Online information and database access or retrieval (OIDAR) services provided online electronically from outside the taxable territory and received in India by Government, local authority, governmental authority or an individual for purposes other than business/profession, is taxable from 1st December 2016.

OIDAR-Notifications and Circulars

CBEC Notification No. 48/2016-Service Tax dt. 09-11-2016

Seeks to amend Service Tax Rules, 1994 so as to prescribe that the person located in non-taxable territory providing online information and database access or retrieval services to ‘non-assesse online recipient’, as defined therein, is liable to pay service tax and the procedure for payment of service tax. click here to view the Notification

CBEC Notification No. 47/2016-Service Tax dt. 09-11-2016

Seeks to amend notification No. 25/2012-ST dated 20th June , 2016 so as to withdraw exemption from service tax for services provided by a person in non-taxable territory to Government, a local authority, a governmental authority or an individual in relation to any purpose other than commerce, industry or any other business or profession, located in taxable territory. click here to view the Notification

CBEC Notification No. 46/2016-Service Tax dt. 09-11-2016

Seeks to amend Place of Provision of Services Rules, 2012 so as to amend the place of provision of ‘online information and database access or retrieval services’ with effect from 01.12.1016. click here to view the Notification

CBEC Circular No. 202/12/2016-Service Tax dt. 09.11.2016

Withdrawal of exemption from service tax on cross border B2C OIDAR services provided online/electronically from a non-taxable territory to consumers in taxable territory in India. click here to view the Circular

In view of the Notification NO. 46 to 49/2016-ST, all dated 9th November 2016, coming into force with effect from 1.12.2016, Service tax would be charged on ‘Online Information and Database Access or Retrieval (OIDAR) Services’ provided by any person located in non-taxable territory and received by a person located in taxable territory, in India.

Application for Registration (Form ST 1A) for issuance of Registration Certificate (Form ST2A) in respect of service providers of Cross Border B2C Online Information and Database Access or Retrieval (OIDAR) Services are available in ACES from 01-12-2016.

To Register with the ACES

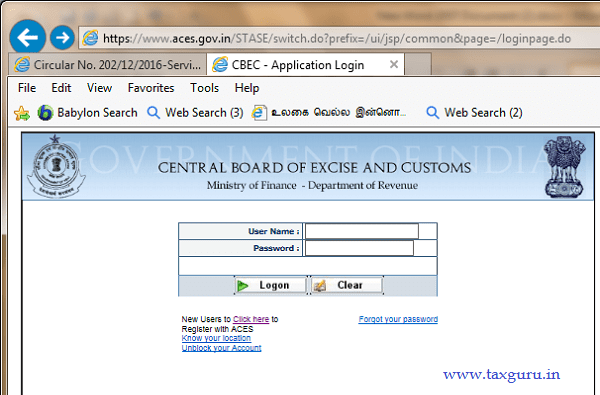

Please visit website www.aces.gov.in

Click SERVICE TAX tab

Click ‘New Users to Click here to Register with ACES’.

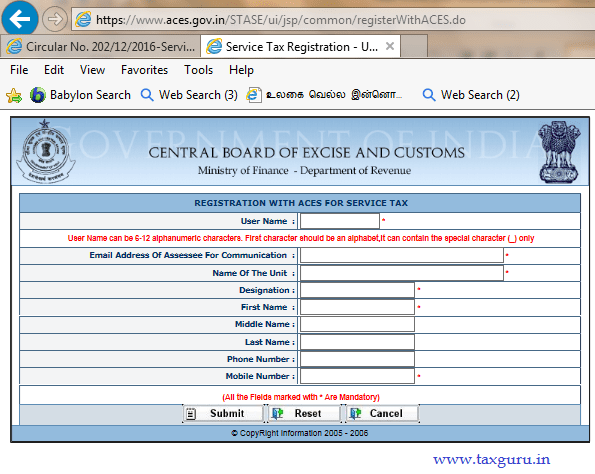

On clicking the following screen will open. Fill in the required details and submit to complete Registration with ACES .

Then the login credentials will be sent to the e-mail ID provided.

Then the login credentials will be sent to the e-mail ID provided.

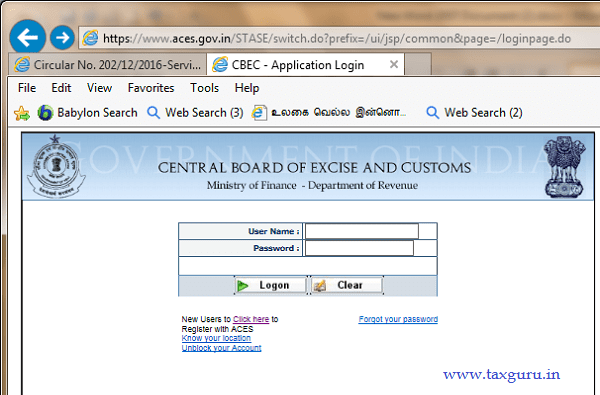

Use this login credentials to login and apply for Service Tax Registration.

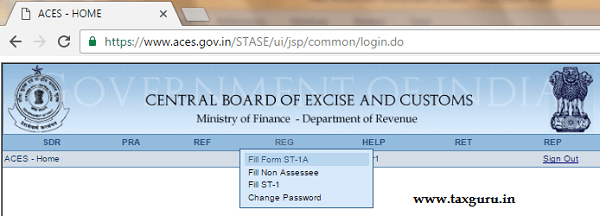

After login Click REG>Fill Form ST-1A

Fill the Form and submit and then ST-2A (Registration Certificate) will be generated automatically.