establishing a legal entity such as legal and secretarial costs, expenditure to open a new facility or business (pre‑opening costs) or expenditure for commencing new operations or launching new products or processes (pre‑operating costs).

Preliminary expenses, therefore, incurred on or after, the date on which the Standard becomes mandatory for an enterprise or the preliminary expenses incurred on or after the date on which the enterprise opts to apply the Standard in the preparation and presentation of financial statements would be written off in the year in which they are incurred. The expenditure on preliminary expenses shall not be carried forward in the balance sheet to be written off in subsequent accounting periods.

Preliminary expenses already shown in the balance sheet on the date the Standard is first applied would be required to be accounted for in accordance with the requirements laid down by paragraph 99 of AS 26

Transitional Provisions

99. Where, on the date of this Standard coming into effect, an enterprise

is following an accounting policy of not amortising an intangible item or

amortising an intangible item over a period longer than the period

determined under paragraph 63 of this Standard and the period

determined under paragraph 63 has expired on the date of this Standard

coming into effect, the carrying amount appearing in the balance sheet in

respect of that item should be eliminated with a corresponding

adjustment

In the event the period determined under paragraph 63 has not expired

on the date of this Standard coming into effect and:

(a) if the enterprise is following an accounting policy of not

amortising an intangible item, the carrying amount of the

intangible item should be restated, as if the accumulated

amortisation had always been determined under this Standard,

with the corresponding adjustment to the opening balance of

revenue reserves. The restated carrying amount should be

amortised over the balance of the period as determined in

paragraph 63.

(b) if the remaining period as per the accounting policy followed

by the enterprise:

(i) is shorter as compared to the balance of the period

determined under paragraph 63, the carrying amount of

the intangible item should be amortised over the

remaining period as per the accounting policy followed by

the enterprise,

Sir i totally agree with the views tht AS will overide revised sch but i am an student of cs so if an question come in exam nd there is a premilinary exp for ex 10000 and 5000 has been written off so what shall i do in tht case shud i follow AS and make a note or else write off amt should show in p&l as other exp and the amnt left will shown as other assest bit confuse ib this i m really oblige if you cud help me.

Why the preliminary expenses should be shown under other current assets?

Am abiodun by name. am from Nigeria, am an upcoming accountant. i also have this problem(Preliminary Expenses), i got confused in the treatment. but with what i have seen in the accountants’ comment above, it made the work seems to be easier for me. thanks so much

What if there is not a adequate profit to write-off the same…???

For e.g

if profit before w\off is 5000/-

and preliminary exp amount to 10000/-

then what should be the treatment in above case…???

All the preliminary expenses incurred should be w/o in P&L A/c in that year itself. Also as per AS-26 there is no need to show the preliminary expenses in the Balance Sheet.

Preliminary Expenses can be written off in Income Tax Act over a period of 5 years. But under Accounting Standards or IFRS, it hass to be charged to P & L in the first year itself. This will give rise to Deferred tax asset (assuming compnay earns profits in coming years) as this is temporary difference and will be reversed over five years.

It should be disclosed separately under “other expenses” in income statement.

Fully agree with Rajiv, After introduction of AS -26 Accounting standard on Intangibles, there is no scope to recognise Preliminary expesnes as asset and has to be written off immediately. The test given in the AS for recongnising an Intangible must satisfy. else it has to go to P&L

Preliminary Expenses should be charged /write off in the same year in the profit and loss account as per AS- 26. There is no scope to show in the Balance Sheet under the head ” other assets ” in the main head of ” Non Current Assets.

preliminary expenses Dr. Rs 5000/

Cash / Bank Cr. Rs 5000/-

2.Other Expenses ( Preliminary Expenses ) Dr.Rs 5000/

preliminary Expenses Cr. Rs5000/

3.Profit and loss account Dr. Rs 5000/

other expenses Cr. Rs5000/

in the note forming part of the financial statement also disclose the amount of Rs 5000/ under the head other expenses includes Rs 5000/ as preliminary expenses incurred by the company has been charged to profit and loss account ( as per revised norms ) instead of showing as Assets under the head Miscellaneous Expenditure ( as per earlier norm ) to be set off in subsequent years profit.

This is my View.

CA. Subhash Chandra Podder , FCA

Kolkata

23/09/2012

@ Tax Guru

i completeley agree with Rajiv

In Revised Schedule,order of authority has been given Istly to AS,then co law and then Rev. Sch VI. It means first we have to refer to AS for the treatment and AS 26 says Misc. exp are not assets and hence it should not be shown as assets. However for academics or examination purpose it may be shown under Non Current assets. In reality(practical life)if there is any pre exp standing in the books, then it should be written off from opening balance of P & L A/c (referring to the provisons of As-26)…

My Opinion is that there is no scope for recognising prelimnary expenses in the Balance Sheet. Prelimnary expenses has to be written off in the same year when expenditure incurred. AS-26 and opinion of ICAI may be reffered in this regard.