Introduction: Explore the nuances of Section 43B(h) of the Income Tax Act, which delineates the tax implications of payments to Micro and Small Enterprises (MSMEs). Effective from Assessment Year 2024-25 onwards, this section imposes certain obligations and considerations for businesses dealing with MSME suppliers. Let’s delve into its intricacies.

Section 43B(h)- MSME Payment New Tax Implications to Ay 2024-25 & Onwards

OVERVIEW OF NEW SECTION

Effective From AY 2024-25 And Onwards.

Section 43B (h) of the Income Tax Act, 1961 “Any sum payable by the assessee to a MICRO or SMALL enterprise beyond the time limit specified in Sec 15 of the Micro, Small and Medium Enterprises Development Act, 2006,”

This indicates that, in order to be eligible to claim a deduction of the sum payable to micro and small enterprises, the payment shall be actually made within the time limit specified in Sec 15 of the MSME Development Act, 2006.

As per Section 15 of the MSME Act, Liability of buyer to make payment: Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day.

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed 45 days from the day of acceptance or the day of deemed acceptance.

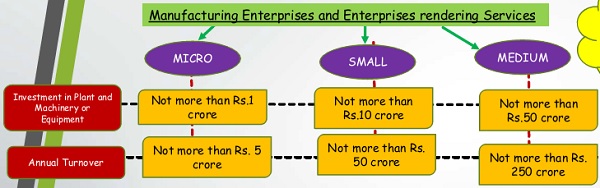

CRITERIA FOR CLASSIFICATION IN MSME

Investment In P&M Or Equipment And Turnover Limits Is To Consider As Filled In Previous Years ITR

Manufacturing Enterprises and Enterprises rendering Services

Enterprise means an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 or engaged in providing or rendering any service(s).

Categories of Enterprises under MSME

- Manufacturer

- Service Provider

- Trader

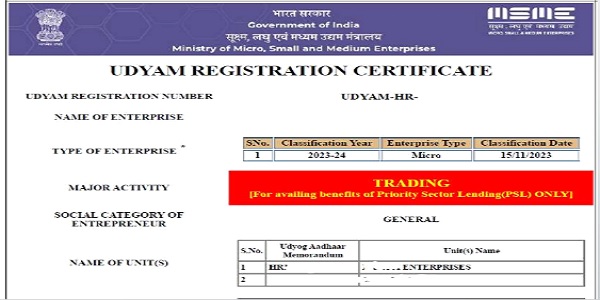

However, An Enterprise Which Is Engaged In Trading Is Not Covered By The Term “Enterprise”

Not applicable on purchase from MSME Trading (Category)

“Supplier” Means A Micro Or Small Enterprise, Which Has Filed A Memorandum With The Authority Referred To In Subsection (1) Of Section 8, And Includes,–

a. The National Small Industries Corporation, Being A Company, Registered Under The Companies Act, 1956

b. The Small Industries Development Corporation Of A State Or A Union Territory, By Whatever Name Called, Being A Company Registered Under The Companies Act, 1956

c. Any Company, Co-operative Society, Trust Or A Body, By Whatever Name Called, Registered Or Constituted Under Any Law For The Time Being In Force And Engaged In Selling Goods Produced By Micro Or Small Enterprises And Rendering Services Which Are Provided By Such Enterprises;

SECTION 15 OF THE MSME ACT : LIABILITY OF BUYER TO MAKE PAYMENT

Supplies Any Goods Or Renders Any Services

Payment On or before the appointment date

i. Agreed Upon Written Agreement Between them: Limit 45 days

ii. There is No Agreement : Limit 15 days

Amount of Allowance / Disallowance

If the payment is due for more than 45 days or 15 days as specified but the payment is made before the end of FY: Deduction allowed in

same year

If the payment is made after 45 days or 15 days as specified : deduction will be available in the year in which the payment is made

♦ As per sec 16, if buyer fails to make payment as required u/s 15, the buyer shall be liable to pay compound interest with monthly rests to the supplier on that amount from the appointed day or, as the case may be, from the date immediately following the date agreed upon, at 3 times of the bank rate notified by the Reserve Bank.

♦ The interest amount payable or paid as per above will not be permitted as deduction for the purposes of the calculation of the income u/s 37 of Income tax act 1961 as payment of such interest is considered as penal in nature.

|

S.NO |

NATURE OF CASE | PERIOD TO BE COUNTED FROM |

| 1 | Day of acceptance | The day of actual delivery of goods or services |

| 2 | Day of acceptance (Objection is made by the Buyer in writing, objection must be made within 15 days from the day of delivery of goods or services) | The day on which such objection is removed by the supplier |

| 3 | Deemed day of acceptance (No objection is made by the buyer in writing) | The day of actual delivery of goods or services |

CONCLUSION

NOT APPLICABLE ON :-

♦ Outstanding Balance Prior To 31.03.2023

♦ Purchase From MSME- Medium Enterprises

♦ Purchase From MSME- Traders (Category)

♦ Purchase From Those Vendors Who Are Unregistered Under MSME

1. Applicable only towards payments made to Micro & Small Business (Not covering Medium business).

2. The amount outstanding as on 31st March towards amount payable and payments has not been made within 45 days or 15 days, as the case may be, shall not be allowed as deduction.

GENERAL SITUATIONS

Payment to a MSE after the time limit set by Sec 15 of the MSMED act, 2006, but within the same FY in which the expense was incurred

Since the payment is settled after the specified time limit but the payment is made within the same FY in which the expense was accrued, deduction shall be permitted in that same FY.

A dealt with an MSE where expenses were accrued in March 2024. However, payment is made to vendor during the subsequent FY in April 2024, within the deadline specified u/s 15 of the MSMED Act, 2006.

The payment is made as per the time limit specified u/s 15 of the MSMED Act, 2006 so in the FY 2023-24 they will be able to claim the deduction on an accrual basis

Expense incurred in the FY 2023-24 payable to an MSE but got settled it in the subsequent FY after the expiration of the time limit specified in Section 15 of the MSMED Act, 2006.

One will not be eligible to claim a deduction for that payment in the FY 2023-2024 when the expenses was initially accrued

Within the specified time limit under Section 15 of the MSME Act, 2006, One completes payment to an MSE and accrues the expense in the same FY

The provisions of section 43B of the Act would not apply to the payment made to the MSE. He will be permitted to take a deduction in the financial year in which the expense is accrued.

On March 16, 2024, an invoice was received from the MSE for the supply of goods. The delivery of the goods were done on the same day. On March 18, 2024, buyer communicated concerns about the quality of the supplied goods to the MSE vendor. Both parties resolved the dispute on April 30, 2024, & the payment was made on May 31, 2024

The payment is within 45 days from the resolution of the dispute when the expenses accrued so buyer can claim a deduction for the payment in the FY 2023-24.

Conclusion: Section 43B(h) of the Income Tax Act, pertaining to payments to MSME suppliers, introduces significant tax implications. It mandates adherence to the timelines set by Section 15 of the MSME Development Act, 2006, for claiming deductions. While it provides clarity on allowable deductions, it also outlines exceptions and practical scenarios to consider. Understanding these provisions is essential for businesses to ensure compliance and optimize tax benefits.