Discover what to do if your application for registration as a legal heir is rejected in the Income Tax portal. Understand the grounds for rejection and steps to reapply for a successful approval.

The return of deceased person can only be filed by Legal Heir Representative assessee. For this Legal heir has to make an application to register himself as Representative Assessee in Income Tax Portal. Click here to know the steps for registering as Legal Heir Representative. After submission of documents and details the application can be approved or rejected. If it is rejected then legal heir has to firstly understand the grounds of rejection and then make fresh application.

HOW TO KNOW THE REASONS OF REJECTION

The Legal Heir will receive message after its rejection/acceptance from Income Tax. He has to then login to the portal and follow the following steps–

1. Login to Legal Heir Income Tax e-filing account by entering username (PAN) and Password.

2. Go to Authorised Partners tab and Click on Register as Representative Assessee.

3. Click on Lets get started.

4. Click on Inactive Request.

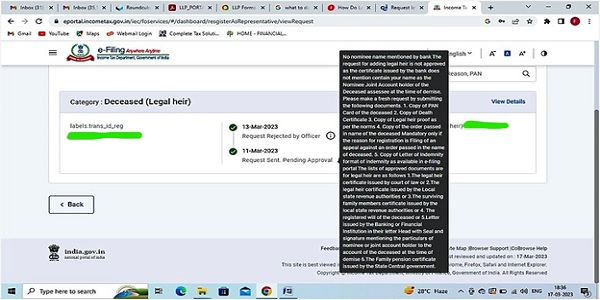

5. Move your curser to “i” button near request rejected by officer.

6. After understanding grounds of rejection you have to re-apply with adequate details and documents.

7. You will again receive the mail/message regarding acceptance/rejection of application within 7 days.

After receiving mail of acceptance you can login both as self and legal heir from your income tax account. You can now file the return or claim the refunds of deceased person.

OUR COMMENTS

Filing of return of income as representative legal heir is additional responsibility and many other factors and situations are to be seen before making the compliance. There are certain additional procedures to be followed with due diligence. The insertion of correct bank account details, nominee details, computation of income and claim of refund requires adequate submission of details and documents. Financial Tree Company helps in making such compliance with ease after death of taxpayer.

*****

The above comments do not constitute professional advice. The Author CA Divya Agrawal can be reached at contact@financialtreecompany.com.