Clarification on Applicability of Sec 43B(h) on MSME Payments – Point to be Consider Before Closing Books of Accounts as on March, 24

Introduction: In the realm of financial compliance, Section 43B(h) of the Income Tax Act has emerged as a pivotal consideration for businesses, especially in their dealings with Micro, Small, and Medium Enterprises (MSMEs). This section mandates the timely payment to MSMEs, failing which businesses face disallowances and penalties. This detailed analysis aims to provide clarity on the applicability of Section 43B(h), its impact on businesses, and the necessary steps for compliance.

Had you missed out any 2023 budget an important amendment in INCOME TAX ACT specifically u/s 43B. Hey all, had you registered your entity under MSMED Act?? If yes, then here is good news for you, in fact it is a good provision to all the MSMED registered entities. Let’s check the applicable provision in detail with practical questions by taking this topic as conversation between client and an auditor.

Auditor: Hi, How are you?

Client: Hello Auditor, I am good are you ready to close books of accounts as on 31st March,2024 and for audit.

Auditor: Yeah Of Course, firstly you need to give information to close books of accounts. (this is impossible)

Client: Ok ok… will try to give information as early as possible (inner voice of client; books will be closed as usual on 30th Sept)

Auditor: Remember one thing… This year we will have a big impact on financials and tax liability computation, be careful

Client: Why? Any new provision has come into picture?

Auditor: Yes, in sec 43B of Income Tax Act, regarding payments to MSME entities.

Client: Oh.. last year only we faced some difficulties in understanding the implications of TDS u/s 194Q & 206C(1H) and ended up with 30% disallowances and paid tax on that. Now again a provision u/s 43B!!! What is that provision and let me know as there was time to end our FY 23-24 ! will definitely sought it out as earliest and this time ! won’t pay any extra tax due to that disallowance.

Auditor: Ok sir, I will explain you in detail. Firstly, do you know anything about Sec 43B? Client: No

Auditor: Let me explain you, Sec 43B provides for certain deductions to be allowed only in the year in which payment is actually made (i.e deduction is allowed only upon payment basis) even if we are maintaining books under mercantile basis.

Client: Yeah, I know this provision under this section taxes and duties, employer contribution to employee PF account, interest payments to banks or public financial institutions etc. will come here.

Auditor: Correct, absolutely right.. Now a new clause added to that section 43B which relates to PAYMENTS TO MSME REGISTERED ENTITIES

Client: Of course we are paying to all MSME entities within 6 to 12 months and closing our creditors outstanding balance in the books of accounts.

Auditor: Very good, appreciate your prompt payments but this clause states that

“any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006),”

Client: What is the time limit specified u/s 15 of MSMED act,2006

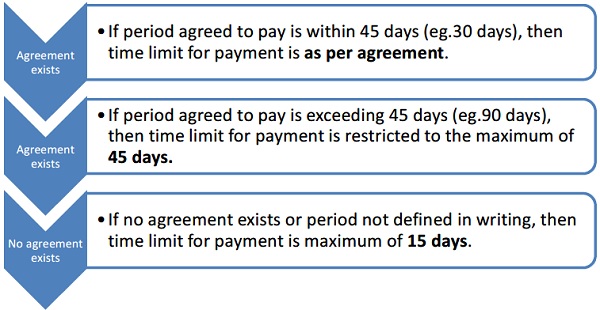

Auditor: Where any person purchases goods / services from a micro or small enterprise, the payment shall be made within the date specified in agreement between them. In no case, the period agreed between the supplier and buyer should not exceed 45 days. If there is no such agreement, the payment shall be made within 15 days of acceptance/ deemed acceptance of goods or services.

Client: No, I didn’t understand this time limit concept share some examples

Auditor: Ok

| Date of Invoice or Acceptance of goods | Date of payment as per Agreement | Actual Date of payment | Due Date as per MSMED act | Is Sec 43B applicable |

| 10-04-2023 | 23-07-2023 | 25-01-2024 | 25-05-2023 | Yes |

| 20-04-2023 | 30-04-2023 | 26-04-2023 | 30-04-2023 | No |

| 26-08-2023 | No agreement | 01-01-2024 | 10-09-2023 | Yes |

| 31-03-2024 | 21-05-2024 | 19-05-2024 | 15-05-2024 | Yes |

Client: We are paying amount upon mutual understandings or within the time limit prescribed orally between me and supplier. Is this permissible?

Auditor: No, written document is mandatory to claim 45 days time limit.

Client: For whom this section is applicable?

Auditor: To all the assesses who are liable to tax audit u/s 44AB need to follow this provision and make necessary changes before closing books of accounts for FY 23-24

Client: Whether there was any supplier definition?

Auditor: There was no specific definition for supplier, supplier means the entity which is registered under MSMED act and such supplier must belongs to MICRO or SMALL category. So, Medium category suppliers were not included here.

Client: Whether supplier definition includes TRADERS also?

Auditor: Very good question, even though retailers and wholesale traders can register under MSMED act, the benefits to Retail and Wholesale trade MSMEs are restricted upto Priority Sector Lending only, and any other benefits, including provisions of delayed payments as per MSMED Act, 2006, are excluded. Ministry of Micro, small and medium Enterprises issued Office Memorandum vide E-19630 dated 01-09-2021 . So, TRADERS are specifically excluded for benefit of delayed payment.

Client: How can I Know, who is Micro, Small & Medium category suppliers?

Auditor:

| Size of the Enterprise | Investment and Annual Turnover |

| Micro | Investment less than Rs. 1 crore & Turnover less than Rs. 5 crore |

| Small | Investment less than Rs. 10 crore & Turnover up to Rs. 50 crore |

| Medium | Investment less than Rs. 20 crore & Turnover up to Rs. 100 crore |

Client: What if I pay to that supplier in next year?

Auditor: Say for example we bought for 1lakh rupees from X ltd, we paid only 60,000/- in FY 23-24 and remaining will be paid in next years (20,000 in 24-25 and 20,000 in 25-26)

In FY 23-24 , purchases value is of Rs.60,000/- only (40,000 is disallowed upon non-payment)

In FY 24-25, Rs.20,000/- will be allowed as expenditure

In FY 25-26, Rs.20,000/- will be allowed as expenditure

Client: What if I didn’t pay to suppliers within this time limit?

Auditor: We need to pay interest @ 3 times of RBI interest rate compounded monthly and disallow such interest paid to supplier. This will be a huge impact to the profit of an organization and even tax liability also increases.

Client: Any template for interest calculation for delayed payments to MSME entities?

Auditor: Interest calculation template is attached with this article and this template may vary time to time and case to case, RBI interest rate took as an assumption. Please use it after verifying thoroughly.

Client: Ok fine, now I am registered under MSMED act, as a Small entity, now how can I get my payments in time?

Auditor: Please send a declaration to all your debtors and ask for payment, declaration template is attached hereby.

Client: What are the consequences and any specific disclosures related to delay in MSME payments? Auditor: Consequences for delayed payments and compliance disclosures are as follows

1. MSMED act- Interest @ 3times of RBI rate compounded monthly

2. Reporting in Financials – Disclose additional information with regard to principal amount and the interest thereon remain unpaid to any MSME supplier as at the end of each accounting year.

3. Companies Act- Every company need to file MSME Form -1

a. April to September : On or before 31st October

b. October to March : On or before 30th April

Non-Compliance with filing MSME Form-1 with ROC– As per Section 405(4), the company and every company that is in default shall be liable to a penalty of Rs. 25,000 and in case of continuing failure, a further penalty of Rs. 1,000 per day after the first day during which such failure continues, subject to a maximum of Rs. 3,00,000.

4. Income Tax: As per Sec 43B(h), penal interest paid or provision created will be disallowed u/s 37 of Income tax act while computing taxable income.

Client: What should I do now and from where to start now?

Auditor: Please follow the steps mentioned below.

1. List out all the suppliers and categorize them into micro & small entities by collecting MSMED registration certificates and check the status in online portal

2. Remove traders, now manufacturers and service providers were left in that list.

3. Keep separate group in your accounting software and check whether any outstanding balances were left to your suppliers.

4. If yes, then make payment to creditors and close outstanding balances in books of accounts.

5. Check the date of invoice or date of acceptance of goods or services and date of payment.

6. Calculate due date for payment as per MSMED (as mentioned above) and if any delay, calculate interest for that delayed months.

7. Disallow such interest .

Client: Any suggestion to the organizations who are going to audit this year FY 23-24? Auditor:

a. If any organization has MSME supplier, first have a written agreement to avail 45 days time limit.

b. Pay in time to avoid penal interest and disallowance.

Conclusion: The introduction of Section 43B(h) under the Income Tax Act signifies a significant shift in the regulatory landscape, prioritizing the protection of MSMEs’ financial interests. Businesses must adopt a proactive approach to compliance, incorporating systematic changes in their payment processes and financial reporting. By doing so, they not only adhere to the legal mandates but also contribute to fostering a more robust and supportive ecosystem for MSMEs, ultimately benefiting the broader economy.

Very nice article Thank You