Equalisation Levy

Overview:

♦ Equalization levy was introduced by the Finance Act, 2016 on certain non resident companies and related activities. The levy was applied @6% on certain ‘specified services’ such as online advertisement, any provision for digital advertising space or any other facility or services for the purpose of online advertisement if the aggregate amount of consideration for specified services in a previous year exceeds 1 lakh.

♦ The scope of the said provision has now been expanded to include equalisation levy of 2% on consideration received or receivable by an e-commerce operator from e-commerce supply or services and is effective from 01.04.2020.

Key Features:

Equalisation levy on e-commerce transactions:

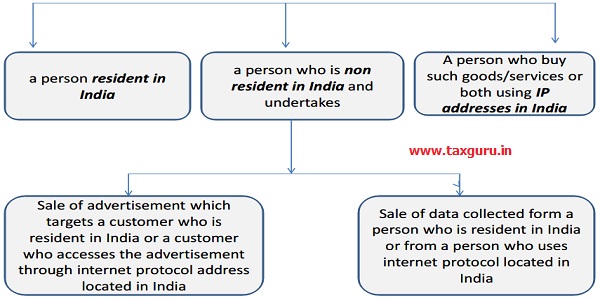

> Equalisation levy of 2% shall be chargeable on consideration received or receivable by an e-commerce operator from e-commerce supply or services made or provided or facilitated by it to:

E-Commerce Operator:

- A non resident who owes, operates or manages, a digital or electronic facility or platform for online sale of goods or online

provision of services or both

E-Commerce Supply or Services:

- Online sale of goods owned by the e-commerce operator,Online provision of services provided by the e-commerce operator,Online sale of goods or provision of services or both facilitated by the e-commerce operator or any combination

> Equalisation levy shall not be charged:

- Where the e-commerce operator has a permanent establishment in India and such e-commerce supply or service is effectively

connected with such permanent establishment - Where the equalisation levy is leviable on online advertisement and related activities

- Sales, turnover or gross receipts less than 2 crores during the previous year

> Equalisation levy is to be paid by every e-commerce operator quarterly within following due dates:

| Date of ending of the quarter | Due Date |

| 30th June | 7th July |

| 30th September | 7th October |

| 31st December | 7th January |

| 31st March | 31st March |

> Due date of furnishing equalisation levy statement (In Form -1) is on or before 30th June of the subsequent financial year.

> Delay in payment of equalisation levy by the assessee or e-commerce operator would attract interest @1% for every month or part of the month and

> Penalty:

| Default | Penalty |

| Failure to deduct equalisation levy (wholly or partly) | A penalty would be equal to amount of equalisation levy |

| Failure to deposit tax after deduction | Rs. 1000 each day of default but it shall not exceed the amount of equalisation levy |

| Failure to furnish statement | Rs. 100 for each day of default |

Additional Points on Equalisation Levy:

- Equalisation levy is only applicable only for Business to Business transactions.

- Foreign entities operating e-commerce platforms in India or generating revenue in the country will require a PAN/Adhaar No

for paying the equalisation levy - The challan for payment of equalisation levy required PAN and Indian bank account number.

Equalisation Levy Rules

| Rule No | Particulars | Description | Amendment in Rules |

| 1 | Short Title and Commencement | Rules shall come into force as on 01.06.2016 | – |

| 2 | Definitions | New definion has been inserted “Electronic Verification Code” “electronic verification code” means a code generated for the purpose of electronic verification of the person furnishing the statement of specified services as per the data structure and standards laid down by the Principal Director- General of Income-tax (Systems) or Director General of Income-tax (Systems), as the case may be; | |

| 3

|

Rounding off of consideration for specified services, equalisation levy, etc. | The amount of consideration of specified services, equalisation levy, interest and penalty payable shall be rounded off to the nearest multiple of ten rupees. | Rule 3 is amended to exclude the word specified services |

| 4

|

Payment of Equalisation Levy

|

Every assessee, who is required to deduct and pay equalisation levy, shall pay the amount of such levy to the credit of the Central Government by remitting it into the Reserve Bank of India or in any branch of the State Bank of India or of any authorised Bank accompanied by an equalisation levy challan. | Rule-4 is amended to include e- commerce operator in addition to the assessee

|

| 5 | Statement of Specified Services | The statement of specified service is required to be furnished electronically in Form No. 1 (verified through either a digital signature or an electronic verification code by an authorised signatory) on or before 30 June immediately following that financial year. | Rule 5 is amended to include a statement of e-commerce supply or services in addition to specified services |

| 6 | Furnishing of statement in response to notice | The Tax Officer has been empowered to issue notice for furnishing such statement, which then has to be furnished within 30 days from date of serving of such notice, where the same is not filed within the prescribed timeline. | Rule 6 is amended to include the furnishing of a statement of specified services or e- commerce supply or services in response to a notice issued by the Assessing Officer.

Further, this rule is made applicable to an e-commerce operator apart from the assessee. |

| 7 | Notice of Demand | Where any levy, interest or penalty is payable under the equalisation levy provisions, a notice of demand specified in Form No. 2 shall be served upon the assessee.

Further, intimation issued upon processing of the |

The notice of demand can now be served upon an assessee as well as on an e- commerce operator under Rule 7 by the Assessing Officer. |

| 8 & 9 | Filing of appeal against the penalty order before the Commissioner of Income-tax (Appeals) & ITAT respectively | The payer may appeal against a penalty order before the Commissioner (Appeals) within 30 days, and before the Appellate Tribunal within 60 days of receipt of the penalty order. | An e-commerce operator is also allowed to file an appeal before the CIT(A) as per Rule 8 and 9. |

thanks