Introduction

Interest and penalty provisions apply to the assessee when he contravenes the provisions of the Income Tax Act. Some of them are mandatory while others are at the discretion of the tax authorities.

There are various penalties under Income Tax Act, 1961 which an assessee can attract intentionally or unintentionally. One must be aware of the penalties arising from negligent non-compliances to safeguard themselves from bearing severe consequences.

| Section & Nature of Default |

Penalties leviable | Additional Points |

| 234F Late/Non-Filing of ITR

|

Rs.5000 if ITR is filed before 31st December of the AY.

Rs.10000 if ITR is filed after 31st December but before 31st March of the AY. However, the amount of penalty does not exceed Rs.1000 in case the income of the assessee does not |

The penalty shall be leviable in case persons whose income is less than Rs.2.5 lakhs but are having the following transactions during the previous year relevant to the AY.

> Those who have made expenditure`towards electricity consumption > Individuals with expenses over Rs.2 lakhs on foreign travel. > Those who have a total deposit of more than Rs.1 crore in one or multiple current accounts with a bank. > Those who are Indian residents but have Further in the Case of SENIOR CITIZENS: The Said penalty shall be applicable only in the following cases: > Aged between 60-80 years with a total taxable income of more than Rs.3 Lakhs > Aged above 80 years with total taxable income exceeding Rs.5 Lakhs. |

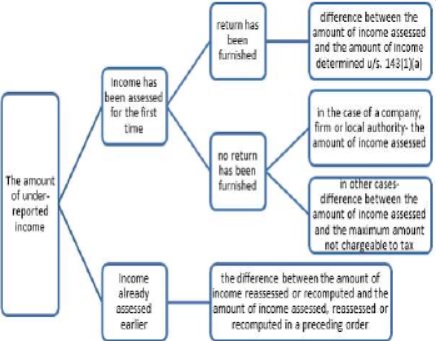

| 270A -Penalty for underreporting of income

-Penalty for under reporting on account of misreporting of income |

50% of the amount of tax payable on under-reported income 200% of the amount of tax payable on under reported income |  |

| 272A

Penalty for failure to answer questions, sign statements, furnish information, returns or statements, allow inspections, etc. |

Rs.10000 for each default | Any person who fails or refuses

√ to answer any questions asked by the Income Tax Authorities which he/she is required to answer √ to sign the statements required by the √ to give evidence √ to produce the books under summon u/s131 (1). √ to comply with the notice issued u/s 142(1) or 143(2) or 142(2A). |

| Section 271GA

-Failure by the Indian concern to furnish any information or The document under Section 285A

|

(a)Transaction impacted the transfer of management/control of an ndian Concern – 2% of the value of the such transaction

Other Cases – Rs.5,00,000/- (b) Delay Less than one month- Rs.5,000/ per day More than one month- Rs.15,000/ per day Continuing default even after service of notice under either under (a) or (b) –Rs.50,000/ for every day of Default. |

|

| Sec 271B- Failure to get accounts audited or furnish a report of audit as required under section 44AB

|

0.5% of the Total Sales, turnover or gross receipts, etc.

Or Rs.150000 whichever is less

|

Tax Audit Applicability:

In case of business if turnover exceeds the amount of Rs.2 Cr or Rs.10 Cr( if at least 95% of the gross receipts and expenses are received and expensed off through channel other than cash) In case of Profession if turnover exceeds Rs.50 Lakhs. |

| Sec 271 I- Failure to furnish information related to payments u/s 195(6) in Form 15CA and 15CB. | Rs.100000 | As per section 195(6) of the Act, any person responsible for paying to a non-resident or a foreign company, any sum (whether or not chargeable to tax) is required to furnish information for such transaction in Form 15CA and 15CB. |

Penalties related to self-assessment tax payment

- Failure to pay wholly or partly— Such amount as Assessing Officer(AO) may impose but not exceeding tax in arrears

- self-assessment tax/fringe benefit tax, or

- interest, and fee, or

- both under section 140A(1)

- Penalty leviable shall be such amount as AO may impose but not exceeding the amount of tax payable.

Penalties related to Unexplained Income

> As per Sec 271AAC -Income determined by the Assessing Officer includes any income referred to in section 68, section 69, section 69A, section 69B, section 69C, or section 69D for any previous year and such income is not included by the assessee in his return or tax in accordance with section 115BBE has not been paid then penalty equal to 10% of tax payable under section 115BBE shall be payable by the assessee in default.

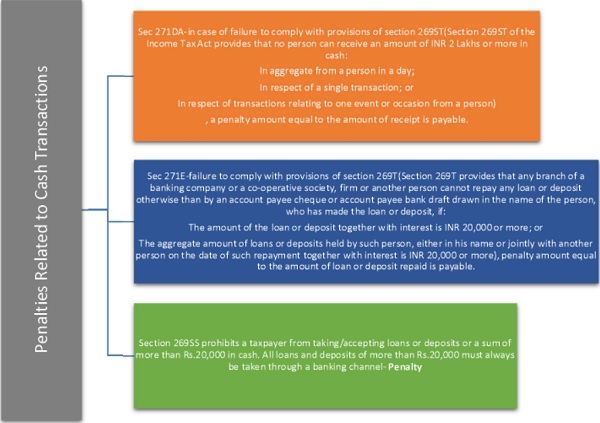

Cash Transactions Related Penalty Provisions-

Other Penalties under Income Tax Act, 1961

Disclaimer: The contents of this article are solely for informational purpose. Neither this article nor the information contained herein constitutes a contract or will form the basis of a contract. The material contained in this article does not constitute or substitute professional advice that may be required before acting on any matter. While every care has been taken in the preparation of this article to ensure its accuracy at the time of publication. Jyotsana Thareja assumes no responsibility for any error which may be found herein despite all precautions. We shall not be liable for direct, indirect, or consequential damages if any arising out of or in any way connected with the use of this article or information as contained herein.

jyotsanathareja@rediffmail.com – linkedin.com/in/jyotsana-thareja