Pardeep Kumar

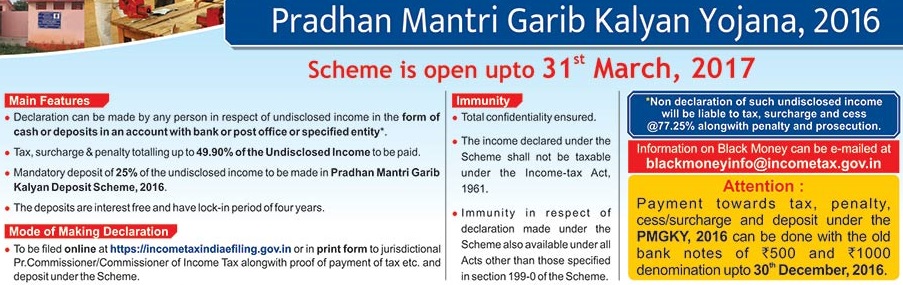

The CBDT vide Circular No.43 of 2016 dated 27.12.2016 issued explanatory notes on provisions of the taxation and investment regime for Pradhan Mantri Garib Kalyan Yojna, 2016 as contained in Chapter IX-A of the Finance Act, 2016. The summary of the same is given below.

-The Taxation Laws (Second Amendment) Act, 2016 has been enacted by Parliament on 15.12.2016.

-Insertion of New Chapter in Finance Act, 2016 i.e. The “Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojna, 2016”.

Pradhan Mantri Garib Kalyan Yojana, 2016 (PMGKY, 2016)

-Following three simultaneous actions needs to be taken under the scheme:-

| 1. Payment of Tax | 2. Deposit in PMGKY Deposit Scheme | 3. Filing of Declaration | ||||||||||||

| > Tax@49.9% of Declared Income including tax, surcharge and penalty.

(Rs.)

|

*Mandatory deposit of not less than 25% of such income.

*No interest is payable on deposit. *Lock in period-4 Years. |

*From 17.12.2016 to 31.03.2017 only.

*Declaration in Form-1. *Acknowledgement in Form-2. Within 30 days from the end of the month in which the declaration under Form-1 is made. *Mode of declaration:- (i) Electronically under DSC. (ii) Electronically under EVC. Declaration not eligible in following cases:- 1. Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974. 2. Chapter IX or XVII of Indian Penal Code. 3. The Narcotic Druges and Psychotropic Substances Act, 1985. 4. The Unlawful Activities (Prevention) Act, 1967. 5. The Prevention of Corruption Act, 1988 6. The Probhition of Benami Property Transactions Act, 1988. 7. Prevention of Money Laundering Act, 2002. 8. Trial of offences Relating to Transactions in Securities Act, 1992. 9. Black Money (Undisclosed Foreign Income & Assets) and Imposition of Tax Act of 2015. Circumstances where the declaration shall be invalid:- Misrepresentation or suppression of facts. Effects of declaration:- (i) Such income shall not be included in the total income (ii) No reassessment (iii) Declaration shall not be admissible as evidence against the declarant. |

||||||||||||

(The author, Pardeep Kumar, is a Chartered Accountant from Rohtak, Haryana. He can be reached at pardeep.kumar2@escorts.co.in)