Background

- Unlike the erstwhile Excise law, under Goods and Services Tax (‘GST’) law, there is no provision for issuance of CT-1 form which enables merchant exporters to purchase goods from a manufacturer without payment of GST.

- The transaction between a manufacturer (‘supplier’) and a merchant exporter (‘recipient) is in the nature of supply and same is liable to GST as any other normal taxable supply.

- The GST Council in its 22nd meeting had decided that merchant exporter can pay a nominal GST of 0.1 percent for procuring goods from a domestic supplier for export.

RATE OF GST

GST rate would be as under:

| GST Type | Rate (percent) | Relevant notification no. |

| CGST | .05 | 40/2017 – Central Tax (Rate) |

| SGST | .05 | See Note |

| IGST | .10 | 41/2017- Integrated Tax (Rate) |

Note: This is subject issuance of notification under respective State GST Acts. The notification for the State of Haryana is still awaited.

PROCEDURE

The procedure for supplying goods to a merchant exporter shall be as follows:

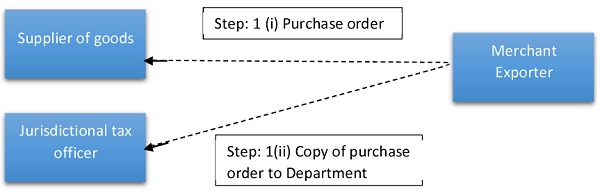

Step 1: Placing an order by a merchant exporter and furnishing copy thereof to the Department

- Merchant exporter shall place an order on registered supplier for procuring goods at concessional rate

- Copy of the order shall also be provided to the jurisdictional tax officer of the registered supplier

- Graphical transaction flow is as under:

Step 2: Supply of goods

For exporting the goods, the recipient shall

- directly move the said goods from supplier’s place to the port/inland container depot (ICD)/airport/land custom station (LCD) from where the said goods are to be exported; or

- directly move the said goods to a registered warehouse from where the said goods shall be move to the port/inland container depot (ICD)/airport/land custom station (LCD) from where the goods are to be exported

- Graphical transaction flow is as under:

Option to aggregate the inward supplies:

- If merchant exporter intends to aggregate supplies from multiple suppliers and then export, he can move goods to registered warehouse and thereafter to the port/ICD/airport or LCD and then export therefrom

- In this case merchant exporter shall endorse receipt of goods on the tax invoice and also obtain an acknowledgement of receipt of goods from the warehouse operator

- The endorsed tax invoice and the acknowledgement of the warehouse operator shall be provided to the registered supplier as well as to the jurisdictional tax officer of such supplier

Step 3: Post-export compliance

Once the goods are exported, merchant exporter shall provide following documents to the supplier and the jurisdictional tax officer of the supplier:

- Copy of shipping bill/ Bill of export (incorporating supplier’s GSTIN)

- Tax invoice provided by supplier

- Export General Manifest/ Export report

CONDITIONS

Following are the conditions to be satisfied for availing benefit of concessional rate of GST on supply to a merchant exporter:

- Supplier shall supply goods under a tax invoice

- Goods must be exported within a period of 90 days from the date of issue of tax invoice by the supplier. The exemption would not be available to the supplier if the merchant exporter fails to export the said goods within a period of 90 days from the date of issue of tax invoice

- Merchant exporter shall indicate the GSTIN of the supplier and tax invoice number issued by the supplier in the shipping bill/ bill of export

- Merchant exporter must be registered with an Export Promotion Council or a Commodity Board recognized by the Department of Commerce

I had supply the goods to merchant exporter at concessional rate @0.1% and paid @28% on raw material.what is the procedure for the claiming refund on such higher paid tax? Please reply to the earliest.

When we purchase material from local manufacturer @18% and supply to merchant exporter under 0.1% we are sale this trangection.???

i am in rajasthan and purchase goods from Tamilnadu @18% and sell the goods to delhi person @.1 % as he will export the goods. The delivery will be done from tamilnadu(factory) to tamilnadu (port). how to proceed in this matter?

when we purchase from local supplyer and given to local byer for export purpose how many tax applu to local byer and which tax apply for us purchase from local supplyer we are the dealer in between pls suggest

If Merchant Exporters fails to do export with in 90 days and same material sale in domestic market which he has taken @0.1% IGST. Now how to pay IGST 18% by recovering from Merchant Exporter & Interest thereon to Govt. ?

We have supplied to an exporter who procured goods from us at 0.10%. He forwarded us the BL copy but he has not mentioned anything about is in shipping bill. Please advise what can be done and the exporter now not responding to our calls and emails also.

sir we are merchant Exporter

We buy goods from Dubai and sale China . what we will charge tax on the goods on our bill, the goods are not enter in India, this goods will directly transfer

Dear Sir,

We purchase goods from another state and paid IGST 18% and that goods we exported. Now how to get refund IGST which we paid on purchase.?

Kindly suggest us.

sir the export has been delayed by about 20 days more than the 90 days period . what can be done ?

mention VALVUE IN THE GSTR-1

What is the procedure of e-sealing for merchant exporter?

Step 3: Post-export compliance . I am manufacturer or registered supplier, what if the merchant exporter doesn’t send the Export Docs after export?

Sir,

I am a Merchant Exporter (Registered Receipant) and procure the goods from Registered Supplier at concess. rate @0.10%. In that Case Registered Supplier Issue the Tax Invoice and send the goods directly at Port.

In the shipping bill we have mention Tax Invoice No. & GSTN No. of Reg. Supplier.

Regd. Supplier show the invoices in his GSTR-1 in B2B Sheet.

Sir, My question is what is teratment is the merchant Exporter end.

(1) Can we issue the Tax Invoice of those goods or not.

(2) if yes we can issue the invoice without received the goods in our factory.

(3) In the GSTR-1 what treatment given by merchant exporter.

Please suggest me.

(9910447144)

I m a manufacture in ghaziabad and I supply my goods to a exporter who is in Punjab. I charge him IGST 0.10 % ON THE INVOICE VALUE.

I M BUYING THE RAW MATERIALS AT 18 % GST AND SELLING AT 0.10% . I M CONFUSED . WILL I BE GETTING 17.90% BACK AS REFUND FROM THE GOVERNMENT . THE EXPORTER HAS FORWARED ME THE SHIPPING AND BILL OF LANDING .

I WANT TO NOW THE PROCEDURE ON HOW WILL I GET THE REFUND .

THANKS

We are Manufacturer exporters. We sale goods to Merchant exporters on 0.1 per cent tax. Can we claim refund of the same? How much?

Sir I am an merchant doing domestic and export trade majorly domestic sales

I am coming in the 18%gst slab

I just want to know that

Shall I move goods directly from manufacturer or supplier as I am recipient to my buyer domestic market

Sir, Step 3 post export the merchant exporter has to provide copy of shipping bill to the Supplier/manufacturer. I think this will lead to disclosure of the exporter’s customer name and address mentioned on the Shipping bill to the manufacturer. Exporter will always be in constant fear that the manufacturer may directly approach their overseas customer and start exporting once they come to know the buyer’s details. So saving GST is at the cost of losing future business. Kindly correct me if I am wrong.

WE have procured goods from Registered Manufacturer Supplier @ 0.1% for export.

Inadvertently the details of the supplier was not mentioned on the shipping bill as per rule 40/2017.

The customs officer says the shipping bill cannot be changed now since the shipment is done. He can give an amendment certificate if possible.

Kindly advise if there is any alternative or remedial action. Thanks and regards.

sir we are merchant exporter and since our supplier charging us 5% gst instead of 0.1% we will get refund for gst 5% paod. pls advise

sir we are merchant exporter and our supplyingcotton yarn charging 5% gst instead of 0.1% gst. will we get refund for 5% paid being merchant exporter. pls adviae

Kindly clarify if the manufacturing ‘supplier’ selling goods at concessional rate to the exporting ‘receiver’, take full ITC on the raw materials used to manufacture the concerned product? Is there any requirement of ‘reversal of credit’?

Notification 41/2017- Integrated Tax (Rate) does not states anything in this regard. Please provide relevant notification in this regard.

Can we shown supply to merchant export under deemed export or regular export,. the supply to merchant exporter does not fall under the definition of deemed exports

Sir, We supplied goods to merchant Exporter(Intra State) and collected CGST @.05% and SGST @.05%. When we tried to post in GSTR 1 for the Month of October 2017.If we put Deemed Export IGST @.025% is appeared and if we put intra state supplies CGST @.025% and SGST@.025% is appeared in the screen . no provision for .05% CGST and .05% SGST. How to file GSTR 1 for Oct before 31.12.2017

Sir, I am manufacturer and supplying to merchant exporter with tax invoice, which documents i have to received from merchant exporters in this regard?

We have sale the goods to Merchant exporter @ 0.1% tax rate How to File the GSTR 1 Return ,there Is no option showing the tax rate in Item details

Sir we are merchant exporter . Our manufacturer is from Denmark and we are exporting food supliment to UAE. What is the rate of gst on our bill to importer and should we have to pay import duty

If as a merchant exporter, I export with 0.1% and then provide all documents like invoice, shipping bill etc. then how can I safe guard my trade as my customers will be known.

Dear Sir,

Very clear explanation. But as MErchant exporter if I sahre ny shipping bill and Invoice with supplier how do I safeguard my trade ?

Can I buy at 18% and calim the inout credit in GST filling? Please clarify

How to File GST return when there is no clause for the 0.1% or 0.5% rates ?

HOW CAN SHOW THIS TAX INVOICE IN MY GST RETURN & 0.1% IGST, & 0.05%, 0.05%, AGAINT SALE TO MERCHENT EXPORTER

Sir do you have any idea that how the supplier who is charging only 0.1 % to the merchant exporter and whereas he has paid 18 % GST on purchase of raw material for which there is no set off available to the supplier.

How will the supplier get the refund on output GST ?

Hello Sir/Mam,

What would be the process after GST for supply of material to Merchant Exporter. as per the notification 41/2017 the rate of IGST is 0.1 percent. But my question is that can supplier take benefit of Deemed Export / can supply the material under Advance Licence.

All our production is supplied to a merchant exporter. Can we deposit gst at 0.1% slab?

In Bill of Entry is their field to indicate GSTIN of supplier who sold this goods at 0.10%????

And if no what would be case with sale of Oct and Nov 2017 since Bill of entry is filed and sales was also made @0.1%…..

Another issue is there is no filed in GST Return where Supplier to show such sale @0.1% as such rate is not there in GSTR1 and Table 6 A cannot be filed by supplier, which is to be filed by direct exporter.

CAN ANYBODY EXPLAIN AFTER SUPPLY @ 0.1% TO MERCHANT EXPORTER, WHERE TO ENTER IN GSTR-1, BECAUSE THERE IS NO SLAB OF IGST 0.1%, PLEASE RSOLVE.

Very Nice article and well presented.I am manufacturer and supply to merchant exporter but according to merchant exporter there is no provision for updating my (manufacturer GST no) on shipping bill yet . The system is not updated in ICEGATE for updating manufacturer GST number . If you know anything please let me know .

Can the exporter claim refund of IGST charged at 0.10%?

When a situation arises to charge CGST&SGST / IGST by registered supplier? Is CGST&SGST in case supplied to registered warehouse and IGST in case supply directly to airport/port/ICD/LCD?

is supplier need to be manufacturer must? my supplier is trader and they are being paid 28% from their supplier. so they denied to pay as with 0.1 %. what to do in this case?

CAN ITC WILL BE AVAILABLE ON 0.10% WHICH WAS CHARGED AS CGST/SGST AND IGST

WHETHER GOODS ARE EXPORTED TO NEPAL ETC WILL TREATED AS EXPORT BECAUSE IN GST WITHOUT IEC CODE NOW YOU CAN NOT SALE THE GOODS TO NEPAL

From which date thiS will be implemented

Sir is there any procedure for the supplier of goods to claim any ITC on those goods? As the supplier would be paying more on procuring the goods.

Has any new forms notified for supply of goods to merchant exporter at concessional rate of GST @ 0.1% ??

Dear Sunil Ji,

It is very nice presentation of procedure.

But w.r.t SGST exemption you have mentioned that we shall await the exemption notification from respective states, but as per Section 11(4) of State GST Acts, (including Haryana GST Act) notification issued by central government under section 11(1) shall be deemed to be issued under SGST Act also.

As notification no. 40 is issued under section 11(1), then I would like to advice that we shall need not to wait for notification under SGST Act, SGST portion stands exempted automatically with notification 40 of CGST.

Thanks,

Government has taken 15-20 days time to issue notification after its GST council meeting and further still ice gate site is not updated for entering GSTIN and invoice detail of the supplier.