F.No. 225/358/2018/ITA.II

Government of India

Ministry of Finance

Department of Revenue (CBDT)

North Block, New Delhi,

Dated the 25th of October, 2018

Order under section 119 of the income-tax Act

The Tax Bar Association, Gauwahati (Petitioner), has filed a representation dated 20.09.18 before the Central Board of Direct Taxes (CBDT) seeking extension of the due date prescribed under section 139(1) of the Income-tax Act, 1961 (Act), being 30th September, 2018, for filing of Income-tax Returns (ITRs) as well as Tax Audit Reports (TARs) pertaining to assessment-year 2018-19. It may be mentioned that taking note of all the relevant issues, CBDT, vide orders dated 24.09.18 & 08.10.18, has already extended the due date for filing ITRs as well as TARs from 30.09.18 to 31.10.18. In this matter, petitioner had also filed a Writ-Petition before the Hon’ble Gauhati High Court. In hearing before the Hon’ble Court, Petitioner stated that the relaxation provided by the CBDT till 31.10.18 may not be sufficient. The Hon’ble Gauhati High Court vide order dated 12.10.18 in WP(C) 7361/2018 while disposing off the petition has directed the CBDT to consider representation of the Petitioner dated 20.09.18 and pass a speaking order in this matter on or before 25.10.18. Accordingly, this order is being passed in consequence to the directions of the Hon’ble Gauhati High Court.

2. In their representation dated 20.09.18, Petitioner has stated that since 01.04.18, many changes/alterations have been made in the Utility & Schema which are essential for e-filing ITRs & TARs thereby reducing the effective time available for e-filing TARs & ITRs by the prescribed due date. It is further stated that due to amendments effected in format of the TAR with effect from 20.08.18, as accountability of the auditors has increased further, the due date should be extended so that quality of audit is not compromised. It is also stated that it may not be practicable to certify the audited accounts under Income-tax Law without auditing the turnover under GST laws in view of due date of Turnover Audit under GST law, being 31.12.18. The Petitioner has also stated that ICAI has already submitted three representations in this matter and it was joining hands with ICAI in the requests made therein.

3. The three grounds in representation of the Petitioner dated 20.09.18 are discussed as under:

Page Contents

3.1 Multiple revisions in Schema/Utility for ITR/TAR:

3.1.1 Findings: The ITR Forms 3, 4, 5 and 6 were notified for assessment-year 2018-19 vide Notification of CBDT dated 03.04.2018 in PDF (readable) format. Thereafter, these ITR Forms were e-enabled and were available for e-filing from 18th, 21st, 26th, 21st May respectively. The Utility for e‑ filing the TARs was available from 01.04.18 itself while facility for uploading of TARs for assessment-year 2018-19 was specifically enabled from 05.04.18. It has been reported that since 01.04.18, a large number of ITRs/TARs were successfully filed by this segment of taxpayers.

3.1.2 Relaxation given: Considering some difficulties expressed by the stakeholders in their representations, the CBDT, has already extended the due date for filing of ITRs & TARs from 30.09.18 to 31.10.18. Thus, this issue stands suitably redressed and no further extension of time is warranted on this ground.

3.2 Amendment in format of Tax Audit Report:

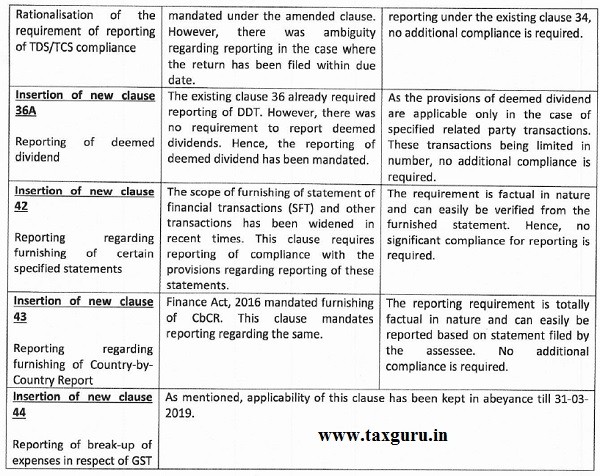

3.2.1 Findings: Vide Notification No. 33/2018 of CBDT dated 20.07.18, TAR Form was amended to ensure reporting of certain transactions in view of changes affected in provisions of the Act in last 3-4 years and also to rationalise reporting of the some of the existing clauses of the TAR. For sake of clarity, amendments in TAR vide Notification No. 33/2018 of CBDT dated 20.07.18 are discussed clause by clause in Annexure to this order. It emerges that amendments made vide Notification dated 20.07.18 are mostly incremental and routine in nature and do not require any major changes in audit technique applied for reporting in TAR. Further, since most of the amended reporting requirements are factual in nature, they are readily available from assessees records. Also some of changes in the TAR are essentially reporting requirements in respect of certain anti-abuse provisions, being applicable to a limited number of cases only while some of the reporting requirements in respect of international transactions are applicable to the assessees required to file report under section 92E of the Act, wherein the due date for furnishing of ITR /TAR is 30th November, 18.

3.2.2 Relaxation given: (I) Considering the fact that amendments in format of TAR may have some impact on completion of ongoing audits, notification for amendment to TAR issued on 20.07.18 was made effective from 20.08.18 & TARs were allowed to be filed in the old format upto 19.08.18. Therefore, a clear one month time was provided to the tax auditors and stakeholders to complete the ongoing audits on the basis of reporting requirements in the pre-amended TAR.

(II) Further, to ensure that two of the substantive amendments in the TAR Form do not impede the process of filing TARs pertaining to assessment year 2018-19, vide Circular No. 6/2018 of CBDT dated 17.08.18, reporting requirements prescribed under clause 30C (pertaining to General Anti-Avoidance Rules (GAAR)) and under clause 44 (regarding reporting of break-up of expenses in respect of GST) have been kept in abeyance till 31.03.19.

(III) Thereafter, to further facilitate the taxpayers in filing their ITRs/TARs by the prescribed due date, the CBDT, in exercise of its powers under section 119 of the Act, vide orders dated 24.09.18 & 08.10.18, extended the due date for filing ITRs/TARs for assessment-year 2018-19 from 30.09.18 by one month.

3.3 Reconciliation of Financial Statements with GST Returns:

3.3.1 The last issue mentioned in the representation is regarding need to reconcile information being furnished in the ITR/TAR vis-a-vis Turnover Audit Report under the GST. It is also stated that for rectification of mistakes in claim of input tax credit under the GST, time is available till 20.10.18. It has been further stated in the representation that it is not practical to certify the audited accounts under Income Tax Laws without auditing the turnover under the GST Laws.

3.3.2 Findings: (I) It is pertinent to mention that audit under the Income Tax Act is an independent audit based on the primary evidence in the form of bills/vouchers. Under section 44AB of the Act, an auditor is required to audit the books of accounts of the assessee which are written on the basis of primary documents e.g. invoices, bills, vouchers, bank statements etc. These documents are available with the assessee at the time of the closure of the financial year on 31st March or shortly afterwards.

(ii) Under GST, monthly sales and purchases figures are available in the GSTR-3B Form which was required to be filed by the prescribed date in the following month. Thus, information regarding Turnover for the financial year 2017-18 on the basis of the GST Return for reconciliation with the books of accounts was also very much available with the assessees soon after the closure of the financial year. Further, information regarding input tax credit is also available in the invoices/bills which are already available with the assessees.

(iii) It is noteworthy to mention that this year there is a significant jump in filing of ITRs & TARs by the taxpayers covered under clause (a) of Explanation 2 to section 139(1) of the Act for whom the prescribed due date is 30.09.18. Last year till 24.10.17, 9.47 lakh ITRs/TARs were filed whereas the figure has almost doubled with 18.44 lakh ITRV/ TARs being filed till 17.10.18 for this year. Therefore, when a large number of assessees are able to file their ITRs/TARs under Income Tax without any difficulty, there is no valid reason for further extension of due date for the reasons related to GST as stated in the representation of the Petitioner.

3.3.3 Relaxation given: The request for grant of further time for filing of ITRs/TARs stands suitably redressed with extension of prescribed due date for filing ITRs/TARs under the Income Tax Act for assessment-year 2018-19 from 30.09.18 to 31.10.18 vide orders of the CBDT dated 24.09.18 & 08.10.18.

4. It may be mentioned that span of time for revising an ITR & filing a belated ITR has been considerably reduced from assessment year 2017-18 onwards. Now, the time available for filing a belated/revised ITR for any assessment year is till the end of the relevant assessment year. Therefore, granting any further extension of the prescribed due date under section 139(1) of the Act beyond 31.10.18 would be detrimental to those assessees who may want to revise their return later on and also defeat the purpose of improving the culture of tax-compliance in the country.

5. As concerns of the assessees have been suitably redressed with extension of due date by one month (i.e. till 31.10.18), representation of the Tax Bar Association, Guwahati dated 20.09.18, requesting for further extension of due date for filing ITR/TAR beyond 31.10.18 is hereby rejected.

Also, Check out tax audit due date.

Enclosure: as above

(Rajarajeswari R.)

Under Secretary to Government of India

Copy to:

- The President, Tax Bar Association, Guwahati

- CCIT, North-Eastern Region

extend date only 05/11/2018

once again request to you plz provide only 5 days time ie 05/11/2018

to be date extand 5 nov 2018

Please extend till November 2018

FLOODS IN KERALA IN AUGUST DEVASTATED THE STATE IN WHICH ONE THIRD OF THE THE STATE LOST THEIR HOMES, OFFICES AND EVERYTHING. BUT THE CBDT STATES THAT THE AUDITS WOULD HAVE CONDUCTED WELL BEFORE THE FLOODS.I WONDER CAN THE AUDITORS START THE AUDITS JUST AFTER 31ST MARCH EVERY YEAR, IF SO, HOW? QUITE SILLY AND IRRESPONSIBLE RESPONSE FOR A GENUINE DEMAND WITH LEAST RESPECT FOR THE TAX PAYERS, WHO ARE THE MASTERS OF EXCHEQUER.

SIR Please CBDT extend due date up to 30.11.2018.

can any extension will get till the end…..?

Sir the Last Date of GSTR 1 is also 31.10.2018 so we are unable to complete our both work please Extend the Time as on 31.12.2018

please extend audit report

When ICAI has not considered it necessary to state in its representation that time is required to carry out an audit as per the standards of ICAI, the shrinking of time schedule for carrying out audit and filing return from 1984, the increases in compliances and instead only spoke about reasons for this assessment year only the representations are bound to fail. There is a need to delink filing of audit report and filingof IT Return.

Sir,

Please CBDT extend due date up to 30.11.2018. Still we are working at 02:56 AM 28.10.2018 lot work pressure. We are human please think about us.

Sir,

Please extend due date 30.11.2018 . 100 % required extension is genuinely for all Professional.

please extend audit report

Pl update status association filed appeal or not.

Pl challange the CBDT order and request HC to extend date to at least 30 Nov 18.

sir high court decision is in favour of people and professional community.cbtd also act accordingly please extend the date at least till 15 of this month please sir

Where is opposition jara jara si bato me media par debate chalta hai ye to Gst ke bad ka 1st audit hai media chup hai opposition parties kaha hai road pe aao sab highcourt ne 30 nov ka order kiya tha

The Tax Bar Association, Gauhati must challenge this order in high court. The Hon’ble High Court in the Judgement mentioned that in the event the petitioners are aggrieved by the order that may be passed, they would have the liberty to approach the Court again.

So let’s hope for the best

CBDT insulted to the Tax Bar Association and verdict of Hon’ble High Court Gauhati by this type reply . They had to extend the due date at least 10 days in the respect of court order.

Tax Bar Association must approach the court again for Justice.

Sab professional ki Nazar Unhi par Tiki hai, please insaf dikhaiye .

Challenge the order and gets 30.11. 2018 for sake of professionals please come on bar and professional association.

Sir cbtd not cared for high court. If gst problems is not there no body asked for extension.we felt 31.10.2018 is enough but due this Gst we are not concentrating on tax audit so please kindly reverse the order and do the needful 30. 11.2018 is very good or 15.11.2018 is OK sir please.

Tax bar association should challenge this order in high court.

Pl update status association filed appeal or not

Professional Association, Trade association and Chamber of Commerce across the country must oppose this order of CBDT in High Court having jurisdiction in their states.

Professional Association, Trade Associations and Chamber of Commerce from all the states must challenge this order in High Court of their respective states

Tax Bar Must challenge CBDT order

Tax bar association should challenge this order in high court.