It is advised to choose the correct ITR form in order to avoid further notice of defective return. Following forms below gives you insight to file correct ITR form as per Nature of Income and Status of person A.Y. 2020-21:

ITR 1: (SAHAJ)

1. Resident Individual whose total income does not exceed 50 lakhs can use this form for return filing

2. Having income from Salaries, from one house property and Income from other sources

3. Agriculture income does not exceed Rs. 5000

4. A director in a company cannot use Form ITR-1 for return filing

5. And an individual holding shares of unlisted company also can’t file return in ITR-1

6. An individual having foreign income or foreign assets cannot file return in ITR-1.

ITR-2

1. Eligible for Individuals and HUFs not having income from PGBP

2. But having Income from capital gain, Income from two house property and income from salary

3. Total Income is more than Rs. 50 lakhs

4. Holding directorship in a company at any time during the previous year

| Name of Company | Type of Company | PAN | Whether its shares are listed or unlisted | Director’s Identification Number |

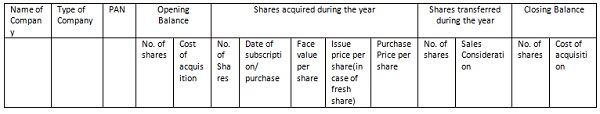

5. Holding unlisted equity shares at any time during the previous year

6. Details of immovable and movable assets at the end of the year is to be disclosed if total income exceeds Rs. 50 lakhs and liabilities in relation to Assets

7. Details of Foreign Assets and Income from any source outside India

ITR-3

1. Individual or HUF or as a partner in a firm having Income from PGBP

2. Return may include Income from house property, Salary/Pension, Capital gains and Income from other sources.

3. This include both tax audit and non tax audit cases

4. It also include income under Presumptive basis taxation under section 44AD, 44AE, 44ADA whose total income does not exceed Rs. 50lacs

ITR-4 (Sugam)

1. Applicable to Resident Individual, HUF, Firm(other than LLP)

2. It also includes those who have opted for the presumptive basis of taxation under section 44AD, 44AE, 44ADA whose gross total income does not exceeds Rs. 50 lacs. However, if turnover of business exceeds Rs.2crores, the taxpayer have to file ITR-3

3. Nature of income included: Income from Business and Profession, Income from Salary, Income from one house property (excluding the brought forward loss or loss to be carried forward cases), Income from other sources (excluding winning from lottery and income from horse races).

4. Note: An individual who is director in a company or has invested in unlisted equity shares cannot use this form.

ITR-5

1. Eligible for persons other than Individual, HUF, company and persons filing Form ITR-7 which means it is for

- Firms

- LLPs

- AOPs

- BOIs

- Artificial Judicial Person

- Estate of deceased/insolvent

- Business Trust

- Investment fund

ITR-6

1. Eligible for companies other than companies claiming exemption under section 11

2. Key Changes in ITR-6 Form:

- A separate schedule 112A for the calculation of the LTCG on the sale of equity shares or units of business trust which are liable to STT

- Details of tax on secondary adjustments to transfer price under section 92CE(2A)

- The details of tax deduction claims for investments or payments or expenditures made between 1st April 2020 to 30 June 2020

- Details of recognition as a start up by DPIT

- Details of declaration filed in Form-2

- Bifurcation of donations made in cash and non-cash mode of payment

- Information on turnover/gross receipt reported by GST.

ITR-7

1. For persons including companies require to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only

- Return under section 139(4A) is required to be filed by every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

- Return under section 139(4B) is required to be filed by a political party if the total income without giving effect to the provisions of section 139A exceeds the maximum amount, not chargeable to income-tax.

- Return under section 139(4C) is required to be filed by every –

- Scientific Research Association

- News Agency

- Association or institution referred to in section 10(23A)

- Institution referred to in section 10(23B)

- Fund or institution or university or other educational institution or any hospital or other medical institution

- Return under section 139(4D) is required to be filed by every university, college or other institution, which is not required to furnish return of income or loss under any other provisions of this section.

Hello tax guru,

For salaried person(less than 50 lacs income)and investments in stock markets(not trader),which IT formto be used. (b) how/where to show LTCG?STCG in the ITR FORM ? Please guide.

HI,

I am a salaried employee and my my taxable salaried income is below then Rs.5 lac in FY 19-20. I have invested in mutual fund.

In FY 19-20 i have shifted some fund from one scheme to other, on which i get LTCG in Rs.6614(without indexion) & LTC loss of Rs.2531/- (without index)in other fund .

My Question is this which ITR should I File it ITR 1 or ITR2 .

Thanking You ,

Sumit

Dear Tax Guru,

I want to know,

1. What is the limit of tax free income for NRI Senior Citizen in India, Rs. 500000 or less.

2. Is 80TAA deduction of Rs. 50000 on Fixed deposit interest available to Senior. Citizen NRI.

3.What other benefits and deductions can be admissible to Senior Citizen NRI, from Salary, pension, Interest Income, sale of property, and gain in income.

I shall be thankful if you send me the reply at my EMail.

Thanking you,

Dr. Avtar Singh Shinh

avtar_shinh@yahoo.com

If we get retirement funds in financial year 2019-20 and salary income goes beyond 50 lacs which ITR to file – ITR 1 or ITR 2 other wise salary income is below 50 lacs pl reply as early as possible

What ITR should be used for a private beneficiary trust for a minor (specific trust) treated as an individual for tax purpose? ITR 5 is not applicable as it does not allow deductions under chapter VIA